Fox’s content assets (both film and TV properties) will play a big factor in the success of a direct-to-consumer streaming service encompassing content from both companies, particularly at a global level. While every streaming provider ultimately wants to own as much of the value chain as possible, none so far can achieve global ubiquity without third party content. This will see streaming providers continue to move upstream in the content development life cycle with increasing investments in original content with the aim of reducing the percentage of content investment into third party content – still currently in the billions annually for the large SVODs.

Meanwhile, even Disney risks being pigeon-holed into a ‘niche’ category without offering broader content if they want to be one of the winners in each global market. Licensing third party content is expensive at a global scale and some of the deal’s costs would have been written off for owning the IP against the potential cost of licensing some of that content in the future.

US Demand for FOX titles on Netflix

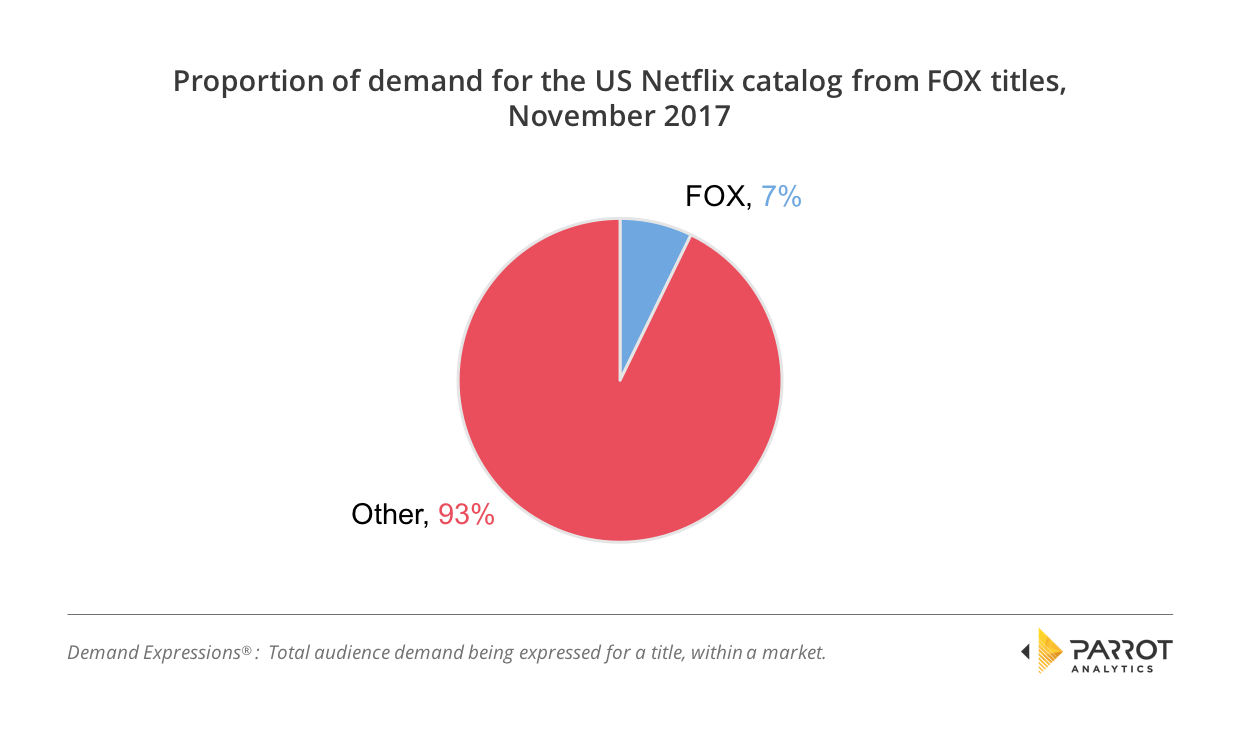

Parrot Analytics examined the US demand for FOX titles from the FOX, FX and FXX networks that were part of the US Netflix catalog in November 2017.

Parrot Analytics found over November, the average demand for FOX titles on Netflix was 2.02 times higher than the overall average demand for Netflix in the US. Put another way, the typical FOX title was twice as popular as Netflix’s average for their US catalog.

Further, despite only accounting for a small percentage of the Netflix catalog in November FOX content nevertheless accounted for 7.2% of the Netflix’s total demand last month.

While a deeper analysis would investigate this relationship in other markets internationally and over a longer period of time, based on the results from November, Parrot Analytics data supports the conclusion that FOX titles on the service do account for a disproportionate amount of demand for Netflix in the US.

How Facebook Watch and YouTube TV are Changing the TV Ecosystem

In examining the Disney/Fox deal in the context of some of the existing industry dynamics, two specific examples of how tech companies are changing the TV ecosystem come to mind.

Facebook Watch

Humans of New York

Facebook is attempting to disrupt the traditional TV ecosystem with Facebook Watch. Facebook already connects people on the basis of being the largest social network in most major markets worldwide. Along with engaging with their network, Facebook is now making it easier for its users to engage with TV series content – Humans of New York is good example of this.

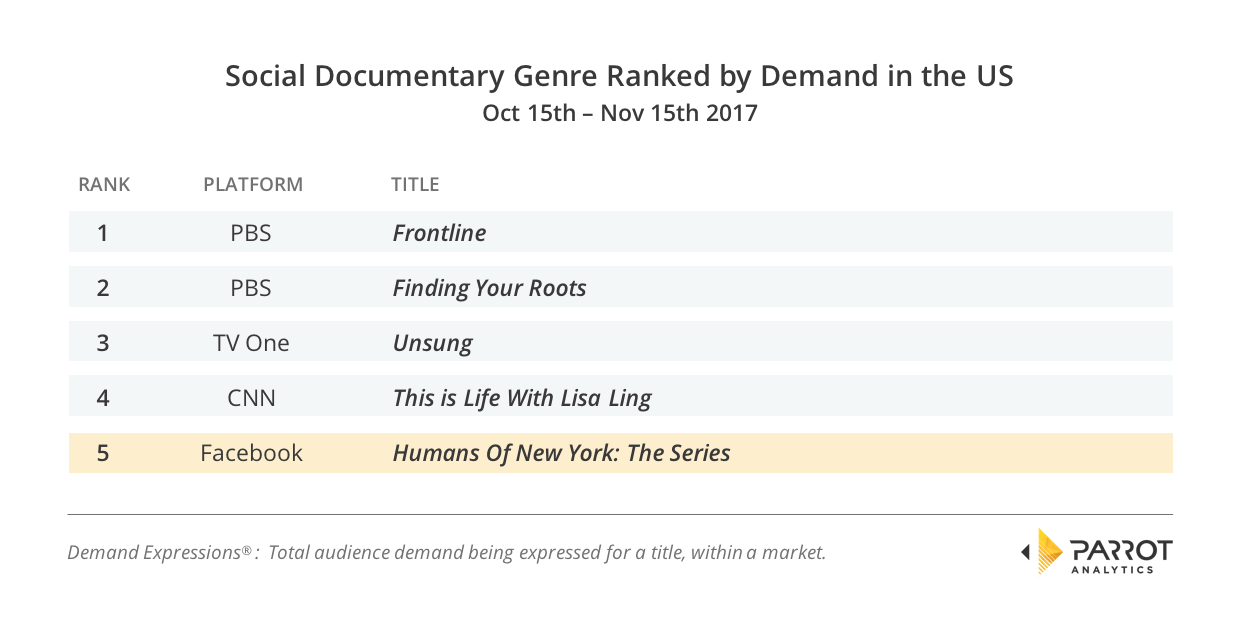

Looking at October 15th-November 15th, the Facebook Watch series Humans of New York: The Series was ranked 5th in the “Social Documentary” TV series genre (US domestic):

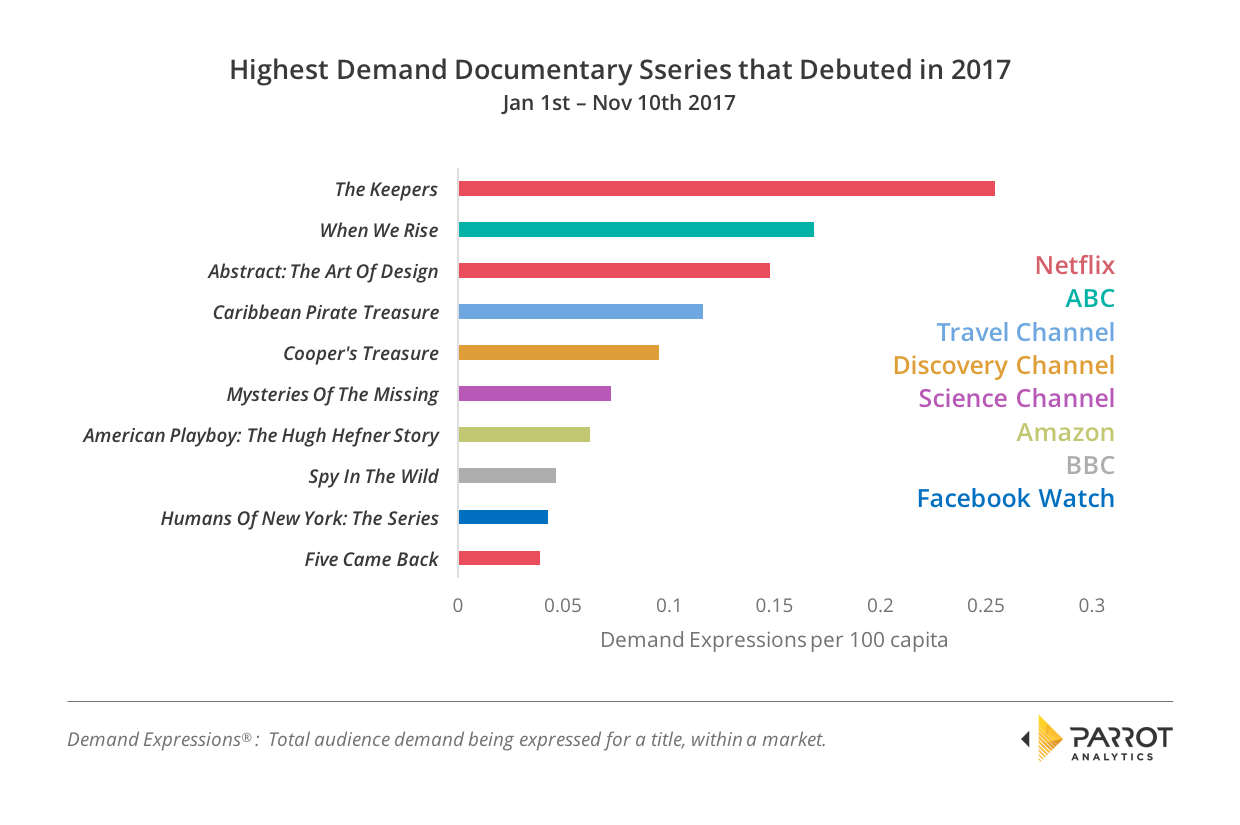

In a separate analysis, the following chart shows the international impact the series is having, by looking at the ten most popular documentaries premiering in 2017 in 15 international markets (average): Spain, Brazil, India, Germany, Poland, Mexico, Italy, Finland, Australia, Sweden, Denmark, Norway, United Kingdom, New Zealand and The Netherlands.

Humans of New York: The Series appears at #9, meaning that it was the ninth most popular new documentary of 2017, on average, in the markets examined. What’s most interesting about that is that the show is only officially available in the US – but people are still engaging with it, at a high rate, internationally. That speaks to both the content itself as well as the potential of the Facebook Watch platform globally.

Skam

Another Facebook Watch example is Norwegian teen drama Skam. Before Facebook announced its purchase of the program in mid-October, Parrot Analytics had already observed the series to be within the top 10 teen titles in the United States: In June/July 2017, Skam ranked above American productions including KC Undercover and Switched at Birth. Skam never aired outside of Scandinavia and does not have official English subtitles, yet it attracted a worldwide interest that inspired fans to create their own translations. The acquisition makes sense for Facebook Watch because the format fits: The show has been credited with “streaming television’s first compelling alternative to binge-watching”.

YouTube TV

YouTube TV is disrupting the space with cable-free live TV; having recently expanded, the service is now available in 80 territories across the US, which translates to over half of all American homes. At only $35, the service offers incredible value for consumers that are already used to streaming television and they will likely see it as a worthwhile bundle to watch live, on-demand and recorded TV.

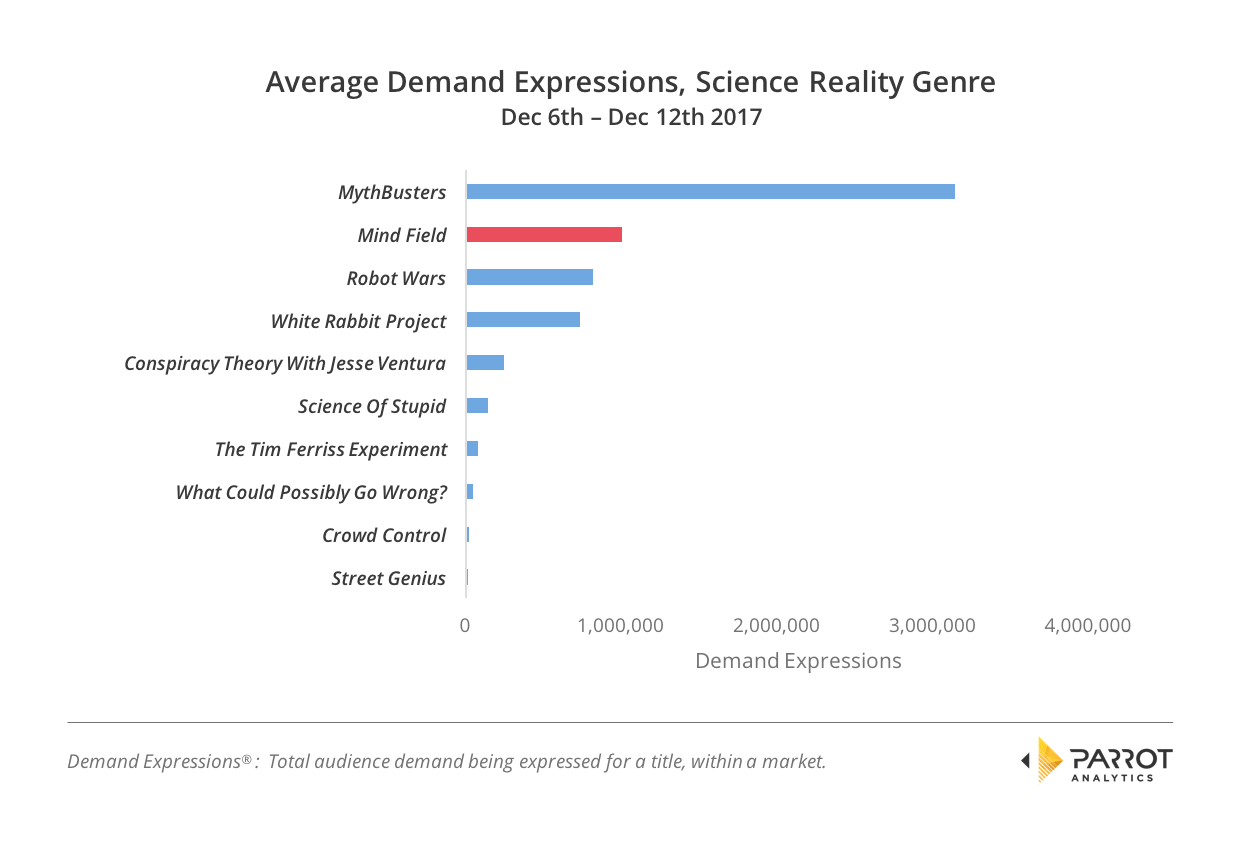

Apart from YouTube TV, YouTube Originals are finding success in different niches, for example Mind Field in the Science Reality genre. Four episodes of the second season were recently released December 6th. Though based on the chart below, clearly the Discovery Channel’s MythBusters is in the lead, it’s impressive that YouTube Red’s Mind Field is already the second most popular show in the category.

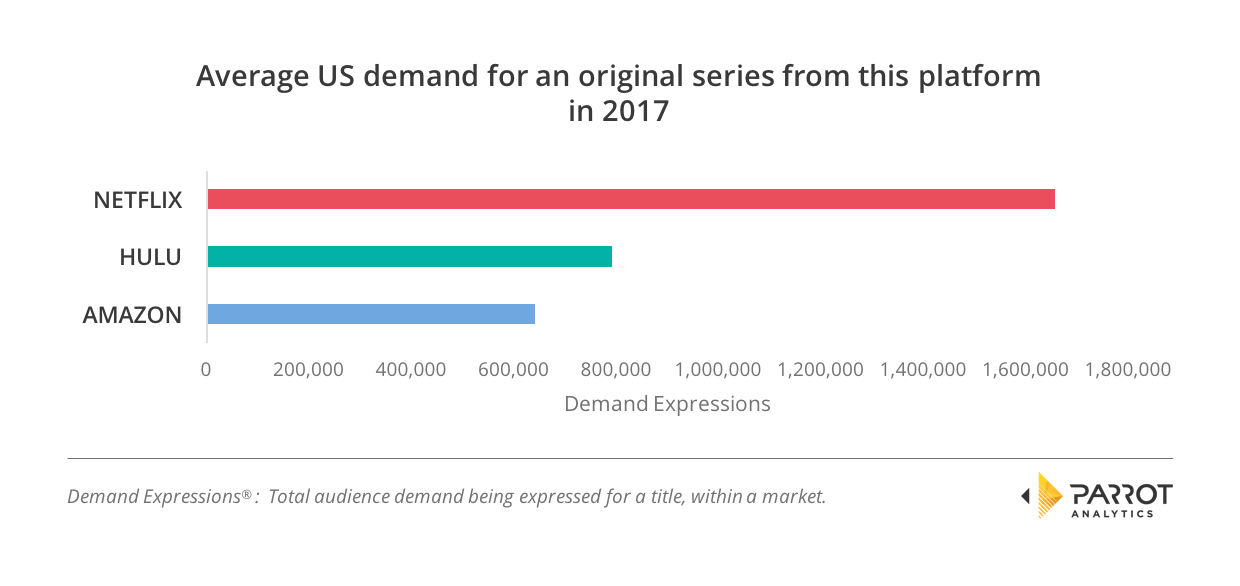

Average Demand in the US over 2017 to date for all the original series produced by Netflix, Amazon and Hulu

Parrot Analytics has also investigated the average demand in the US over 2017 to date for all the original series produced by Netflix, Amazon and Hulu.

We found that the average demand for a Netflix original series was highest at 1,656,183 Demand Expressions. The average demand for a Hulu original series was 47.8% of the Netflix average with 791,441 Demand Expressions. Finally, Amazon original series had the least average demand with 641,133 Demand Expressions, or 38.7% of the average demand for a Netflix original series.

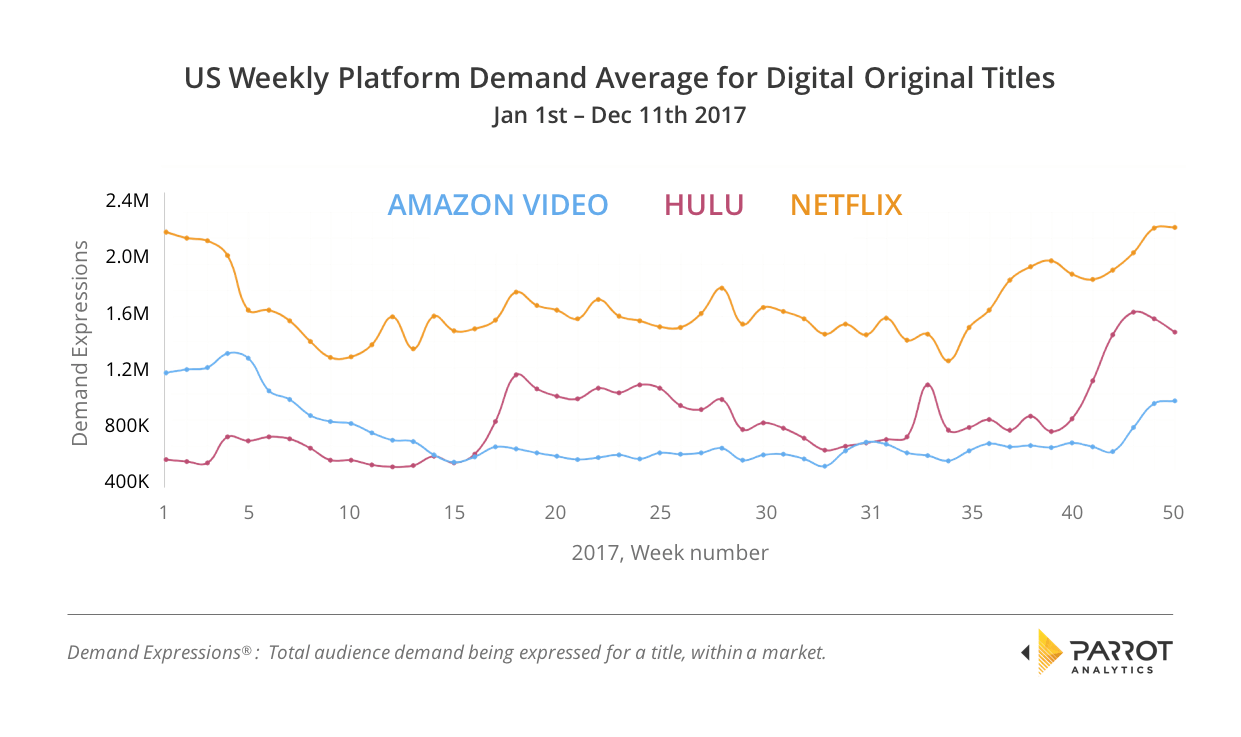

Breaking down this demand into weekly averages, other patterns emerge.

Although Netflix has over twice the number of original series as the next platform, the demand for it still reflects individual releases if they are big enough. The best example of this is the release of Stranger Things season 2 on October 27th.

Another interesting pattern is that the demand for Netflix originals peaks over the winter months, while the summer is comparatively quiet. A notable exception to that in 2017 is the release of the anime-styled Castlevania on July 7th, the surprise anime success, which raised the average demand briefly.

On the other hand, Hulu has the least number of originals and so the release of their dystopian drama hit The Handmaid’s Tale meant the service had much stronger demand over the summer of 2017 compared to earlier in the year. The same show was responsible for the sharp uplift in demand for Hulu on September 17 as it led the streaming service to win a record number of Emmy awards. The increase in demand since November 21st is mostly due to the release of Hulu’s superhero show Marvel’s Runaways. Helped by this release, December 2017 has the highest average demand for Hulu original series that Parrot Analytics has recorded to date.

Amazon has a relatively stable demand pattern, with one exception, their motoring show The Grand Tour. Demand for season 1 of that show is responsible for the higher demand for Amazon at the start of 2017 – and the start of season 2 can be observed raising demand at the beginning of December. We conclude that although it is not yet at the point where it is exceeding demand for Netflix originals, Hulu originals are generally performing well on a per title (platform) average basis, and that the service looks likely to improve on this in 2018.

Conclusion

Whilst streaming incumbents present a strong offering of content, Fox’s brand assets will play a big factor in the success of a direct-to-consumer streaming service encompassing titles from both Disney and Fox, especially in international territories.

Third party content will continue to play an important factor, which puts ongoing pressure on SVODs to continue to move upstream in the content development life cycle. Original content investment will only accelerate, the objective being to mitigate strategic risk by reducing their reliance on third party content. Licensing third party content is expensive especially on a global scale, and some of the costs associated with the Disney/Fox deal will have to be written off for owning the IP, against the potential cost of licensing some of that third party content in the future.

For more information, check out the most up-to-date United States television industry overview.