Disney+ has launched today in the US, Canada and the Netherlands with Australia and New Zealand to follow next week. Disney’s direct-to-consumer streaming service has been anticipated as a historic moment in TV for at least a couple reasons. First, Disney’s storytelling is iconic. Second, Disney has clearly set its intentions to make streaming the core of the business; CEO Bob Iger states that Disney+ is the most important product they’ve launched in over a decade. But, is Disney’s Disney+ strategy set on a course for success? In this piece, Parrot Analytics uses global TV demand data to evaluate the library at launch and its potential trajectory.

Disney+ launch day demand

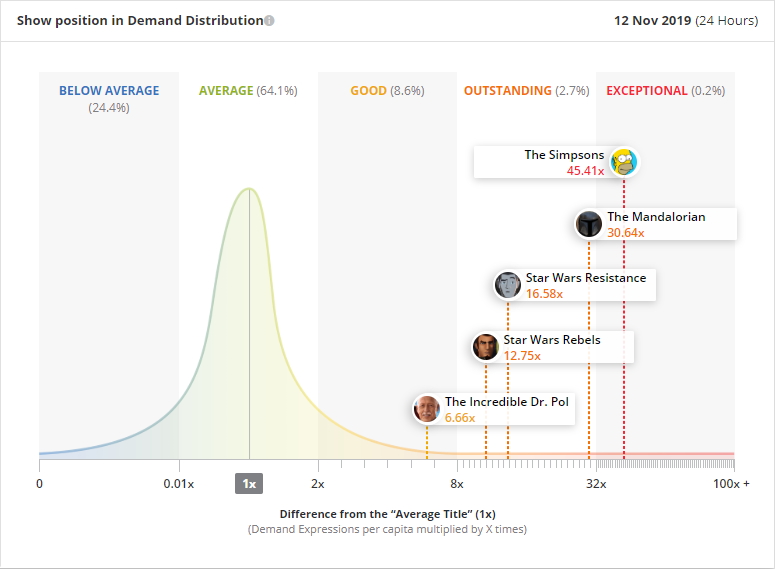

Before we dive in, let us set the scene with an up-to-date launch day comparison of demand for some of Disney’s most popular licenced and original titles. The below chart is based on US demand over the first 24 hours of Disney’s platform launch; each title is compared against the US market average.

Despite all the hype surrounding The Mandalorian, it is eclipsed by Fox’s The Simpsons. Whilst The Mandalorian is over 30 times more in demand than the US market average on launch day, The Simpsons has managed to attract over 45x the demand of an average title in the United States.

Let us now examine Disney’s strengths across its entire catalog; the 2019 year-to-date is used as the underlying dataset for this analysis.

Catalog strengths

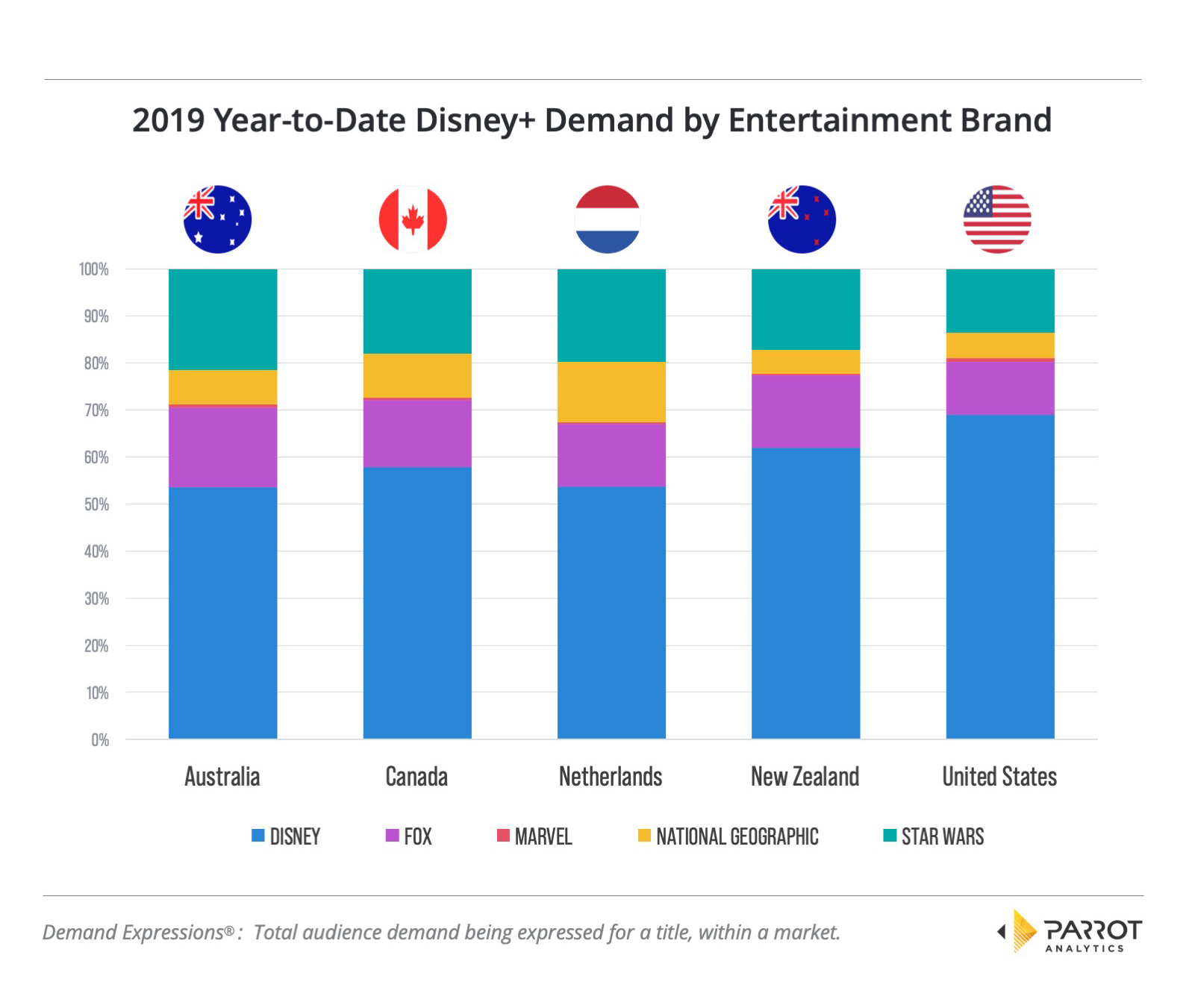

During September’s D23 expo – Disney’s fan event celebrating its brand universes Pixar, Marvel and Star Wars – Disney’s direct-to-consumer director Kevin Mayer reinforced that the company’s key differentiating factor in the streaming market is nostalgia. Parrot Analytics’ demand data (see Chart 1 below) examining the announced library of television at launch reveals that the Disney classics are stimulating this nostalgia. Across markets in which Disney+ launches over the next 7 days, Disney titles are most in-demand, followed by entertainment brands: Star Wars, FOX, National Geographic and Marvel titles (though, note, no Marvel titles had aired yet). Notably, FOX, which is only represented by The Simpsons, impressively accounts for 10% of demand – double the share from National Geographic.

Yet, domestically, based on Parrot Analytics’ demand data, almost 70% of demand and thus potential subscribers on day one are expected to be driven by the subset of Disney classics to be released at launch such as Duck Tales, Goof Troop and The New Adventures of Winnie the Pooh. Internationally, especially in Australia and the Netherlands, the to-be-released Disney titles at launch alone are expected to generate approximately 55% of the demand. In these markets, Disney+’s subscriber growth may be equilaterally informed by Disney and non-Disney IP. In other words, Disney+’s value extends well beyond that of Disney.

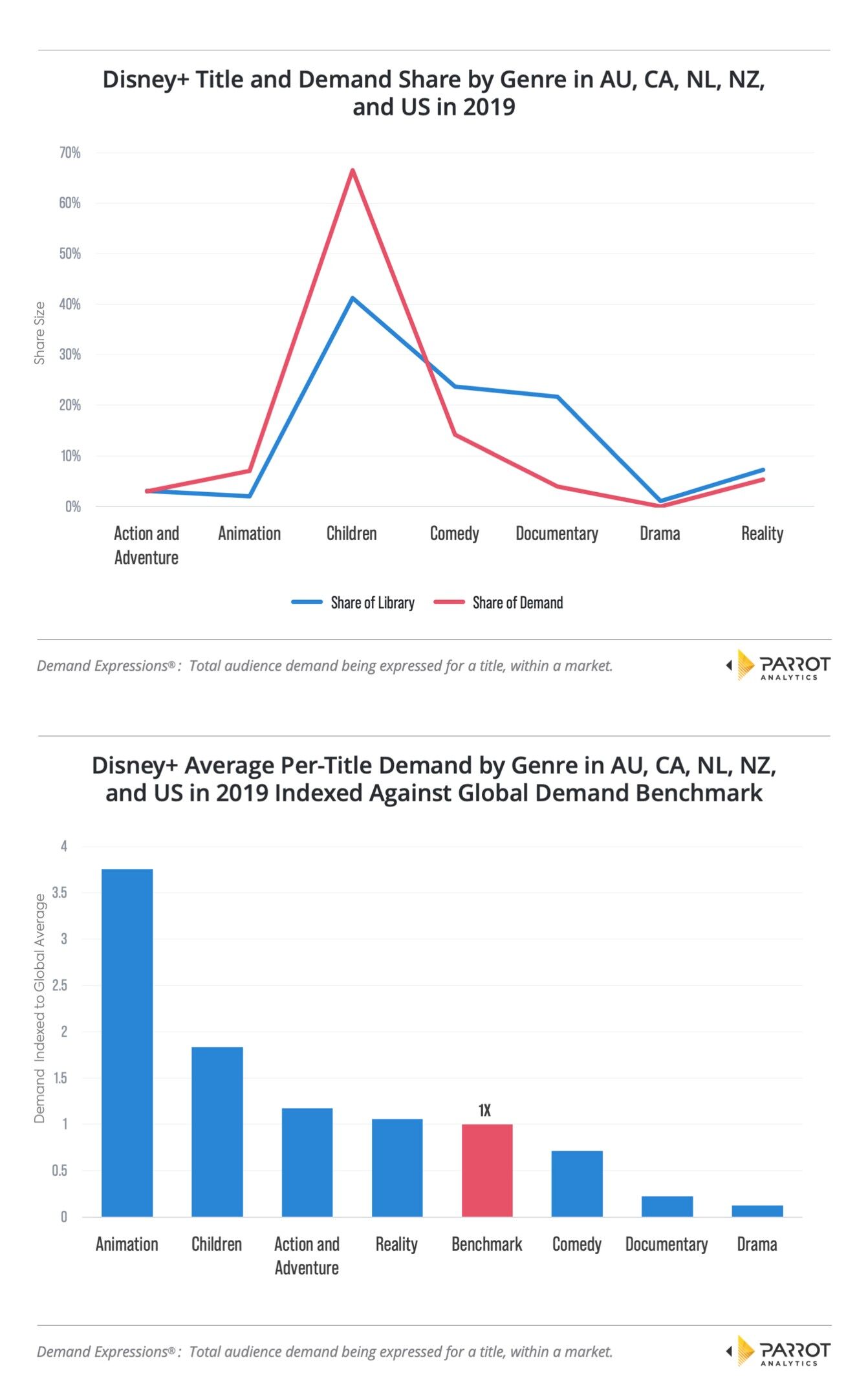

In the first chart below we compare the share of the library by title count from each genre, with the share of demand contributed by the titles of that genre. Children titles’ demand over-performs: Though children’s titles comprise 40% of the share of the Disney+ launch library, these titles have amassed 67% of the total audience demand over the last year.

The strength of Disney-specific content is not surprising; Disney thrives off of its family-friendly and child-centric brand. Our demand data reflects the value of the Disney+ catalog at launch, which is fundamentally driven by children’s content demand as mentioned, but also comedy demand (14%) and animation demand (7%).

Yet, Disney+ is not just an extension of Disney. It has an arsenal of content from other giants to expend. When examining which genre’s titles, on average, are most in-demand and can boost the perceived value of Disney+’s catalog relative to the global demand average, animation takes the lead, followed by children’s content and then action and adventure content (see Chart 3 above).

Animated content such as The Simpsons (FOX) and action and adventure titles from Star Wars and Marvel stand to drive perceived value for subscribers. These genres’ share of demand also over-perform relative to the share of titles they each provide. Yet, this leaves much headroom in other genres for Disney+ to capture.

So the question that emerges is, will it be enough for Disney+ to be mainly targeted at children and families? Or, is Disney+ selling the new entertainment conglomerate it embodies short?

Is “King of Kids” enough?

While the foundation of Disney+’s success currently resides with children and family focused genres, in the long-term, being “king of kids content” may not be enough to keep subscribers, and keep Disney shareholders appeased. The bundling of Disney+ with Hulu and ESPN+ provides a safety net, but does not entirely reduce the pressure for it to succeed independently.

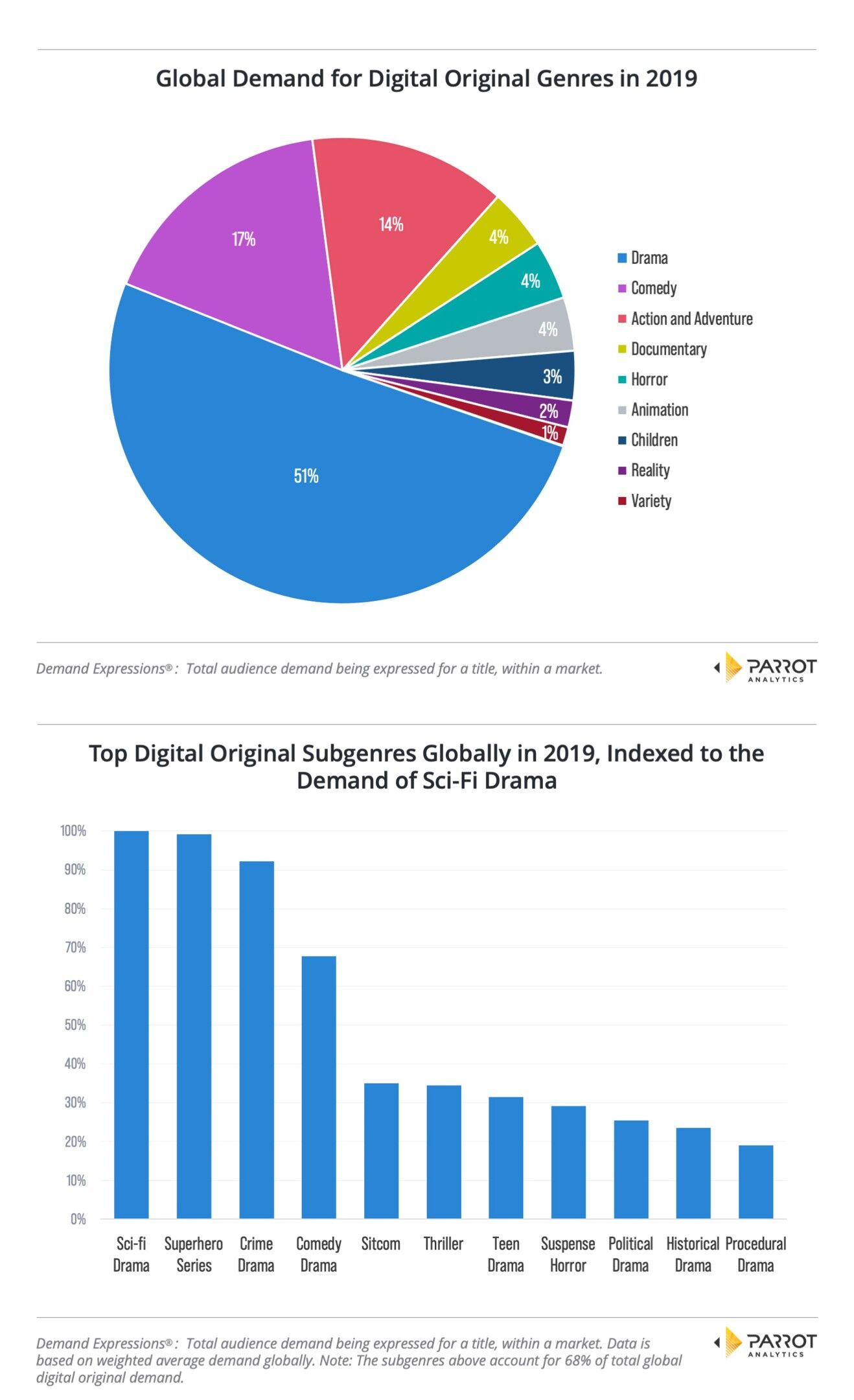

Using existing global demand share as a benchmark, Disney+’s most in-demand genre, children’s content (i.e., 67% — see Chart 2 above), greatly over-indexes on the global demand share of this genre amongst digital originals (3% see the Chart 4 below). Meanwhile drama, comedy, and action and adventure collectively draw 82% of the total demand for digital originals globally, yet currently make up under 30% of Disney+’s launching catalog. Hulu, which is intended to capture a wider audience with general entertainment and adult content, will likely fill the content gaps in genres such as drama.

Still, Disney+ may be overly reliant on Disney content. With the “right” library, Disney+ can not only engage the core Disney customer but also occupy a greater share of their attention and encompass more of their preferences. If the service has engaging originals, it can inspire more rewatching and connection with their characters. So, what is at stake here is data. Disney+’s success is to be measured in the magnitude of the touchpoints the platform represents with its global consumers, which Disney can leverage in a growingly data-driven and consumer-centric world as part of its overall ecosystem. Disney+ subscribers may well present the launchpad for accelerated Disney resort and park sales.

Chart 5 (the second chart below) reveals that the top 11 subgenres capture over two-thirds of the total global demand for digital originals. The demand for some of these top most in-demand subgenres are well within Disney+’s reach. For example, the chart is topped by sci-fi drama and superhero series: Disney+ has already announced and has started executing plans to leverage IP in entertainment brands such as Star Wars and Marvel within these subgenres. Beyond these chart toppers, Disney+ could also engage audiences with more beloved content in subgenres such as comedy dramas and teen dramas.

However, Disney+ only has the potential to maintain – rather than elevate – Disney’s presence in the Golden Age of TV if the outlined opportunities are not fully leveraged. This would be a loss for audiences and Disney alike. As Variety’s Daniel D’Addario warns, leaning too hard on past successes may not drive the company positively towards capturing all of the available opportunities of the future. He goes on to state, ”Disney+’s launch is a milestone in making library material available, and – with one notable exception – a non-event for viewers seeking out new programming”. (Though at least as far as launch-day demand is concerned, with Disney+’s infrastructure buckling, it doesn’t look at all like a non-event thus far).

But is The Mandalorian the blockbuster original Disney+ needs; and if so, what will subscribers do once they’ve watched it? More to come soon.

—

A note on methodology: We define “genre share” as the share of demand made by the total demand for titles of a genre first within Disney+ launching catalog and then across platforms’ digital originals. Demand in the above analyses includes pre-release demand, which is demand for titles not yet released such as The Mandalorian. “Digital Originals” are defined as a multi-episode series where the most recent season was produced or first made available on a streaming platform. Demand in a territory is attributed to the original platform.