Image: Twisted Metal, Peacock

Networks have long realized the potential that video-games have for engaging TV audiences. From the 1982 Pac-Man animated show to the upcoming Fallout Prime Video series, the graphics, storylines, and character development in games have significantly improved, broadening their fanbase.

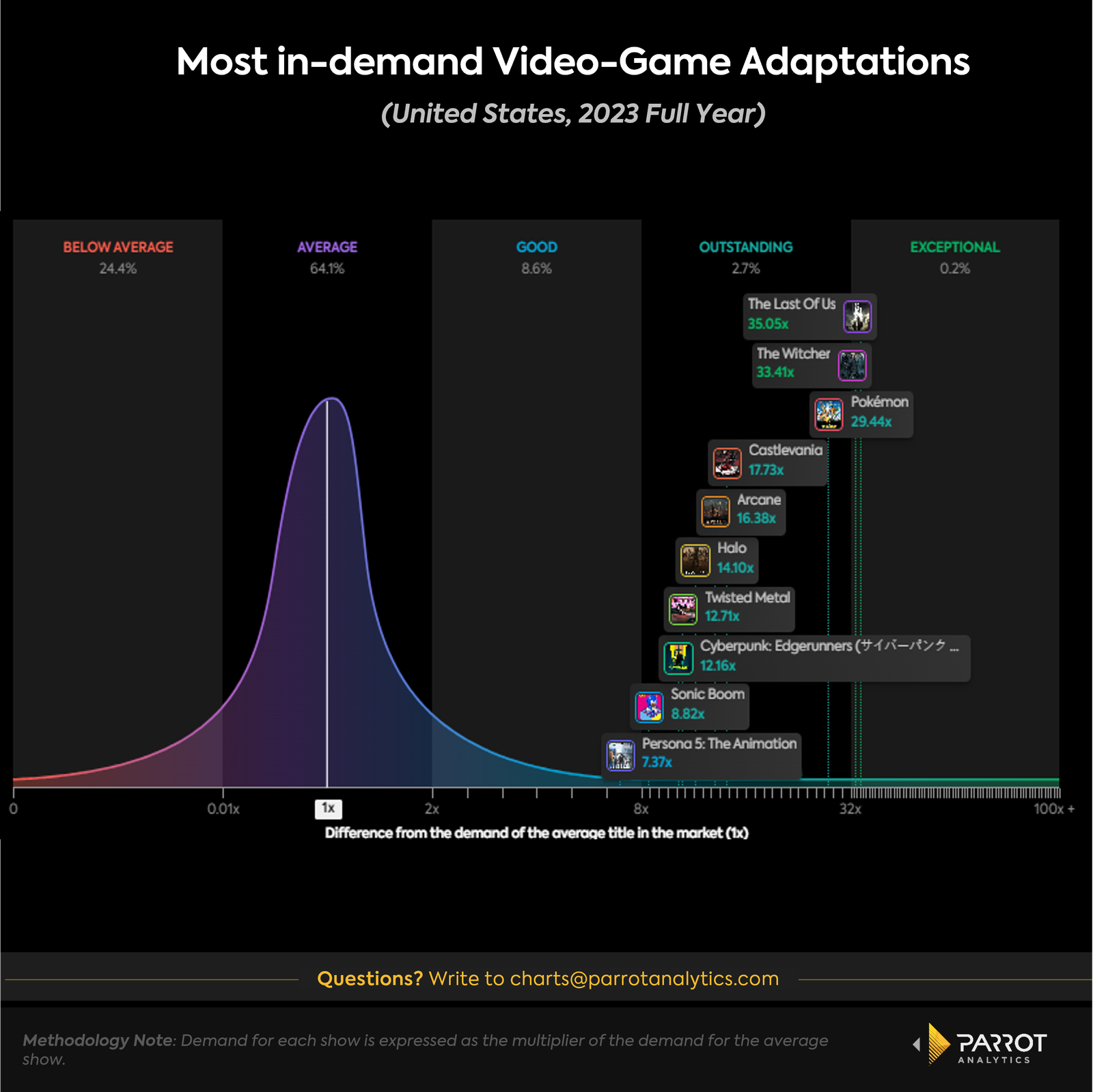

After a long period of unsuccessful US video-game adaptations to TV and movies in the past, recent years have seen a resurgence in the genre’s popularity thanks to a string of successes. According to Parrot Analytics DEMAND360, of the top 10 most in-demand video-game TV adaptations of all time in 2023, seven have been released since 2018. Some examples of these shows are HBO’s The Last of Us, the most popular video-game adaptation last year, Paramount+’s Halo and Peacock’s Twisted Metal, all of them based on popular US video-game franchises.

Among SVOD platforms, Netflix leads in adapting video-games, dominating the top-10 with shows like The Witcher, the second most in-demand show based on a video-game, Castlevania, Arcane, and Cyberpunk: Edgerunners.

Japan, alongside the US, is globally renowned for its video-game adaptations. Two Japanese adaptations are among the top-10 US list. The original Pokémon series, first released in 1997, is still highly popular in the US and around the world, and the more recent Persona 5: The Animation.

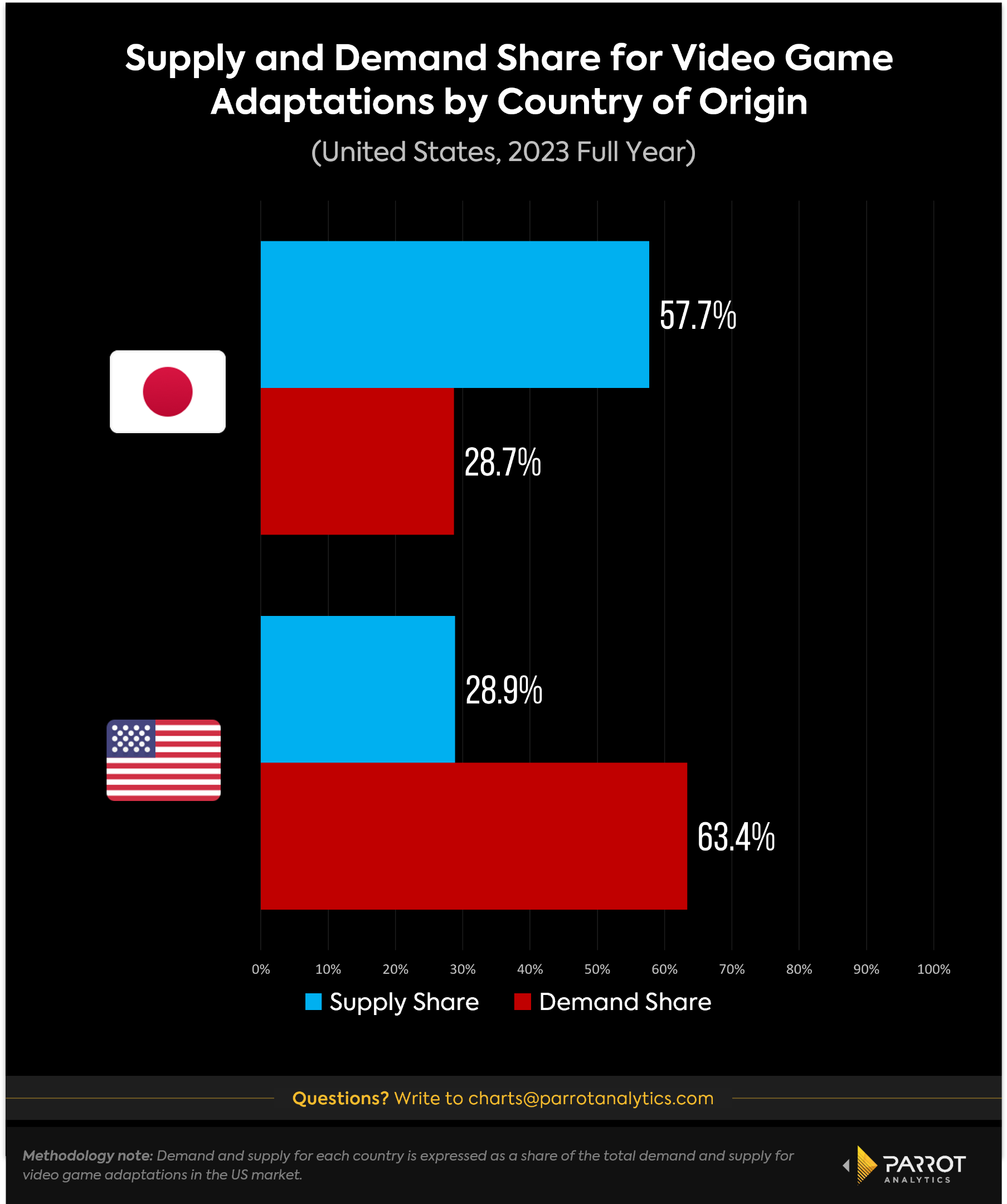

Using Parrot Analytics’s Content Panorama to break down video-game adaptations by country of origin, we can see that Japan is responsible for 57.7% of video game adaptation supply, twice the number of titles the US produces (28.9%). Despite a smaller number of shows, the US adaptations still generate a higher share of the demand in the domestic market at 63.4%, compared to Japanese shows at 28.7%. As is the case for most genres, the few top shows are driving the majority of the demand.

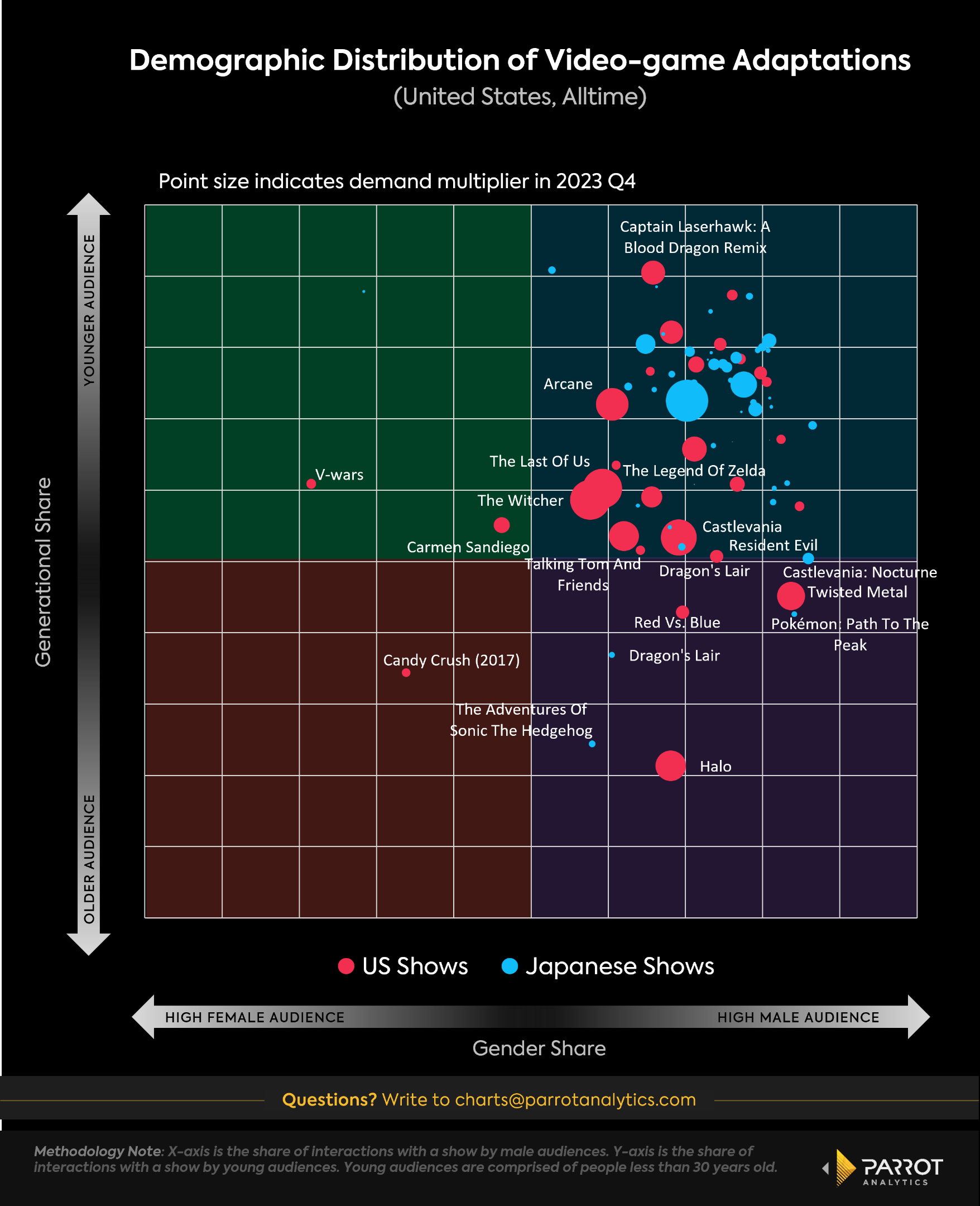

According to Parrot Analytics’ Audience Demographics, unsurprisingly, video-game-based shows predominantly attract young and male audiences, traditionally the biggest consumer group of video-games. Yet, analysis of the demographic distribution of these shows reveals notable trends.

First, Japanese adaptations are much more young-male skewed than US ones. Even as some of the most popular US adaptations fall within the top right quadrant, they are more centered than their Japanese counterparts, meaning that they generate (slightly) more universal appeal. For example, shows like The Witcher and The Last of Us have garnered significant female viewership, exceeding 40%.

Second, an increasing number of shows are appealing to older audiences. The most striking case is Halo, a show with an overwhelming share of its audience made of people more than 30 years old. This may be due to the age of the IP, which first launched in 2001 and has since built a multi-generational fan base. Other shows like Twisted Metal, which premiered in 1995, and Candy Crush also cater to this same age group. Netflix’s adaptations of Resident Evil (which debuted in 1996) and Castlevania (1986) nearly achieve a balanced distribution between older and younger viewers. Given that all of these shows (besides Candy Crush) are based on video games released more than 25 years ago, the core audience likely played or interacted with the games early in their release years.

Video games have evolved with more complex storylines and scripts, moving from niche to mainstream. They are no longer a separate type of entertainment, but a valuable source of material and inspiration for the TV industry, with a growing and increasingly broad audience.