Parrot Analytics has recently taken an in-depth look at the market share of SVOD platforms in Australia based on the Australian audience demand of each platform’s digital original productions. The SVOD market share report leverages Australia demand data for streaming originals from Netflix, Amazon Prime Video, Hulu, CBS All Access, as well as local SVOD platforms.

Please download the full 68 page report here, which also includes data and analysis for 9 other countries: Australia SVOD Market Demand Report.

SVOD market share in Australia

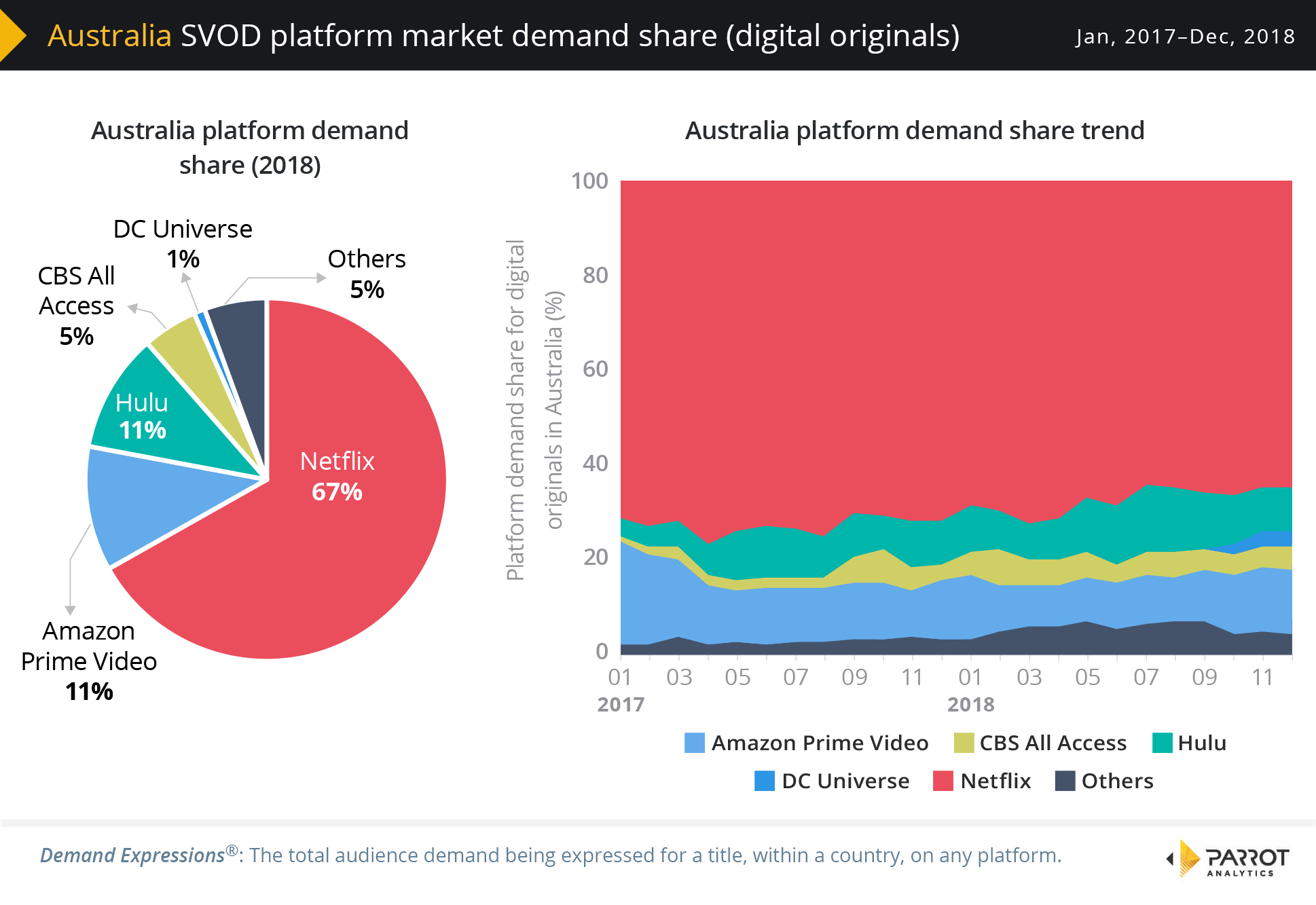

We define “SVOD market share” as the share of demand for each platform’s digital originals. Based on this measure, we are able to make the following observations:

- In the Australian digital original space, Netflix titles have the largest share of demand; 67% of all demand expressed in 2018 was for a Netflix title.

- Prime Originals have an 11% demand share in this market, as do Hulu titles.

- The 24-month Australian demand share trend is fairly steady, with a slight trend towards a smaller share of demand for Netflix Originals.

SVOD drama market share in Australia

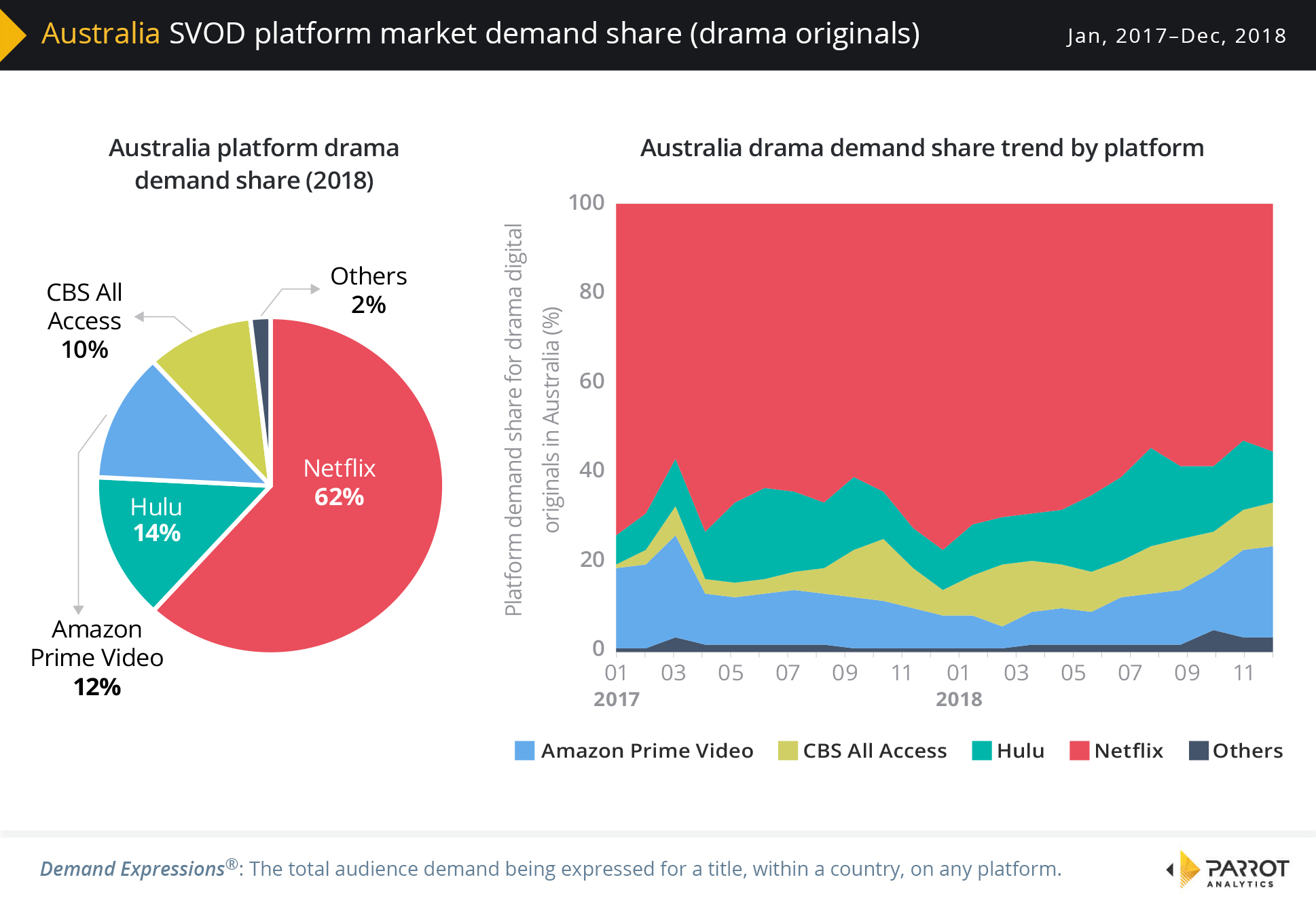

Here we define “market share” as the share of demand for each platform’s drama digital originals in Australia. Based on this measure, we are able to make the following observations:

- The majority (62%) of demand for drama titles in Australia is expressed for titles from Netflix.

- Hulu has the second largest demand share in Australia with 14% of drama demand expressed for Hulu original titles; Prime Originals account for 12% of Australian drama demand in 2018.

- The 24 month demand share trend chart reveals that Netflix’s share of drama demand has decreased from approximately 75% two years ago to around 55% at the end of 2018.

SVOD action/adventure market share in Australia

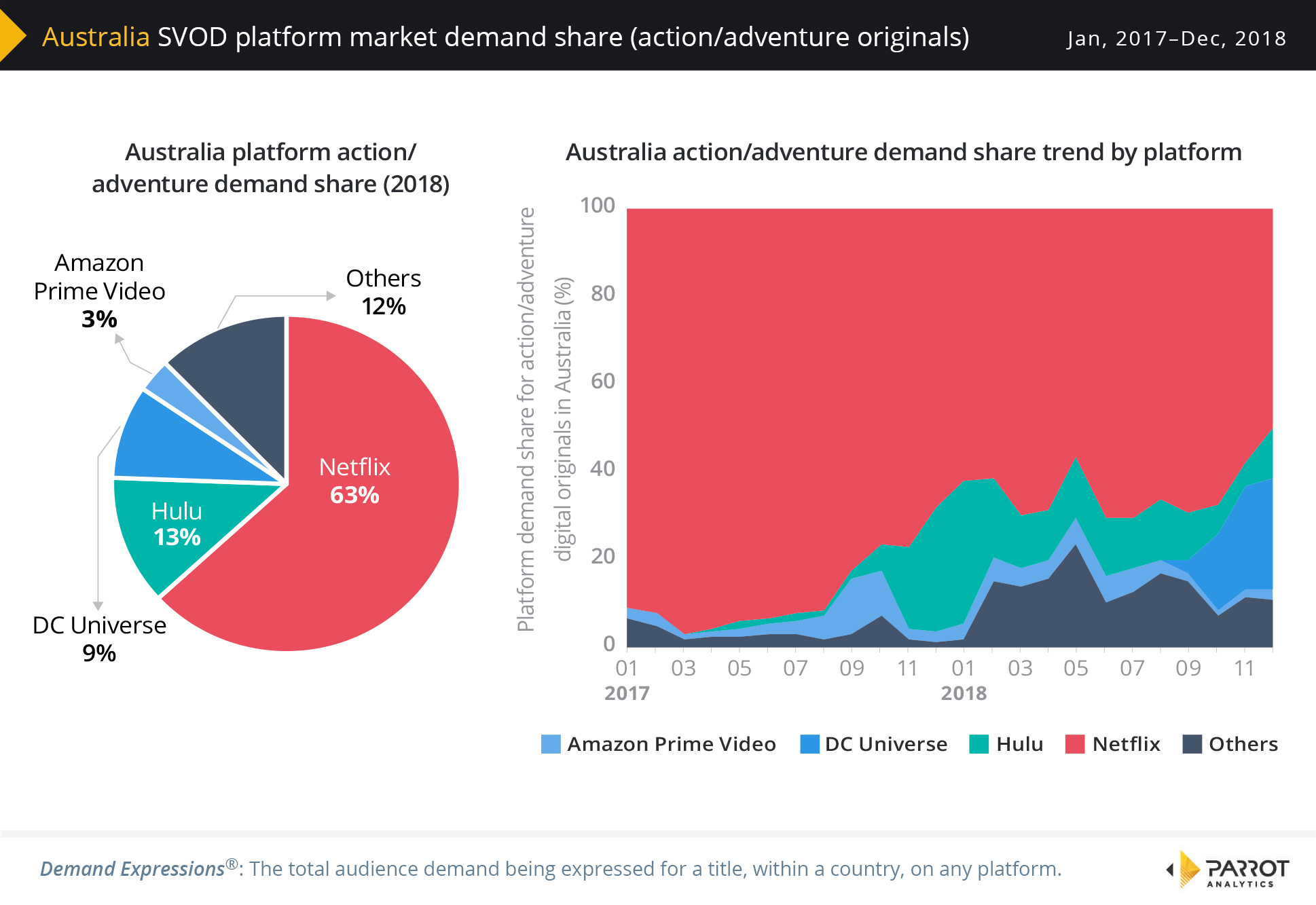

Here we define “market share” as the share of demand for each platform’s action/adventure digital originals in Australia. Based on this measure, we are able to make the following observations:

- Netflix titles account for 63% of Australian demand for action/adventure digital originals.

- Hulu titles attract the second largest share of demand (13%) in this market, followed closely by DC Universe with 9%.

- Netflix’s share of demand for action/adventure digital originals in this market has decreased rapidly over a two year period; in the second half of 2018 this decrease was accelerated by DC Universe.

Download the free SVOD market share report for Australia

Download this report now and discover the latest SVOD market demand trends for Australia. Our comprehensive global TV demand report includes the following insights:

Australia Domestic TV Insights:

- We reveal the 2018 Australia SVOD market share of the major platforms including Netflix, Amazon Prime Video, Hulu and CBS All Access based on audience demand for each platform’s digital originals.

- Discover how SVOD market share trends in Australia have changed over the last 24 months, including the contribution made by DC Universe.

- Find out what percentage of the market for drama and action/adventure digital originals each SVOD platform has managed to capture over the last 24 months.

- Learn where in the world content produced in Australia is the most wanted relative to the Australian home market; we refer to this as content travelability.

- Discover which sub genres resonate the most with Australian compared to the global average.

- Find out what the demand distribution of a selection of digital originals in Australia looks like.

- Discover the top 20 digital streaming shows in Australia, as well as 5 additional titles of interest to audiences in Australia.

Global Television Insights:

- Find out the 2018 global SVOD market share of the major platforms including Netflix, Amazon Prime Video, Hulu and CBS All Access across 100+ markets.

- Discover the worldwide platform demand share of drama digital originals as well as the worldwide platform demand share of action/adventure digital originals.

- The increase in the global investment made by SVOD platforms over the last 5 years.

- The global growth of SVOD subscribers over the last 5 years.

- The increase in digital original titles worldwide over the last 7 years.

- A TV industry update for 2018 detailing important market events concerning SVOD services.

- We have also included a mini analysis of the global demand for critically acclaimed digital original comedies.

For more information, check out the most up-to-date Australia television industry overview.