One of the few snippets of information Comcast CEO Brian Roberts gave during the company’s Q3 earnings call last week was about La Brea’s performance.

NBC’s new SciFi drama series about what happens after a giant sinkhole opens up in the middle of Los Angeles (leading to parallel, primeval worlds and all kinds of general chaos) is “a contributor to NBC's overall audience lead this prime-time season,” Roberts said. More importantly, it’s the best performing new show on Peacock. (Roberts did not provide any contextual information, including whether that performance was based on viewership, signups, usage, churn reduction, or a combination of all these value points).

Considering the reported quick interest in La Brea, and the type of series it is, could this be NBC’s next Manifest?

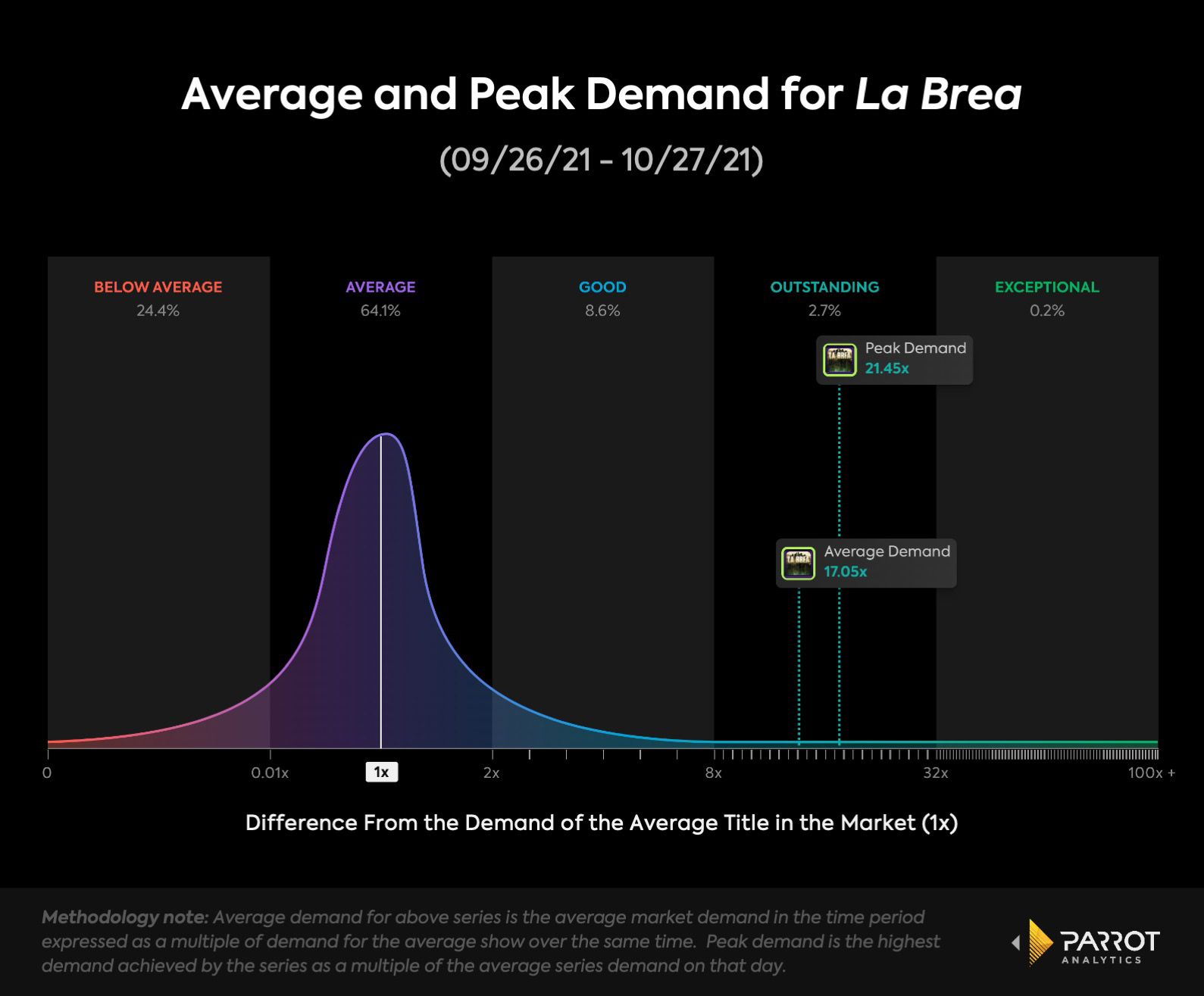

Before diving into whether La Brea could see similar success that Manifest found (especially after it moved to Netflix post-season three), let’s examine how La Brea is doing.

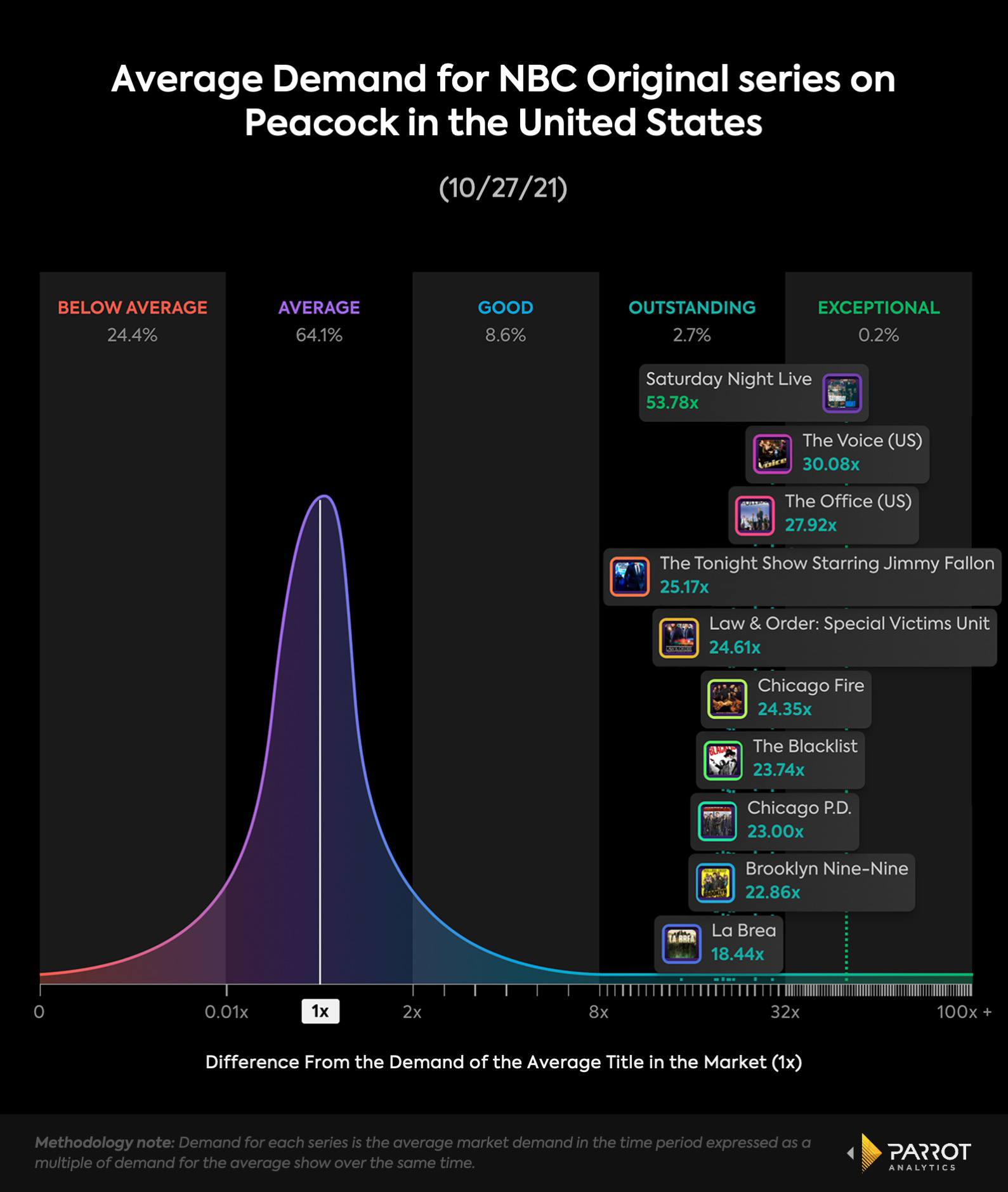

- Despite only being out for six weeks, La Brea is holding its own as an NBC original with some of the most in-demand series, including The Office, Saturday Night Live, and Dick Wolf’s series (including Law and Order: SVU). To note: Friends was removed as its exclusive to HBO Max and streams on Netflix internationally).

- As of October 30th, La Brea was also the 10th most in-demand NBC show available on Peacock.

- Notably, La Brea is just as in-demand in the US, where it’s found an audience on linear television (benefitting from very in-demand shows like The Voice (29.88x the average demand of TV series in the US over the last 30 days) and New Amsterdam (15.75x the average demand of TV series in the US over the last 30 days)) as it is globally.

- In fact, La Brea has seen a slightly stronger demand pull over the last seven days worldwide than the US alone. Canada, Brazil, Mexico, Germany, and Great Britain all closely follow the United States in demand for La Brea.

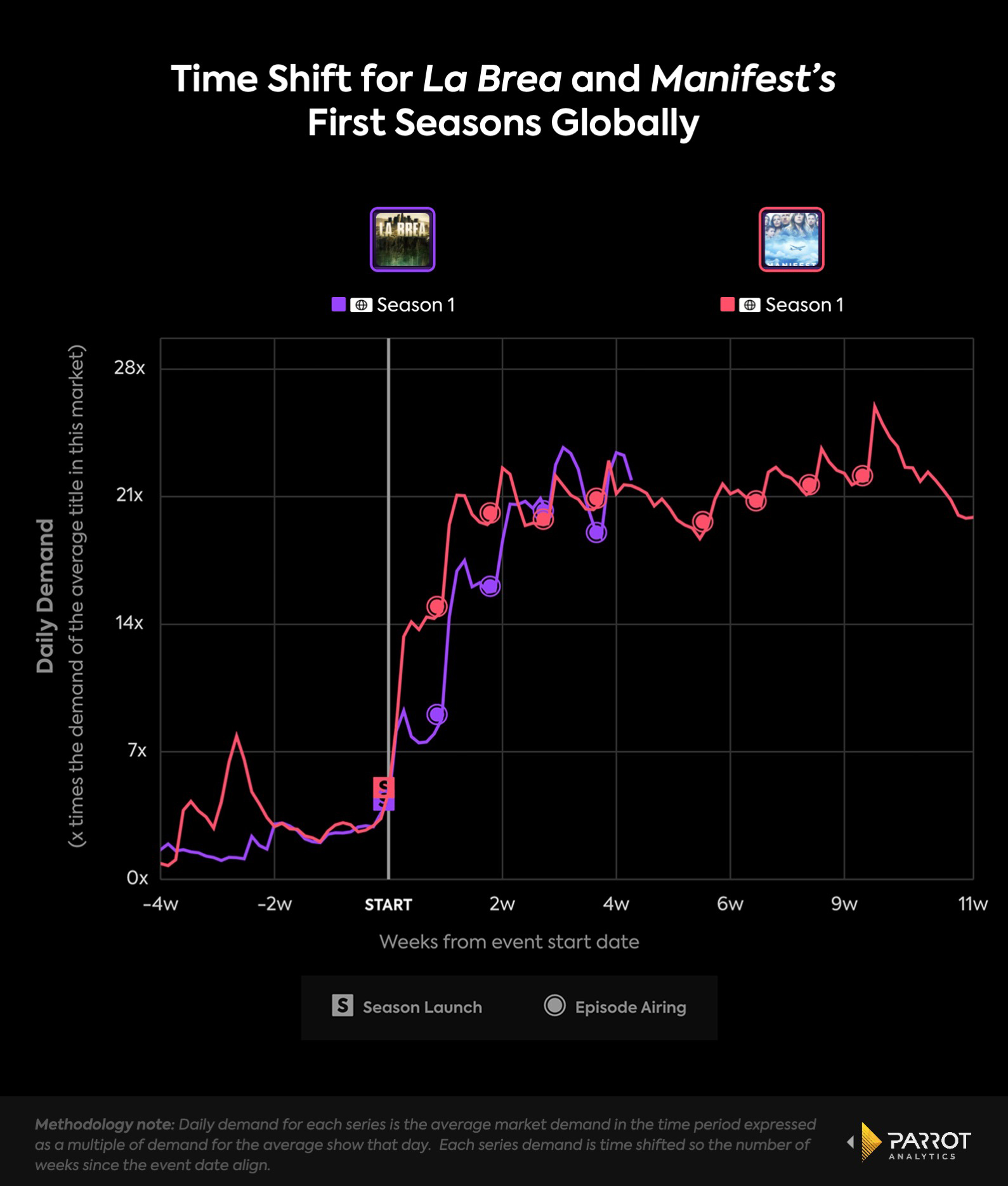

Not only is momentum for the series hitting exceptional levels (33x the average show globally, making it part of a group that only 0.2% of shows hit), but we can see that it’s traveling pretty well outside of the US and outside of Peacock. Capitalizing on momentum and a global audience is key. Take a look at the chart below outlining the demand for La Brea’s first season thus far and Manifest’s first season in the US and globally.

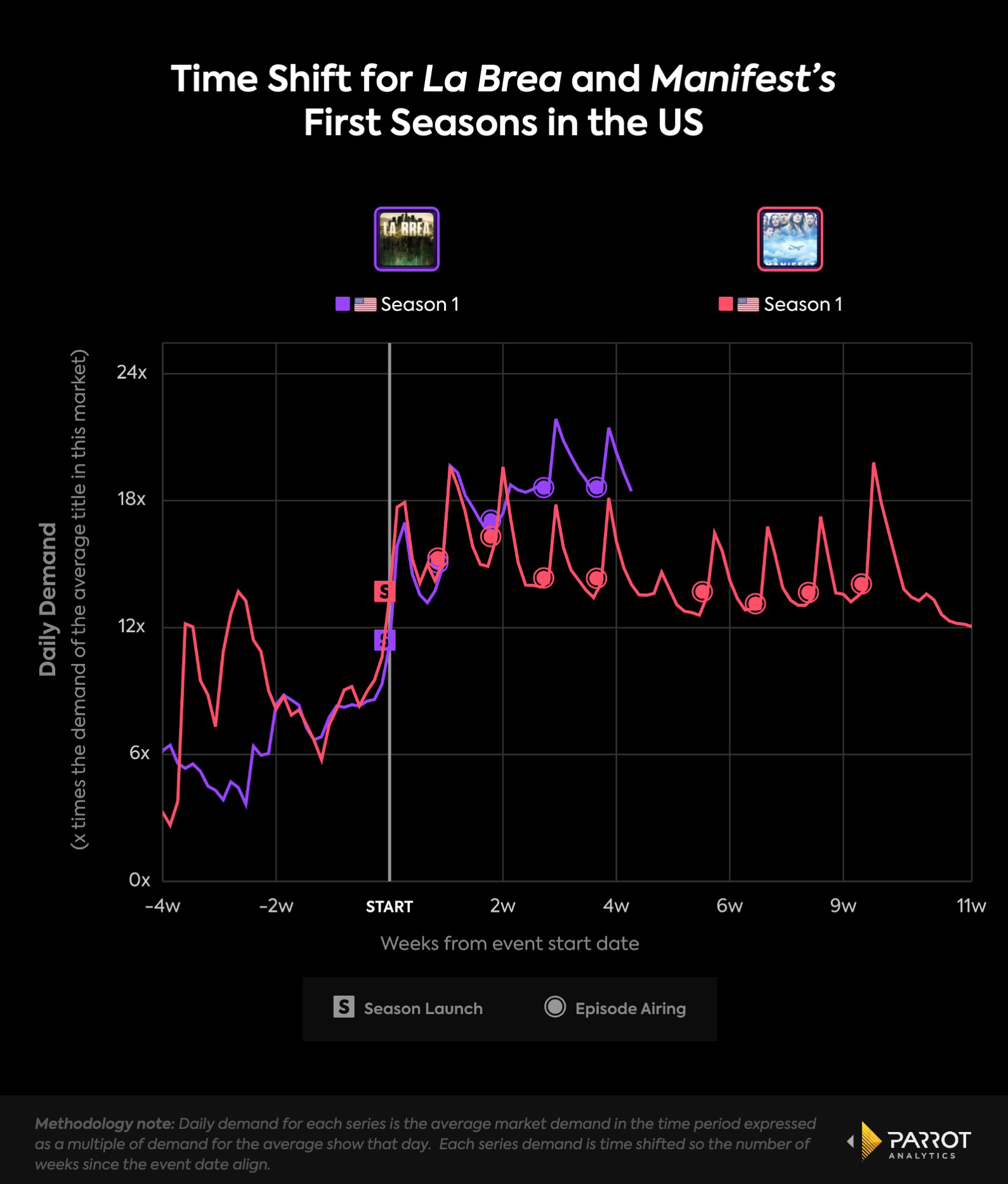

La Brea is outperforming initial demand for Manifest with each new episode. It took close to 10 weeks for Manifest to hit close to 24x the average demand of TV shows in the United States. La Brea did it in four episodes, and is on track to continue growing in demand. Globally, demand for La Brea started off slower than Manifest, but is now outpacing demand for Manifest.

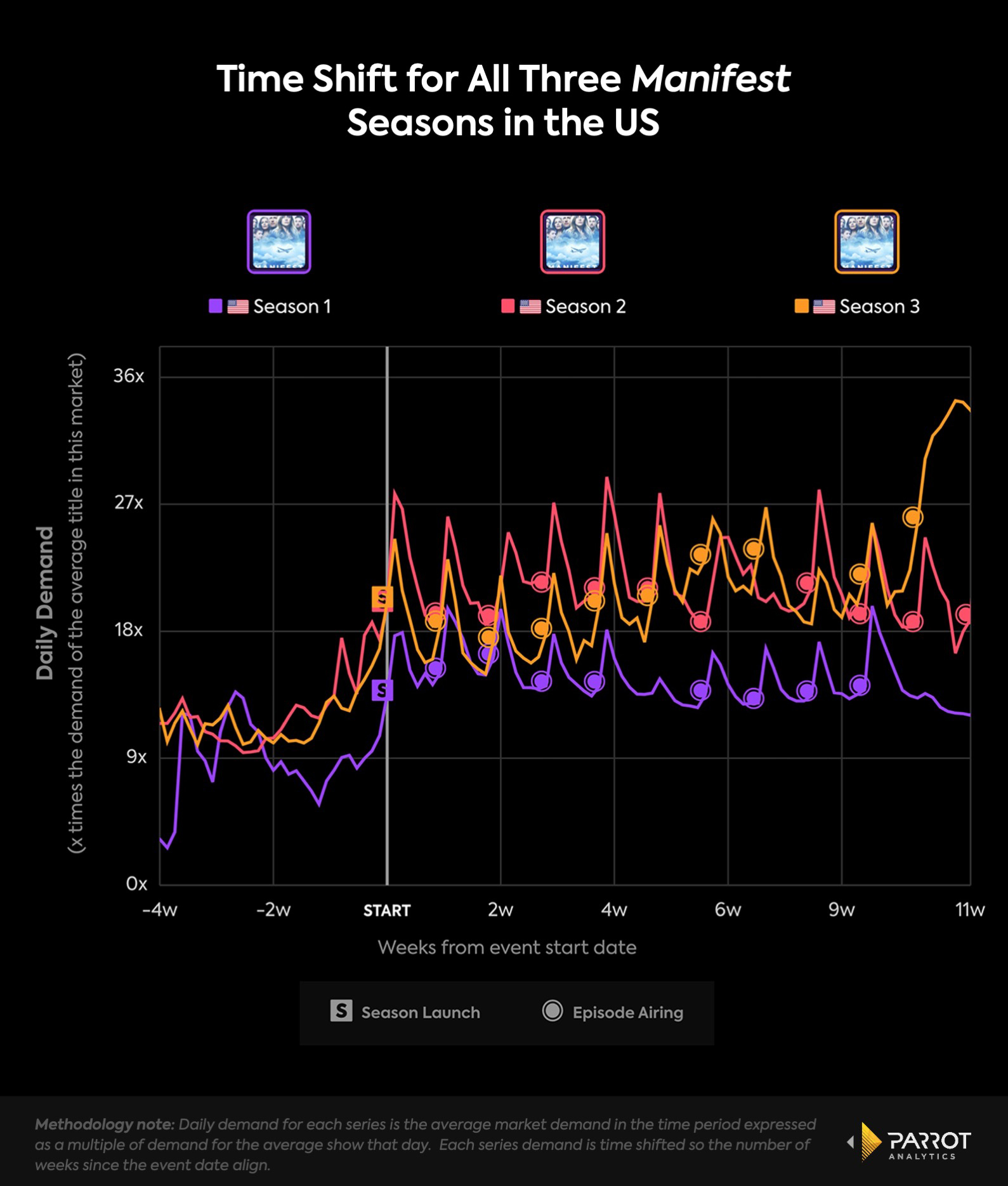

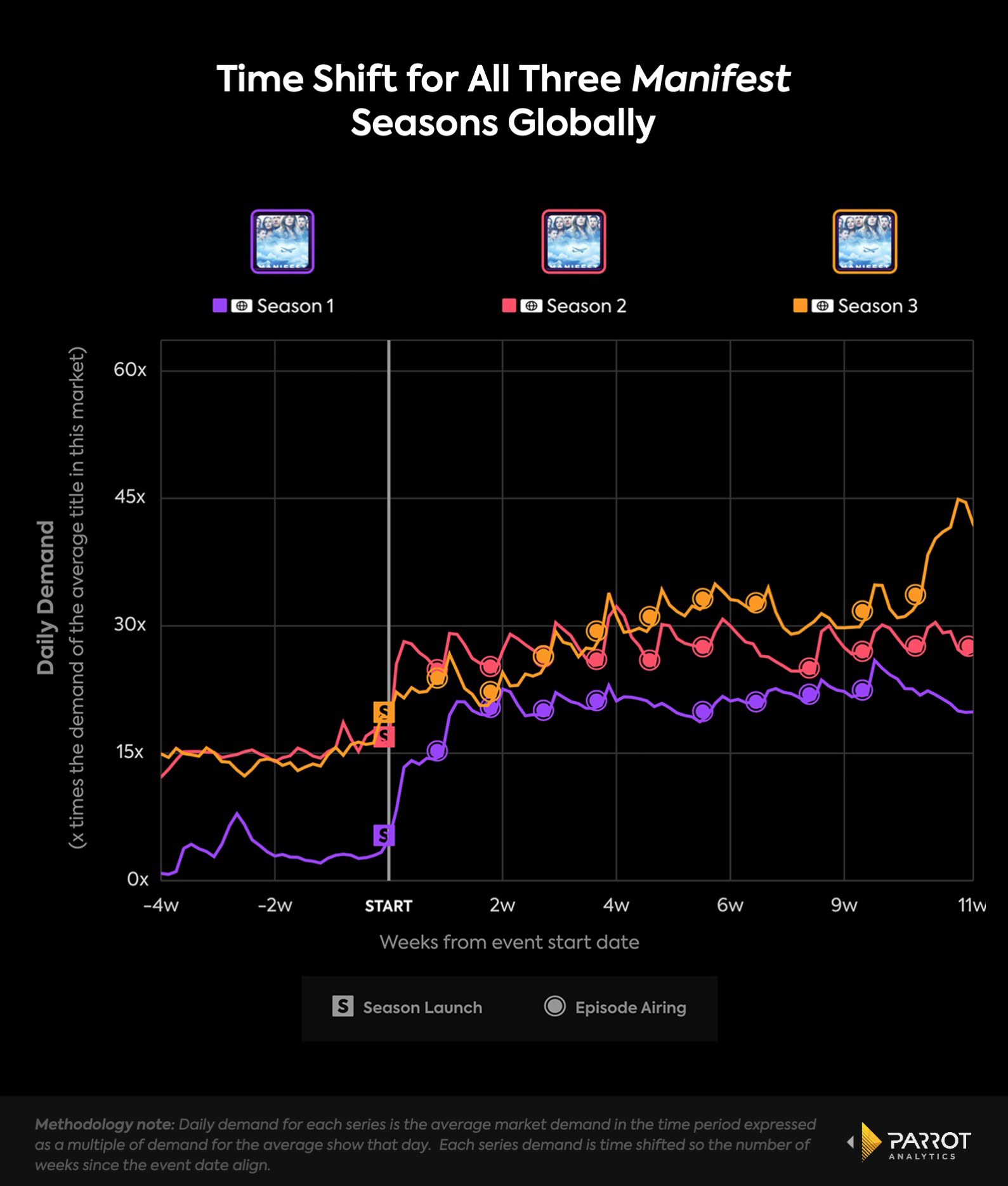

Manifest’s vital audience was online. Netflix became a discovery tool for new fans and a way to binge the series again for current fans. To say that Manifest exploded in-demand is understating the nearly unprecedented performance (more on that here). While the show saw diminished overall ratings between season two and season three from a straight linear perspective — dropping double digits in both total audience numbers and demographic — its demand continued to increase, as seen in the charts below.

Not only is there a notable increase in demand for each season, but the orange line captures demand for Manifest’s third season. The big peak toward the end is when the show premiered on Netflix. This tells us that Netflix as a discovery tool is immensely valuable for creating a highly in-demand franchise, but it’s just a distributor to a massive potential subscriber base.

“The Netflix Bump” is very real — it’s a subscriber base that is looking for new series without having to sign up for a new product. But, those licensed series that work for Netflix come from some of the world’s most valuable content creators, like NBC. It’s also why ViacomCBS sees demand for their series grow once they’re on Netflix.

With Peacock, and La Brea’s growing popularity, one possible way to build upon an audience and bring them to a new product (convincing them to open a new app every day or every week) is through a non-exclusive deal with Netflix for the show’s first season. If an audience finds La Brea through Netflix, while it’s also available on Peacock, then that audience may seek out a second season on the platform where it is exclusively.

What Netflix can offer in potential audience (close to 215 million subscribers, including 74 million in the US alone) is valuable to Peacock, which doesn't have Netflix's reach. Still, it's a gamble. Audience behavior may see viewers discovering a show on Netflix (like The Office, Friends, and Criminal Minds), but not expressing enough interest to jump to another streaming service (HBO Max, Peacock, or Paramount+) to watch the entire collection or new episodes.

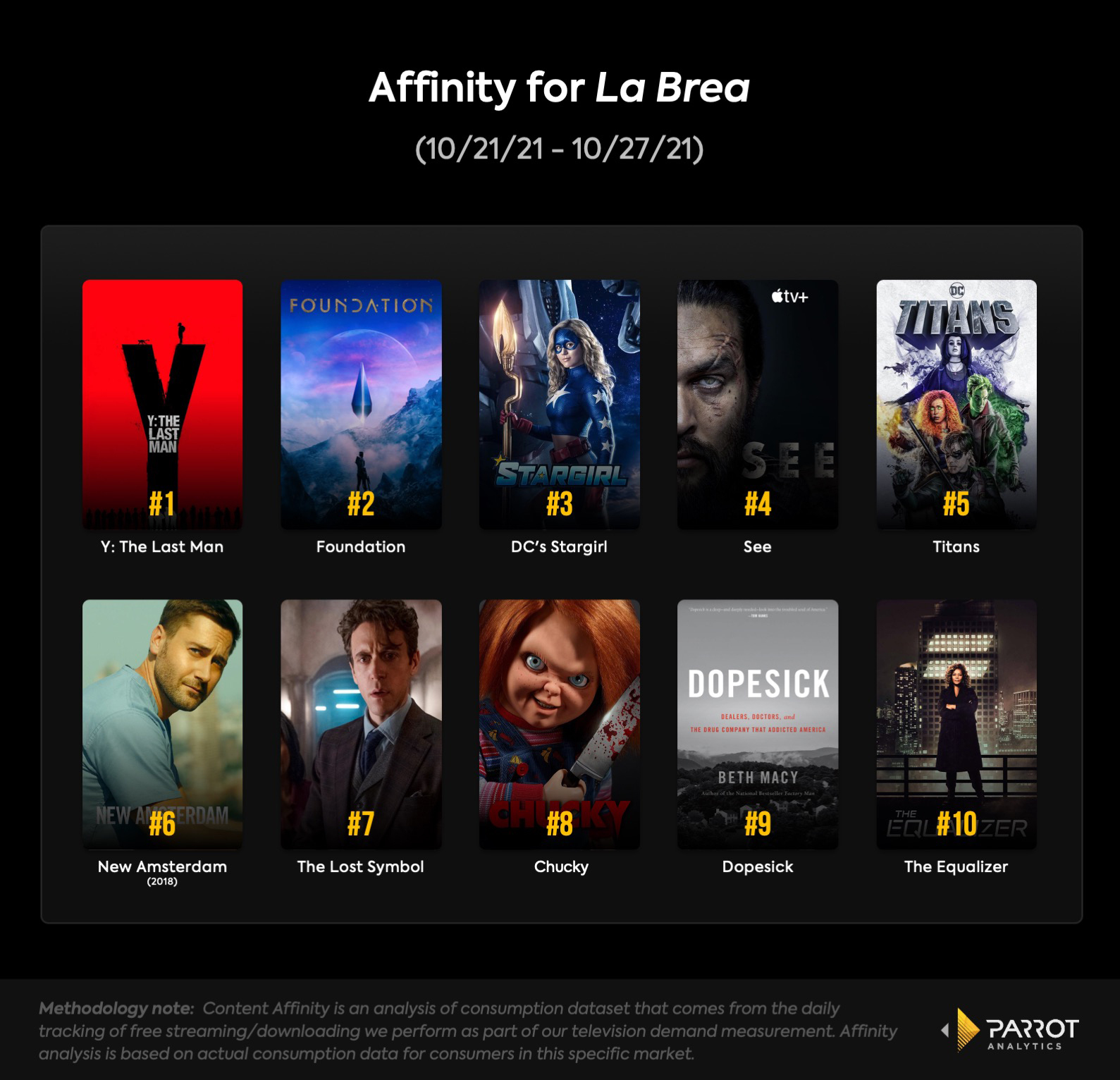

It's one option. The other interesting point about La Brea that Parrot Analytics' data can gleam is how many other NBC and Peacock shows overlap with La Brea viewers. In the chart below, we can see that La Brea viewers also sought out The Lost Symbol, New Amsterdam, and Chucky. All three series are NBCUniversal originals, with the first two titles available on Peacock.

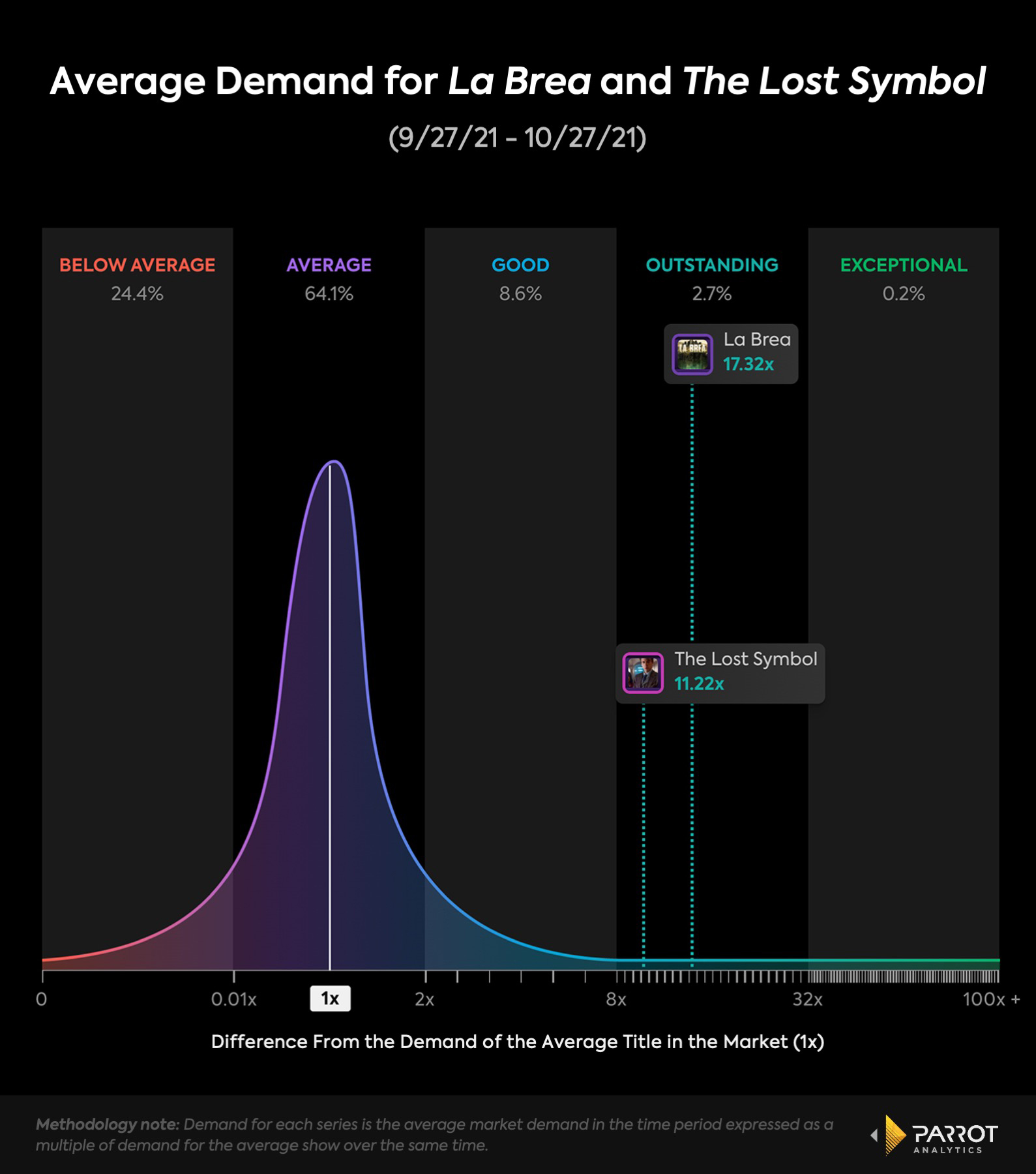

What this demonstrates is that La Brea is sitting in the sweet spot of being a retention driver — those who watch New Amsterdam may be sticking around to watch La Brea — but is also an acquisition driver. The Lost Symbol has significantly less demand than La Brea; The Lost Symbol showed 11.22x the average demand of TV shows in the United States as of October 27th, which is outstanding but much closer to the “good” category.

La Brea was sitting at 17.32x the average demand, slightly higher than The Lost Symbol and edging closer to "exceptional" with each new episode. People could be signing up for La Brea, and then tuning into The Lost Symbol through the platform's recommendations or homepage placement, but that overlap is vital for increased session time (the amount of time someone spends on an app per use case), increased engagement (the amount of time people engage with the app overall), and increased awareness of catalog titles.

NBCUniversal is extremely valuable because it represents a large portion of demand globally. The issue is that linear viewership is dwindling, and Peacock is fighting for space in a very crowded, saturated (specifically in the US) market. That said, penetration rates are still relatively low for new streamers — it only takes one or two big series to get people in the door. Retention is one big primary goal but, while concentration on churn is necessary from the get-go, Peacock still needs a big reason for people to sign up.

That could be football; it could be soccer; it could be a big new show. La Brea is shaping up to be just that.