Netflix partly became the largest television platform in the world thanks to a first-mover advantage in which it built a sizable audience on the backs of licensed content. Recognizing this would not last forever, the streamer spent enormous resources developing and growing its library of originals to maintain interest in advance of rivals launching their own competing SVOD services and clawing back their programming.

Now, after years of in-house consolidation and failing to turn a steady profit, these same companies have largely wound up right where they started — licensing programs to Netflix yet again.

You can’t claim that the Entertainment Industry Gods are not without a cruel sense of humor.

It must be troubling to competitors to feel trapped in a self-fulfilling feedback loop. But given the current market trends, it’s difficult to see how anyone on either side of this equation can afford to break the pattern.

After Wall Street reined in the long leash it had been providing to streaming up until 2022, content budgets stabilized or declined as the business began, and continues to endure, a painful contraction.

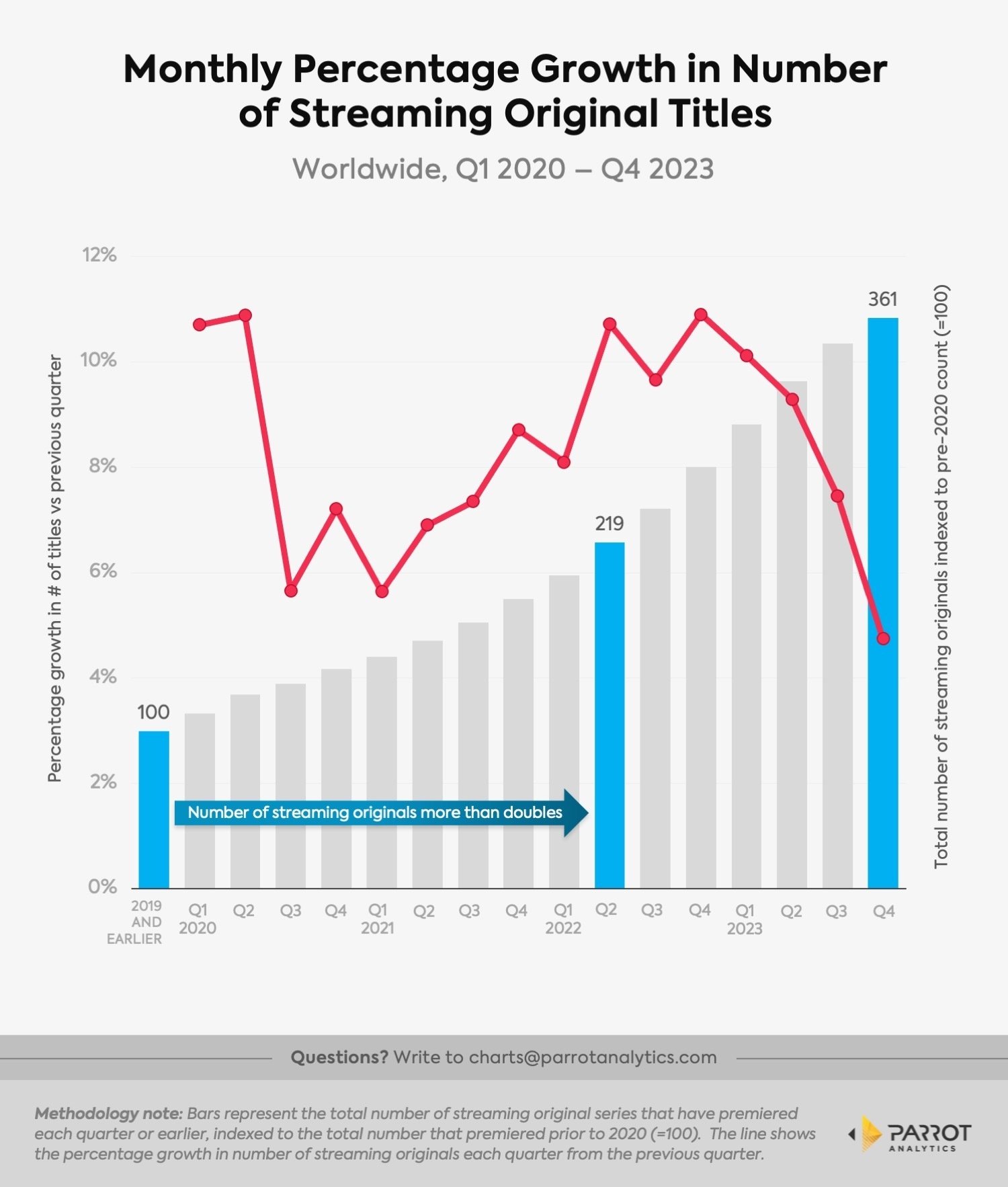

The fourth quarter of 2023 marked the fourth consecutive quarter of slowing output from streaming services in terms of new streaming original series premieres, according to Parrot Analytics.

Contrast this yearlong slowdown with the rapid pace of new content growth from 2020-2022 when the number of streaming original series more than doubled. While last year’s slowdown could be partly attributed to the dual strikes crippling Hollywood, there was not a quick rebound in the number of new shows in the final months of the year. As streaming profitability has become the name of the game amid years of bottom line crunching, legacy media has little choice but to generate much-needed revenue through licensing.

At the same time, linear programming still drives the vast majority of audience demand across seven of the eight premium SVOD services. This leaves a service such as Netflix in need of the bump or consistent engagement that something like Suits or Grey’s Anatomy provides at a smaller price point than trying to unearth the next Stranger Things.

A strong licensed library of in-demand programming enables greater innovation flexibility for Netflix, particularly as it continues to expand into gaming. Syndication has long been the life blood of TV even as it assumes new forms. In many ways, both sides need one another.

But in order to strike a healthier balance, a deeper understanding of consumer behavior is needed. The key for legacy media is to leverage strategic co-exclusivity to drive viewers back to their own platforms, understand ancillary distribution pathways, fill the library cracks that leak viewership to rival services, and more properly value in-demand internal content on the open market. There are ways to make this dance feel less like a leader-follower dynamic and more like the mutually beneficial partnership it can be.

Of course, that’s all easier said than done in Netflix's growing shadow.