Parrot Analytics has recently taken an in-depth look at SVOD demand trends in Japan, including:

- The top 20 digital streaming shows in Japan across all SVOD platforms in the country.

- Which genres Japanese audiences prefer and how these preferences have changed over a period of 12 months.

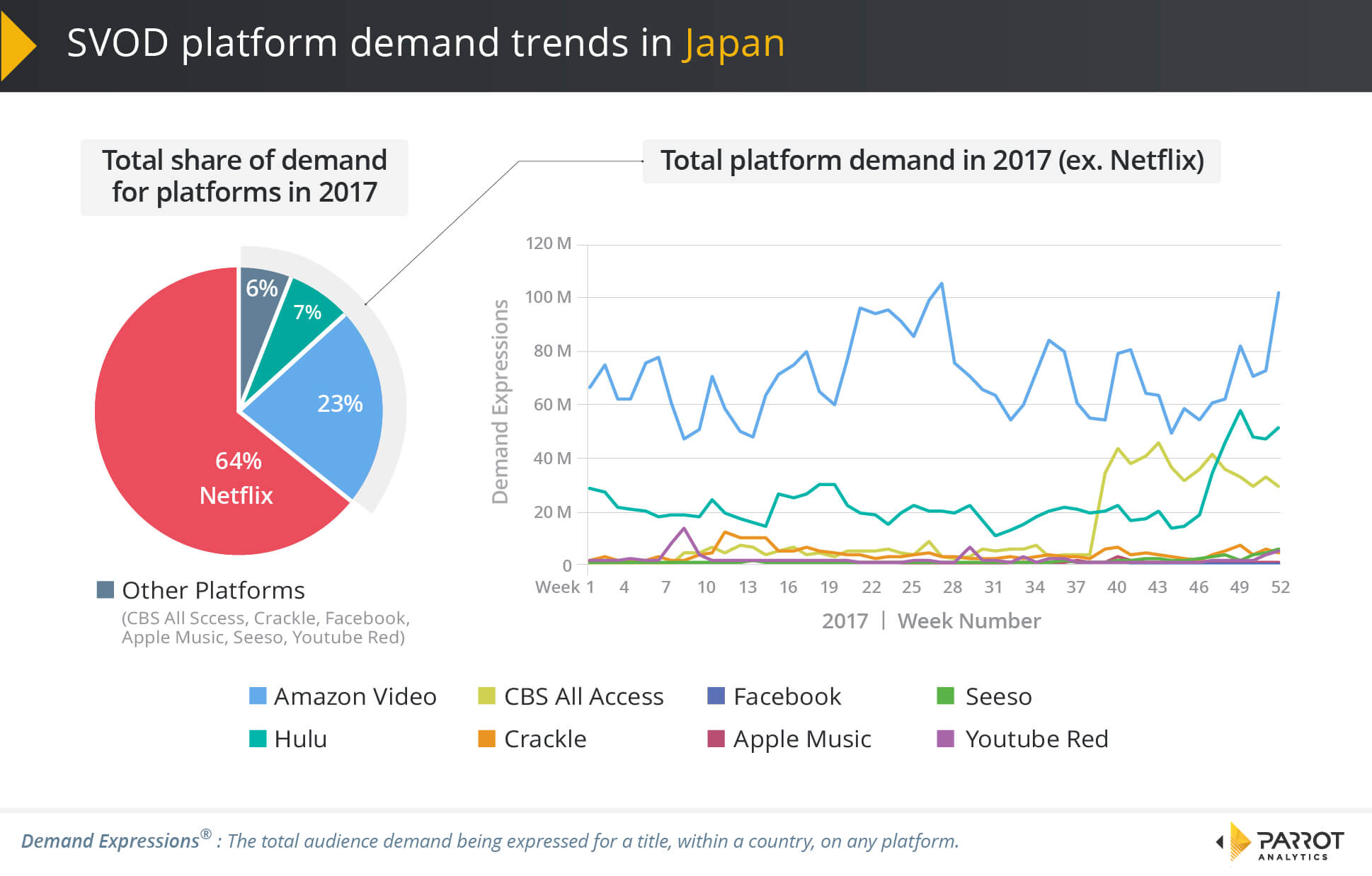

- The market share of the major OTT platforms Netflix, Amazon Video and Hulu in Japan.

- How the platform share of audience demand changes over time for Apple, CBS All Access, Crackle, Facebook, Seeso and YouTube Red.

We are pleased to reveal the following findings of our comprehensive study.

Top SVOD Platforms and Streaming Television Shows in Japan

As in many other markets, Stranger Things was the most popular digital original series in Japan, followed by CBS All Access’ Star Trek: Discovery. Several Japanese titles ranked highly as well: The anime-inspired Castlevania was fourth, Kamen Riders Amazons was sixth, and Midnight Diner: Tokyo Stories was 21st.

Netflix had 64% demand share for digital original series in Japan due to a greater-than-average demand share for Amazon. Unlike many other markets, where Amazon’s demand declined over 2017, it remained steady in Japan. CBS All Access and Hulu had increased demand from Star Trek: Discovery and Marvel’s Runaways, respectively, but these platforms did not have as much popularity as Amazon.

YouTube Red’s Mind Field ranked higher in Japan than Dan Harmon’s Harmonquest or Apple’s Carpool Karaoke.

Top TV Series Genres in Japan

Despite the rise in popularity of the science fiction genre after the release of Stranger Things and Star Trek: Discovery, drama remained the most popular genre in Japan for the entirety of 2017.

Please download the full 65 page report here, which also includes data and analysis for 9 other countries: Japan Television Report – SVOD Demand and Audience Preferences