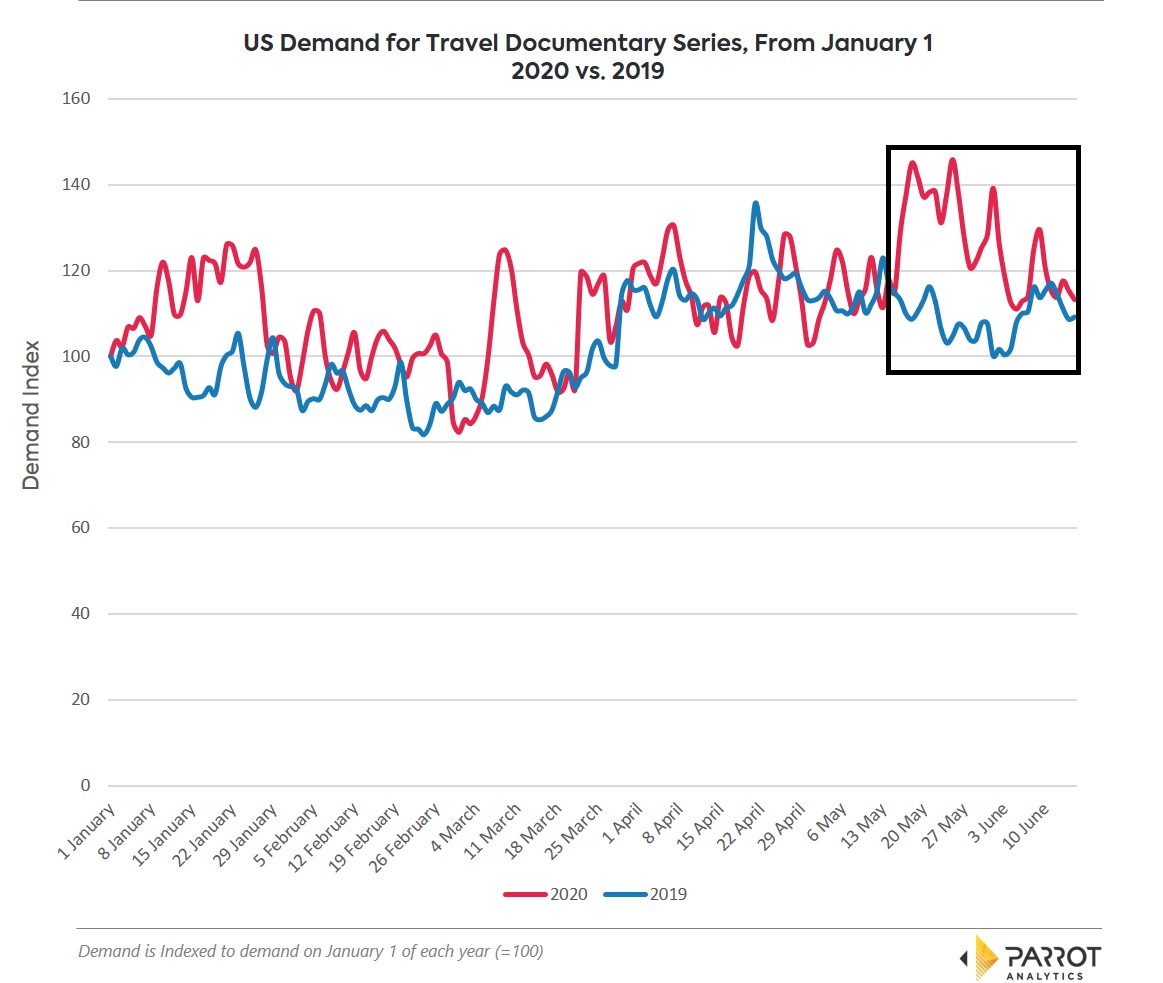

As the Covid-19 pandemic stretches into the summer in the United States, the traditional summer vacation season has been disrupted. People are either unable or unwilling to travel at this time. As audiences face a summer without travel and no return to normality in sight, they will seek an escape from the present situation. We have measured an increase in US demand for Travel Documentary content in May that is likely driven by these factors.

In the final two weeks of May, demand for Travel Documentary series was on average 34.2% higher than at the beginning of the year and 17.7% higher than the same period in 2019.

The large drop in demand from June 1st is not specific to this genre but was measured across all content types and can be linked to the protests in the US. As the short term impacts of this subside but the summer stretches on, we expect there to be elevated demand for travel content. Shows that fall into this category could be good targets to attract viewers at this time

Netflix’s Somebody Feed Phil premiered it’s third season on May 29. The demand for this season premiere (+3 days) was 73% higher than the previous season indicating increased interest in the current climate.

Demand for Great British Railway Journeys has seen a recent surge. It was 112.8% higher in the last two weeks of May compared to two previous weeks. The latest season of this show concluded in January so this impact is not due to new episodes.

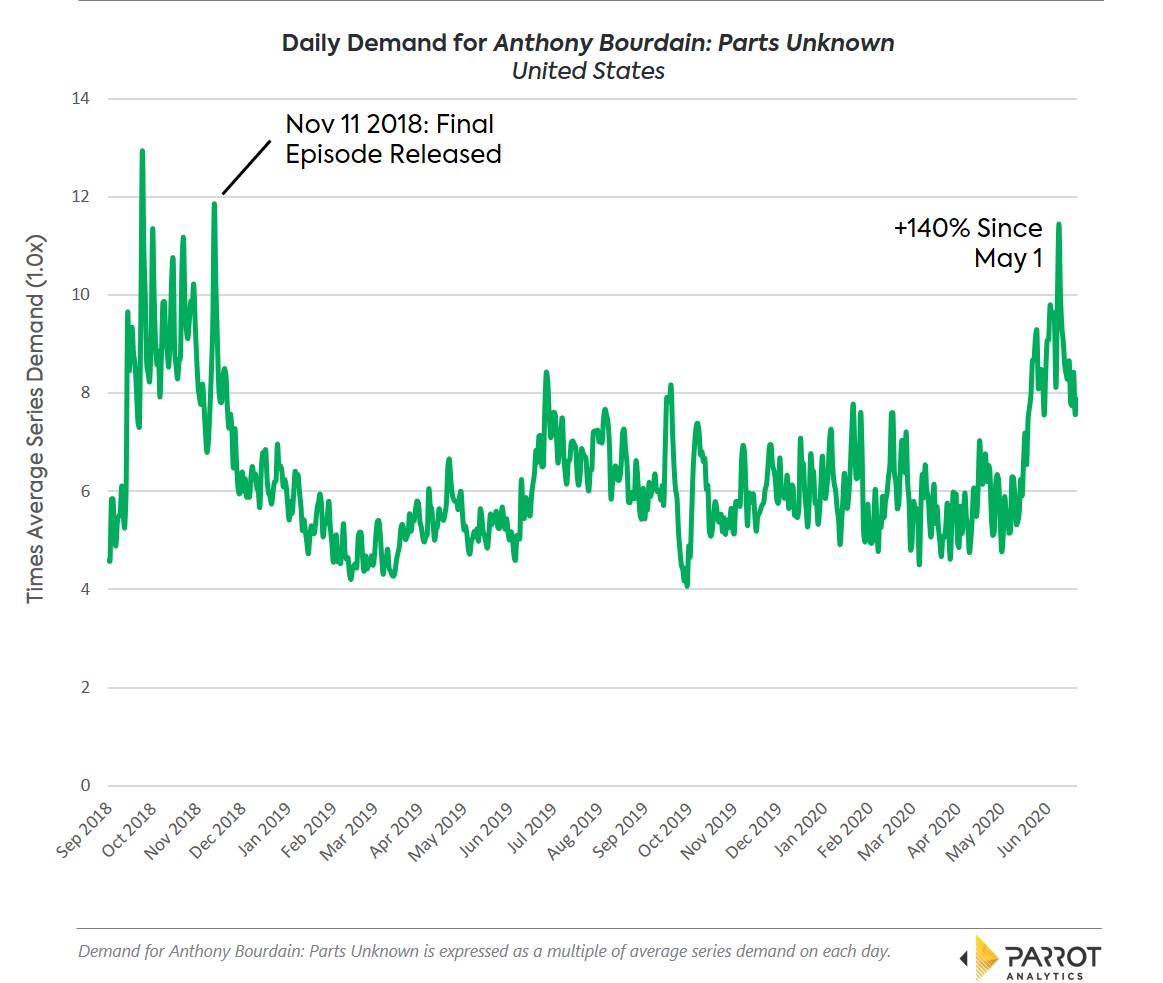

Anthony Bourdain: Parts Unknown concluded in 2018, yet has remained popular. The series has seen the highest demand this May since the last episode was released in 2018. From May 1 to it’s peak on June 9, demand for this series increased 139.9%.