Image: Merlí, TV3

Latin America is an important region for the TV industry. Latin American audiences are well served by local content producers based in many of the countries of the region, a large proportion of which export their content to other Latin American countries either directly or via remakes. Latin Americans are also enthusiastic consumers of international content.

This report contains two sections, namely:

- Part I: Differences in Demand for Regional Content in Latin America.

- Part II: Demand for Regional Language Content from US Hispanic and LATAM Audiences Compared.

Let us get started by looking at the local preferences of three different countries in Latin America; what do these countries like and dislike most about locally-produced content, and which markets prefer Spanish or Portuguese language content coming from the US or Europe?

Part I: Differences in Demand for Regional Content in Latin America

Parrot Analytics has applied global TV demand data to probe deeper into Latin American content trends in Argentina, Colombia, and Mexico.

In this section we also take a look at the TV genre differences for each country compared to the regional average for Latin America.

Which individual Spanish and Portuguese language titles were the favorites in each country last year?

For each of the three countries the ten regional language titles that had the highest average demand over the whole of 2017 were identified.

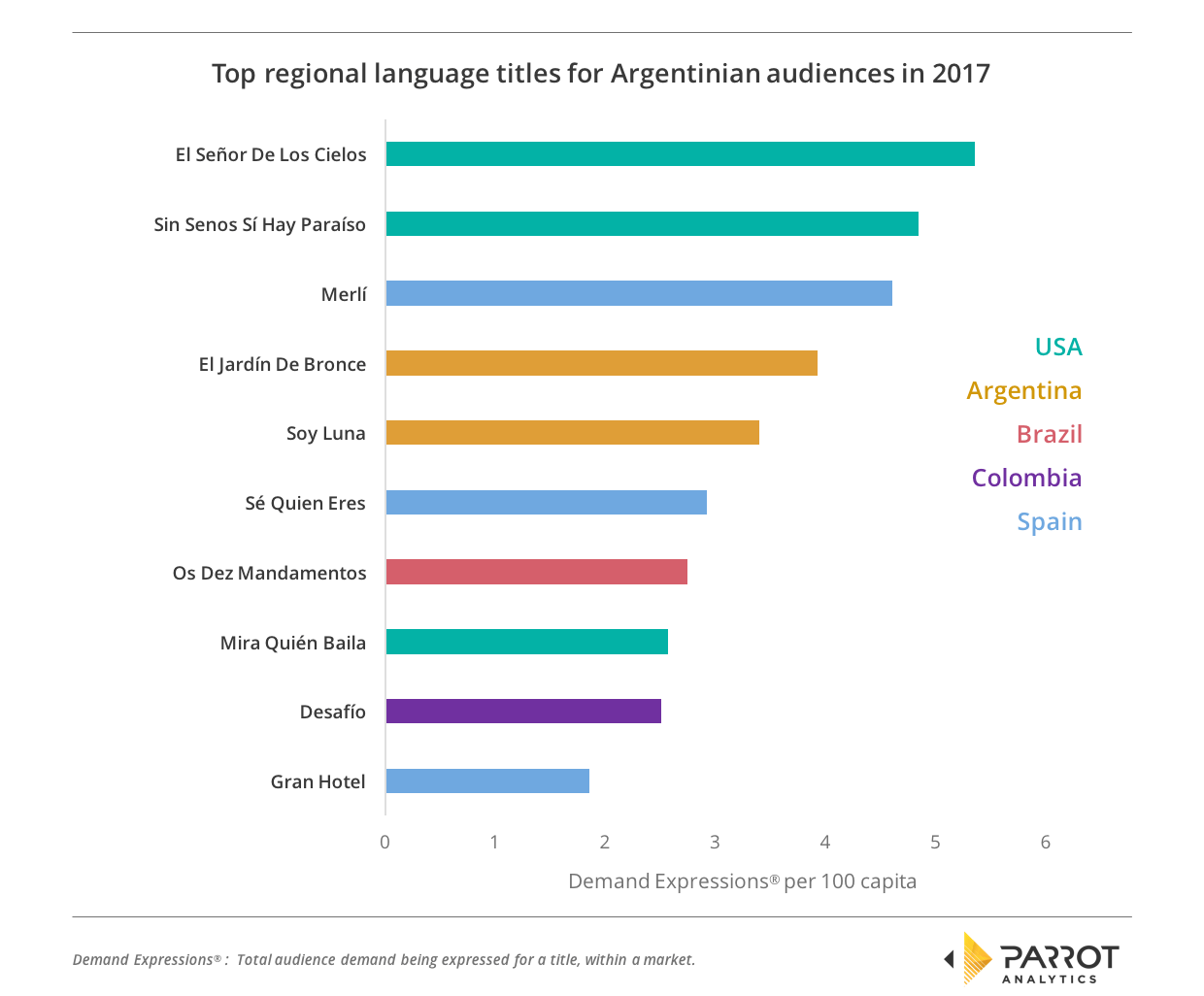

Argentina

Argentina is the only market where two Argentinian titles appear in the top ten, and the only top ten appearance of HBO LATAM’s crime drama El Jardín De Bronce. Argentina’s most in-demand regional show of 2017 was Telemundo’s crime drama El Señor De Los Cielos followed by telenovela Sin Senos Sí Hay Paraíso from the same network. These are joined in eighth position by Univision’s Mira Quién Baila, which makes the USA the most in-demand origin country of regional content for Argentinian audiences.

Spain also has three shows in the Argentinian top ten; TV3 España’s Merlí is the most in-demand of those. Brazilian biblical telenovela Os Dez Mandamentos from Record TV is the seventh most in-demand title in Argentina. It’s the only show from Brazil to appear but has pan-LATAM appeal as it is also popular in both Colombia and Mexico.

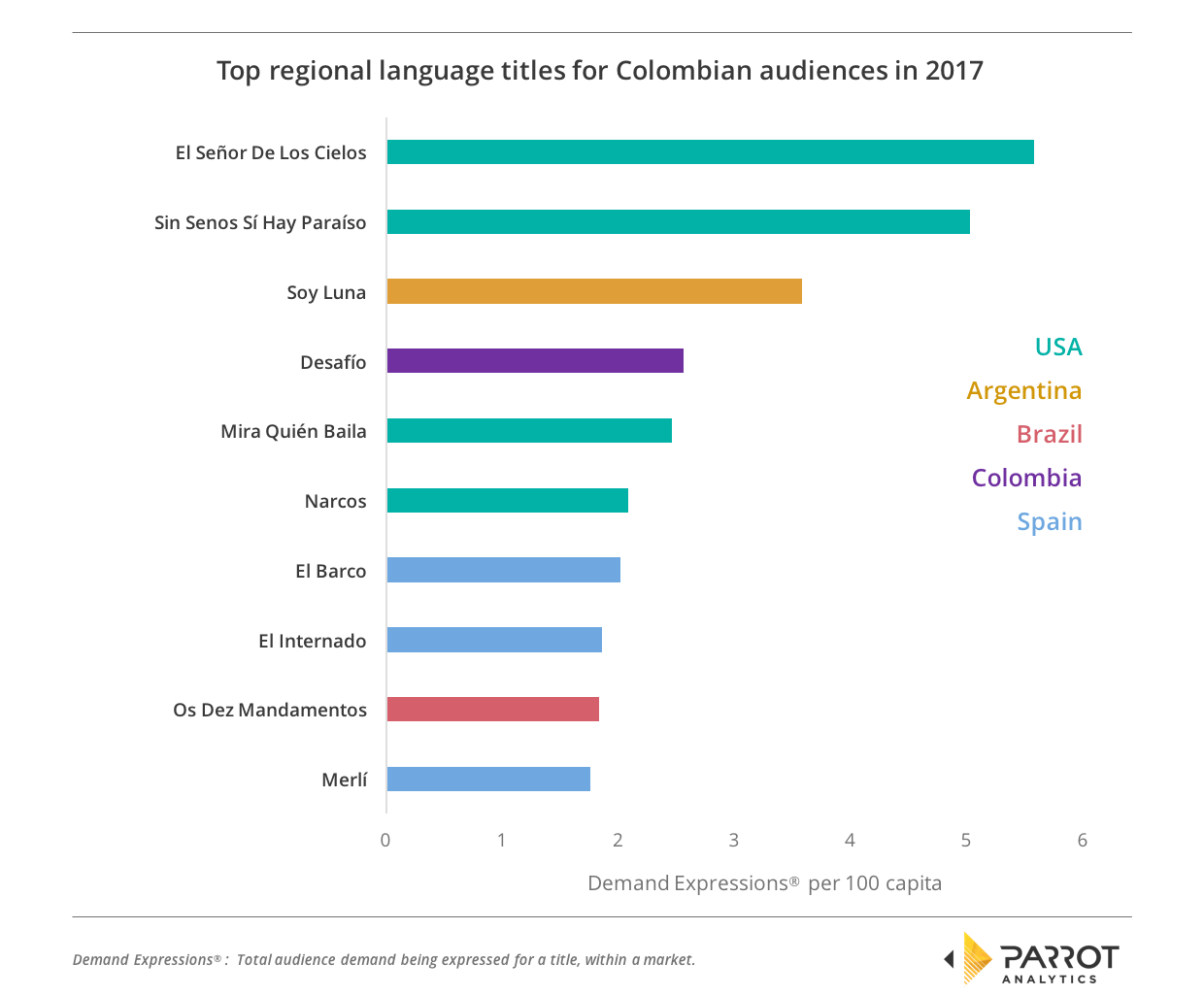

Colombia

Colombia shares its two most in-demand shows with Argentina: El Señor De Los Cielos and Sin Senos Sí Hay Paraíso are first and second here as well. Audiences here also enjoy Mira Quién Baila too, but Colombian demand for Netflix’s story of the Colombian drug cartels told in Narcos means that four US shows make the top ten here.

As with Argentina, content from Spain is the second favorite with three shows from that country, however Colombia’s most in-demand title from Spain is Antena 3’s apocalyptic drama El Barco.

Only one Colombian show appears in Colombia’s top ten, Caracol Televisión’s competition show Desafío. This show is popular throughout Spanish-speaking Latin America as it charts in Argentina and Mexico as well.

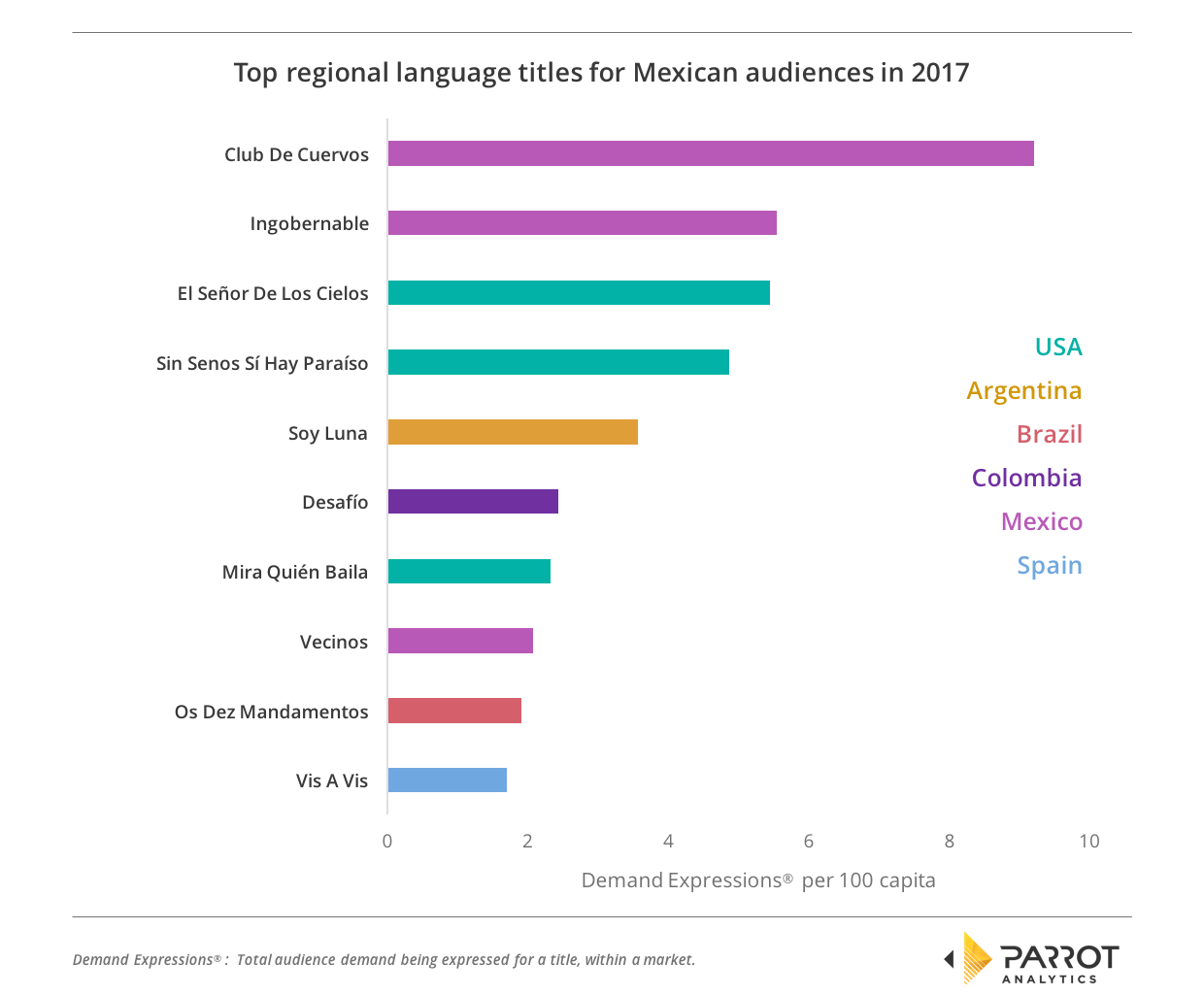

Mexico

Mexico is the only country where Mexican titles are part of the ten most in-demand. More than that, although the same three US titles that were in-demand in Argentina and Colombia appear in the Mexican top ten as well, they are not the most in-demand titles in this country.

Instead, the dominance of streaming platform Netflix in this market shows clearly: The top two shows – comedy drama Club De Cuervos and political drama Ingobernable – are both Netflix originals. The third Mexican show on the list is Las Estrellas’ comedy drama Vecinos, which had the eighth highest demand in the country over 2017.

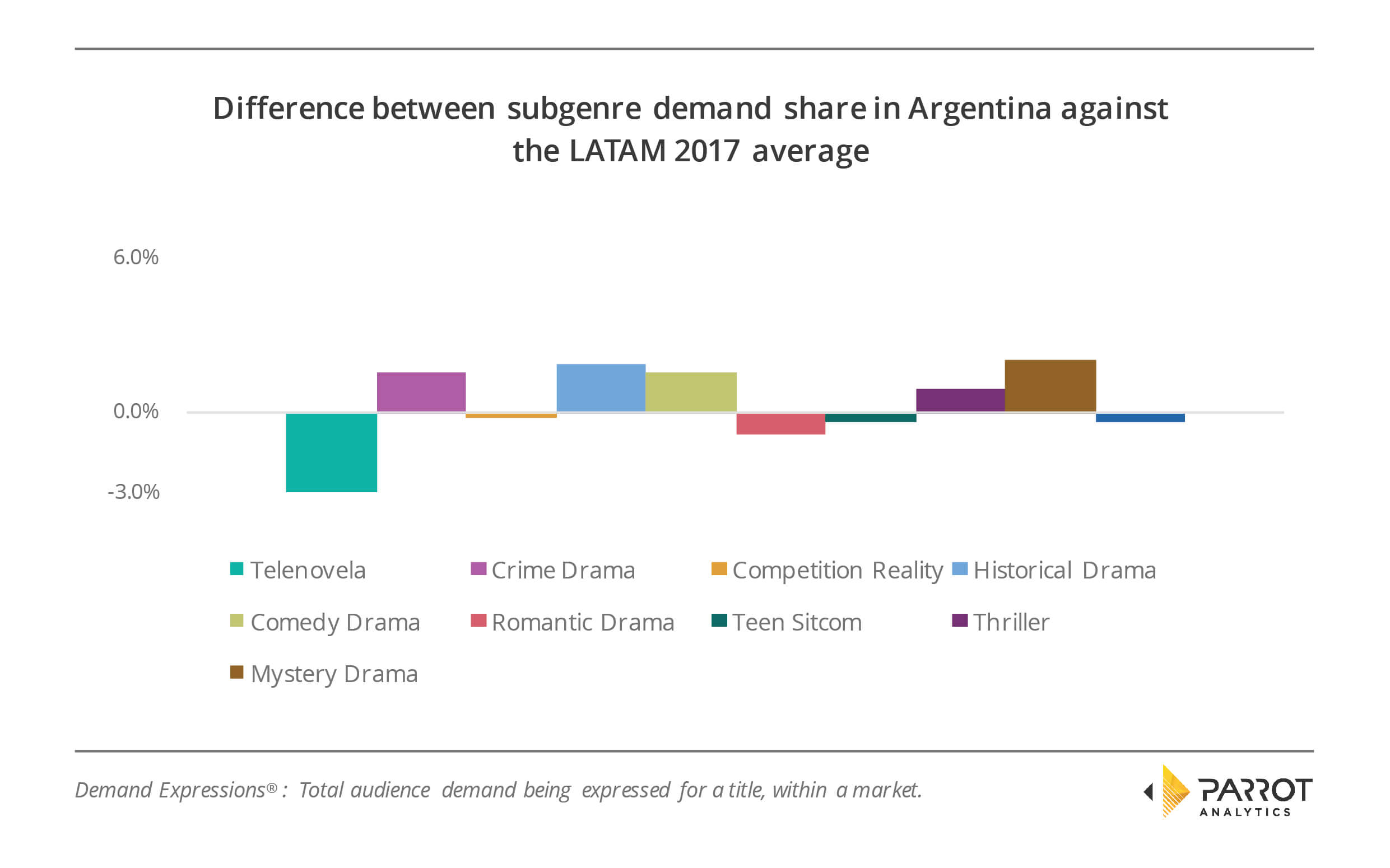

How does the share of demand for subgenres compare to the LATAM average in each country?

Across Latin America, the subgenres with the highest demand are, in order: Telenovelas, crime drama, competition reality, historical drama, comedy drama, romantic drama, teen sitcom, thriller, mystery drama and sitcoms.

By taking these subgenres and calculating the average demand share for each subgenre for all Latin America, we can determine the difference from this regional average for each subgenre in all three markets.

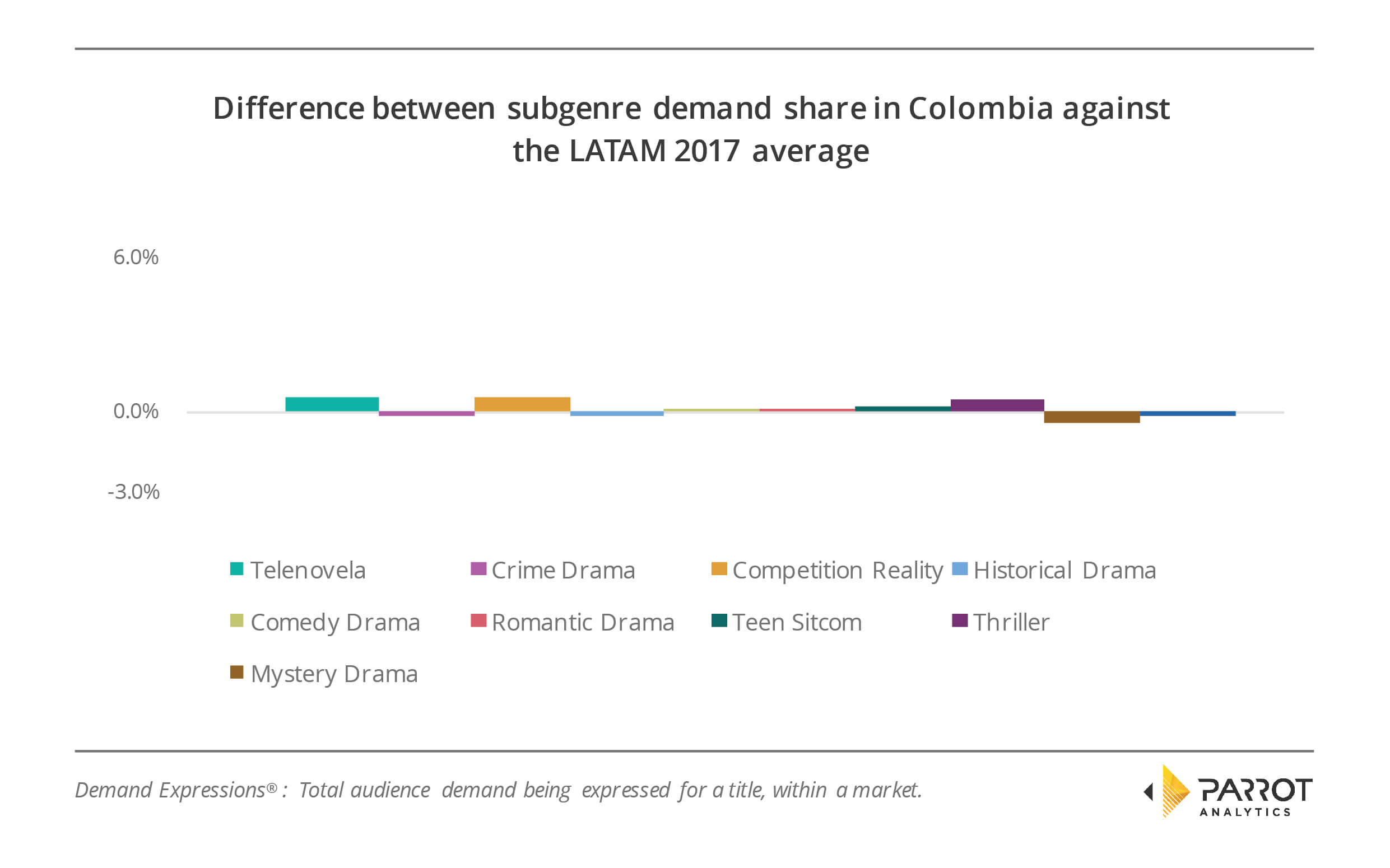

In the three markets studied, Colombia is the closest proxy to Latin America as a whole:

There are only small differences between Colombian subgenres’ demand share compared to the regional subgenre demand share. The biggest change from the Latin American norm is telenovelas and competition reality titles, which Colombians like 0.9% more than the regional average.

On the other hand, the biggest difference from the Latin American averages is Mexico.

This is most obviously due to the Mexican enthusiasm for comedy-dramas. Buoyed by the popularity of shows such as Club De Cuervos, which was Mexico’s most in-demand show of 2017, Mexico had 6.4% more demand share for this subgenre than the Latin American average.

To counterbalance this, Mexico has notably less demand share for the other nine subgenres. This is particularly pronounced in telenovelas, where there is 2.4% less demand share in Mexico than the average.

Argentina also has less enthusiasm for telenovelas, with the demand share for that subgenre down 3% on the regional average:

However, Argentina has over 1% more demand share for four subgenres compared to Latin American averages: Mystery dramas (2.0%), historical dramas (1.8%), crime dramas (1.6%) and comedy dramas (1.5%).

This concludes the first section of our investigation.

Let us now examine how the realities of “Peak TV” are impacting on Latin America. Nowhere is this global trend more apparent than the ever-increasing amount of content arriving for US Hispanic audiences: The United States has several platforms that cater specifically to the Hispanic population inside the US; these networks distribute Spanish-language shows and commission original content for the US Hispanic market. The two largest are Univision and Telemundo.

To commence, we will investigate the demand for regional language content from US Hispanic audiences compared to Latin American audiences. We will conclude our analysis by exploring whether any significant differences exist in subgenre popularity between the US, and Latin America.

Part II: Demand for Regional Language Content from US Hispanic and LATAM Audiences Compared

The Latin American TV industry has never been more productive and is putting out increasingly more shows of ever-increasing quality aimed at audiences in Brazil, Argentina, Colombia, Mexico and the rest of the continent and the world.

As well as these sources, also of interest to audiences in both the US Hispanic and Latin American markets is content that crosses the Atlantic from TV producers in Spain and Portugal. Naturally, streaming services are also starting to court the Spanish and Portuguese speaking markets as well; global platform Netflix is leading the way in this so far with a number of Mexican and Spanish original series released already.

With Latin America no longer as reliant on US content imports, are significant differences starting to appear between US and Latin American preferences in Spanish and Portuguese language content?

Parrot Analytics has relied on its global TV demand data to investigate this question further in this second section of our report.

First, let’s look at the which titles for most popular with US audiences, compared with audiences in Latin America.

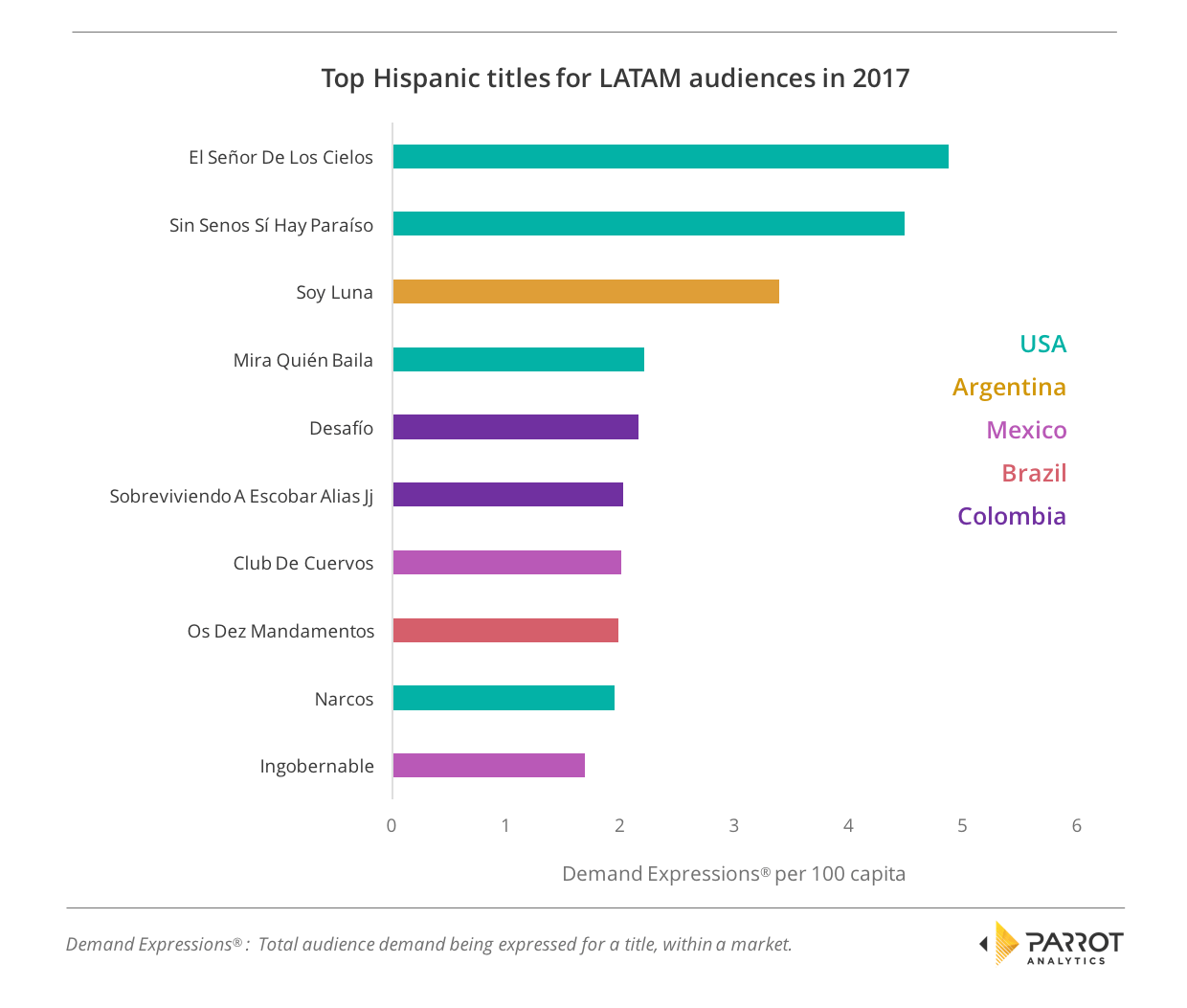

Which titles were the favorites in each region?

The average demand for every Spanish and Portuguese language title was calculated both for the United States and for Latin America over 2017. This allowed us to discover which titles had the highest average demand within the Latino population in the US and outside of it.

In the US, the top show was Netflix’s crime drama Narcos. Set in Colombia, the show’s dual English-Spanish nature helped it appeal beyond the strictly Spanish-speaking audience to the mainstream US.

The most in-demand “purely Spanish” show was Telemundo’s telenovela Sin Senos Sí Hay Paraíso. Brazilian biblical telenovela Os Dez Mandamentos also performed well amongst US Hispanics, as did the Mexican version of the Masterchef franchise.

Unsurprisingly, US titles dominate Hispanic content in the country: Six of the top ten were commissioned in the US, while the remaining four are from Argentina, Brazil, Mexico and Spain.

US titles are also the most common country of origin across Latin America over 2017, but not to the same extent. Four of the top ten are from the US, while two are from Colombia and two are from Mexico. Argentina and Brazil complete the list with one title each.

Telemundo’s crime drama El Señor De Los Cielos was Latin America’s most in-demand show of 2017; it was fourth in the US over the same period. Sin Senos Sí Hay Paraíso and Soy Luna stay unchanged from the US, remaining in second and third place respectively. In the case of Soy Luna it is interesting to note that the lead character is a Mexican national who as part of the plot moves to Argentina. This explains its wide ability to gain traction across the LATAM region and US Hispanic.

Similarly, Sin Senos No Hay Paraíso leverages the fact that it was co-produced by Colombian and US networks. Colombian shows were popular across the rest of Latin America, Caracol Televisión’s competition show Desafío had the fifth highest demand while their crime drama Sobreviviendo A Escobar Alias JJ is sixth.

This list demonstrates the strength of Netflix in the region as three shows of the most in-demand shows are originals from that platform: Club De Cuervos, Narcos and Ingobernable.

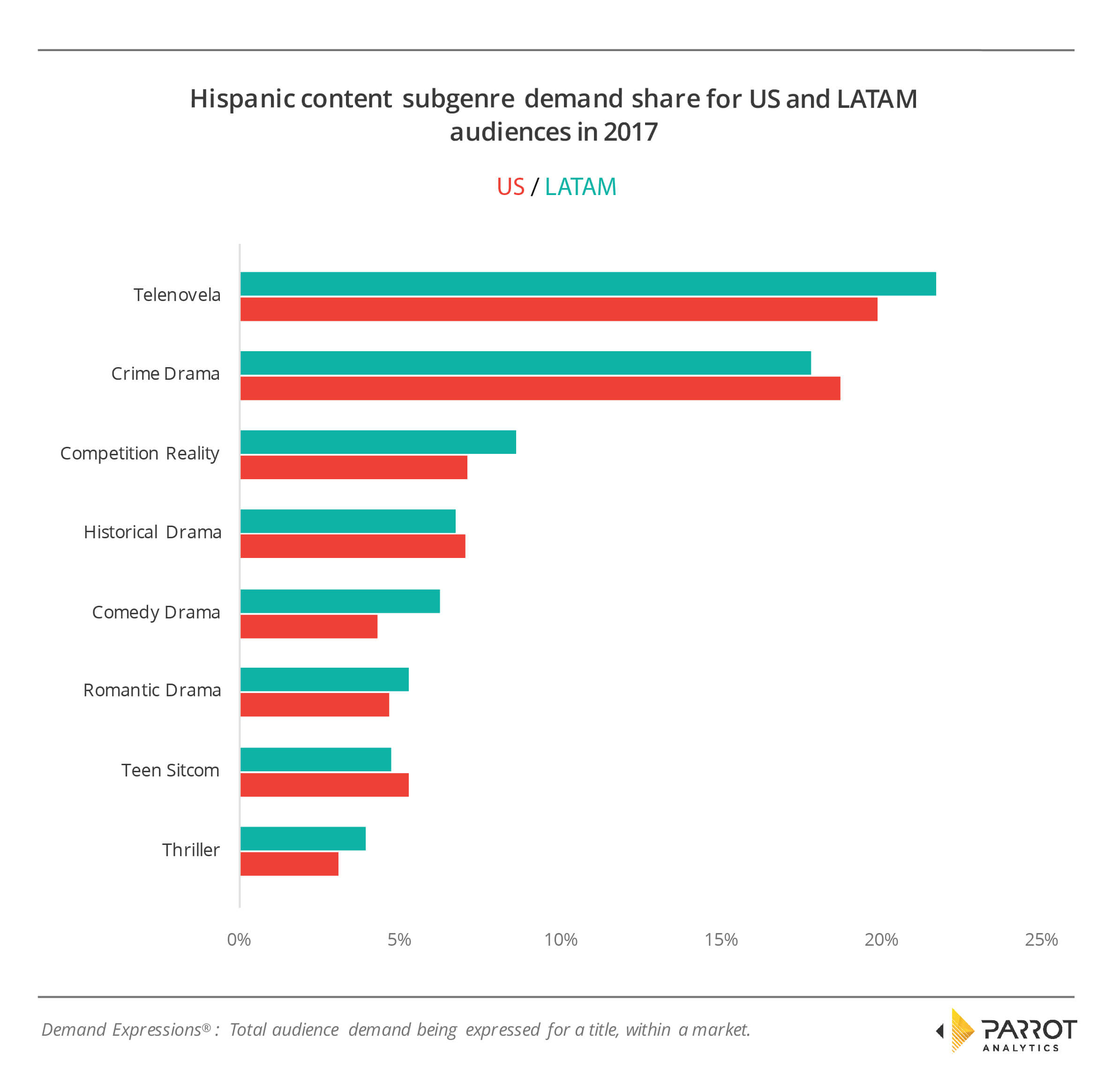

Finally, let us conclude by briefly analyzing the subgenre popularity between US vs Latin American audiences.

Are there significant differences in subgenre popularity between the US and LATAM?

We now take every Spanish and Portuguese speaking title and aggregate their demand by subgenre in both the US and Latin America. This yields the following result:

This graph shows there is not a great deal of difference between the overall content of shows consumed by US Hispanics and Latin Americans in 2017. The top four subgenres are the same, with virtually identical shares of overall demand.

The most popular subgenre is telenovelas which has 22% of the demand share in both regions. Crime dramas are the second most popular subgenre with 20% demand share in the US and 18% in Latin America, unsurprising given the number of titles focused on drug cartels that appeared in each region’s top ten titles! Competition reality and historical dramas are the next most popular subgenres after those.

The first difference comes in at the fifth most in-demand subgenre, where US audiences prefer teen sitcoms while LATAM audiences go for comedy-dramas; the reverse is true in seventh.

The final difference in the highest demand subgenre in each region is that the US prefers action dramas and period dramas, while Latin Americans prefer mystery dramas and sitcoms (not shown on graph above).

Note: Elements of this analysis were first published by ttvnews (in Spanish) and Prensario Internacional.