By Parrot Analytics Regional Director, Alejandro Rojas. Image: Money Heist (Netflix)

A recent study by Harvard researchers validates a thesis that SVOD players seem to know already: Original content drives subscription growth.

Using recent developments as context, and leveraging Parrot Analytics’ exclusive dataset of global TV demand data and audience behavior, I here present – for discussion – the four phases of SVOD subscription growth:

- Launch

- Growth

- Attract & Retain

- Scale

Let’s dive right in.

Launch

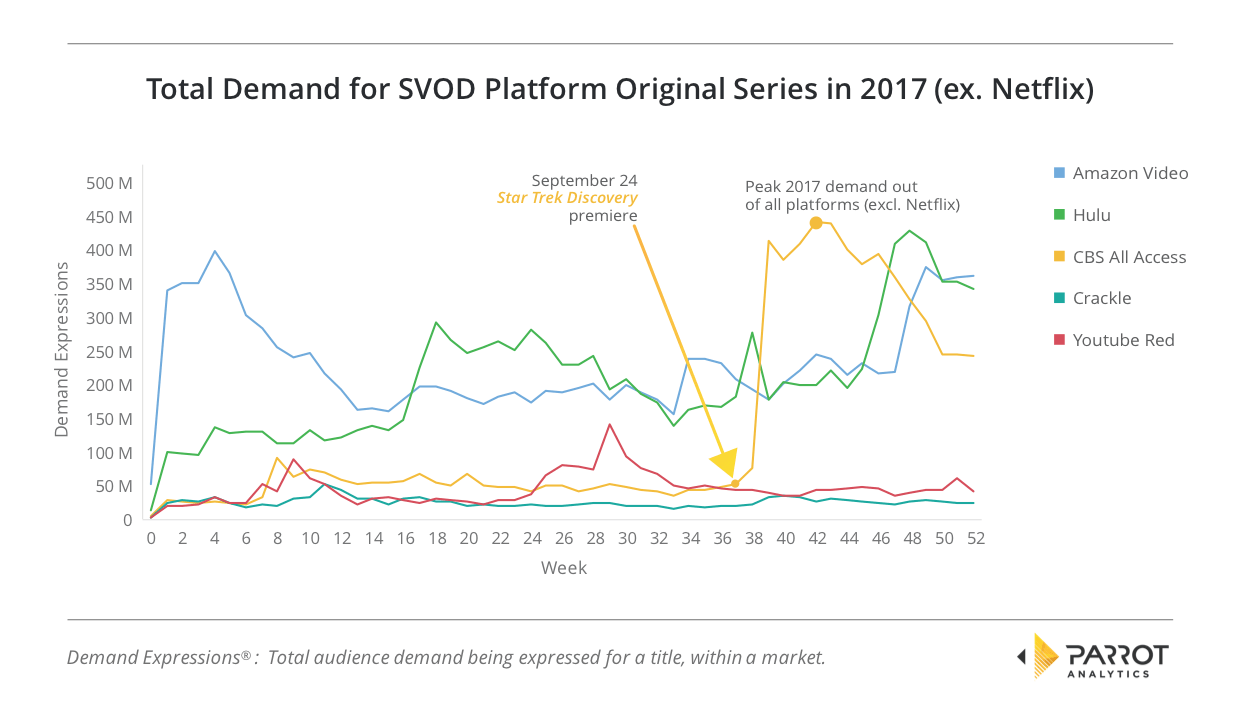

One plausible strategy to successfully launch an SVOD platform is to put all bets into a content property with a vibrant and passionate fan base. As one example, CBS All Access recently announced its international expansion after demand for Star Trek Discovery skyrocketed on its premiere. Platforms can take off with a single successful show, as demonstrated below:

Growth

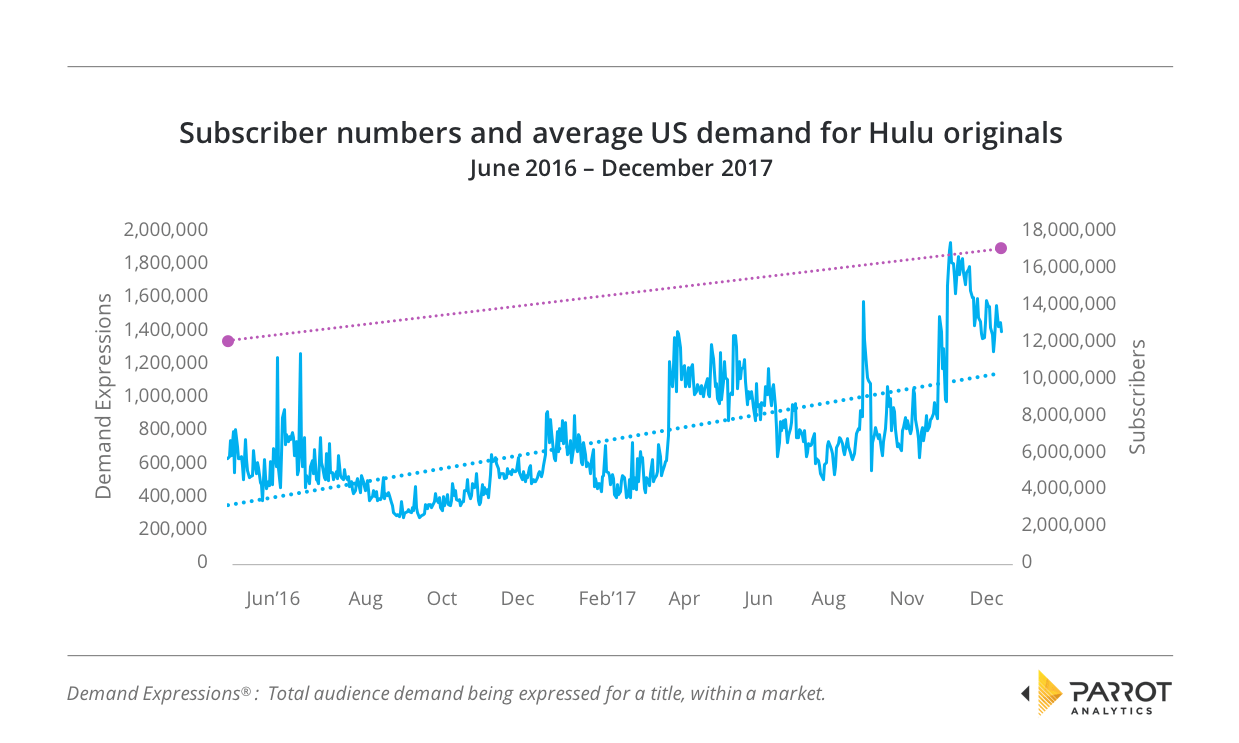

After launch, an SVOD’s original content must continuously grow the platform’s average audience demand. This demand growth is observed in the case of Hulu, suggesting that as the average demand for all originals on the platform grows, subscriptions will follow.

Attract and Retain

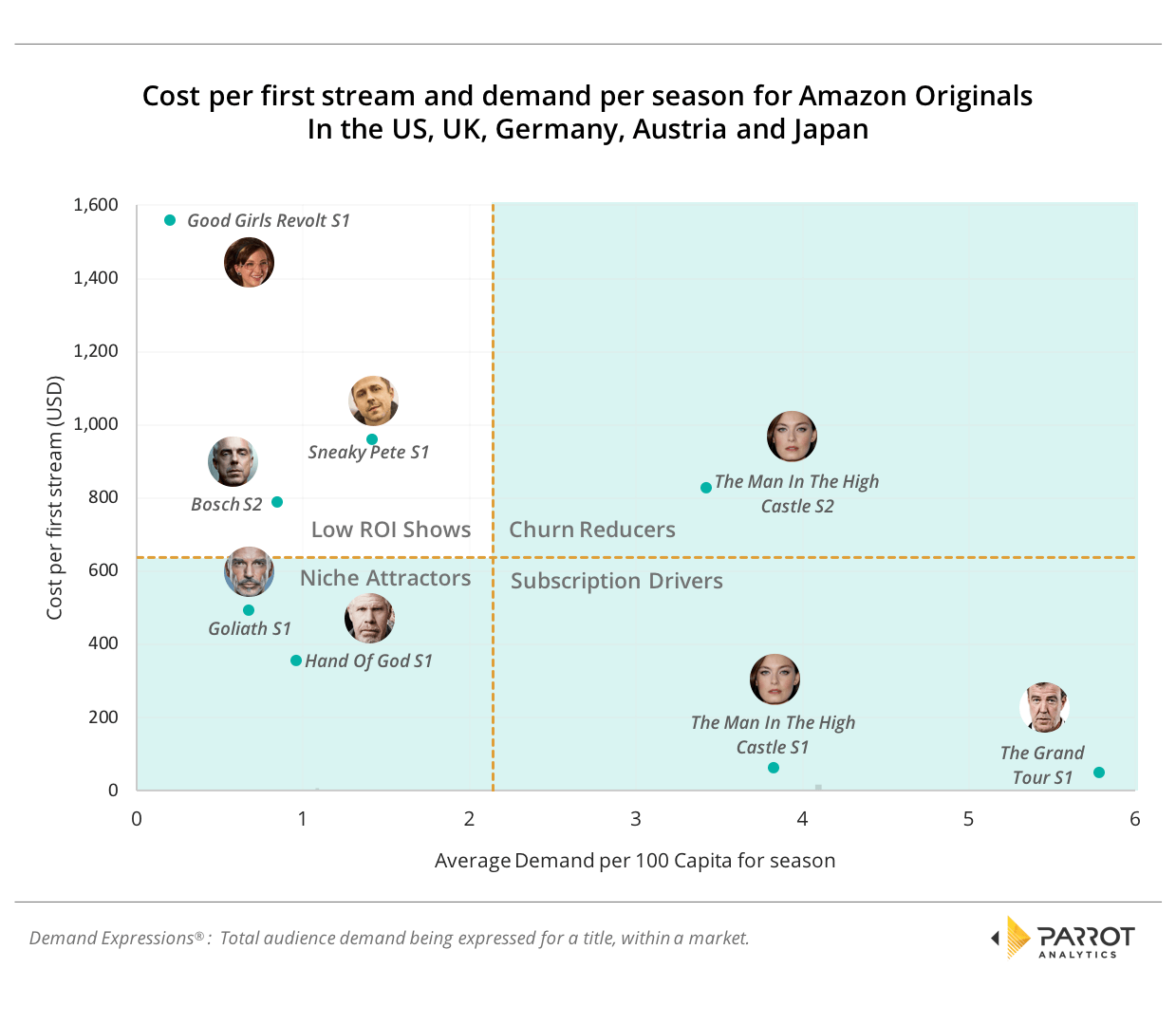

Once an SVOD service achieves a certain reach, the task of attracting and retaining subscribers becomes that of managing a portfolio of original content assets. In that portfolio, the SVOD service must optimize investments on three types of shows: Churn reducers, niche attractors and subscription drivers. Those shows that fall outside these categories are likely candidates for cancellations. Applying this portfolio framework to Amazon’s original content serves as an example to illustrate this phase:

Scale for Global Domination

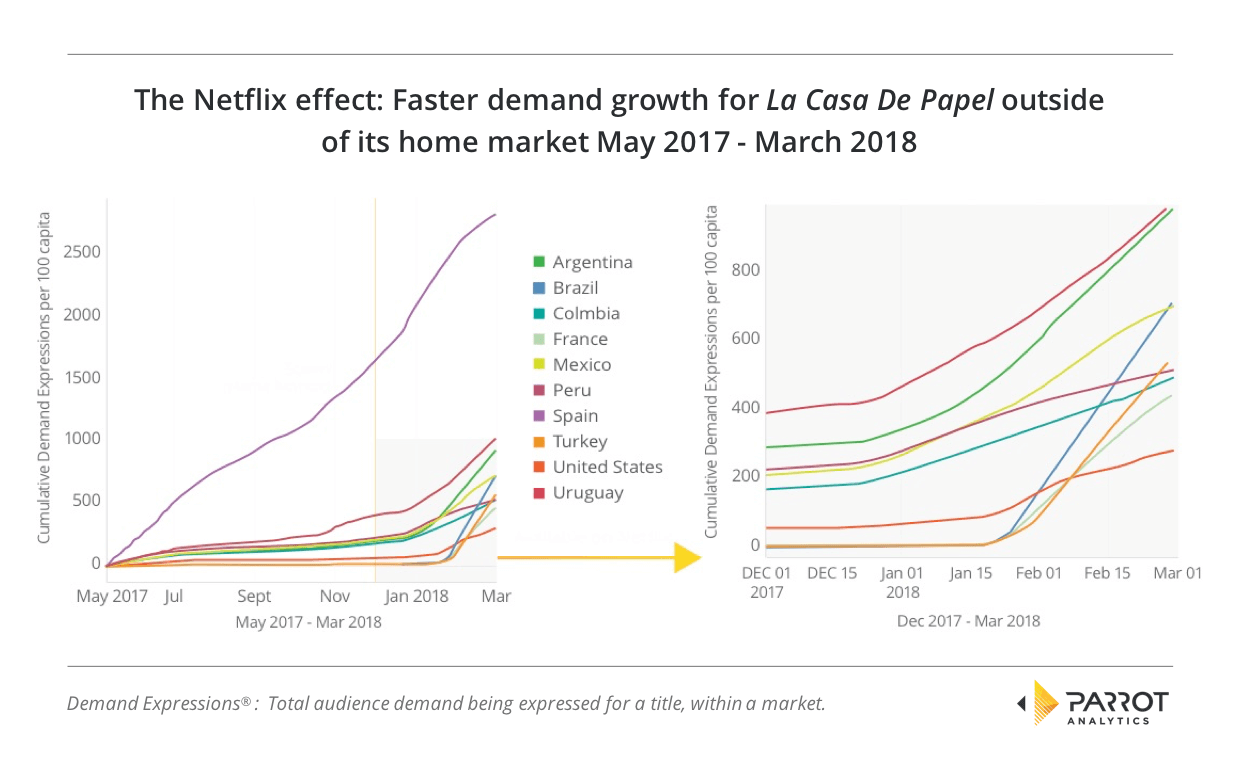

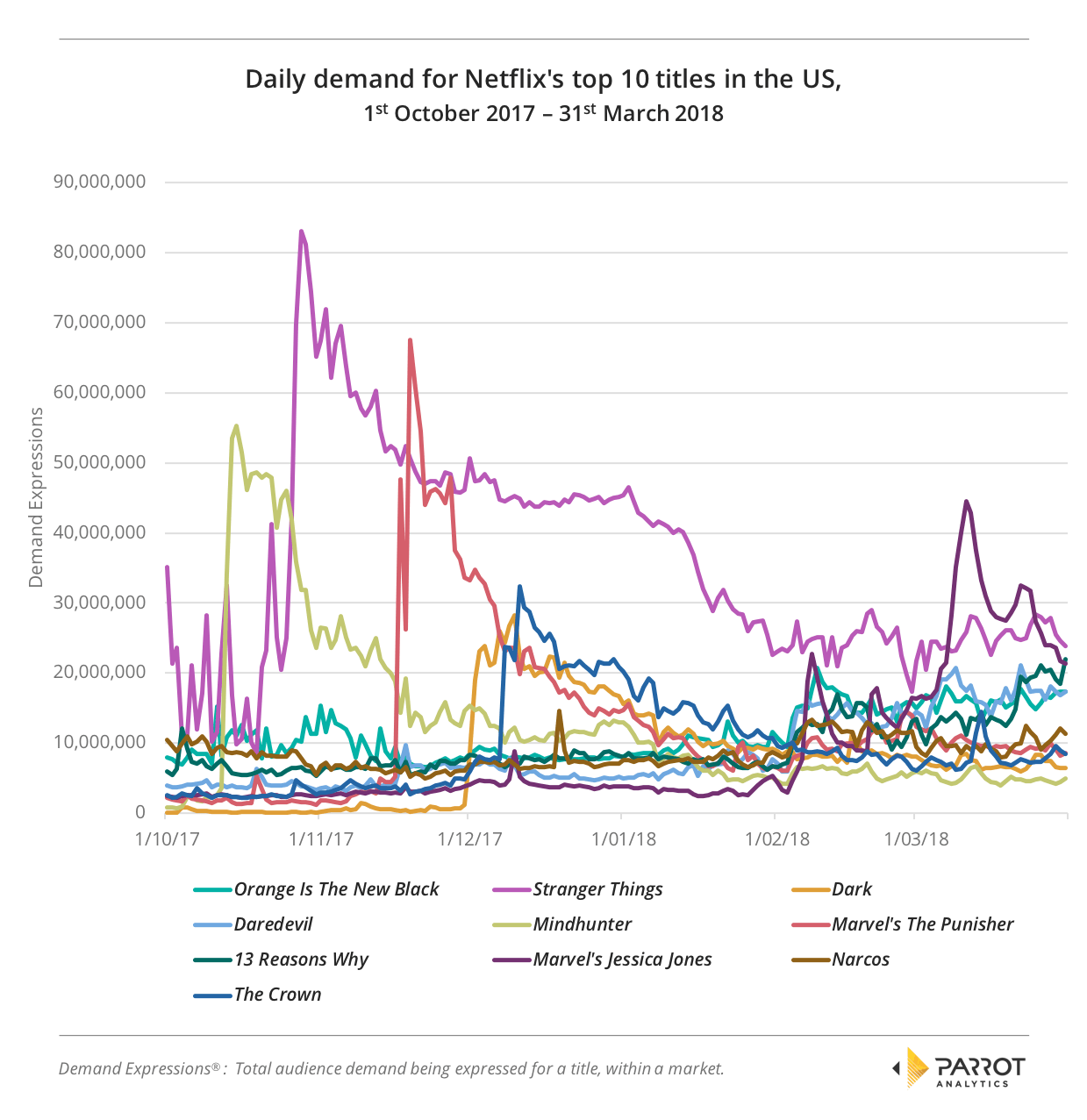

After gaining massive scale, the path to global domination, as followed by Netflix, includes:

(a) Increasing the frequency of release of shows that serve specific audiences, such as The Crown.

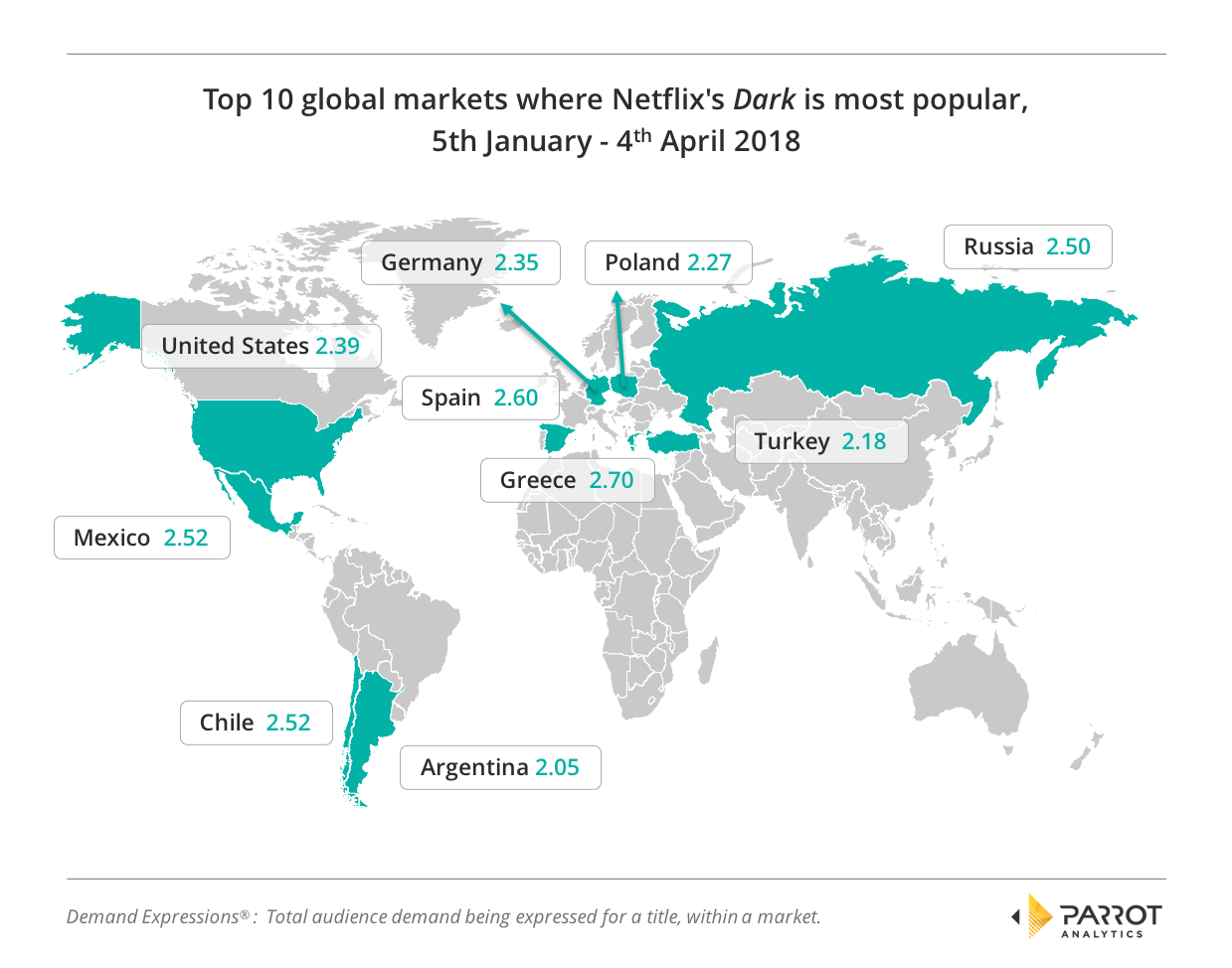

(c) Commissioning originals with true global appeal like the German-language original series Dark.

The question that remains is this: Will Disney-Fox, the elephant in the room, follow this approach when launching its streaming offering next year?