Image: The Fall of the House of Usher, Netflix

The streaming industry is recognized for its oligopolistic nature, where key platforms hold considerable market power. Even as Netflix cements itself as the undisputed market leader, the trend is not towards a monopolistic market, but a more competitive one.

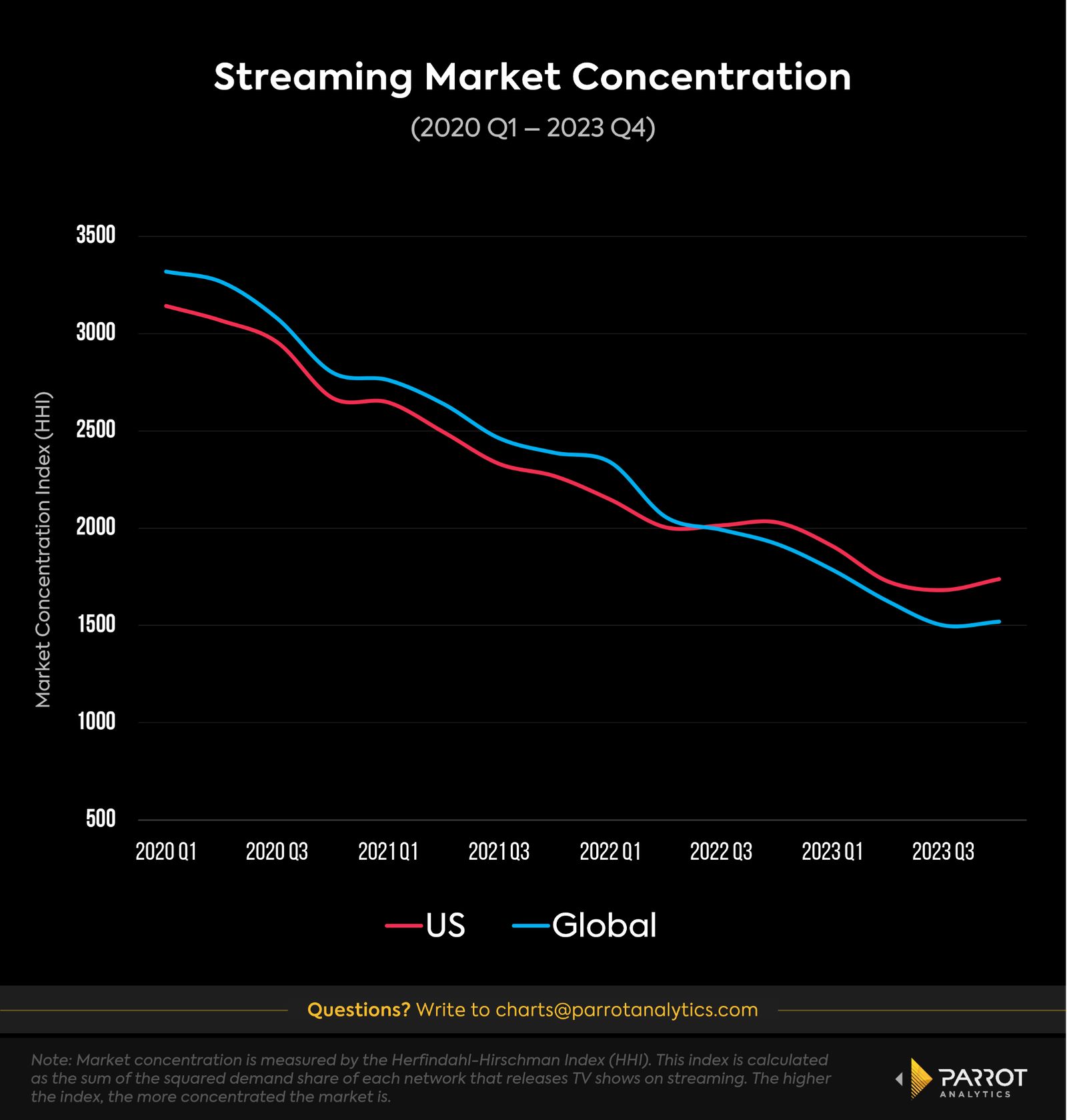

Parrot Analytics data provides insight into this using the Herfindahl-Hirschman Index (HHI), a widely used measure of market concentration. This index, calculated from the TV demand shares of streaming networks, helps track market concentration trends over time. A higher HHI indicates greater market concentration due to higher shares held by main networks.

Since early 2020, both the U.S. and global streaming market have become increasingly competitive. In the U.S., this period was marked by the launch of new platforms like Disney+ (November 2019) and HBO Max (May 2020, now Max). There was a slight increase in market concentration in mid-2022, but by the third quarter of 2023, the HHI reached its lowest point, indicating less concentration.

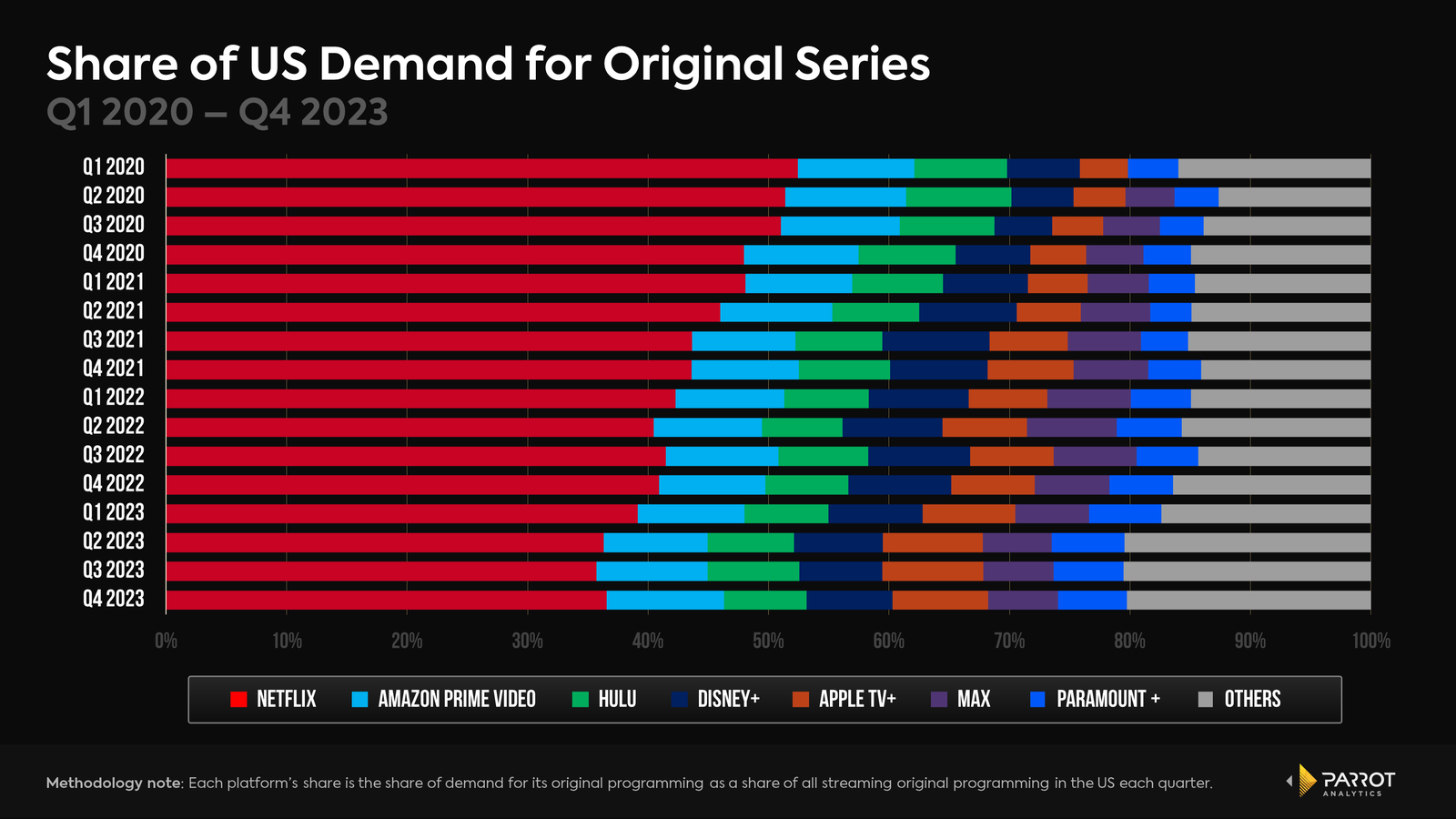

Netflix's dominant position significantly impacts the U.S. market's HHI, though its margin of dominance has been decreasing. Notably, Netflix's demand share for streaming original shows saw an increase in the last quarter of 2023, which was followed by a small increase in the HHI last quarter. This growth is the first since the mid-2022 boost generated by the Stranger Things effect and may be attributed to the release of some of the most successful shows of 2023 in the last quarter such as One Piece and The Fall of the House of Usher.

Another indication of this de-concentration trend is the rise of the 'Other' category. This category's demand share increased from approximately 15% in 2021 to over 20% by the end of 2023, showcasing the growth of platforms other than the main premium SVODs. This includes services such as Bet+, iQIYI, and AMC+.

Interestingly, since the second quarter of 2022, the U.S. streaming market has been slightly more concentrated than the global market. During this period, newer platforms such as Apple TV+ and Disney+ became significant sources of streaming original content, and the decline in the HHI in the US slowed down, in contrast to the continuous fall in the global HHI since 2020.

This analysis suggests that the "streaming wars" will not end with a single victor. Instead, as consumers settle into their preferred platforms based on specific needs, we can expect further market fragmentation, with several platforms thriving simultaneously.