Image: Sé Quien Eres, Telecinco

Many Latin American countries like Mexico and Brazil export their original content to hundreds of countries around the world. Smaller markets in the region, in general, tend to import more content than what they export, consuming Spanish and Portuguese content from the USA, Europe and other Latin American countries like Mexico, Argentina and Brazil. In this article we examine four of these import-heavy markets: Chile, Ecuador, Peru and Panama.

While many of the countries in this study have increasing output from domestic TV industries, we will be concentrating on the impact of imported content. Particularly, which genres do these smaller Latin American markets prefer compared to Latin America overall, and which countries do audiences in these four markets prefer to get their content from?

Parrot Analytics has leveraged global TV demand data to probe deeper into the imported content trends of these four markets: Markets that collectively contain 65 million content viewers.

Which individual Spanish and Portuguese titles were the favorites in each of the selected markets last year?

We focus our analysis on four Latin American markets: Chile, Ecuador, Panama and Peru. For each country, the ten regional language titles that had the highest average demand over the whole of 2017 were identified.

Chile

The most in-demand content origin in 2017 for Chile is the United States, four of the most popular regional language titles in the country were produced in the US.

The most in-demand titles for Chile are actually shared with all four countries in this study: These import-favoring Latin American markets in 2017 have a very clear favorite and second favorite show. Both titles are from the USA’s Telemundo: The highest demand is for crime drama El Señor De Los Cielos while the second highest demand is for the telenovela Sin Senos Sí Hay Paraíso.

Content from Spain also ranks highly in Chile. Three titles originate from Spain, the most of all markets examined in this investigation.

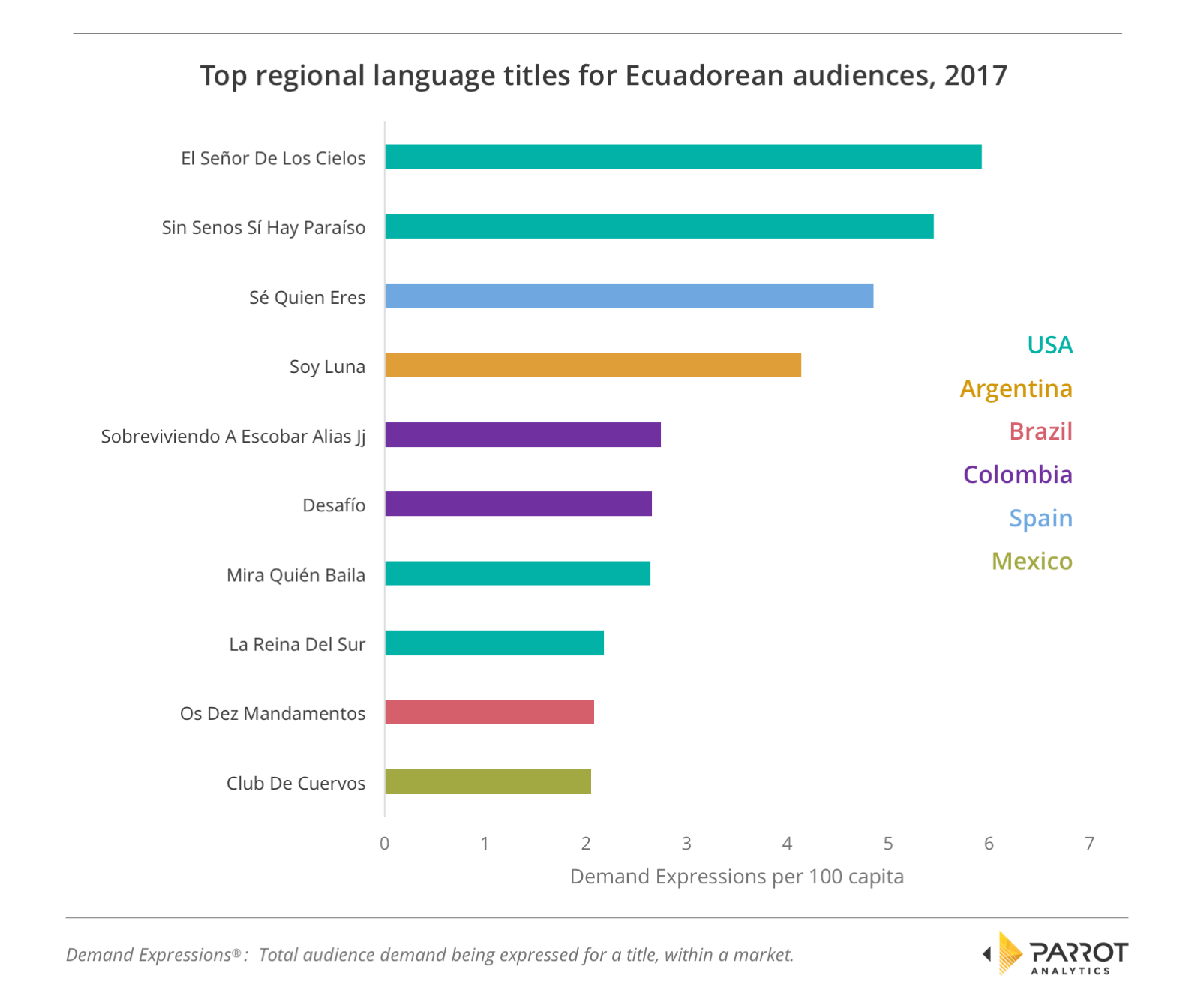

Ecuador

Ecuador also contains four titles from the USA in their highest demand regional language title list. Unlike Chile, however, this market only favors the one title from Spain: Telecinco’s thriller Sé Quien Eres.

Two titles from Colombia are in high demand in this market. As well as Caracol Television’s reality show Desafío, which is popular in all four markets, Ecuadorean audiences also liked drama Sobreviviendo A Escobar Alias JJ from the same network.

Ecuador’s list includes a title that does not appear in the top ten of any other market in this study: Telemundo’s crime drama La Reina Del Sur.

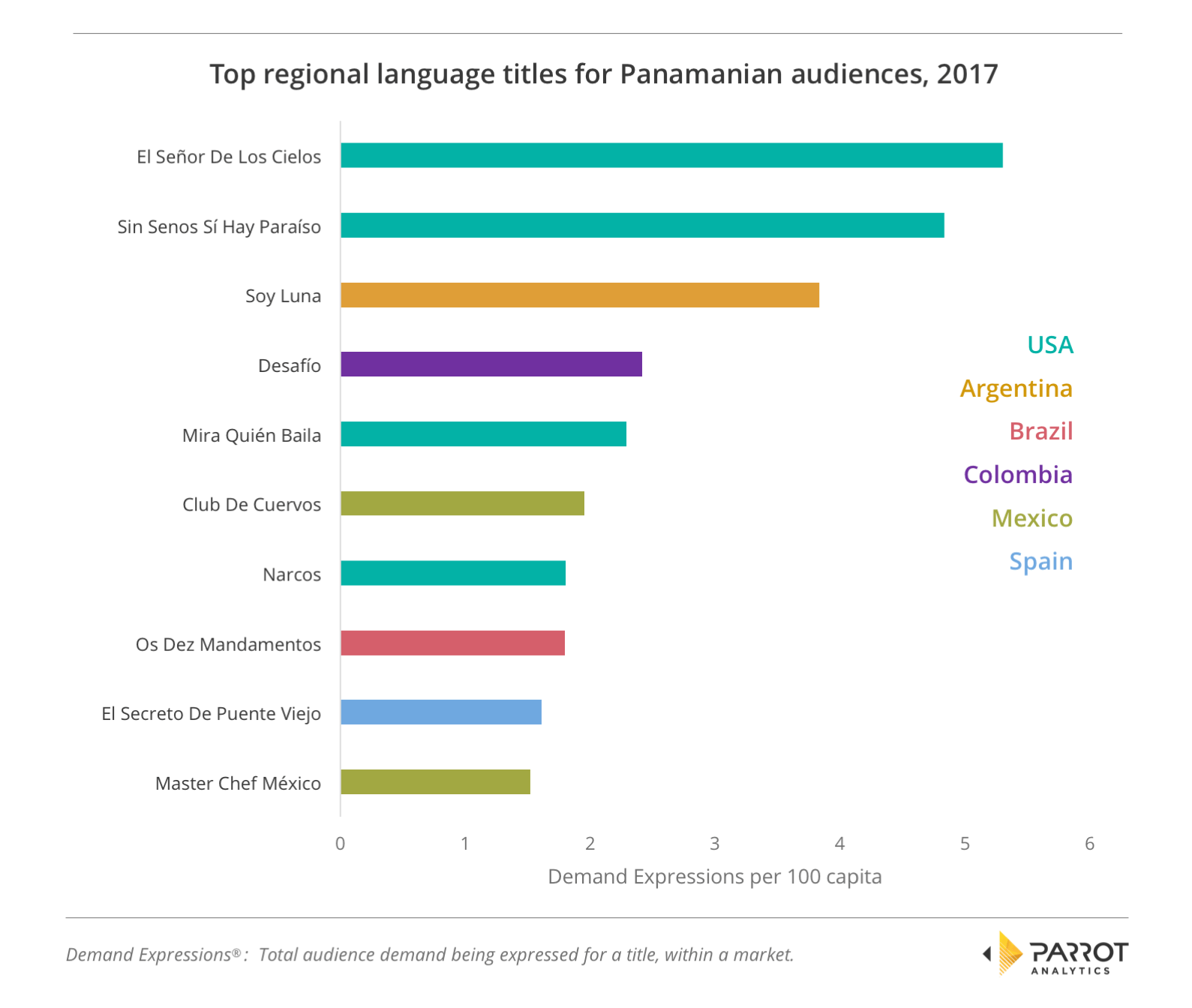

Panama

Panama has a stronger Mexican influence than the other markets with two high-demand titles originating from that country.

It also has two Netflix titles, comedy-drama Club De Cuervos and crime drama Narcos, in the list of most in-demand titles. This is higher than in Chile and Ecuador where the streaming service only had a single top ten title – equal with Peru.

Two shows do not appear in the lists of the other three markets examined here: They are the telenovela El Secreto De Puente Viejo from Spain’s Antena 3 and cooking show MasterChef México from TV Azteca.

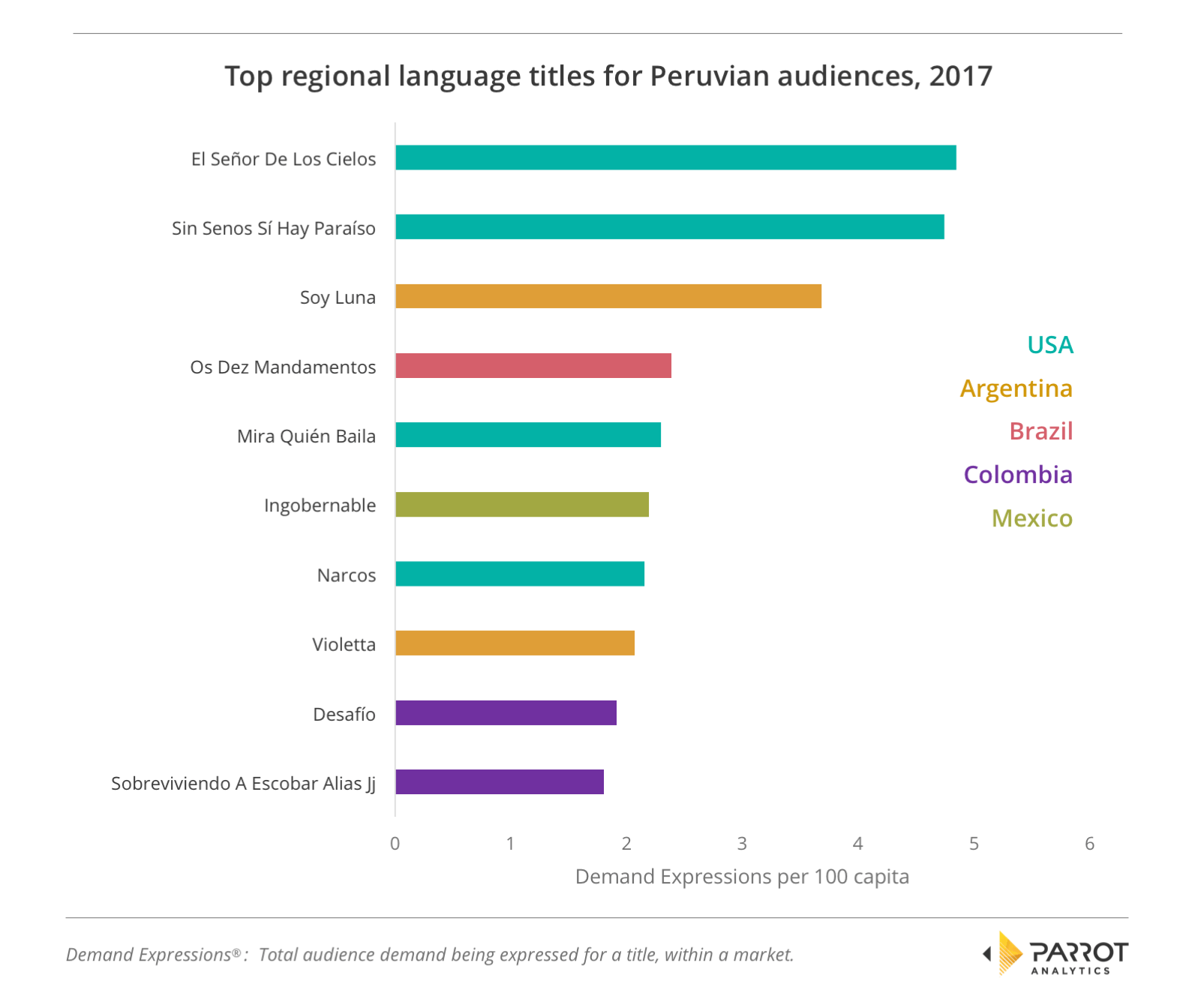

Peru

Of these four import-favoring markets, Peru has the highest demand for Argentinian content with both Soy Luna and Violetta from that country charting. This may also be a sign of high demand for content aimed at teens in Peru as both Argentinian shows are teen titles from Disney LATAM. Soy Luna is popular across all four markets in this study and it is a top ten title in all four of them.

Like Panama, Peru also has two titles from Netflix. Narcos remains one of them, but Peru prefers the political drama Ingobernable to Club De Cuervos.

The only Brazilian title in the Peruvian top ten is Record TV’s religious telenovela Oz Dez Mandamentos. This title is popular across the selected Latin American markets as it is one of the most in-demand shows in all markets studied, however, the show’s placement of fourth in Peru makes it highest ranked in this market.

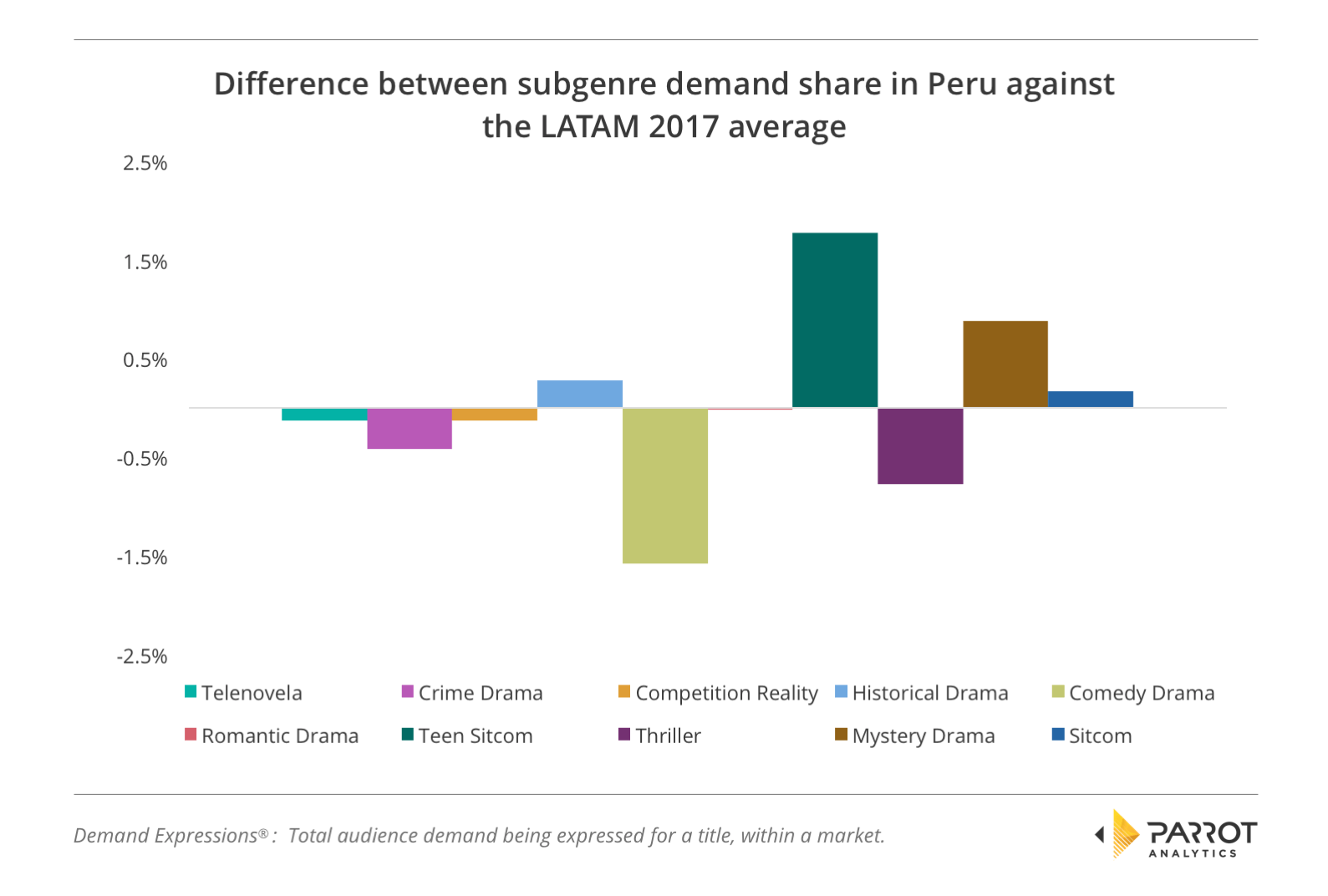

How does the share of demand for subgenres compare to the LATAM average in each country?

Across Latin America in 2017, the subgenres with the highest demand are, in order: Telenovela, crime drama, competition reality, historical drama, comedy drama, romantic drama, teen sitcom, thriller, mystery drama and sitcoms.

By taking these subgenres and calculating the average demand share for each subgenre for all Latin America, we can determine the difference from this regional average for each subgenre in all four selected markets.

The largest difference from the Latin American average in Chile is for thrillers: The demand share for this subgenre is 1.8% above the region. Competition reality also performs well in this market, gaining 1.2% demand share against the region.

The subgenre that Chilean audiences like least compared to fellow Latin Americans is telenovelas, this particular genre loses 0.8% demand share compared to the LATAM average.

Let us now examine Ecuador: Like Chile, the biggest change from the regional average in this country is also for thrillers; in this case the genre has 2.4% more demand share. Crime dramas are preferred in this country too, gaining 1.0% demand share against the region.

The largest loss of demand share in Ecuador, compared to the rest of Latin America, are comedy dramas: That subgenre has 1.3% less demand share.

These numbers mean that Ecuador has the largest deviations from the Latin American average. Therefore, Ecuador has the most distinct taste in content from the rest of the continent out of all four of the markets examined.

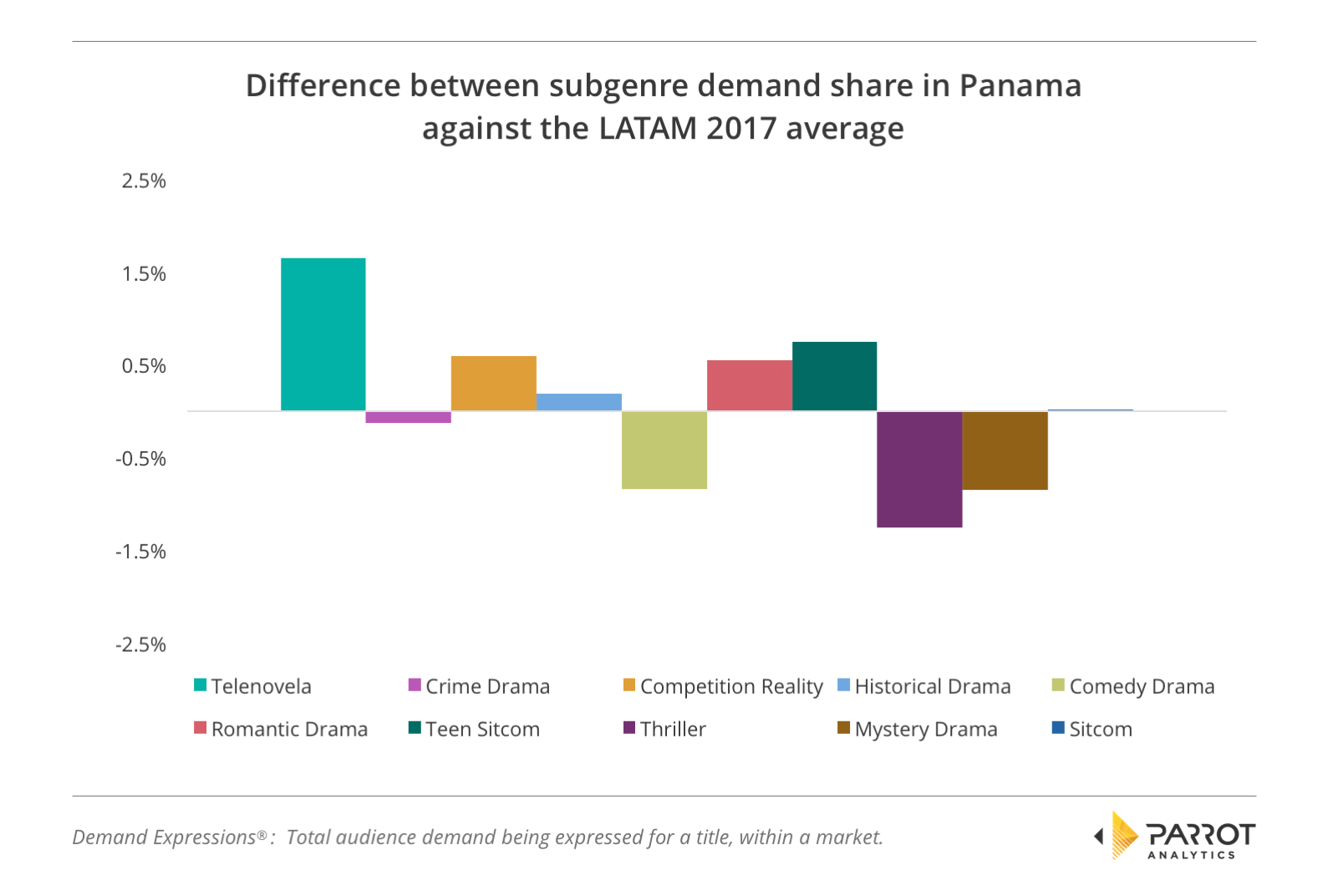

Switching over to Panama, we see that the subgenre with the largest difference from the Latin American average represents a gain of 1.6% in the demand share for telenovelas. While enthusiastic about telenovelas, the next two largest changes are both drops in demand share from the regional average: Thrillers in Panama have 1.3% less demand share and comedy dramas have 0.8% less.

One subgenre in Panama doesn’t change at all: Sitcoms have exactly the same demand share in both Panama and the region as a whole.

These numbers show that Panama is the closest of the four selected markets to the Latin American average; this country is most likely to have high demand for content that is also in demand elsewhere in the region.

Finally, let us now look at Peru: As the top titles chart earlier in this investigation indicates, there is high demand in Peru for teen sitcoms. That particular subgenre gains 1.8% demand share on the Latin American average.

Mystery dramas also do well in the Peruvian market, with 0.9% more demand share for that subgenre in 2017 compared to the region.

In the other direction, there isn’t as much demand in Peru for comedy dramas, that subgenre has 1.6% less demand share compared to the Latin American average.