Being a teenager is not easy, and very few things can help with that. When the real world feels too much to bear, many young people turn to fiction as an escape.

This is probably why Young Adult fiction is so popular. Also known as YA, the genre is originally a literary category. But since it’s been adapted to the audiovisual format, it that has generated some of the most commercially successful movies and TV shows.

The genre is strongly intertwined with a unique marketing concept that targets young people, ranging from 15 up to 25 year-olds. Furthermore, it generally portrays a child or teenager as the main character of a plot that is frequently a coming-of-age story. As a result, stories in this genre touch on common topics for the youth, from sexuality to mental illness.

On TV, YA fiction has had peaks and valleys.

The genre was originally introduced to TV at the turn of the century and morphed into the current format in the mid-2000s. This was when incredibly popular shows, like The CW’s Gossip Girl and Freeform’s Pretty Little Liars, first hit the market. But things only took off for real at the end of the decade, with the premiere of shows like The CW’s The Vampire Diaries and The CW’s The 100.

This was the prime of YA television: the trend dominated the market in the early 2010s. However, interest eventually stagnated and, at the end of the decade, the number of debuts had decreased.

There are signs of a rebound, however. With the debut of Shadow and Bone and the remake of Gossip Girl in 2021, we are raising the question: is YA fiction having a comeback?

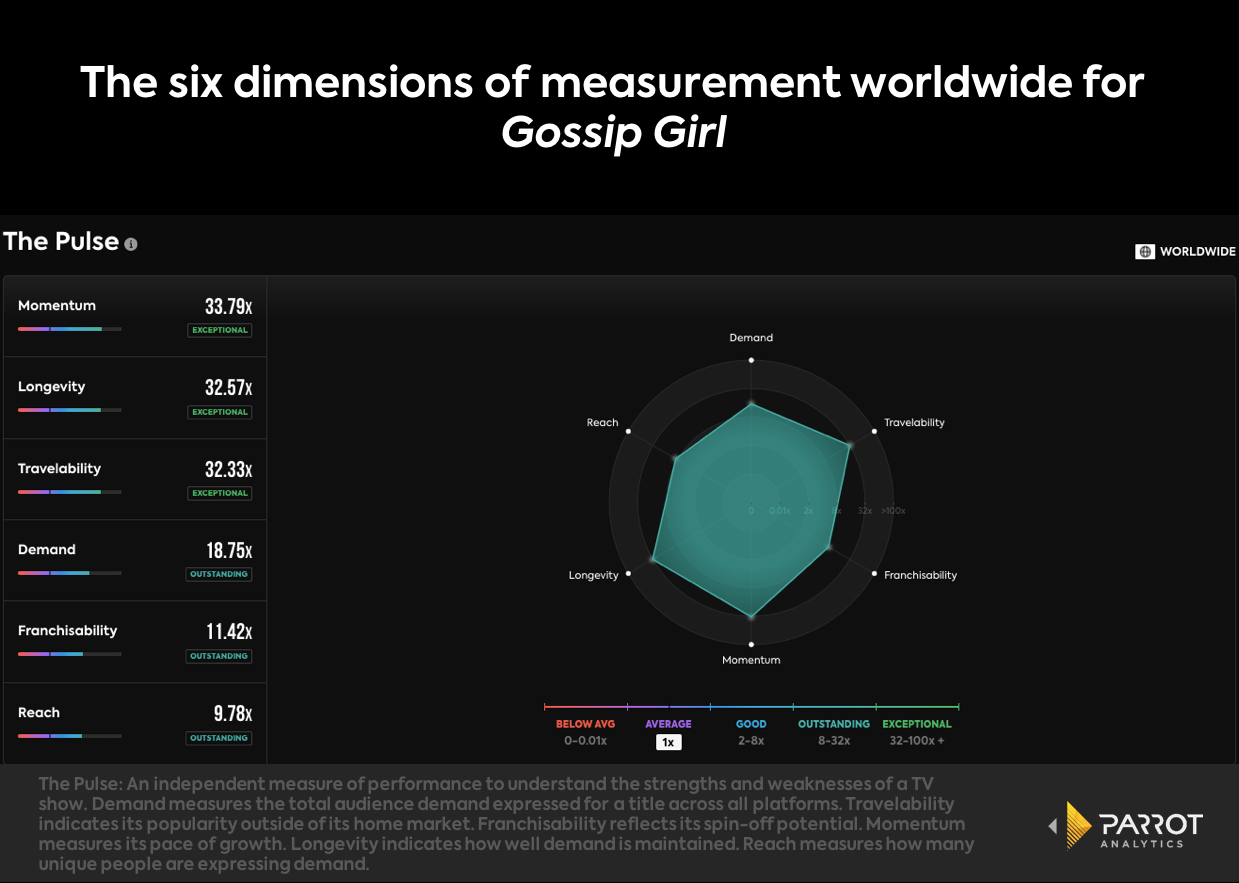

In this article, we answer this question using our demand data and The Pulse, which is our brand new chart within DEMAND360 that provides a novel way to understand a title's overall performance in an instant. There are six dimensions of measurement available for The Pulse, each providing an independent measure of performance.

These comprise of :

- Demand - the core metric, which measures the total audience demand expressed for a title across all platforms in a market, compared to the average TV show.

- Travelability- which indicates the demand of a show outside of its home market.

- Franchisability- which reflects the spin-off potential of a title.

- Momentum- which measures the growth in demand over a time period. - Longevity- which indicates how well a title's demand is maintained over time.

- Reach- which indicates how many unique people are expressing demand for a title.

(To learn more about the methodology behind each metric and how these can be applied to your business, visit our Help Center or reach out to the Parrot Analytics partnerships team for a personalized walkthrough)

The genesis of YA shows

Two well-defined subgenres surged in the early years of Young Adult fiction on television.

The first group includes shows with ordinary teenage stories, with no supernatural elements. One of the most prominent examples of the genre is Gossip Girl. It was phenomenally successful and set standards for the genre.

We can look at The Pulse data to illustrate this point. Gossip Girl’s longevity score of 32.4x the demand average proves the long-lasting interest for the show. Secondly, the show’s momentum score of 35.5x the average indicates that demand has increased at an exceptional rate over the past 12 months - perhaps due to the remake premiere in 2021. Finally, although the show finished nine years ago, it remains in the top 3% of most in-demand series worldwide.

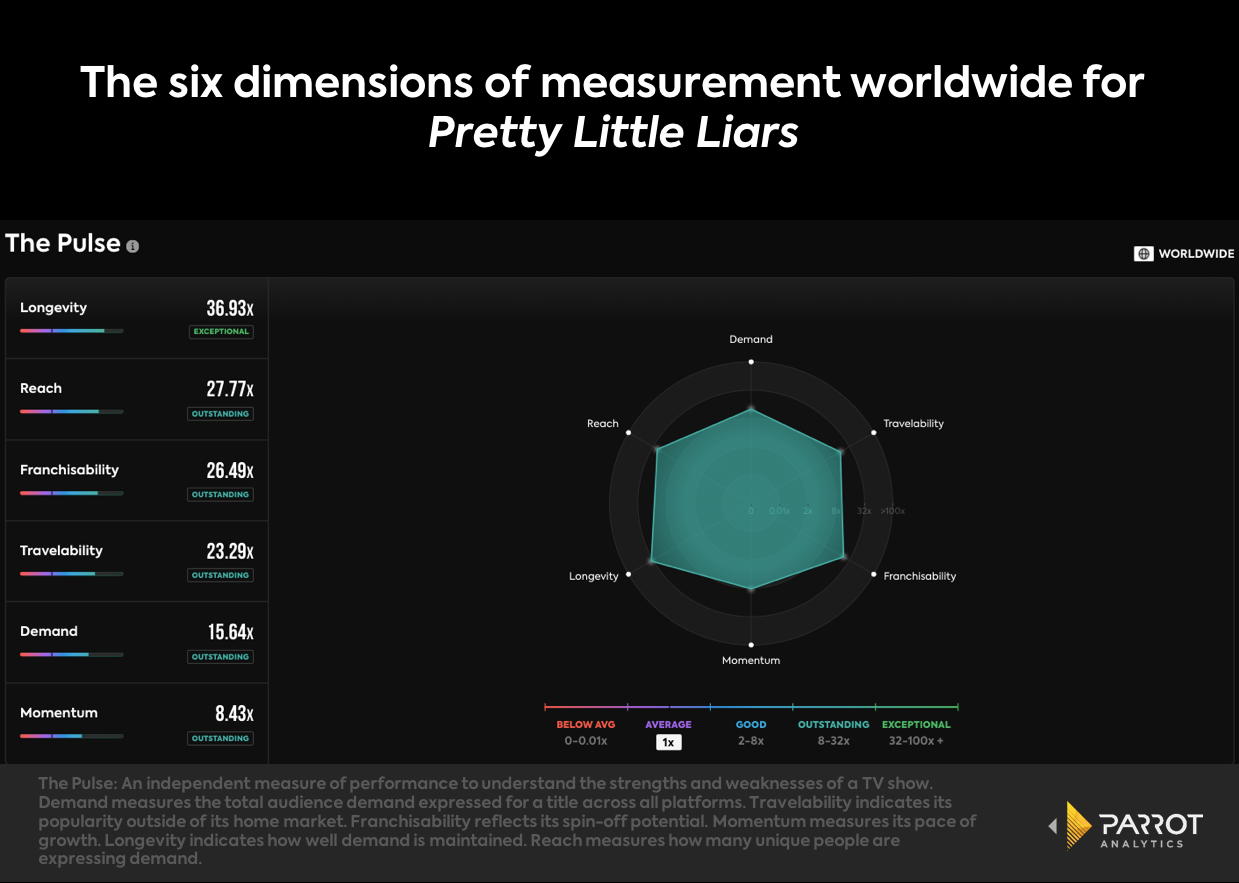

Another show that belongs to this category is Pretty Little Liars. Following the success of Gossip Girl, the series trailblazed its way to success as well. The Freeform series has a great longevity score of 37.5x the demand average. Additionally, it recorded 15.7x the demand average globally over the past year. The number places it in the top 3% most in-demand series in the world.

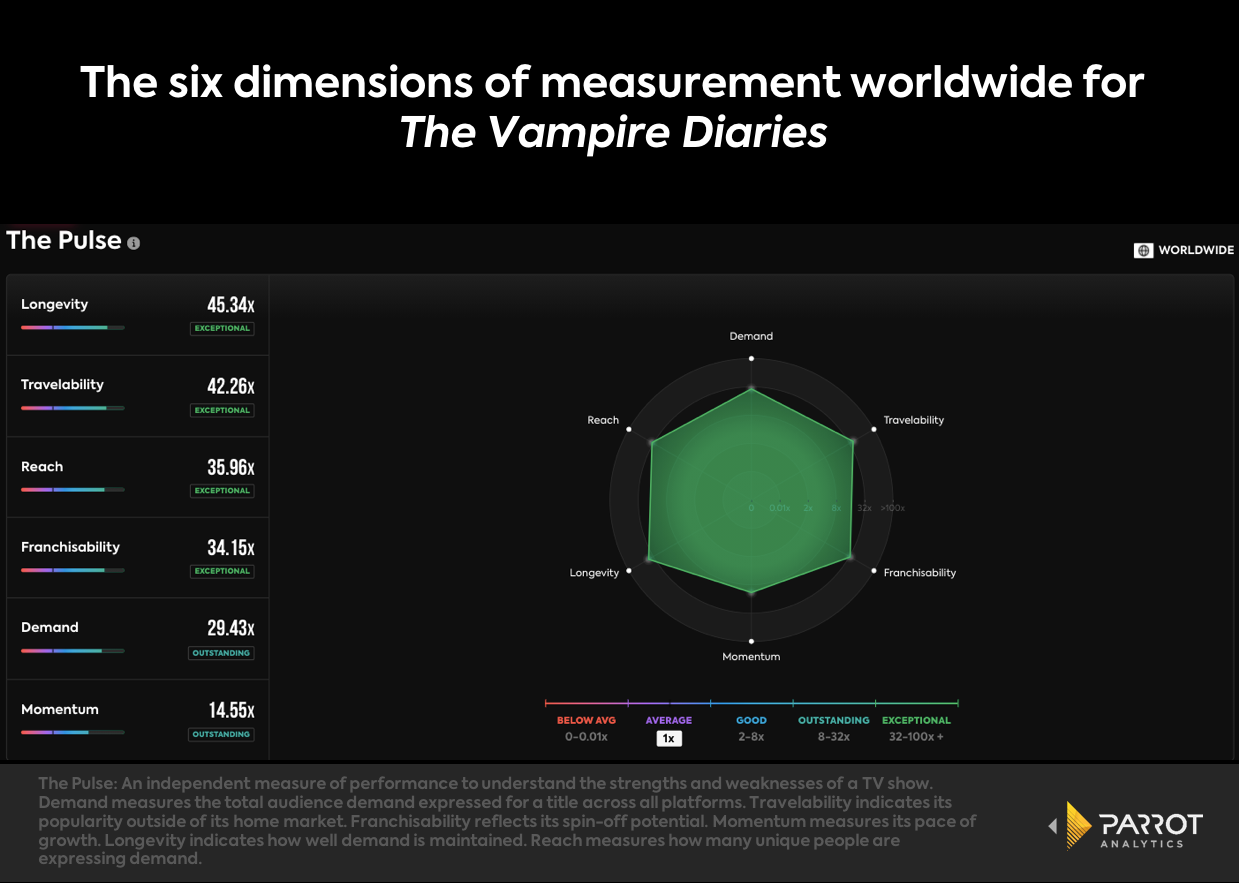

The second group includes teen shows with a supernatural twist. These mainly premiered after the overwhelming success of YA movie franchises such as Twilight and The Hunger Games. One of the shows heading the surge was The CW’s The Vampire Diaries, which debuted in 2008 and aired for eight seasons. It was a success, as demonstrated by its high longevity score of 46.3x the demand average. Furthermore, the outstanding franchisability score explains the success of two spin-offs. One of them was The Originals, which launched in 2013.

The Vampire Diaries paved the way for numerous other YA fantasy shows. The CW’s The 100, which premiered in 2014, and SYFY’s The Magicians, in 2015, were prominent examples of the trend. Both were very successful since they aired for multiple seasons.

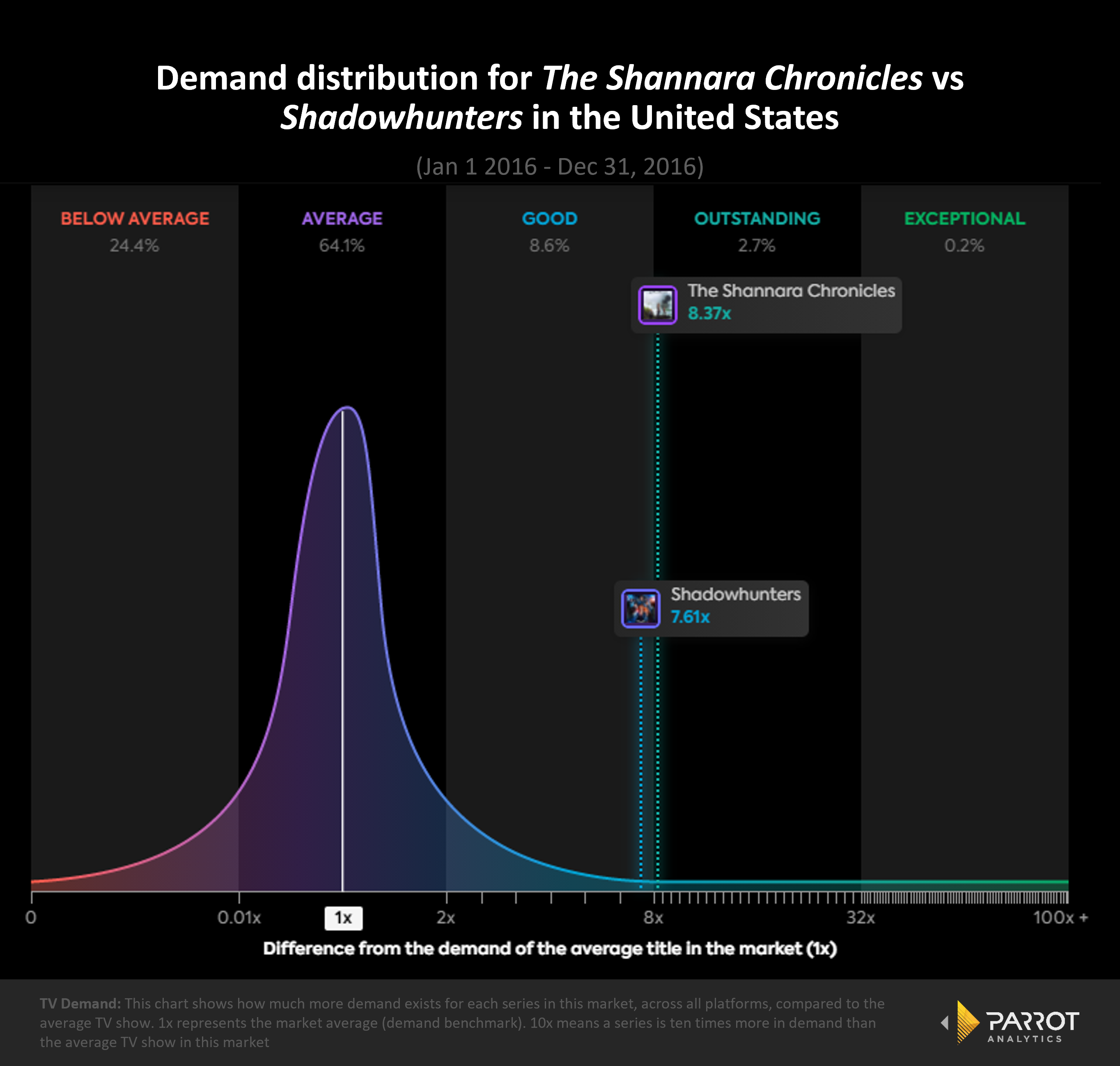

Subsequently, standout titles from 2016 were Freeform’s Shadowhunters and MTV’s The Shannara Chronicles. Looking at the graph, we see that both had successful debuts years: Shadowhunters had a 7.6x, while The Shannara Chronicles had 8.3x the average demand average that year.

By then, fantasy Young Adult shows were the dominant subgenre and overshadowed non-supernatural YA series.

The falloff in 2017

YA fantasy’s momentum was led by the success of the Twilight and The Hunger Games sagas. So, naturally, when these franchises finished, the trend on TV also suffered a slowdown.

While the last movie of The Hunger Games came out in 2015, 2016 was the last busy year for the genre on television. From 2017 on, the number of debuts decreased significantly.

That isn’t to say YA was entirely dead.

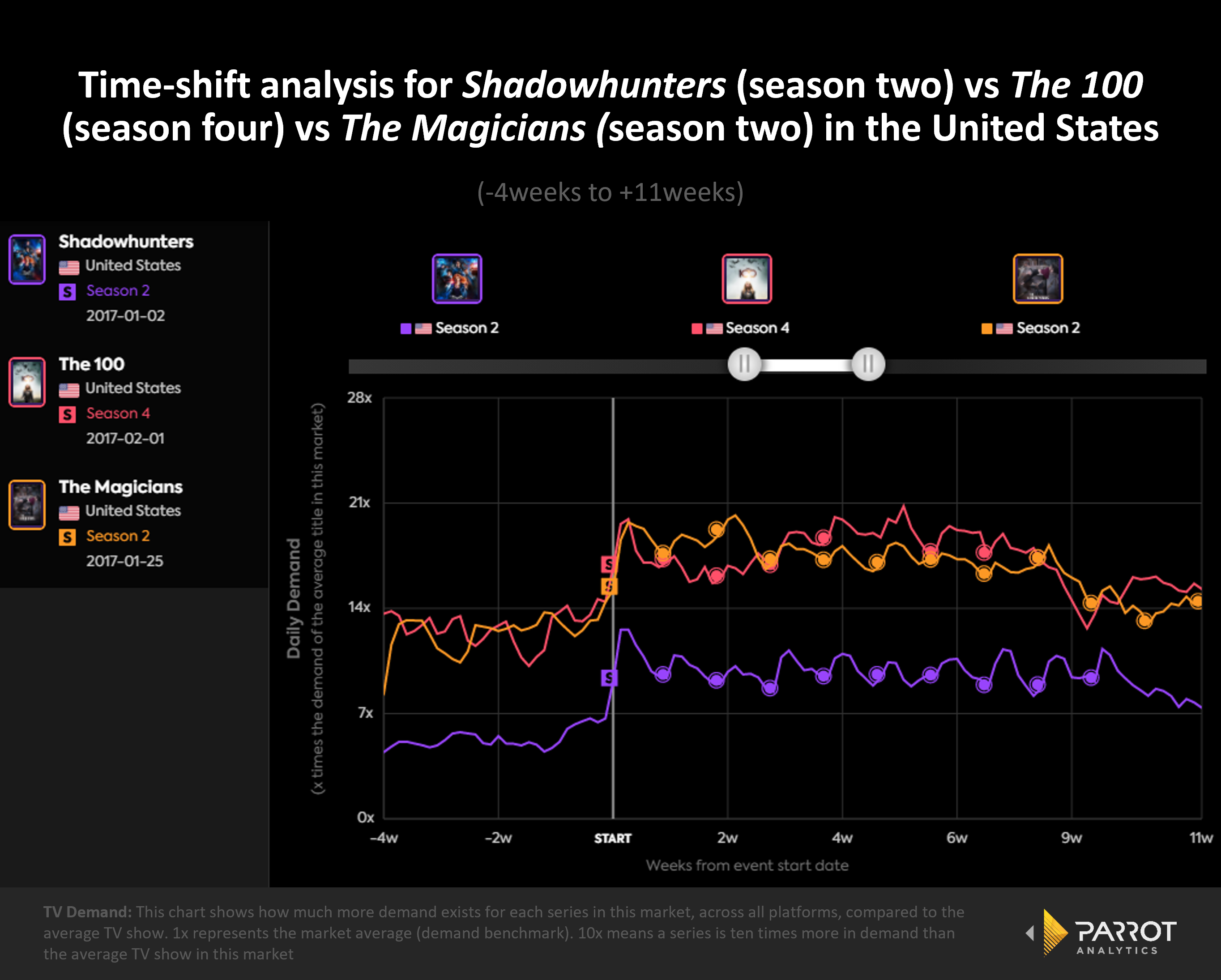

Recently-launched shows like The 100, Shadowhunters and The Magicians were still booming in 2017. When analyzing the seasons airing that year, we gather that The 100 peaked at 20.7x, while The Magicians peaked at 20.1x the demand average. Additionally, the second season of Shadowhunters had a peak of 12.5x the demand average.

On the other hand, a material sign of decline in the trend was the ending of The Vampire Diaries. After eight years, the final season premiered to great success. It recorded 14.6x the demand average and peaked at 22.3x average.

That and the lack of debuts suggested a lull in the YA fantasy craze. Actually, the few Young Adult adapted shows to premiere in 2017 showed a new facet of the genre.

New beginnings

The YA shows debuting in 2017 brought a different edge to the Young Adult TV arsenal.

Netflix’s A Series Of Unfortunate Events and 13 Reasons Why are examples of the shift away from vampires and dystopian societies. While A Series Of Unfortunate Events got praise for its complex tone and consistent pacing, 13 Reasons Why stood out for highlighting mental illness.

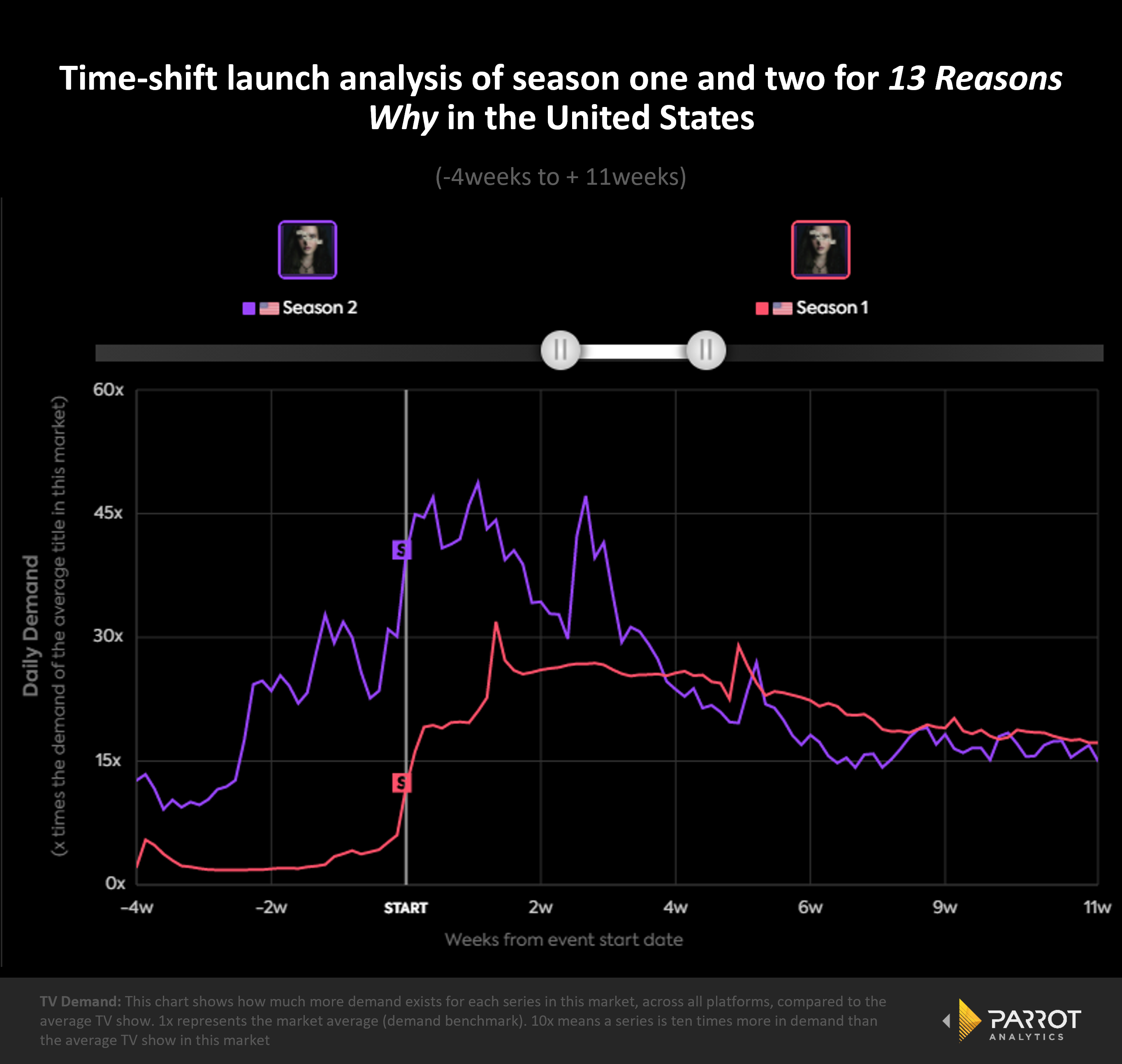

Both shows recorded impressive demand for their first season. Over the year, A Series Of Unfortunate Events had 7.5x and 13 Reasons Why had 12.1x the demand average. Meanwhile, they recorded a peak of 24.3x and 31.9x the demand average, respectively.

The scenario in 2018 was a lot like the year: on-going shows like The 100 and The Magicians garnered a high volume of interest. Over that year, they recorded 18.6x and 10.6x the demand average, respectively. In tandem, Shadowhunters had high demand as well, despite getting canceled in 2018. The last season of the show recorded 13.9x and peaked at 23.8x the demand average.

In a similar way to the previous year, 2018 didn’t bring out many debuts. The only new YA adapted series was The Vampire Diaries’ second spin-off, Legacies. Impressively, the first season of the show recorded 11.5x and peaked at 24.3x the demand average.

Finally, the graphs also show how 13 Reasons Why blew up in popularity in 2018. It had 16.5x the demand average over the year and reached a peak of 48.7x.

A rebound?

A decade after the start of the YA mania, things began to pick up again. 2019, 2020 and 2021 introduced four new series to the public.

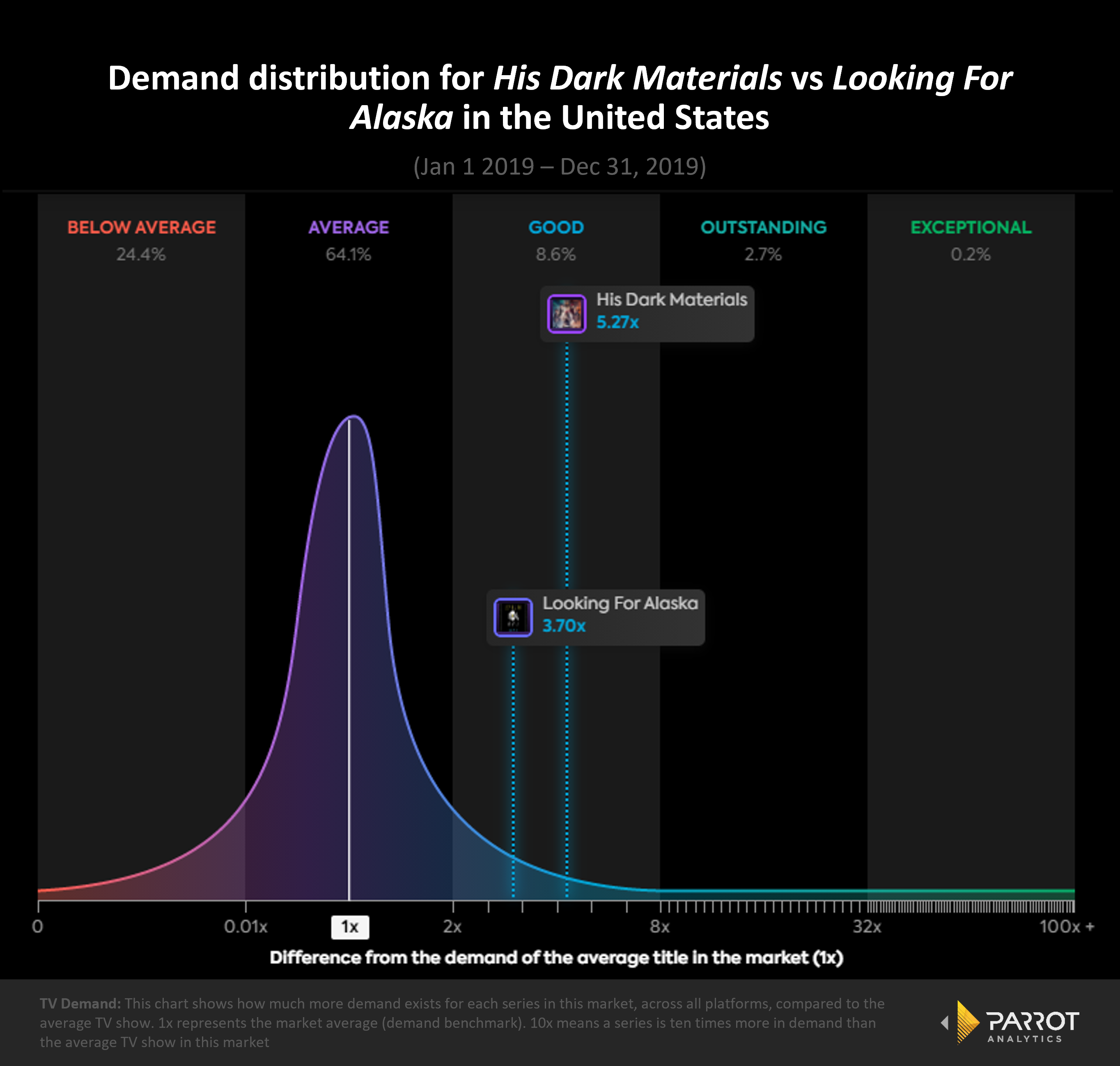

One of them was Hulu’s miniseries Looking For Alaska, which kicked off in 2019. The script was supposed to become a movie, but after many unsuccessful attempts of realizing that, it turned into a television series. The John Green-adapted show garnered a satisfactory amount of interest that year, recording 3.7x the demand average.

Another show debuting that same year was BBC One’s His Dark Materials. With a star-studded cast that includes James McAvoy and Lin-Manuel Miranda, it performed well with audiences. The series had 5.2x and peaked at an impressive 31x the demand average.

Just as some shows were beginning, A Series Of Unfortunate Events and 13 Reasons Why were wrapping up. In 2019, the Lemony Snicket adapted story had a peak of 18.4x the demand average in its final season. Meanwhile, in 2020, the last season of 13 Reasons Why peaked at an astounding 81.2x the demand average.

Despite the pandemic, the year 2020 was able to deliver new shows as well.

Noughts and Crosses premiered on BBC that year. Adapted from novellas by British author Malorie Blackman, the series brings forth issues of racism set in an alternate universe. The first season peaked at 2.9x the demand average, a positive result that has already guaranteed a second season for the show.

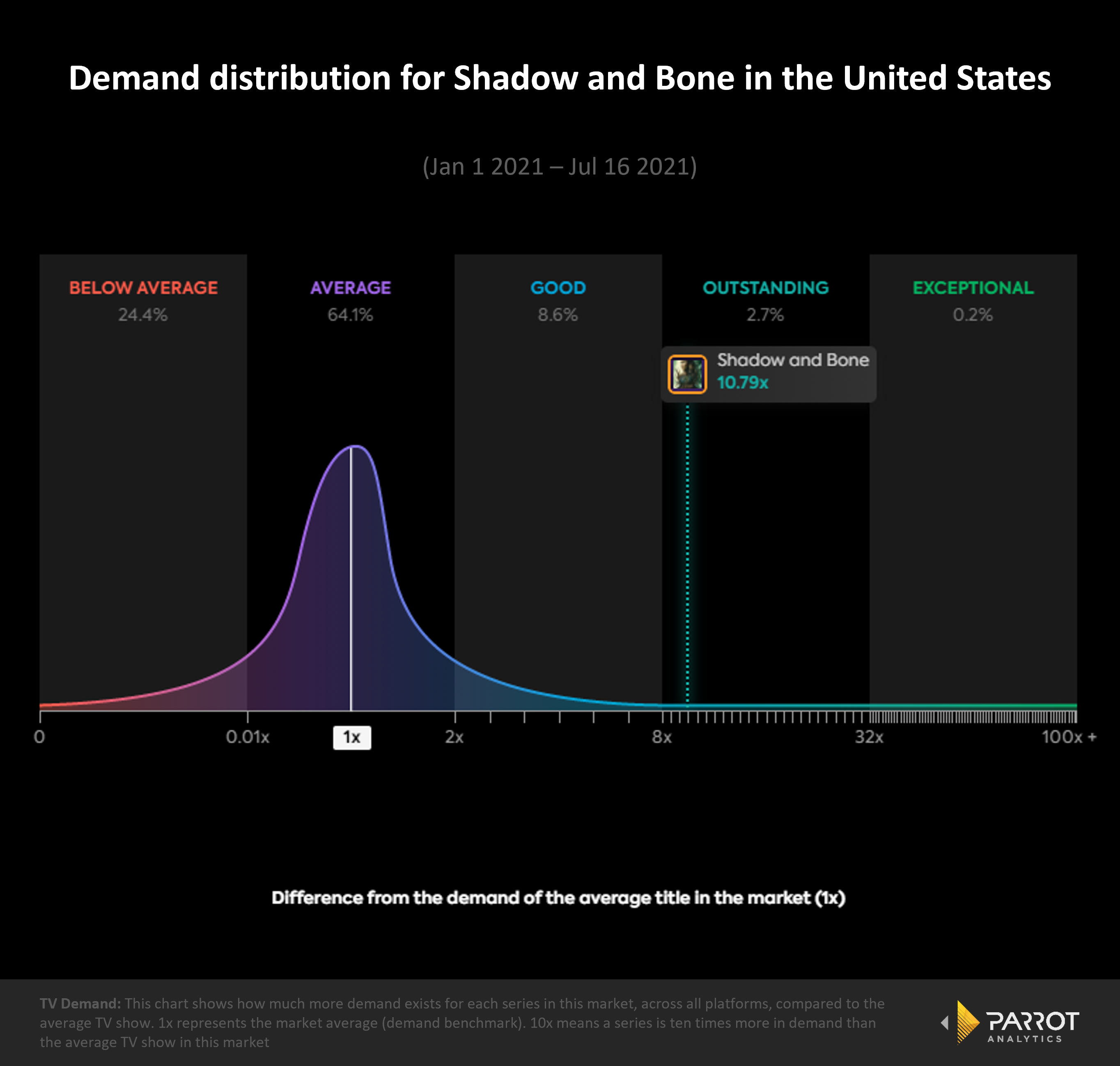

Meanwhile, hit-show-in-the-making Shadow and Bone launched in 2021. Flaunting Ben Barnes in the cast, the Netflix original has already been renewed as well. It recorded 10.7x the demand average since the start of the year.

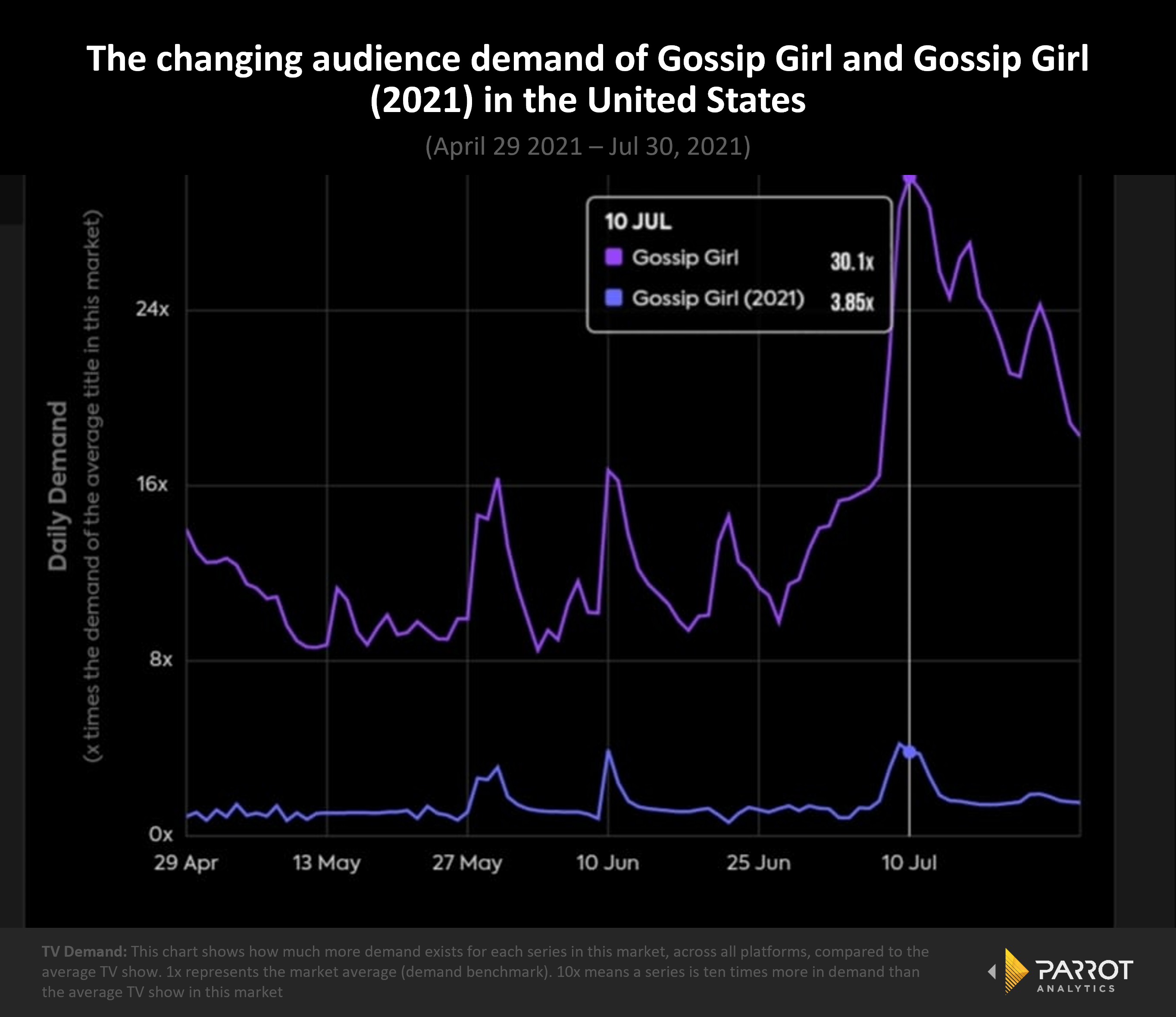

To come full-circle, a sequel of the pioneer show Gossip Girl was recently launched on HBO Max. Since its premiere on July 8th, it has recorded 1.62x the demand average. Most impressively, the reboot has had a dramatic impact on the demand for the original Gossip Girl. The show went from 9.7x the demand average on June 27th of this year, to 30.1x on July 10th when the remake premiered.

While the renewal for the reboot hasn’t been confirmed yet, if it’s is anything like the original, there will certainly be a second season.

Taking into account the history and accomplishments of the genre, it is safe to say that Young Adult fiction has a kind of universal appeal that will always be popular. The rebound in interest demonstrates that producers can never underestimate the power of teenage-centered stories. With so many good books out there, it’s only a matter of time before we see a second wave of YA adapted to the small screen.