Parrot Analytics examines Disney+’s successes and opportunities to date and we analyze how the service is able to coax away competitors’ demand in its November 2019 launch markets.

Parrot Analytics’ top insights for Disney+’s catalog launch strategy:

- Understanding your audiences’ off-platform preferences via your threat to competitors can improve your content strategy development.

- Marketing your catalog’s titles in genres in which your audience expresses demand on other platforms can allow you to increase your subscription rate.

- Acquiring local content in genres that are undersaturated and represent off-platform preferences can boost growth in international markets.

Who’s at risk?

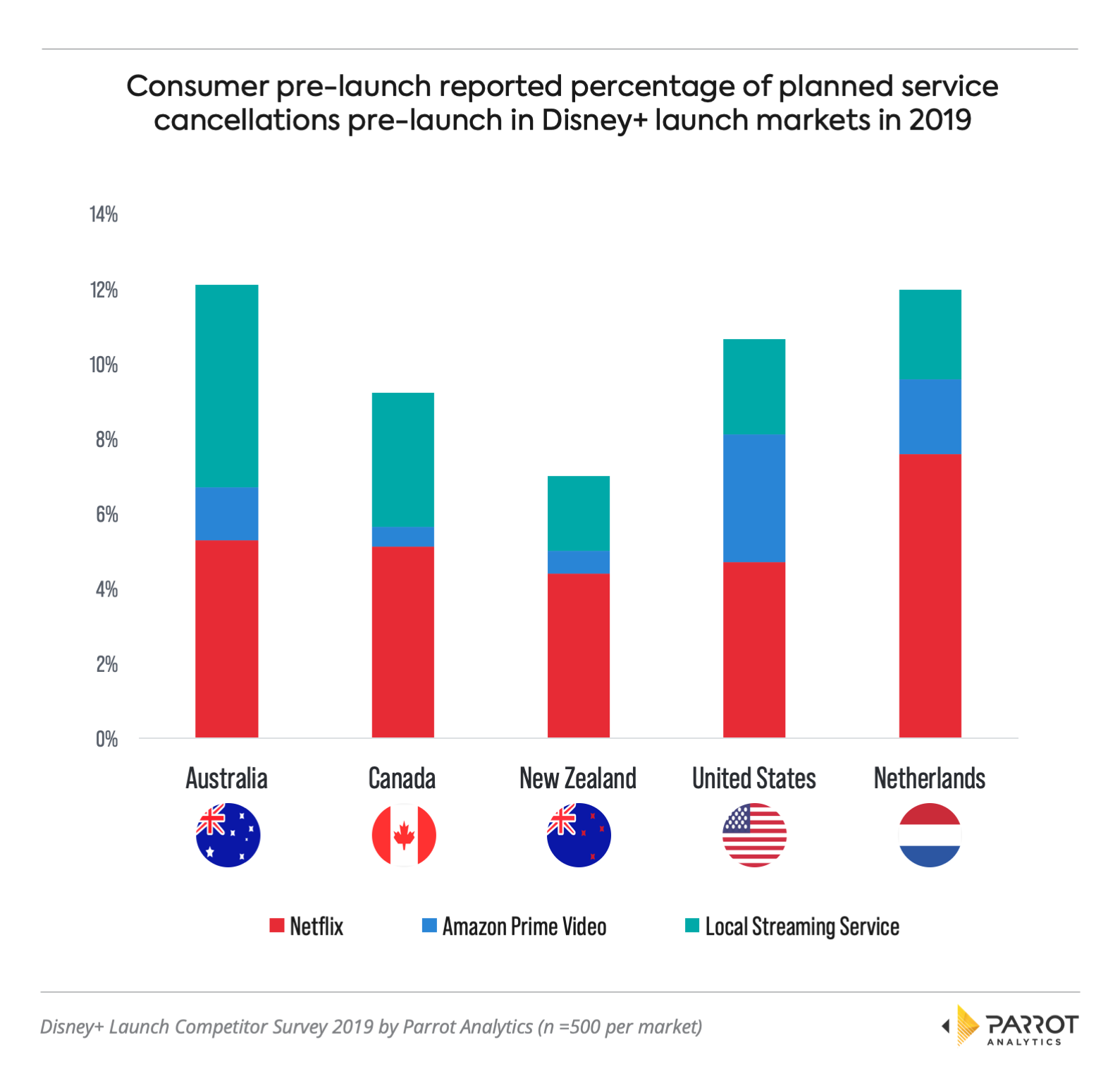

In the attention economy, a convincing catalog can influence some audiences to quit competing subscriptions. Consumers’ self-reported service cancellations (November 2019) evidences that Netflix is the opponent potentially facing the greatest challenges due to Disney+ (see Chart 1 below).

The impact in the Netherlands (near 8% reporting Netflix cancellations pre-launch), which has had more experience with the platform, may foreshadow other markets. Cancellations of competitors’ services signals Disney+ has the opportunity to monopolize more of its audiences’ attention to fuel its profit machine.

Where does Disney+ have headroom?

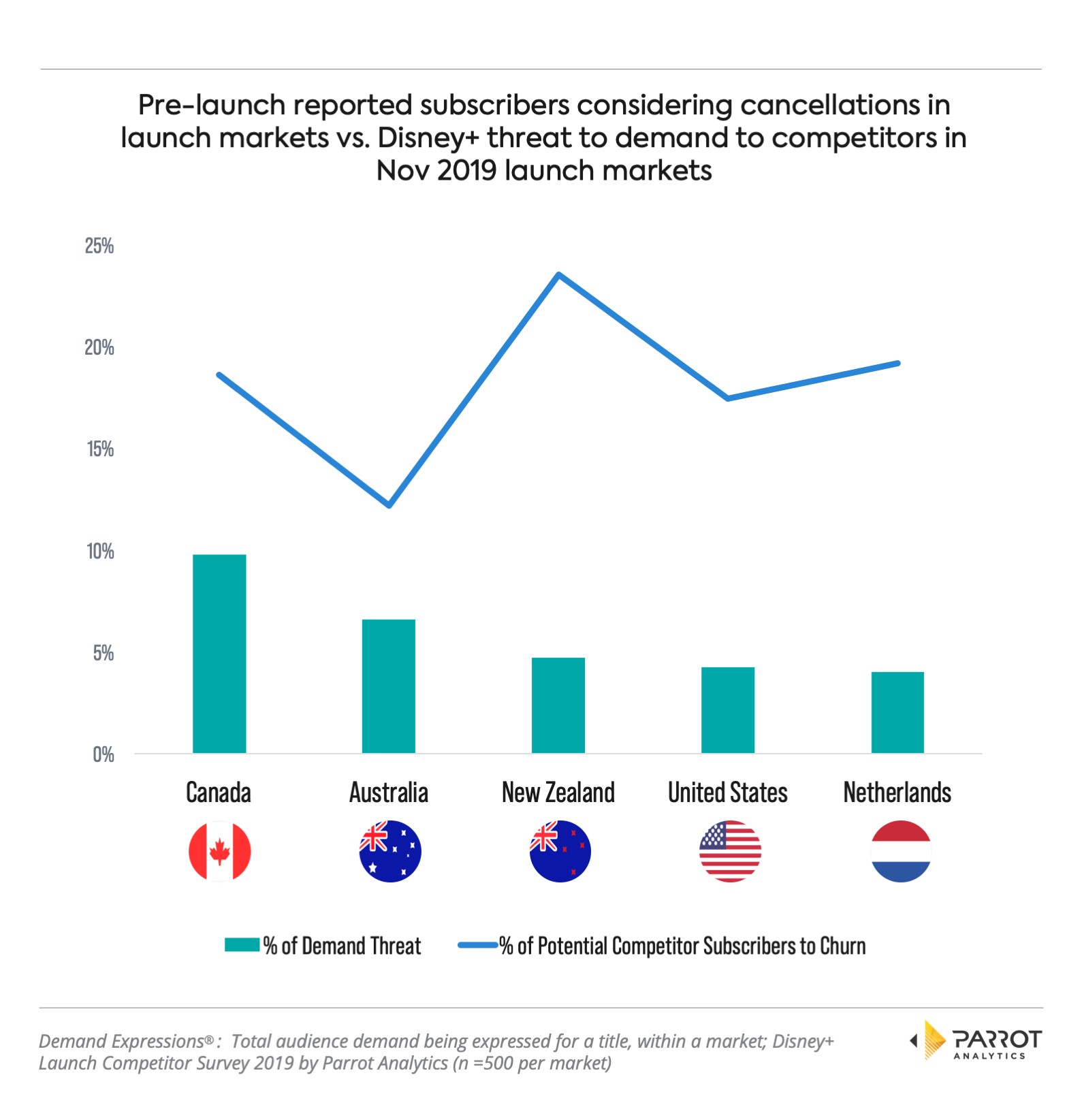

Many subscribers are still on the fence and open to terminating and replacing their existing streaming service with Disney+ (see the blue line in Chart 2 below). Specifically, Disney+’s catalog at launch has most impacted competitors in Australian and Canadian markets. In other markets such as New Zealand, Disney+ may need to make changes to its catalog or marketing strategy.

In Chart 2, Parrot Analytics estimates what percentage of global competitors’ Amazon Prime Video and Netflix’s demand is threatened by the Disney+ catalog at launch in each market based on shifts in the consumption component of demand. To exemplify, Australian Prime Video and Netflix consumers have an 8% likelihood of expressing demand for Disney+’s catalog. At the same time, 12% of subscribers in the market are considering cancelling an existing SVOD service to which they currently subscribe. Disney+ has headroom to capture the attention of these subscribers.

What can Disney+ do to capture headroom?

Disney+’s catalog is already a threat to competitors, but in each market there are opportunities for it to continue to increase its foreboding presence on the competition.

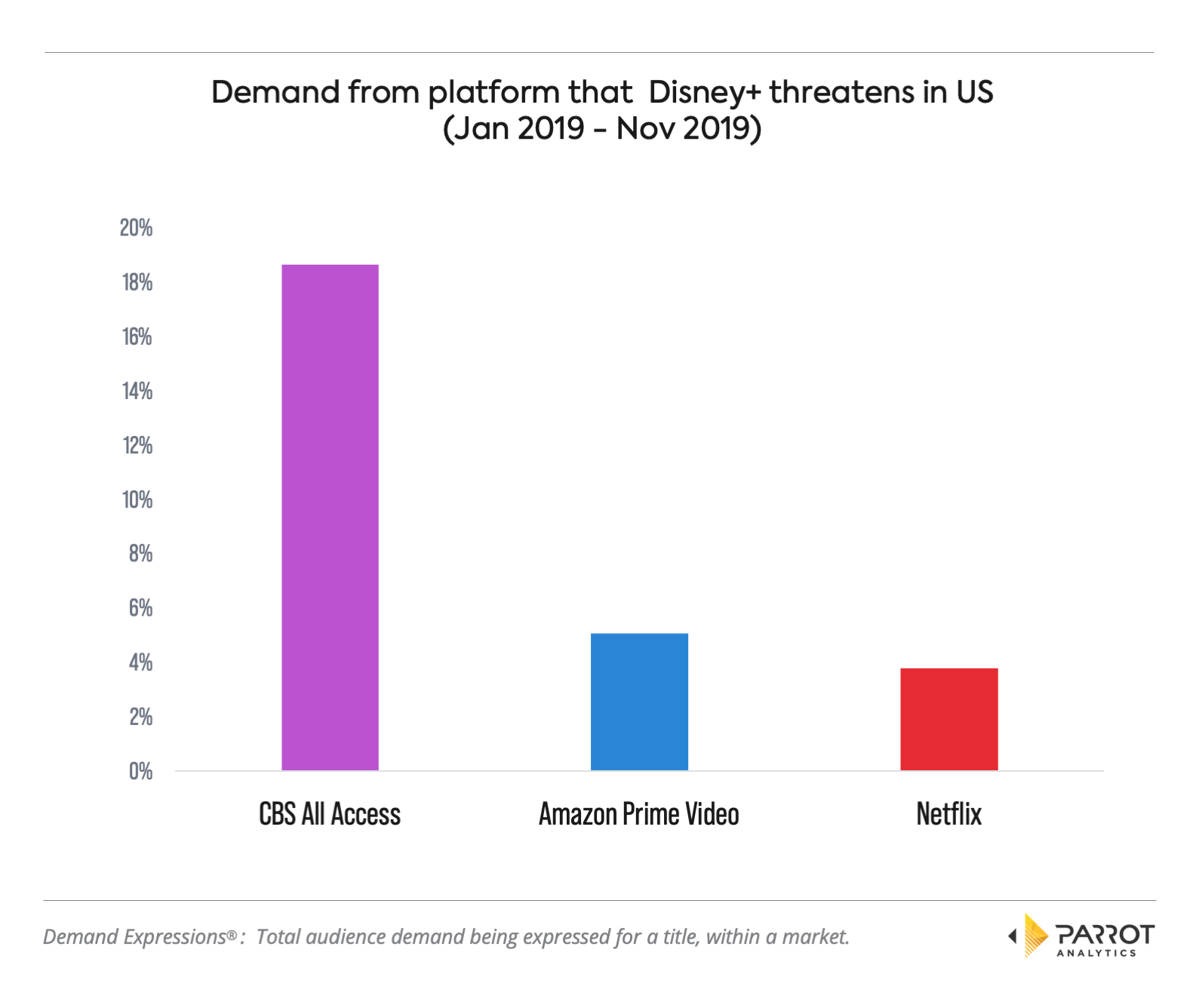

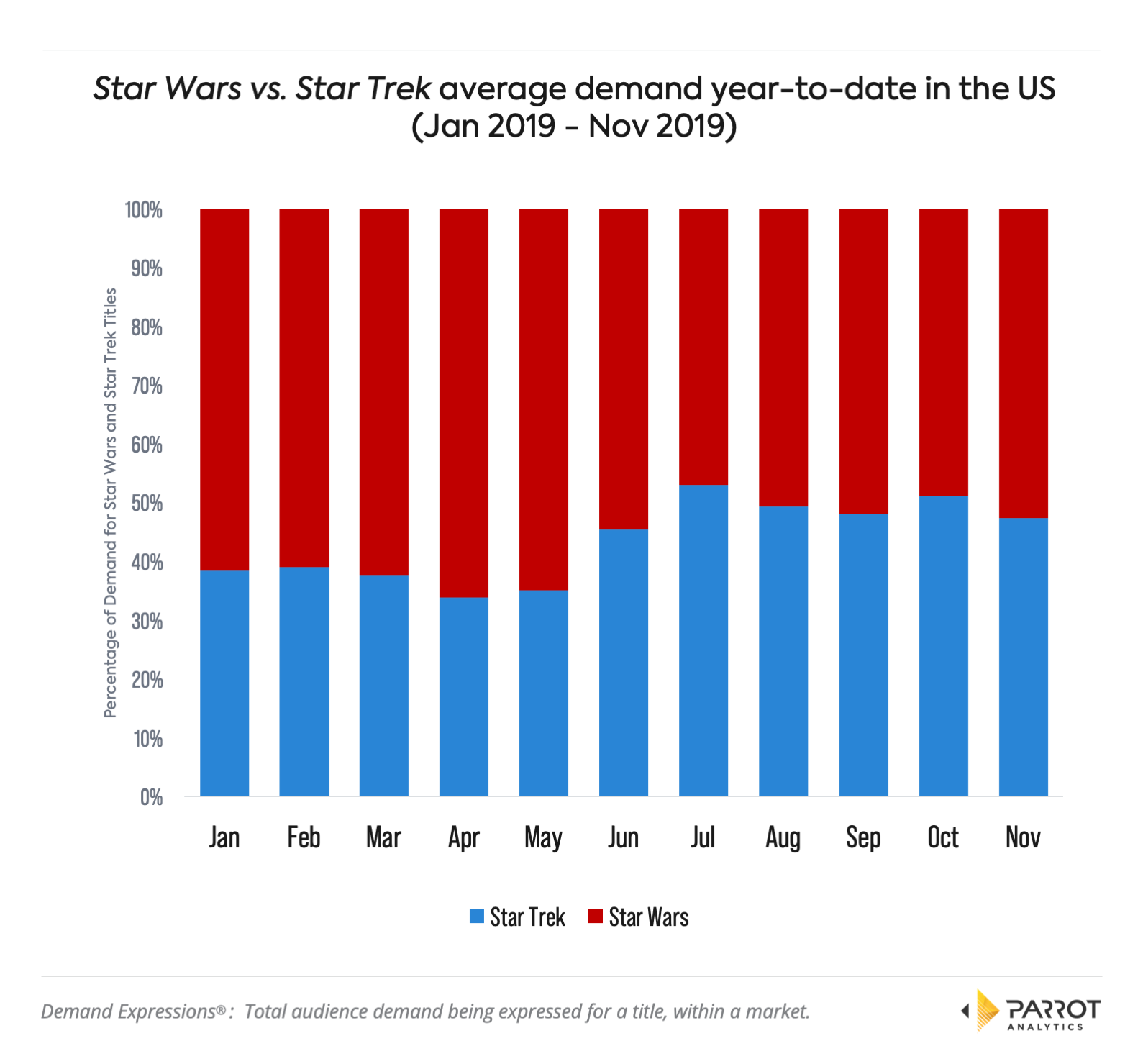

Domestically, Disney+ has the greatest potential to steal attention from CBS All Access (see Chart 3, below), which may be partially explained by the finding that on average Star Wars TV series titles are more highly in-demand than Star Trek titles (see Chart 4 on the bottom below).

Chart 3 (the top chart above) visualizes the extent to which the Disney+ content library threatens to take content demand share from competitors in the US. Due to its high affinity with CBS All Access’ library, Disney+ is threatening almost 19% of the demand currently expressed for CBS All Access’ library, and all of this has the potential to be captured by Disney+.

How to target off-platform preferences?

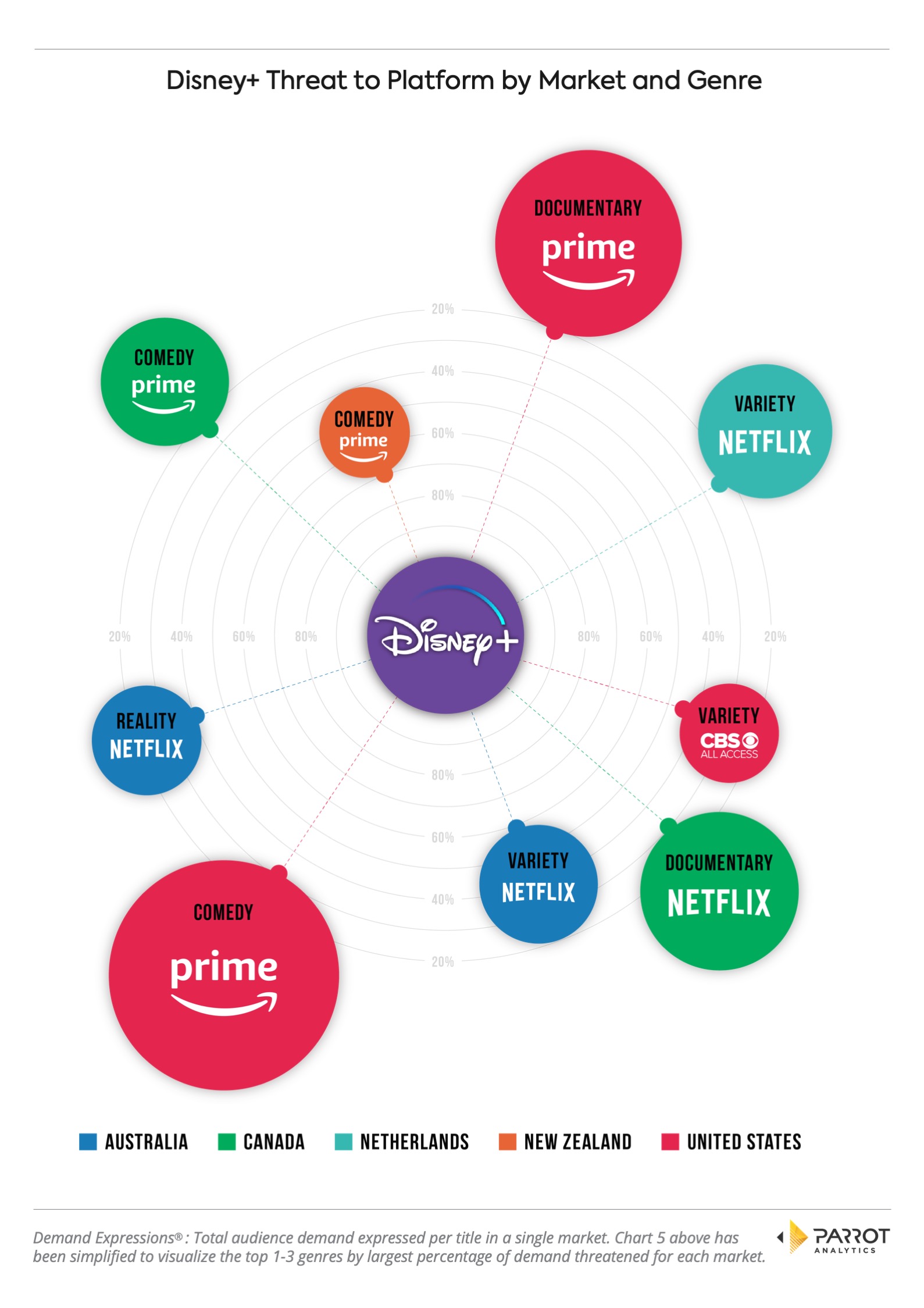

Across markets, demand data pre-launch reveals an opportunity beyond the obvious kids and superheroes content: Light-viewing content. Comedies and varieties are the genres in which Disney+’s launch catalog is placing the greatest pressure on its competitors in launch markets. These threatened genres also represent off-platform preferences to which Disney+ could cater.

Chart 5 visualizes the extent to which the Disney+ content library threatens to convert content demand share from specific competitors’ genre segments, on a per market basis. In Chart 5 (above), the closer the bubble the greater the threat posed by Disney+. The size of each bubble indicates the amount of demand for that genre on the specified platform and market that is threatened. To illustrate, New Zealand consumers of Amazon Prime Video comedies’ have a 70% chance of demanding a Disney+ show, however, this represents a much smaller amount of demand than that of Amazon Prime comedies in the US.

Which local content will boost Disney+’s growth?

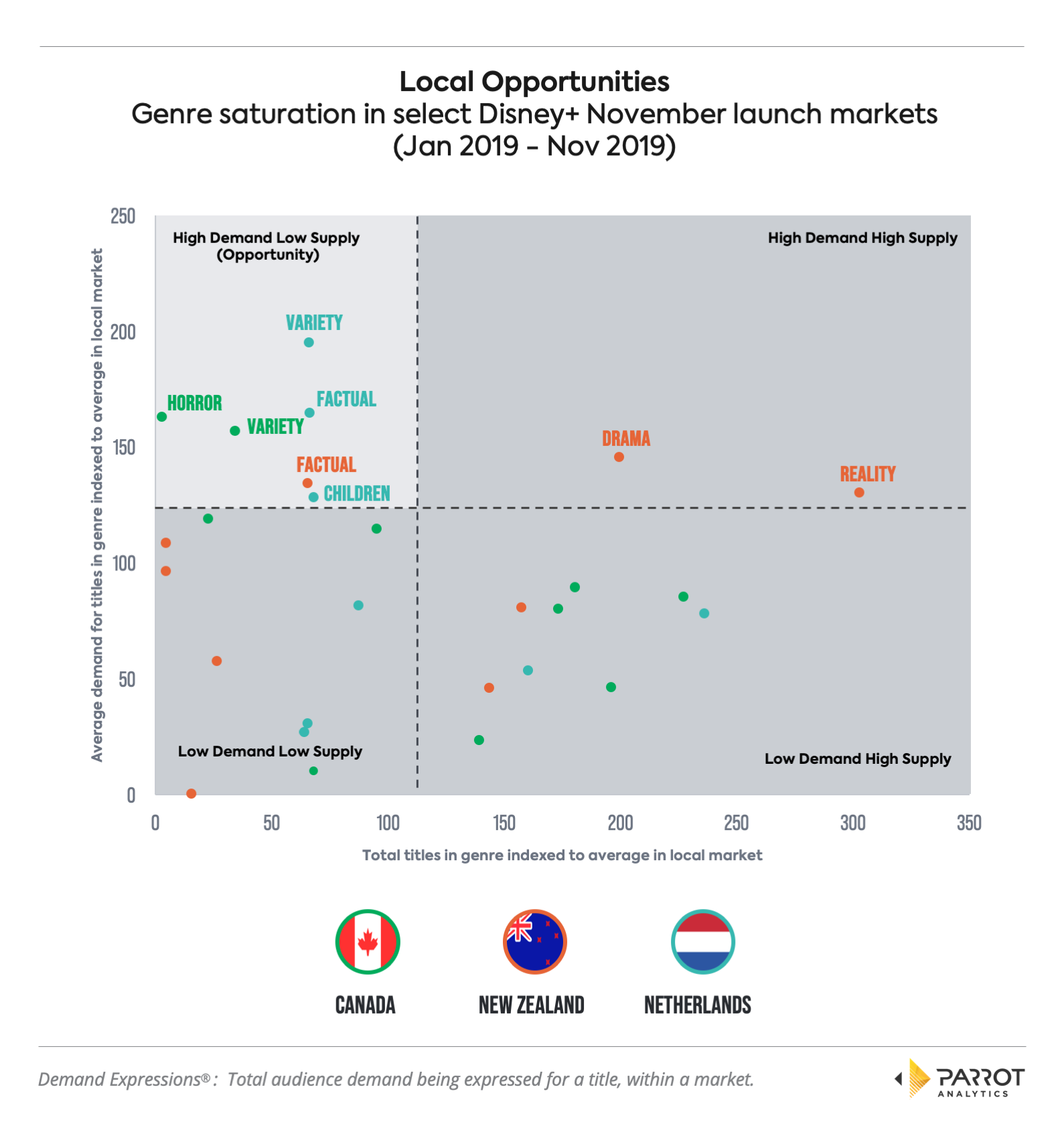

Demand data reveals that the largest strategic opportunity for international content acquisition exists within local variety titles in the Netherlands. This genre-market combination has the highest demand and lowest supply (see Chart 6 below) and poses the largest threat to competitors such as Netflix (see Chart 5 above). As Disney+’s international team builds a strategy for acquisitions in international territories, they should consider that the most local opportunities exist within the Netherlands, including a genre we know Disney+ excels in: Children’s content.

If Disney+ prioritizes local acquisitions based on size of opportunity, the market prioritization should follow: Netherlands, then Canada, and finally New Zealand, as the number of genres represented in the top left quadrant shows.

3 data-driven takeaways for Disney+’s strategy:

- Use Off-Platform Audiences’ Taste: Disney+’s threat to competitors’ demand by genre reveals a preference for light-viewing content.

- Acquire Subcribers by Marketing to Off-Platform Preferences: The uncovered preferences signal that comedies such as High School Musical: The Musical: The Series and Diary of a Female President may deserve a greater marketing investment.

- Retain Subscribers with Local Content to Fill in the Gap: Disney+ can convert audiences and woo over international subscribers by building its catalog with local content in genres in which it threatens competitors and in which local opportunities exist.

Disney+’s future appears to be a fairy tale made of a catalog and marketing of “feel good” varieties and comedies that resonate with parents as well as adults without children (AWOCs).

But fairy tales do not only exist for Disney+.

All teams can use and learn from the strategy outlined in this article. Using Parrot Analytics demand data, we can provide tailored recommendations for your platform’s international content development strategy.

Methodology:

Note: Threat to demand was calculated as the uni-directional relationship (i.e., probability) between demand expressed for one catalog or genre from a catalog and the demand expressed for another catalog genre from a catalog for a specific market. Local opportunities refer to genres of local productions which are undersaturated.