As ViacomCBS prepares to report its latest earnings, Parrot Analytics has found strong demand for the conglomerate’s overall catalog, rising demand for both original and on-platform content for Paramount+, but missed opportunities in leveraging its most beloved content for streaming dominance.

ViacomCBS’s wide range of properties produced several of the most in-demand new series of Q4 2021 with American audiences:

- Showtime’s Yellowjackets (21x more in-demand than the average show in the US in Q4 2021) and Dexter: New Blood (14.2x) were the fifth and 13th most in-demand new shows that debuted in Q4 across all platforms.

- Paramount+’s Mayor of Kingstown (19x) and Star Trek: Prodigy (12.5x) were the seventh and 14th most in-demand new series.

- CBS’s CSI: Vegas (18.8x) and Ghosts (16.2x) were the eighth and tenth most in-demand new series.

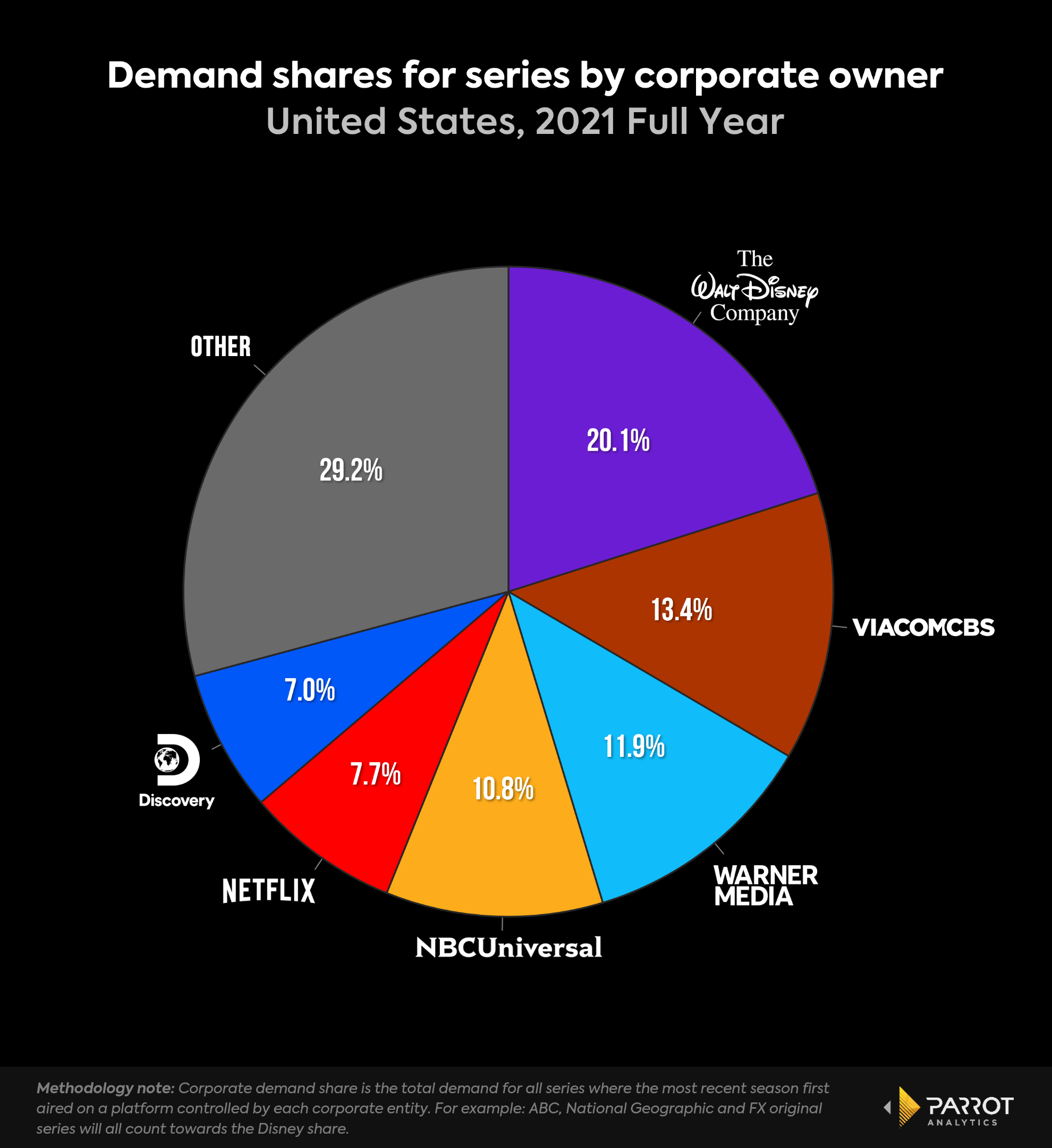

ViacomCBS remains in a solid second place in corporate demand share (13.4%), far behind Disney (20.1%) but ahead of fellow legacy media brands WarnerMedia (11.9%) and NBCUniversal (10.8%) for the year 2021. However, Paramount+ was in seventh place in US originals demand share (4.2%) in 2021, and fifth place in US on-platform demand share (8.4%) as of Q4 2021.

If ViacomCBS wants to be a leading player in streaming, they must exclusively place this highly in-demand content catalog onto Paramount+. Demand for original and exclusively licensed content is a key leading indicator of subscriber growth for SVOD platforms.

One thing that is clearly working for Paramount+ is the Star Trek franchise. Star Trek originals on Paramount+ accounted for 36.6% of the demand for Paramount+ Originals in 2021. By comparison, Marvel shows made up 38.6% of Disney+ Originals demand, and Star Wars series accounted for 30.1% of Disney+ Originals demand for the year 2021.

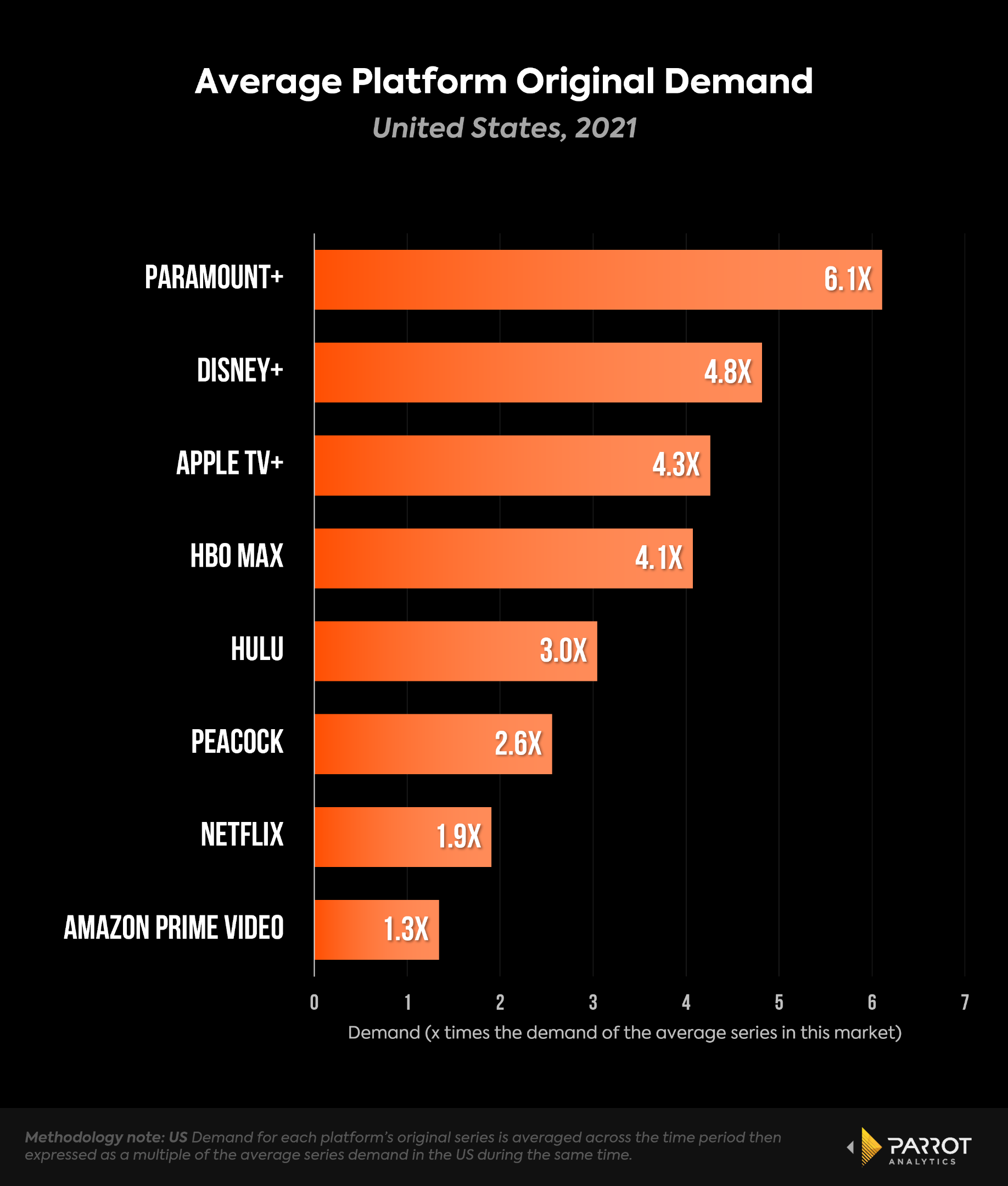

Paramount+ did have the highest average demand per original series of any of the major SVODs with US audiences in 2021. However, a ‘quality over quantity’ approach might not be a winning strategy in today’s media ecosystem where efforts to scale up trump everything else.

Corporate Demand Shares - United States, 2021

(Click here for more details on how we calculate Corporate Demand Share)

- Corporate Demand Share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their own platforms.

- For the full year 2021, ViacomCBS was in a solid second place in this category, with 13.4% share, well behind Disney (20.1%) but ahead of legacy media competitors WarnerMedia (11.9%) and NBCUniversal (10.8%).

- The soon to be Warner Bros. Discovery (18.9%) would leapfrog ViacomCBS in corporate demand share and push it to a distant third, showing the immediate importance of building up demand for exclusive content on Paramount+ and Showtime.

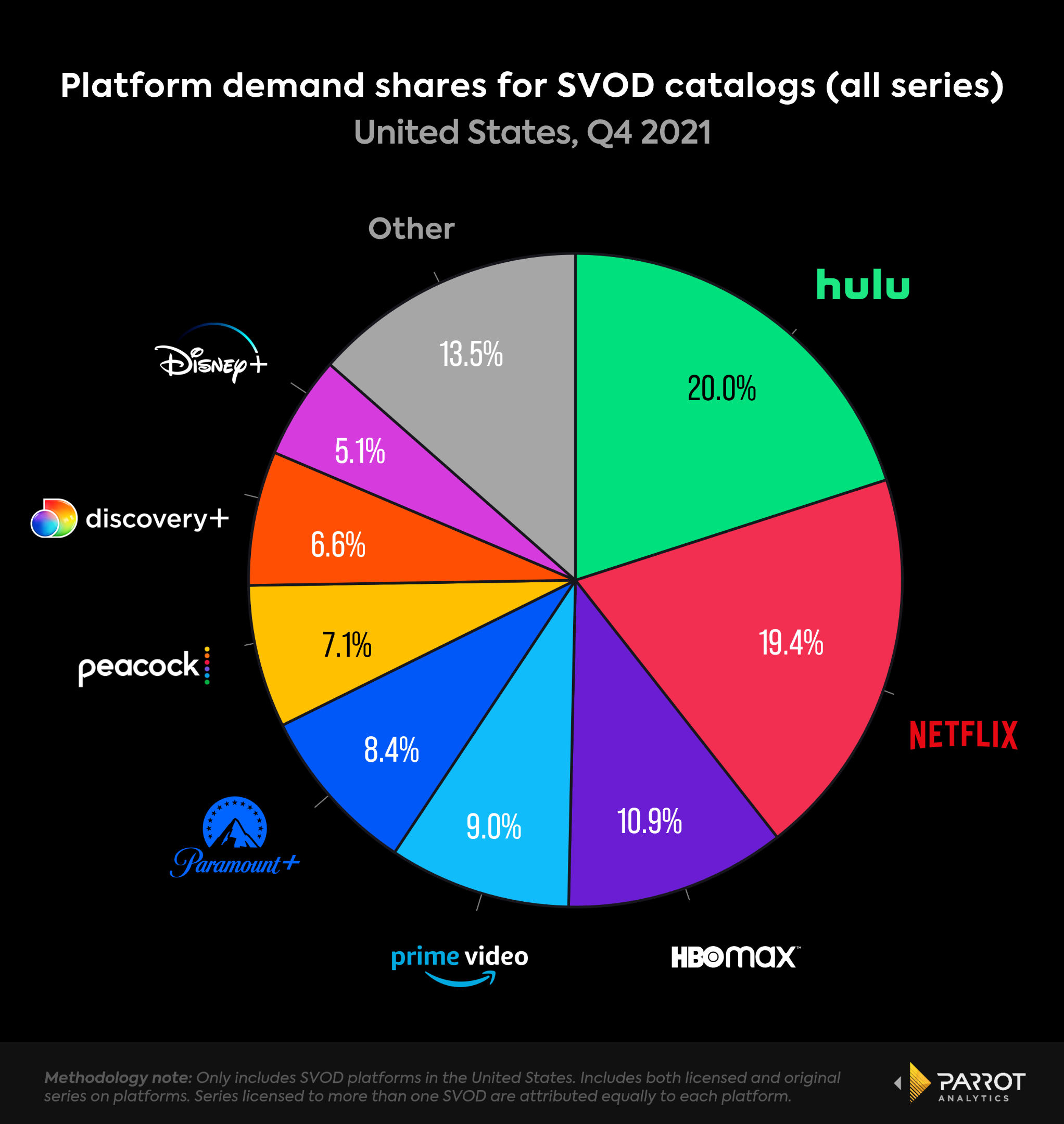

On-Platform Demand Share - United States, Q4 2021

- When considering demand for an SVOD’s full catalog - including digital originals and licensed content - Paramount+ held 8.4% share in the category for Q4 2021.

- Likely helped by the new South Park episodes exclusively available on this platform, this was a decent increase over its share in Q3 2021 (8%).

- Paramount+ closed the distance between it and Amazon Prime from 1.5 percentage points to 0.6 percentage points in just one quarter.

- Nevertheless, Paramount+ has less than half the demand share of leaders Hulu (20%) and Netflix (19.4%).

- Pulling back top CBS shows from Netflix such as NCIS and Criminal Minds and making them exclusive to Paramount+ would help bridge this gap.

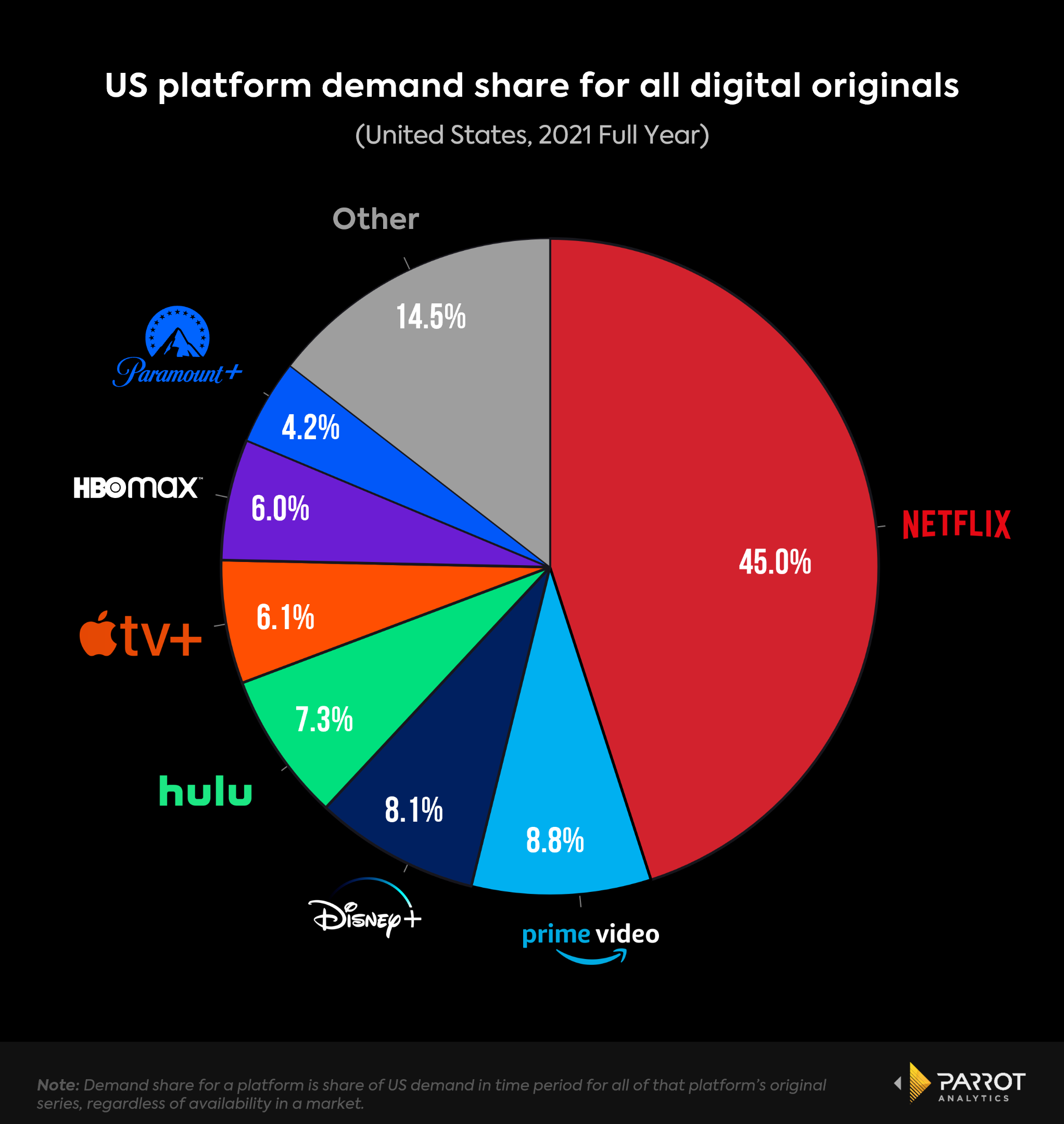

Digital Original Demand Share - United States, 2021

- For digital original demand share, Paramount+ finished 2021 at 4.2% in the US, up 7.3% in demand share versus 2020 (3.9%).

- This growth pales in comparison to the growth of HBO Max (+86.4% YoY), Disney+ (+49.7% YoY) and Apple TV+ (+38% YoY) in 2021.

- Paramount+ has successfully locked in Star Trek fans for the foreseeable future, but the service needs to expand beyond this audience to truly compete.

- Series in the ‘Sheridan Universe’ like 1883 and Mayor of Kingstown are a good start, and have brought a new audiences into Paramount+. Even better would be getting the exclusive streaming rights to Yellowstone back from NBCUniversal’s Peacock.

Average Platform Original Demand - United States, 2021

- What Paramount+ lacks in volume it makes up for in average demand per original.

- Of eight leading streamers, Paramount+ had the highest average demand per original with American audiences in 2021.

- The average Paramount+ Original was 6.1x more demand than the average show in the US, well ahead of Disney+ (4.8x), Apple TV+ (4.3x) and HBO Max (4.1x).

- This data suggests that Paramount+’s original content strategy could be more focused on quality over quantity.