Image: Mirzapur, Prime Video

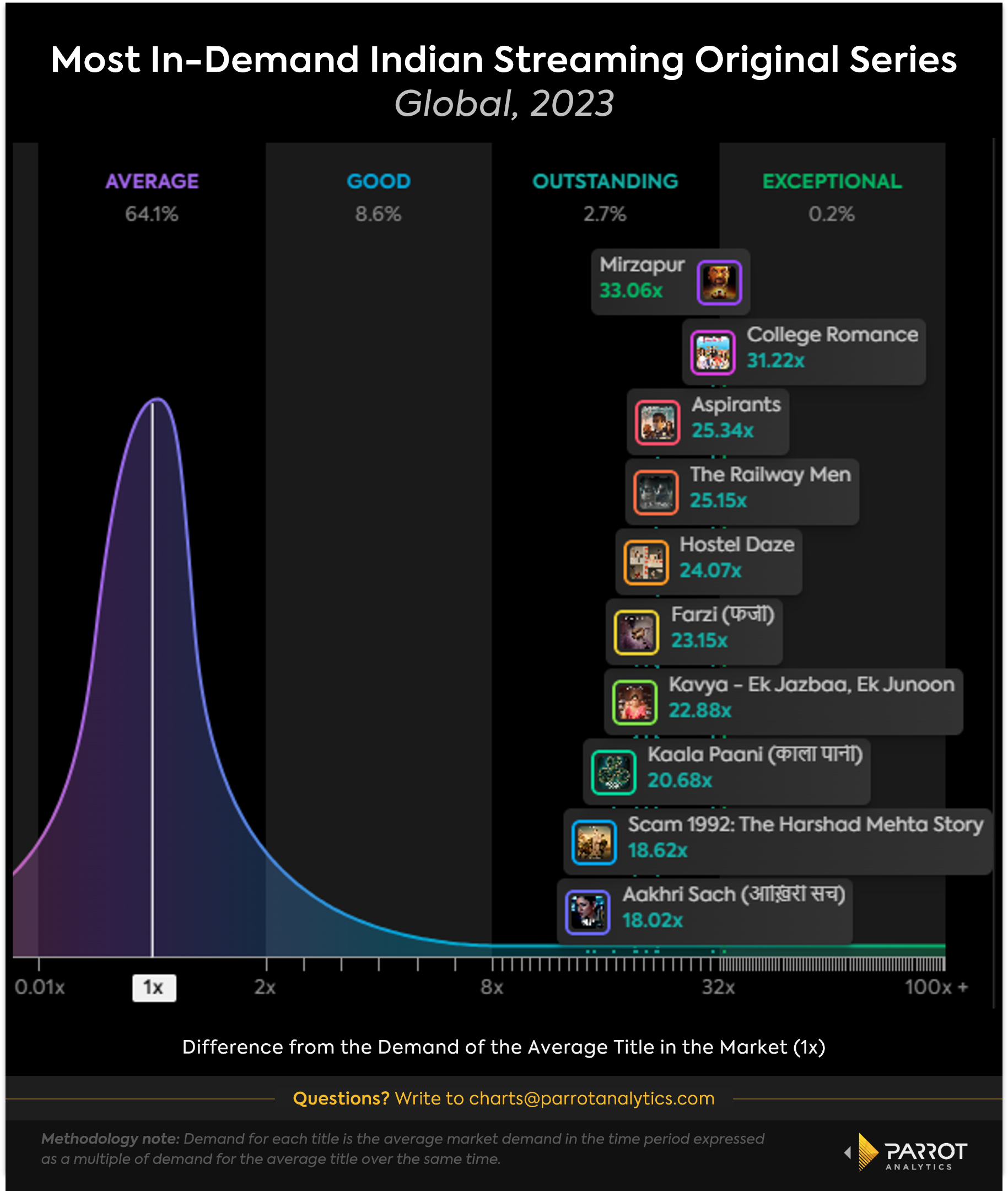

Amazon recently announced its 2024 slate of shows and movies in India, totaling 69 new or returning shows and movies. This is not the first time we have seen the platform making focused content investments in this critical growth market. Prime Video has already had good success here but the competition has been heating up. This year’s lineup heavily featured thrillers, one of the most popular genres, and included the Indian version of Citadel (Citadel: Honey Bunny) and the third season of the hugely popular Mirzapur.

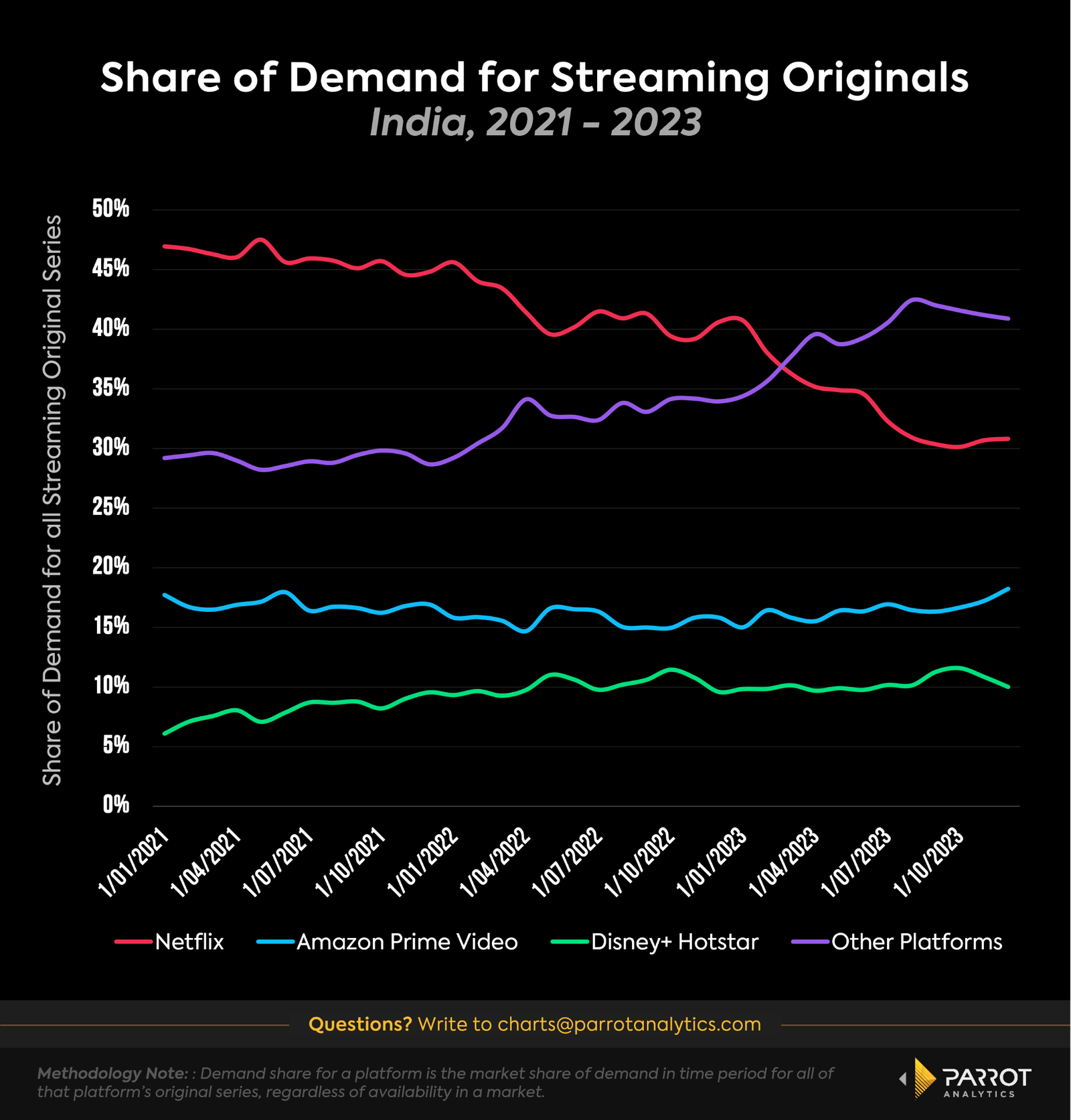

Over the past several years Amazon has managed to defend its market share against tough competition from other streamers in this market. The demand for Amazon original series as a share of demand for all streaming originals in India has remained in the 15 - 17% range for most of the past 3 years but hit a new high in December 2023 when 18.3% of demand for streaming originals in India was for an Amazon original - perhaps a positive signal of things to come from Amazon as it ramps up investment here.

Netflix is a cautionary tale for what can happen if a platform is unable to keep pace with the competition for audience attention. Netflix’s share of demand in India for streaming original content has been on a downward slide for the last three years and accelerated through most of 2023. Netflix’s share of demand here dropped from a high of 41% in January 2023 to 30% in October, recovering slightly in the final two months of the year.

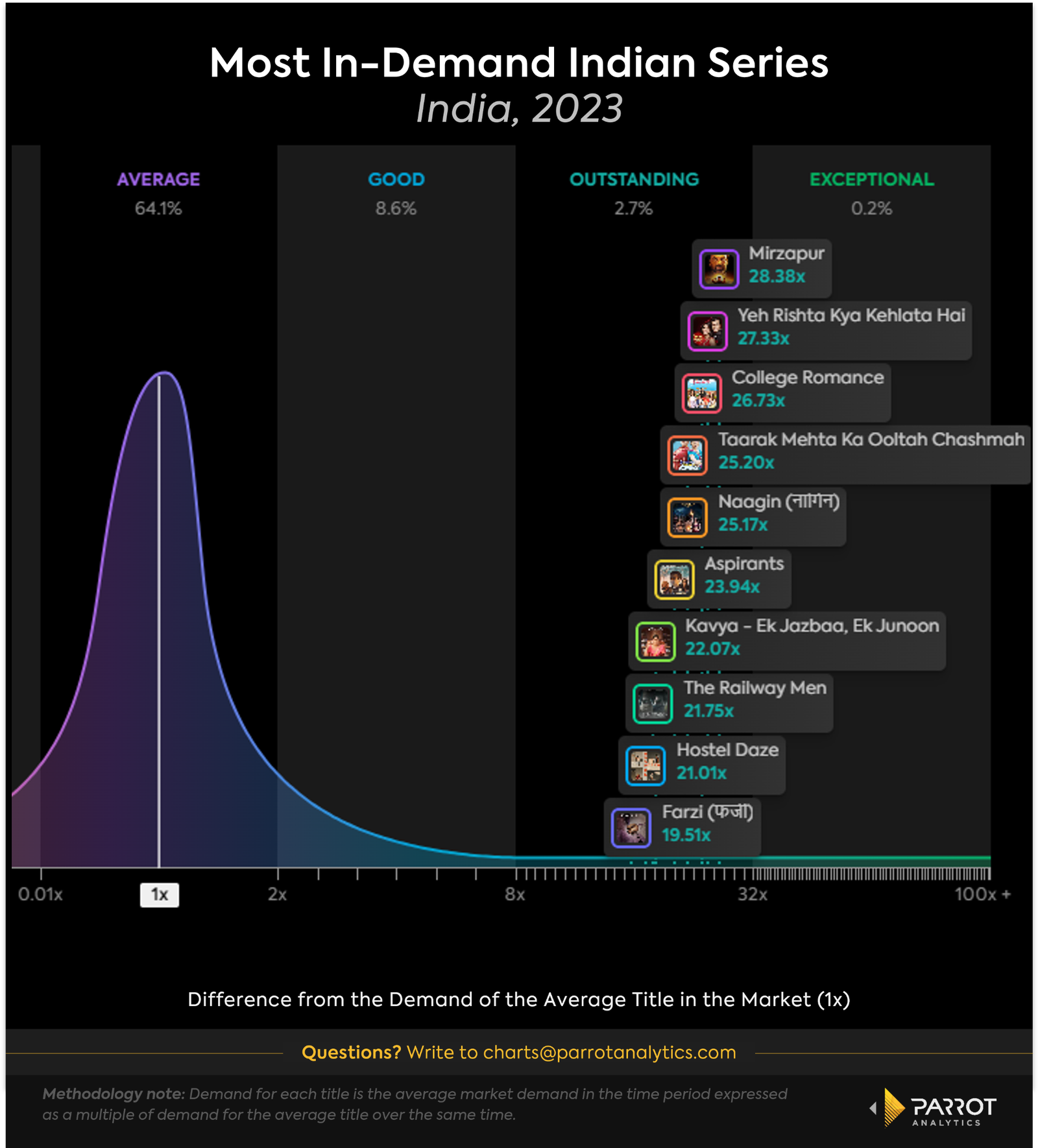

Even though Netflix still has a dominant demand share here, that is due in large part to the sheer size of its global slate of originals, rather than particularly successful series in India. Looking at the most in-demand local shows in India of 2023 it is clear that Amazon has created shows that truly resonate with audiences here. Four of the ten most in-demand local series in India are Amazon originals. Only a single Netflix original made the top ten.

One interesting feature of the current slate of Prime Video’s Indian originals is that the demographics for these shows currently skew older than the overall audiences for Indian series, similar to what we have seen in the US. If Prime Video wants to broaden its audience with the new push into this market it should consider what types of content have the potential to draw younger audiences in. Mike Hopkins, head of Prime Video, highlighted shows in the upcoming slate meant to appeal to younger audiences in India like Call Me Bae and Ziddi Girls.

Finally, it is important to note that the global footprint of Amazon Prime Video means that it is in a position to turn these targeted local content investments into genuine global hits and reap the rewards beyond just India. As global audiences become more open to international and foreign language content, the odds of the next global hit coming from a market like India are improving. Maybe the next Mirzapur will come from this year’s slate of Prime Video originals.