When does it make sense for a major SVOD or AVOD player to “save a show?”

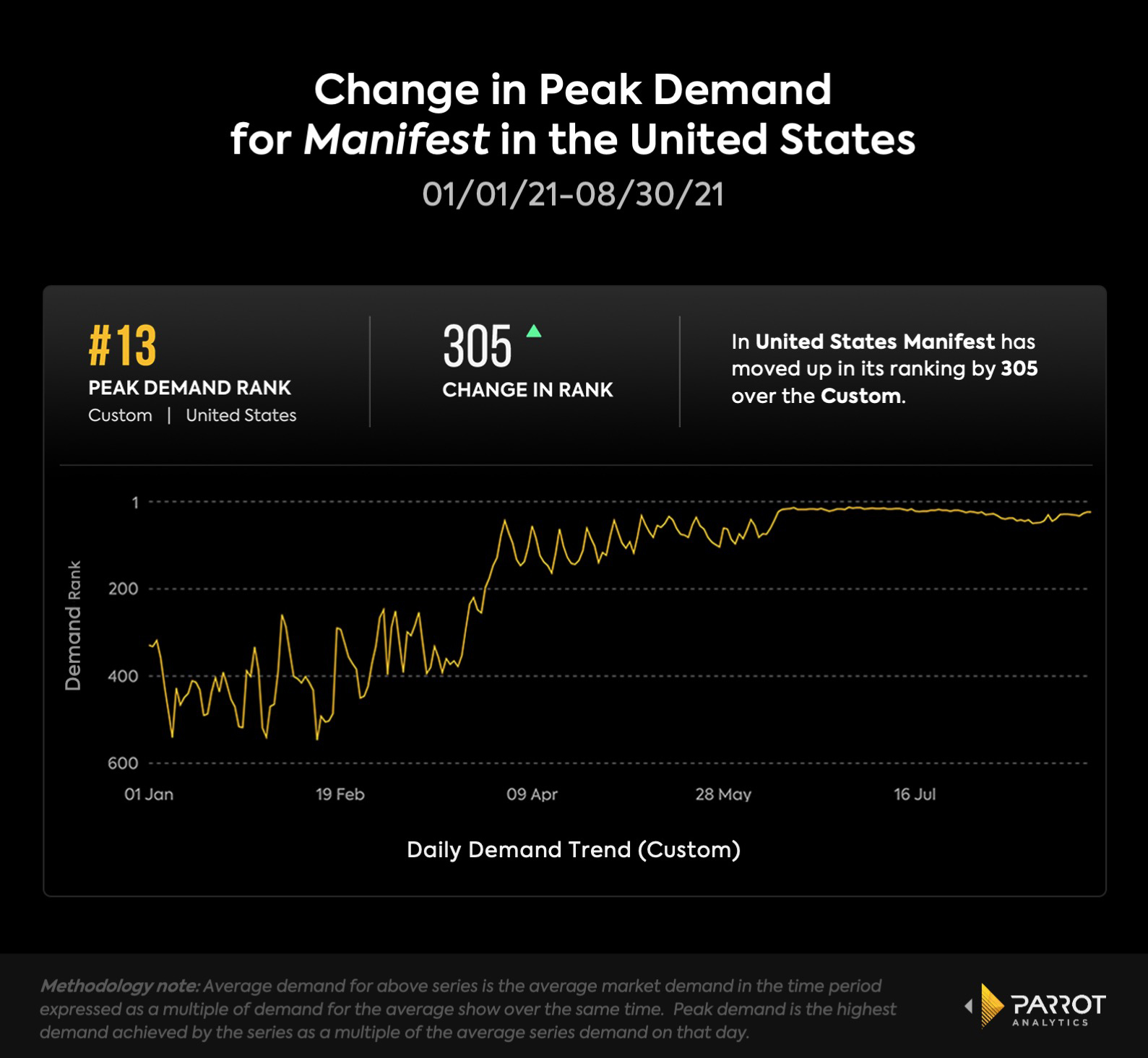

It’s a question that’s come up once again following Netflix’s somewhat inevitable decision to renew Manifest for a fourth and final season. The show, which was canceled by NBC earlier this year, jumped more than 300 ranking spots in the United States between the time just before the third season premiered (on NBC) and when the show appeared on Netflix in the United States.

Since then, following non-stop fan campaigning and, more importantly, consistent streaming from hungry viewers, the show has remained within the top 20 in-demand series in the US. Globally, where the show is on different streaming services depending on the region (Prime Video in India, for example), Manifest has remained one of the top 100 most in-demand shows since April 22nd. It has nearly one billion peer-to-peer streams for anyone trying to watch.

To put it simply, it’s not just that Manifest has an army of fans ready to tweet, post on Instagram and Facebook, or create TikTok and YouTube videos at any given moment — viewers are watching. A lot.

There are a few essential questions that players in the space need to answer before determining whether or not to acquire the rights to a series that someone else has decided no longer works for them.

1. Does the cost of investing in another season, or multiple seasons, come with a confident bet on return as seen through available data?

2. Does the show fulfill a need that a streaming service requires to acquire subscribers or lower churn rates?

3. Does the acquisition come with the entire suite of previous seasons for global distribution?

4. What is the overall longevity of the acquisition?

Manifest is a pretty simple case for executives. The company is investing in one final “super packed” season that will give fans the ending to the show they love. This isn’t Netflix trying to create four more seasons out of a show that might run out of steam three episode.

The second and third points intersect in many ways; does Manifest fill a hole that Netflix needs, and does the deal come with all seasons on Netflix globally? A press release from the company confirms the latter (“The deal also includes previous seasons of the Warner Bros. Television-produced series to premiere on Netflix around the world in the coming months”). The former is a little more complicated to discern, but examining demand data for each season over the last few years can help in determining that result.

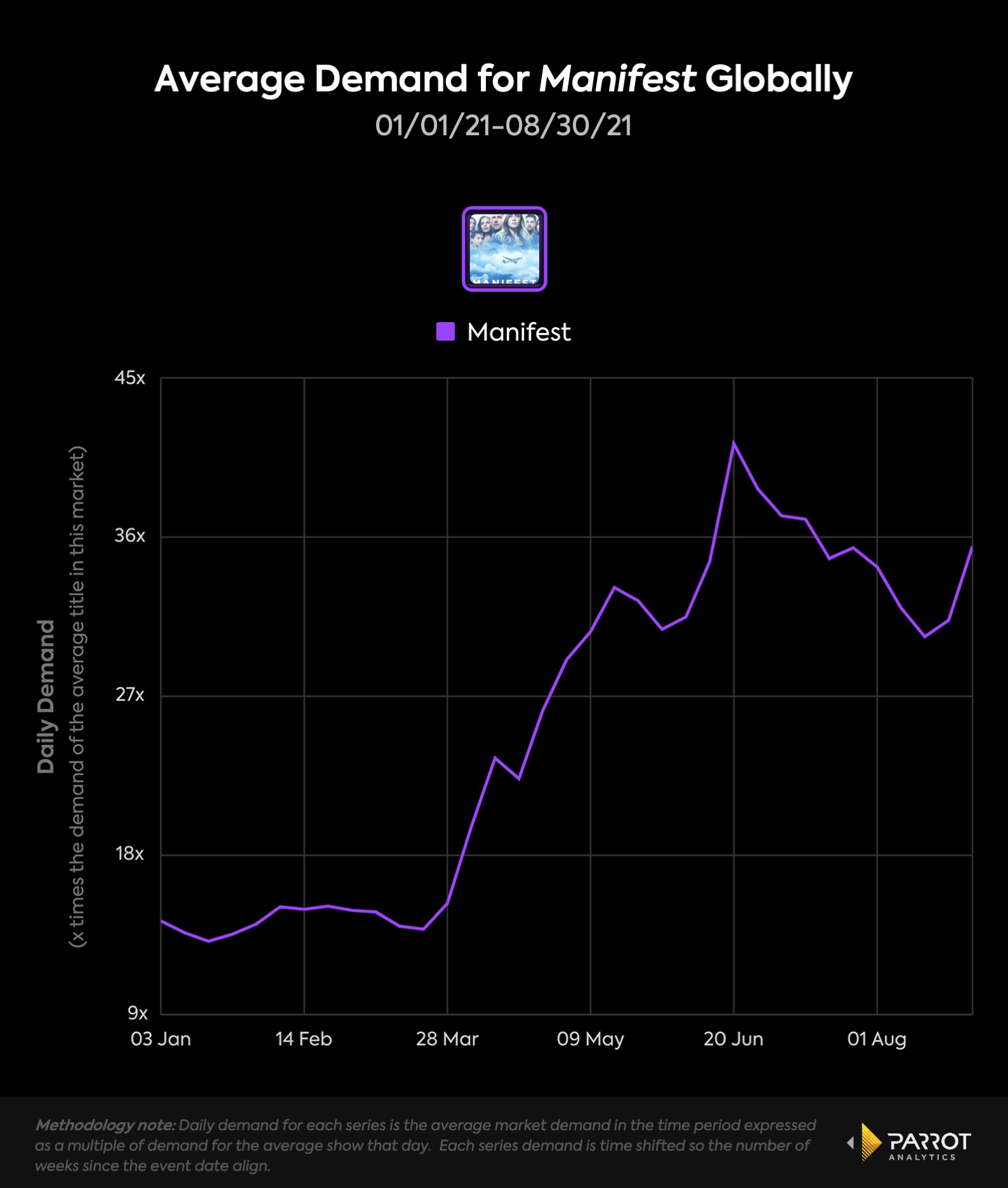

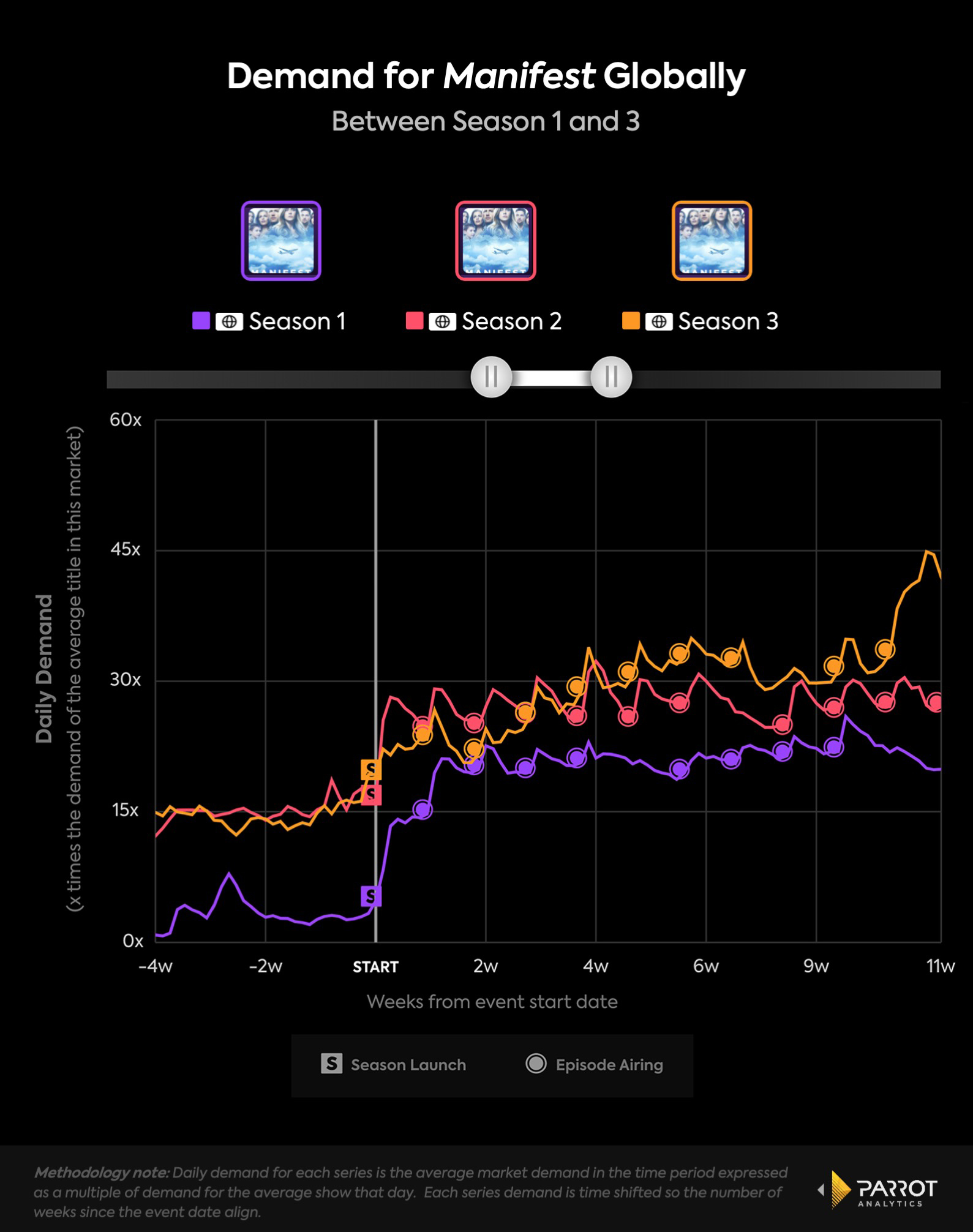

All three seasons of Manifest see a continuous increase in demand with each new season. The first season saw a 20x increase in demand between the premiere date and the 11 weeks that followed. The show’s second season premiered with 10x more demand than the first season’s premiere (understandable, now that an audience had started to dive in), and nearly doubled that demand by its fourth week. The third season saw a small jump in demand for its premiere, but by the eleventh week — when the show hit Netflix and was approaching a cliffhanger ending — it had 45x the daily average demand of any other show in the United States.

Manifest stayed within the Top 10 trending row for weeks on end. It became a surefire hit on Netflix, much like The Office and Friends before it. Netflix is a platform built around discovery and availability; a show on Netflix may find an audience that a network governed by traditional time slots or a smaller streaming service doesn't. Unlike The Office and Friends, however, there was potential for Netflix to take on the series as an original title, with full global distribution just like other in-demand Netflix Originals and finish the show to give newcomers and current fans a series to watch in its entirety — something that’s become much rarer in television. Viewers want shows to end, and end properly.

It’s here that Manifest can help Netflix acquire additional subscribers in the interim and reduce churn down the line. The fourth season should bring in subscribers who want to see what happens post-cliffhanger, and having the full suite of episodes, on top of top homepage placement from the company, may encourage current subscribers to get comfortable and check out the show that made headlines the year before.

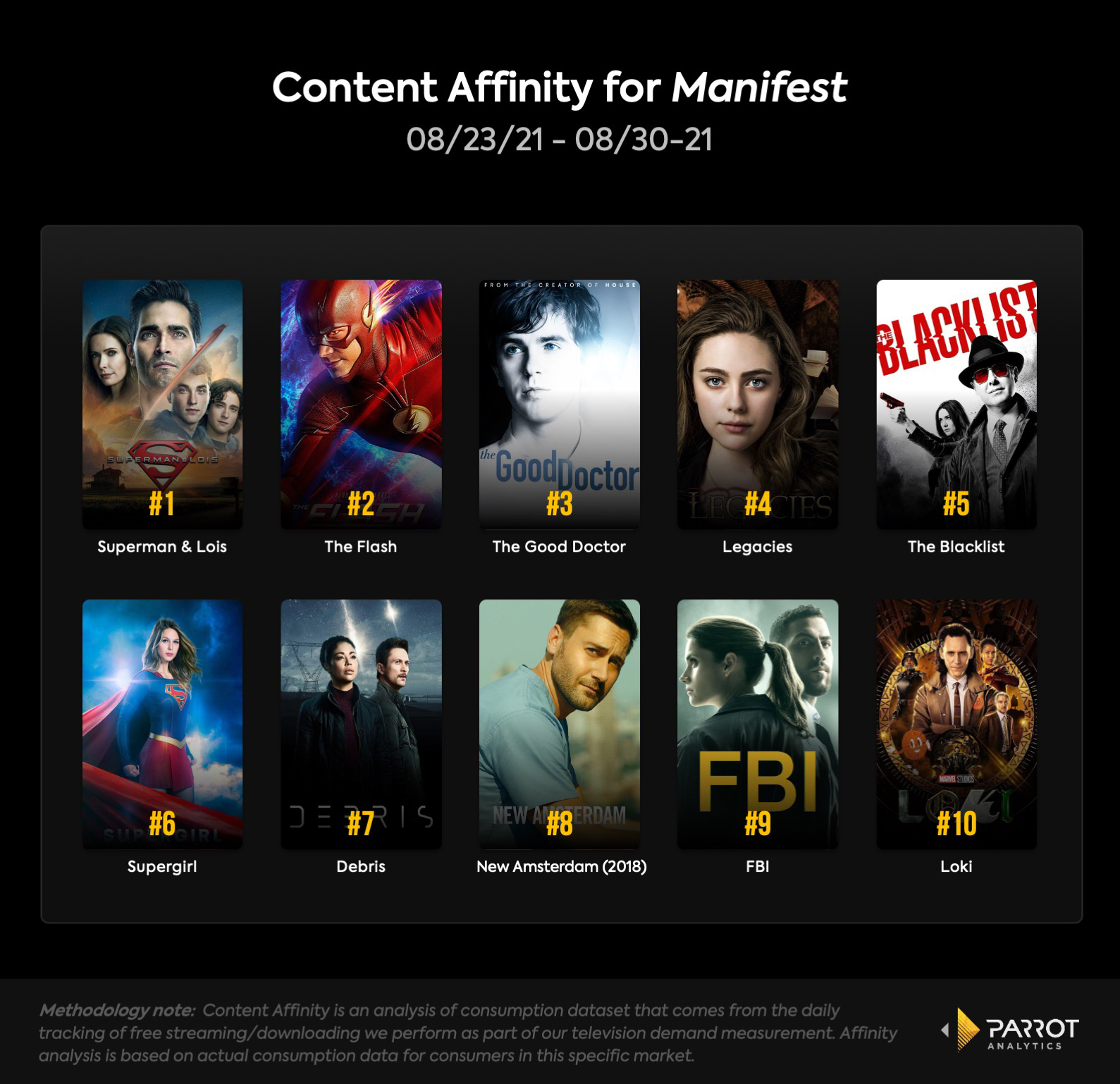

Plus, Manifest shared consumption affinity — meaning audiences who watch Manifest are also watching — with Legacies, The Flash, The Blacklist, and Supergirl between August 23rd and August 30th. Those four shows are all streaming on Netflix. Having all of Manifest, on top of other in-demand series that subscribers are looking for, helps to reduce churn and increase engagement.

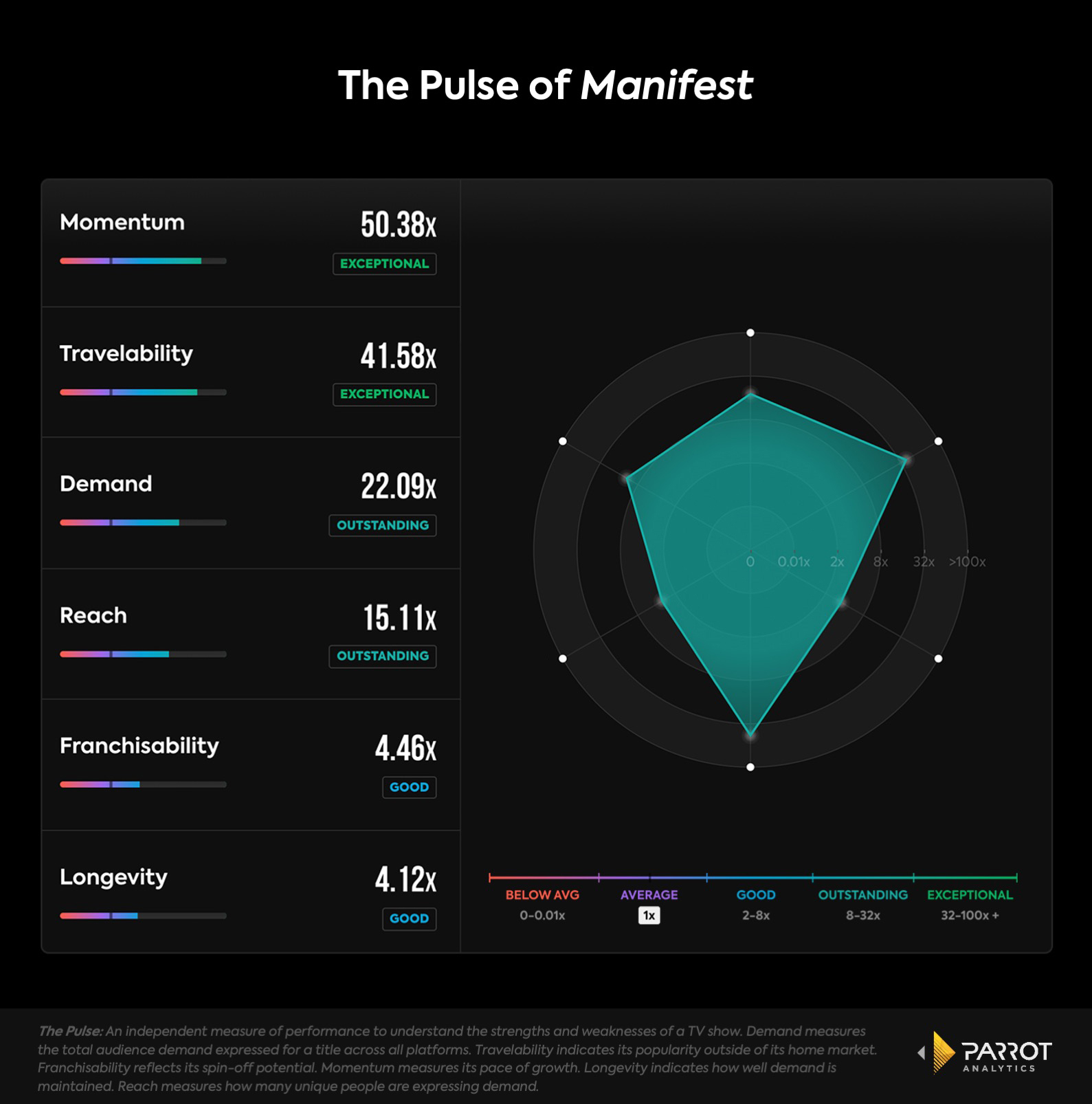

Does Manifest “fulfill a need that a streaming service requires to acquire subscribers or lower churn rates?” In this case, having an in-demand show in its entirety that also boasts strong consumption affinity with other series on the streaming service does fulfill a need. Is there longevity in the series? It’s not exceptional, but it’s good — and for a show that requires just one more season for Netflix to bring it to an end, longevity isn’t as vital as travelability (how in-demand it is outside of the US), momentum (the level of demand picking up speed), and overall demand, which rank exceptionally high.

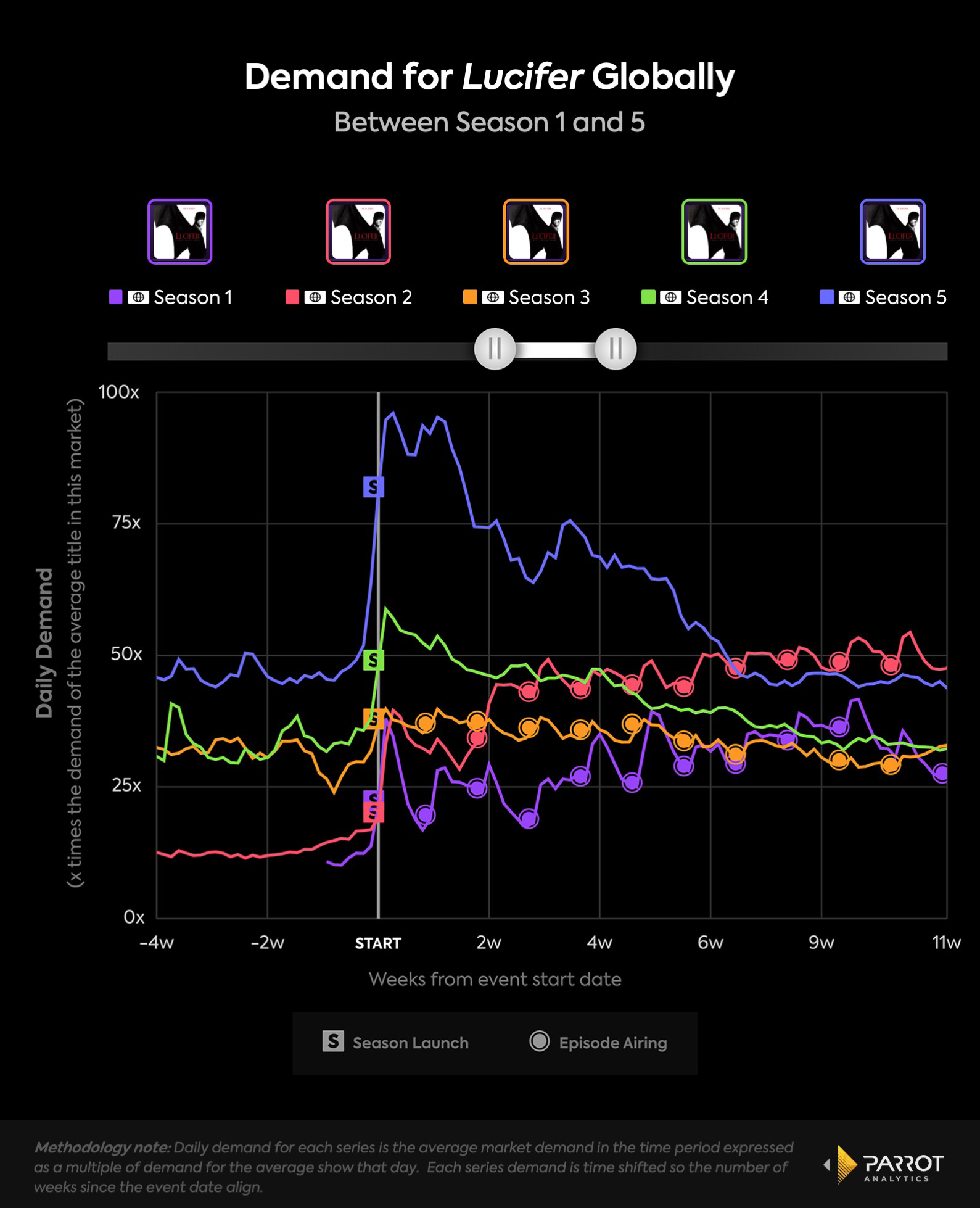

It’s a no brainer for Netflix. The last show the company saved was Lucifer, and it has since become a hit for the streaming platform. Unlike Manifest, Netflix didn’t get international rights to the earlier seasons (it’s on Amazon Prime Video in the UK and Germany, for example), but the franchise potential, longevity, travelability, and overall demand were key to executives’ decision to save the Fox show.

As former vice president of original content, Cindy Holland, said in 2018, Lucifer is “a fantastic show that has really resonated with audiences in parts of the world where we licensed it so we felt it was important to help that show continue for those fans.” International viewership data demonstrated strong demand for the series, and Netflix needed a long running procedural-drama series that viewers could become engrossed with for the first time, or return to time and time again.

Manifest will hopefully do something similar for Netflix. This isn’t an example of a Twitter campaign demanding Netflix to save a show working (well, not exactly). It is a perfect example of undeniable demand for a series, in addition to consistent viewership on a platform, global appeal, and a fair cost analysis fitting well within Netflix’s strategy to acquire new subscribers and keep those on the service from canceling. If Manifest becomes a show that encourages new and faithful Netflix subscribers to stick around month after month, then the investment pays off entirely.