Parrot Analytics has recently taken an in-depth look at the market share of SVOD platforms in Russia based on the audience demand of each platform’s digital original productions. The SVOD market share report leverages Russian demand data for streaming originals from Netflix, Amazon Prime Video, Hulu, CBS All Access, DC Universe as well as local SVOD platforms.

Please download the full 60 page report here, which also includes data and analysis for 9 other countries: Russia SVOD Market Demand Report.

SVOD TV market share in Russia

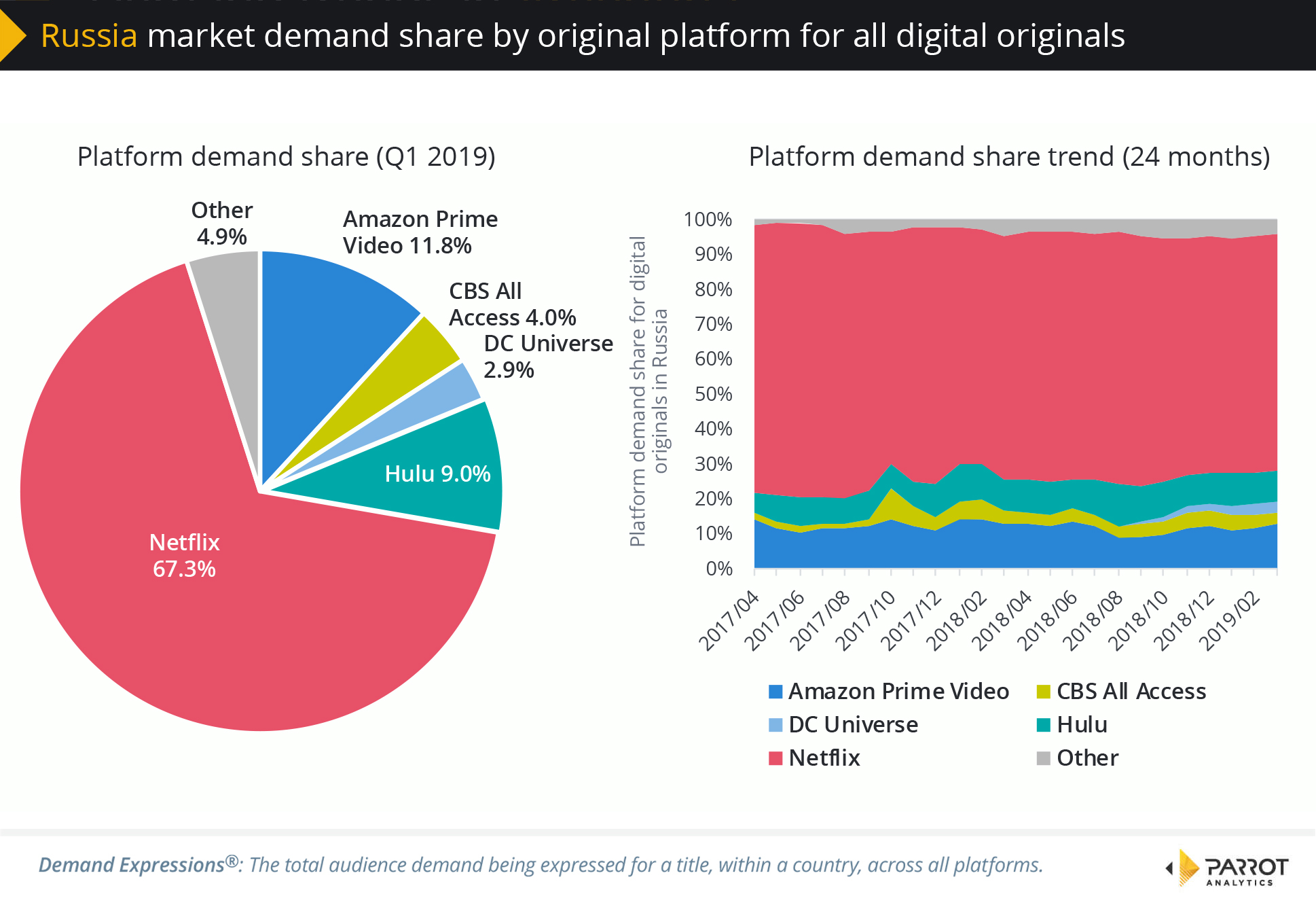

We define “SVOD market share” as the share of demand for each platform’s digital originals. Based on this measure, we are able to make the following observations:

- In this market, the 67.3% demand share for Netflix Originals is above average compared to other markets in the report.

- Russia has the smallest demand share of all the markets for originals from DC Universe. Only 2.9% of demand is for this platform’s titles.

- Similarly, Russian audiences express less demand for originals from CBS All Access than other markets (4.0%).

- The 24 month trend graph shows that the platform shares have been fairly stable over the last 3 months.

SVOD drama market share in Russia

Here we define “market share” as the share of demand for each platform’s drama digital originals in Russia. Based on this measure, we are able to make the following observations:

- As in the all genre demand share chart, Russia is where CBS All Access drama originals have the smallest demand share out of all the markets in this report with 7.0%.

- With 71.3% Netflix has the largest share of demand for drama originals in Russia.

- Amazon Prime Video is attracting 10.6% of the demand for drama digital originals.

SVOD action/adventure market share in Russia

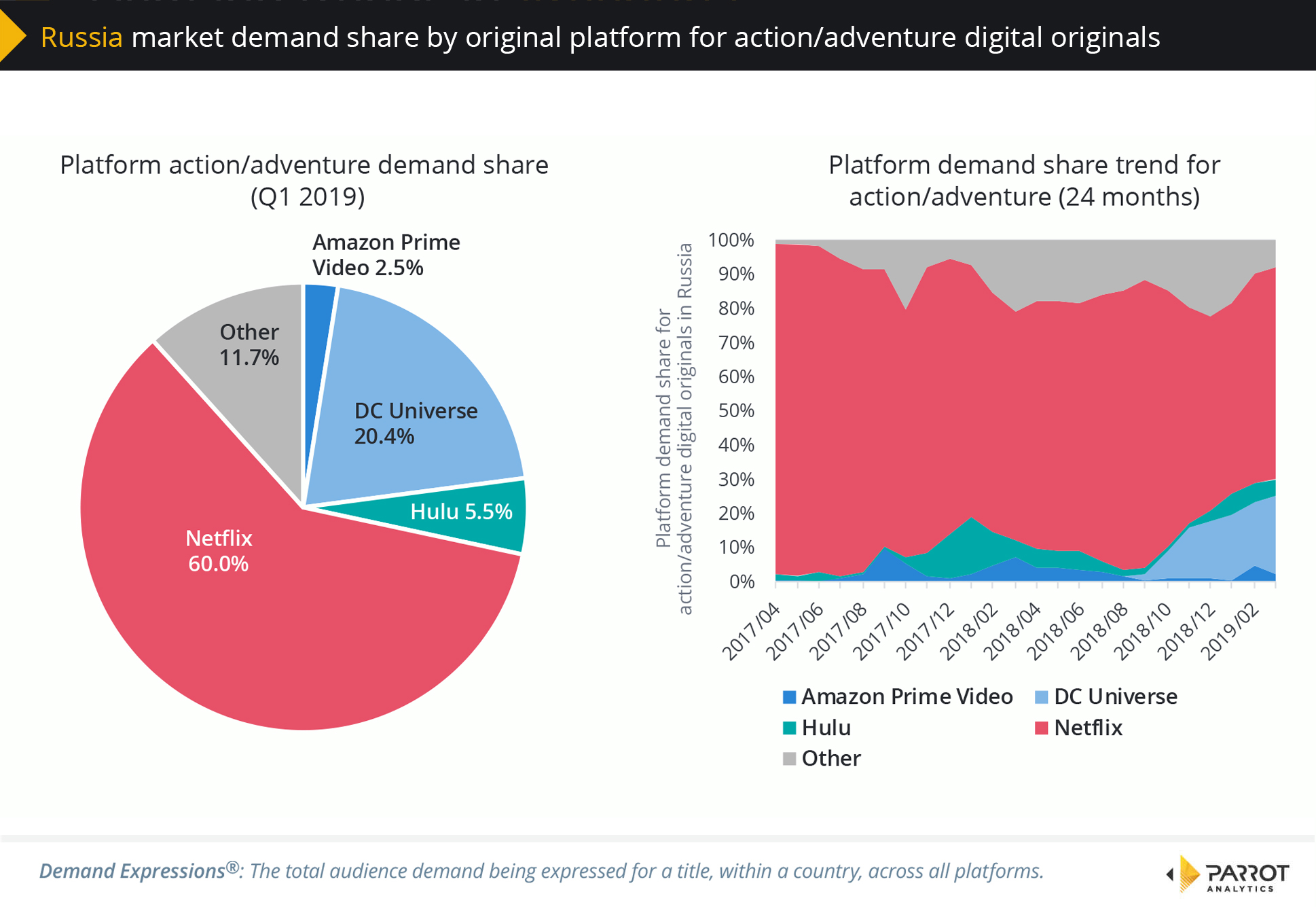

Here we define “market share” as the share of demand for each platform’s action/adventure digital originals in Russia. Based on this measure, we are able to make the following observations.

- Although digital original titles from DC Universe are still the second largest segment of action/adventure originals in Russia, the demand share here of 20.4% is the lowest out of all the markets in this report.

- However, the 24 month trend shows that the DC Universe demand share is still on the increase in this market.

- Netflix’s 60% demand share in this market is the second largest for action/adventure originals in the report, smaller than only in Ireland.

Download the free SVOD market share report for Russia

Download this report now and discover the latest SVOD market demand trends for Russia. Our comprehensive global TV demand report includes the following insights:

Russia Domestic TV Insights:

- We reveal the Russia SVOD market share of the major platforms including Netflix, Amazon Prime Video, Hulu and CBS All Access based on audience demand for each platform’s digital originals.

- Discover how SVOD market share trends in Russia have changed over the last 24 months.

- Find out what percentage of the market for drama and action/adventure digital originals each SVOD platform has managed to capture over the last 24 months.

- Discover the genre demand share for all digital originals in this market as well as the 10 most in-demand subgenres in this territory.

- Find out the demand distribution of a selection of digital originals in this market.

- Discover the top 20 digital streaming shows in Russia, as well as 5 additional titles of interest to audiences.

Global Television Insights:

- Find out the global SVOD market share of the major platforms including Netflix, Amazon Prime Video, Hulu and CBS All Access across 100+ markets; this has been calculated based on the worldwide demand for each platform’s originals.

- A TV industry update for Q1 2019 detailing important market events concerning SVOD services.

- This report also includes data for the following additional territories: Belgium, China, Hungary, Ireland, Japan, Netherlands, South Africa, United Kingdom and the United States.

Note: This version of The Global TV Demand Report does not include any market share information for as yet unreleased SVOD platforms such as Apple TV+ (Apple TV Plus), HBO Max by WarnerMedia/AT&T, NBCU/Comcast’s Peacock, Quibi and Disney+. Parrot Analytics publishes this report each quarter, be sure to bookmark https://insights.parrotanalytics.com/tv to gain access to the latest available market share report across all SVOD platforms.

After reading this article you may have a few questions, such as “How can TV series and SVOD platforms generate demand in markets where they are not yet available?” Please make sure to read our methodology for demand attribution and also our knowledge base article on how Parrot Analytics defines a “digital original” series.