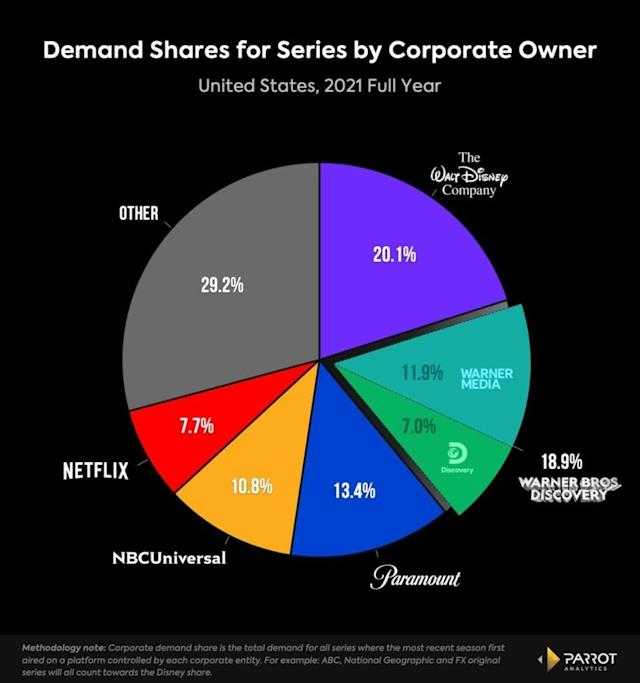

As Discovery, Inc. reported what could be its final earnings before officially becoming Warner Bros. Discovery, Parrot Analytics analyzed what the entertainment landscape would look like following the marriage of these two companies. The combined entity is projected to start out in second place in corporate demand share, leapfrogging Paramount and sitting within striking distance of market leader Disney in this key metric that serves as a proxy for the long-term viability of media companies as they eventually bring their full catalogs onto a unified streaming platform or bundle. In terms of SVODs, the crown jewel of the joint company will clearly be HBO Max, which was the fastest growing streaming service in the U.S. for original series demand in 2021. It has maintained this momentum in early 2022 with breakout hits such as “Peacemaker” and “Euphoria” becoming mainstays in the U.S. and global top 10 TV demand charts since January.

Visit The Wrap to read this article.