Image: Good Omens, Amazon Prime Video

The realm of television is notorious for its unpredictable outcomes. While some series achieve instant acclaim, others quickly fade into obscurity. A particularly intriguing trend within the industry is the contrasting trajectories shows take between their debut and sophomore seasons. Some begin on a high note, captivating viewers, only to lose their charm in the subsequent season. Conversely, others that begin inconspicuously rally to achieve overwhelming success in their second attempt.

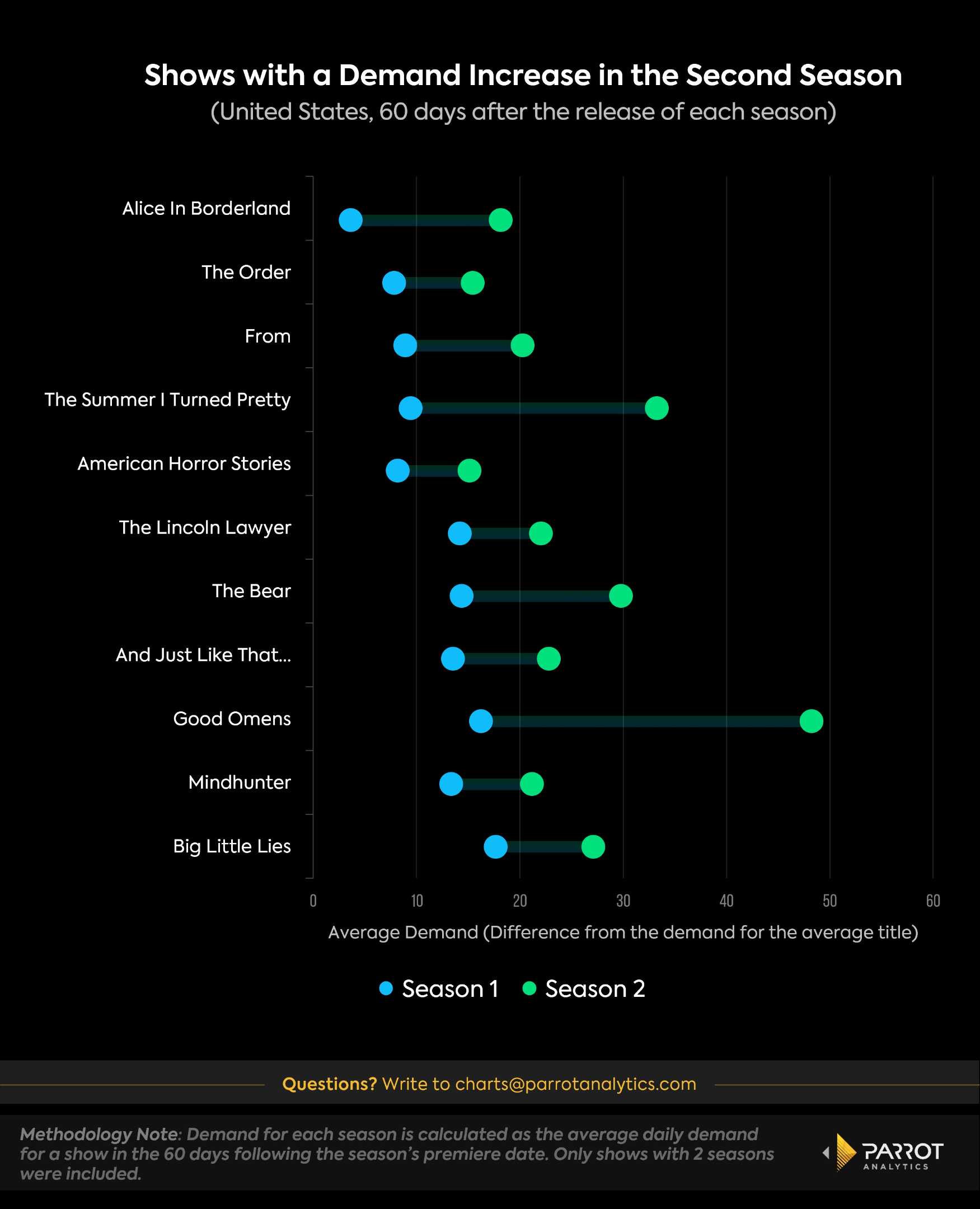

We'll delve into recent data from Parrot Analytics to illustrate how audience demand for some shows evolves between the first and second seasons. The spotlight will first be on shows that, despite an underwhelming first season, gained significant traction in their second.

This is the case of the top 5 shows on the chart below. These are shows that had a relatively modest first season but an outstanding second season. In terms of demand metrics, this means that these shows had more than 10 times the demand for the average show in the first 60 days of the second season, a level reached by less than 2.7% of TV series.

For instance, Netflix’s Japanese live-action series, Alice in Borderland, registered an average demand of 3.6 times the demand for the average show post its first season's global debut. While it received varied reviews, its second season delved deeper into the foundational concepts, seeing its demand skyrocket by nearly 400% to an average of 18.1 times.

Amazon Prime Video’s The Summer I Turned Pretty followed a similar trajectory. After a solid debut season, its second season saw an explosive 250% growth in demand. Netflix’s The Order, MGM+’s From, and Hulu’s American Horror Stories also had at least an 80% surge in demand in their second season.

The chart also shows titles that managed to engage even more audiences after an outstanding first season. Series like the British fantasy-comedy Good Omens saw demand rise by almost 200% from an already successful first season. The extended four-year gap between the two season releases demonstrates the producers' effectiveness in retaining fan interest and building anticipation for the upcoming season.

Another recent show, the acclaimed Hulu original The Bear, saw demand doubling. Other noteworthy mentions with a significant rise between their initial two seasons include The Lincoln Lawyer, And Just Like That…, Mindhunter, and Big Little Lies.

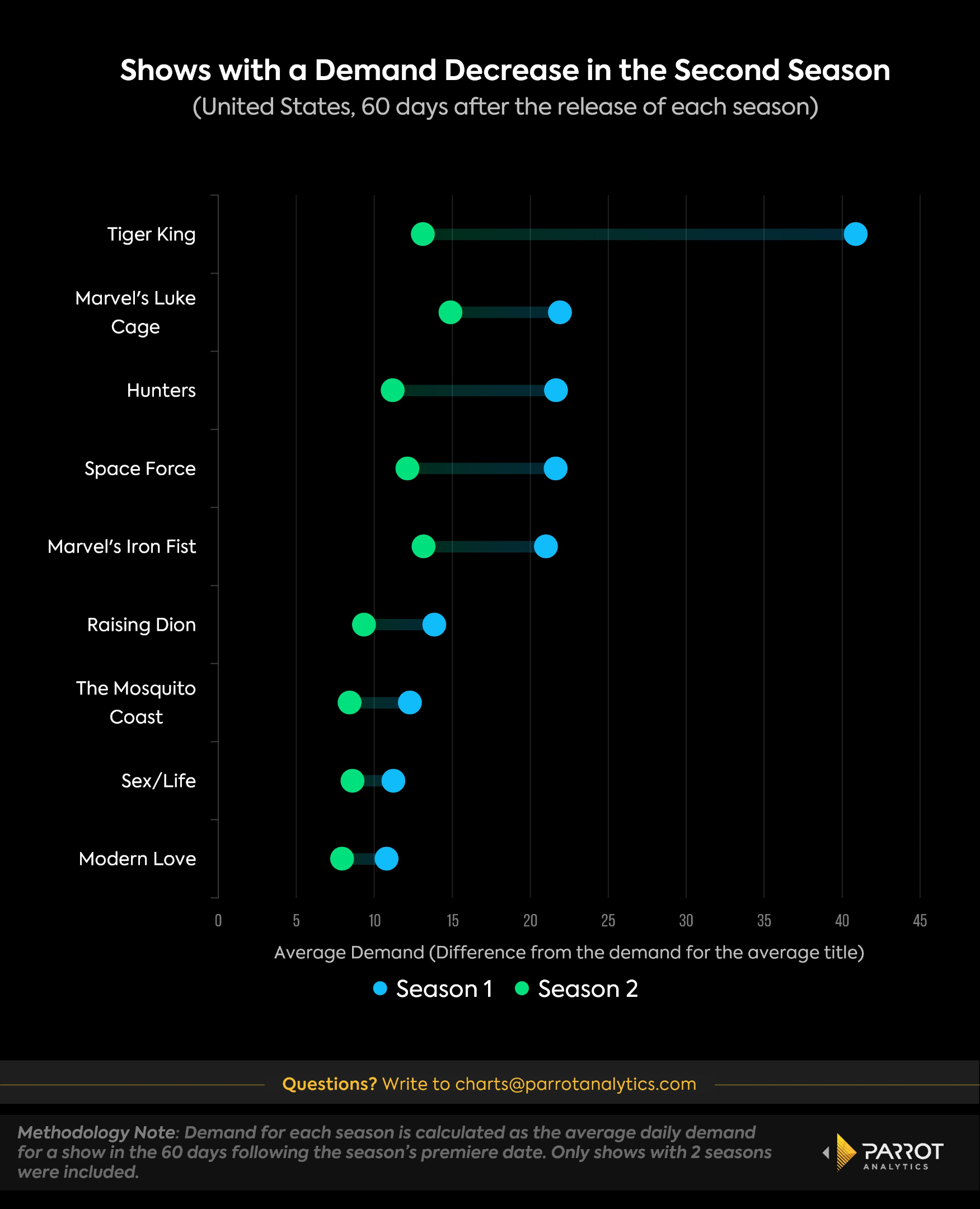

On the other hand, the chart below highlights TV series that failed to maintain their initial momentum. The most striking example of this is Tiger King, which saw its demand plummet by 67% in its second season. When the second season was released, it seemed that the first season had already exhausted the narrative, leaving nothing for the second season, which failed to attract and hold the audience's attention.

Several Netflix originals also witnessed a dropoff in demand after a promising start. Marvel’s Luke Cage, Marvel’s Iron Fist, Space Force, Raising Dion, and Sex/Life couldn't sustain the excitement generated in their initial season. This trend wasn’t restricted to Netflix; Prime Video's Hunters and Modern Love, along with Apple TV+’s The Mosquito Coast, had more demand for their first season than the second. As a consequence, all of these shows have been canceled or concluded their runs after the first two seasons.

A potential factor influencing these declines, especially for shows like Tiger King, could be the timing of their releases. Its inaugural season, launched in March 2020, coincided with the pandemic's onset, a period witnessing an unprecedented surge in content consumption. However, by its second season in late 2021, this pandemic-driven demand had normalized, making the demand gap between the two seasons wider. Other shows such as Hunters, and Space Force, which had the first season released in the first half of 2020, may have been affected by this factor.