Image: Grey’s Anatomy, ABC

Linear and broadcast television continue to provide immense value to streaming services, largely due to the highly in-demand programming they offer. Popular shows like "The Big Bang Theory," "Friends," "Grey’s Anatomy," and others consistently top streaming performance metrics. However, there’s a growing concern: what happens when these long-running hit shows are no longer produced regularly?

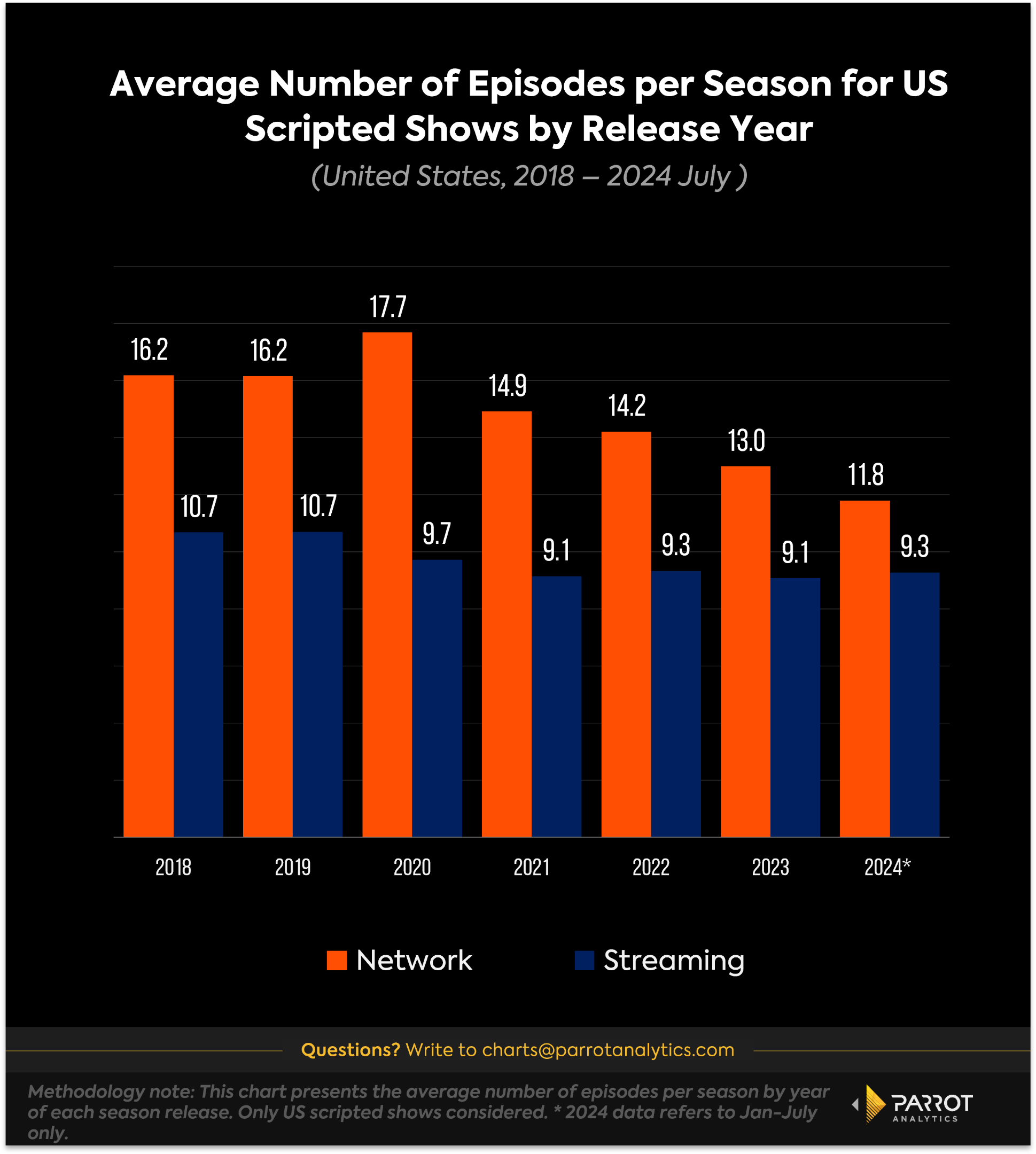

Since 2018, the average number of episodes per season for network shows (including cable and broadcast titles) has declined, dropping from 16.2 episodes in 2018 to 11.8 in the first half of 2024. This trend suggests that new linear series are less likely to achieve the same longevity as their predecessors due in part to rising production costs, declining ratings and shrinking ad revenue. This raises concerns about their future value.

Long-running shows with extnsive episode libraries are among the most valuable assets for streaming platforms. They generate significant audience demand, drive hours of viewership and improve subscriber retention to the platforms, keeping audiences engaged between new original content releases. Across major US SVODs, linear TV contributes to more than half of the demand for all platforms except Netflix (which itself continues to benefit from linear programming such as "The Flash," "The Walking Dead," "Grey’s Anatomy", "Suits" and many more).

Streaming platforms have adopted several strategies to address the decline in longer-running linear series. One effective approach has been the introduction of “serialized procedurals,” streaming versions of network procedurals centered around specific professions like law enforcement, medicine or legal practice. Streaming originals that tap into this popular linear format include hits such as "The Lincoln Lawyer," "Reacher," "Jack Ryan" and more.

Another strategy could involve the adoption of the traditional sitcom model of 18-22 episodes as opposed to the 8-12 episodes streaming original comedies typically consist of. Longer seasons helps to develop closer emotional bonds between the characters and the audiences, create habitual viewing behavior, and leads to better audience retention. However, the economics of streaming do admittedly make this more difficult.

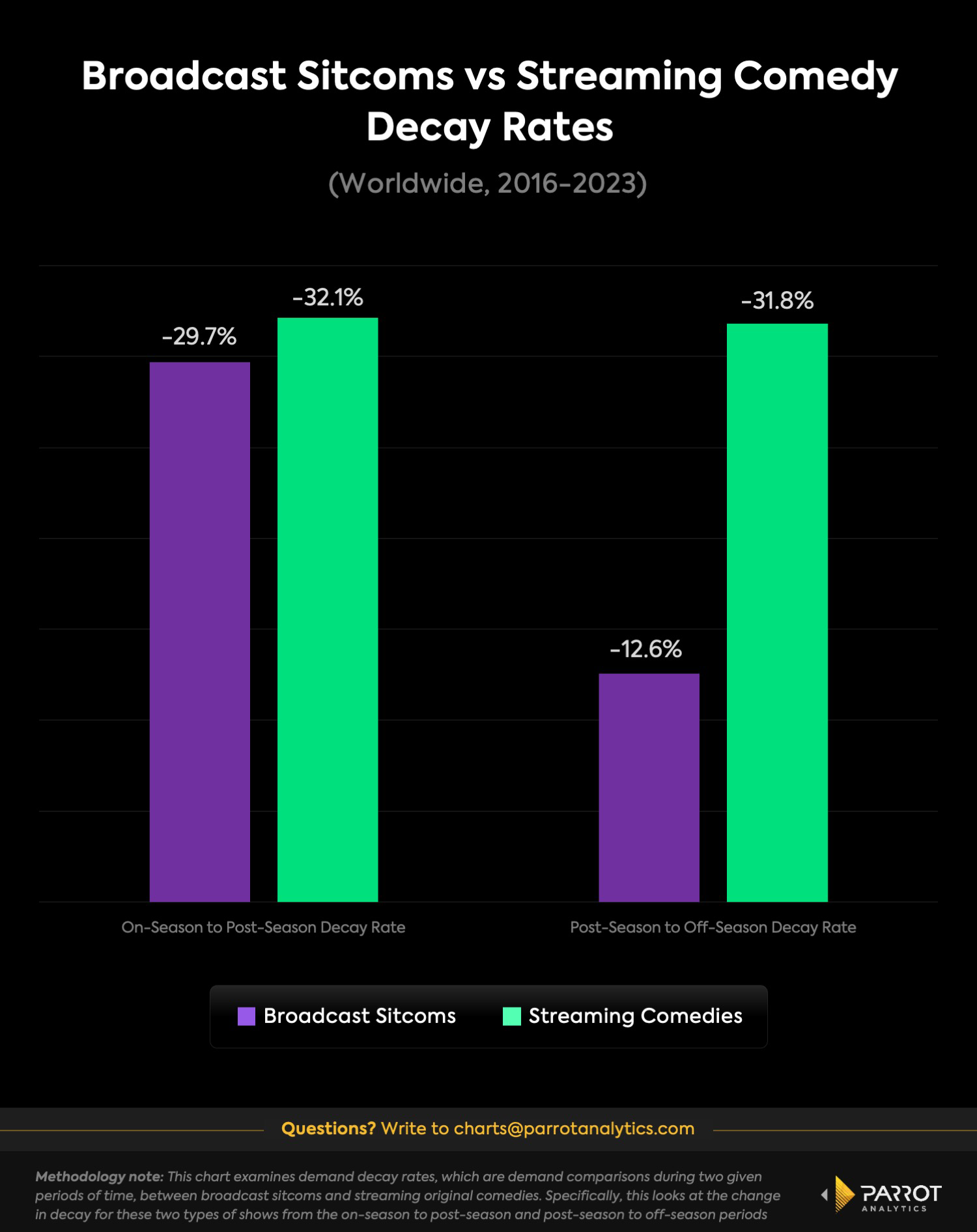

The ability to keep audiences engaged can be quantified by examining decay rates, which measures the decline in demand for a show across different periods: the on-season, when episodes are being released; the post-season, which is the period right after all episodes have been released; and the off-season, when no new episodes are airing.

For broadcast sitcoms, the average demand decay from the in-season period to the post-season is 29.7%, compared to 32.1% for streaming comedies. A lower decay rate indicates better audience retention.

When looking at the decay rate from post-season to off-season, which is the next equally timed window and even further removed from a finale, broadcast sitcoms average a 12.6% decay rate while streaming comedies are at a whopping 31.8%. So in both instances, longer running broadcast sitcoms have more staying power than streaming original comedies.

As scripted entertainment on cable and broadcast continues to be de-emphasized, it may eventually rob streaming of one of its most reliable content funnels. And as the rate of new streaming original series continues to decrease during this era of contraction, customers may not be as entranced by the slowing trickle of SVOD exclusive programming. This creates a conundrum for the industry with no immediate solutions.