Netflix is scheduled to report results for the first quarter of 2024 on April 18th. We previously highlighted how the streamer gained ground on the competition at the end of last year with a jump in the number of its original titles. At the same time platforms around the world scaled back on new original series.

Netflix was able to leverage this short term gain on rivals and had a blowout earnings report, with subscribers coming in well ahead of consensus estimates. Will this trend continue into 2024, helping Netflix to further cement its dominance? Using Parrot Analytics’ Content Panorama we can get a more nuanced understanding of how Netflix’s catalog compares with the competition.

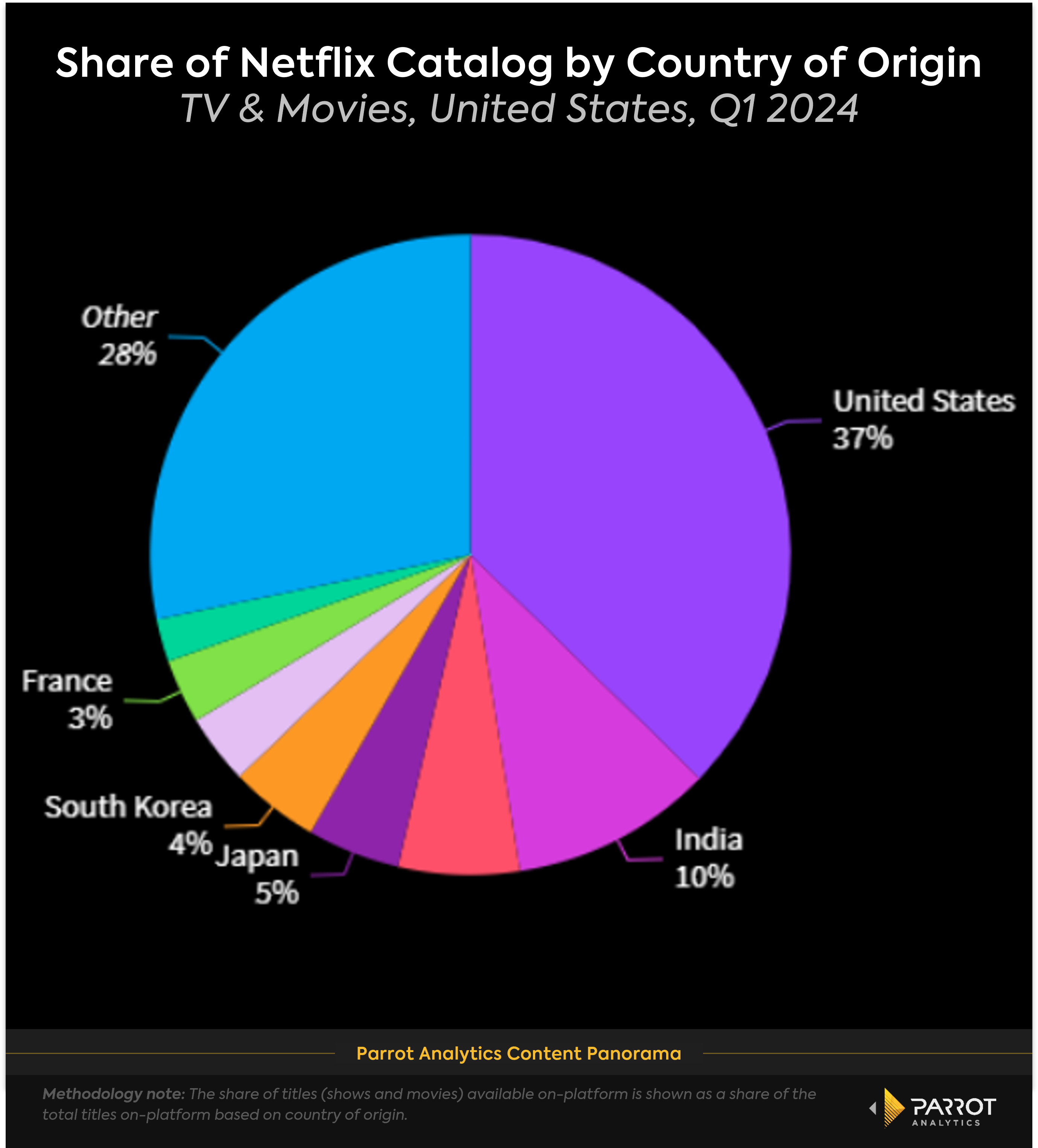

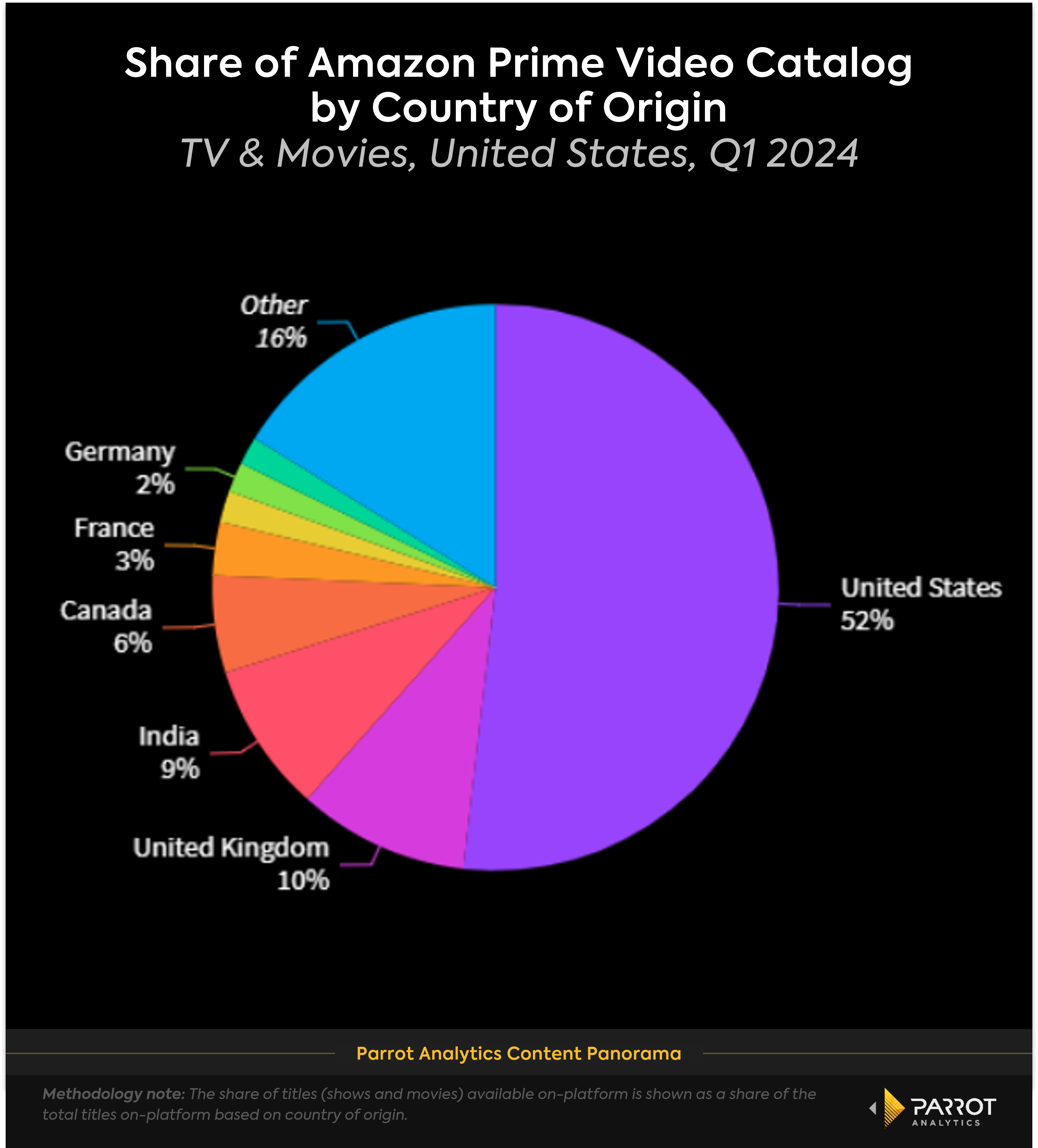

Both Netflix and Amazon Prime Video have some of the largest catalogs of international content in the US. As global streamers making original content for audiences around the world, both Amazon and Netflix are able to serve up this content to their US subscribers.

This is where we see some of the larger differences in catalog composition between the two platforms. While both platforms are market leaders in terms of the amount of foreign content they offer US audiences, Netflix has a substantially larger share of international titles available to stream in the US. A slight majority of shows and movies available on Prime Video come from the US.

For US audiences looking for a show or movie from India, Netflix offers the biggest selection. Ten percent of the titles available on Netflix in the US are from India. While Netflix might have a leg up when it comes to the quantity of these shows, Amazon Prime Video punches above its weight here with some of the most in-demand Indian titles with US audiences.

Prime Video looks like an appealing streamer for American Anglophiles, with 10% of its titles coming from the UK (though it might have to compete with BritBox for this audience). Netflix’s investment in content from East Asia is clear with Japan and South Korea accounting for 5% and 4% of titles on the platform respectively. Neither of these markets ranked in the top 8 by number of titles on Prime Video.

While comparing these platform catalogs gives insight into their different strategies and competitive advantages, to truly understand who is best positioned to tap into audience interest in foreign content we need to look at demand trends to see what audiences want and which types of content are on the rise.