The Flash on The CW

Are superhero shows in a golden age?

With around a dozen high-profile superhero shows putting out new seasons in 2017, ranging from the lighthearted The CW show Legends Of Tomorrow to Netflix’s series The Punisher, to even a dedicated parody in Amazon’s The Tick, there’s certainly an argument to be made for that on quantity alone.

This state of affairs does not look like it will end soon either, in the first quarter of 2018 alone we get a new DC show in Black Lightning and the return of Marvel’s Jessica Jones. However, what do audiences think? Do shows starring super-powered people still have mainstream attraction, or are they starting to slip back to appealing to hardcore fans only?

By diving deep into Parrot Analytics’ genre demand data we can certainly bring some context to this question. Let us first look at who is leading the pack in the US.

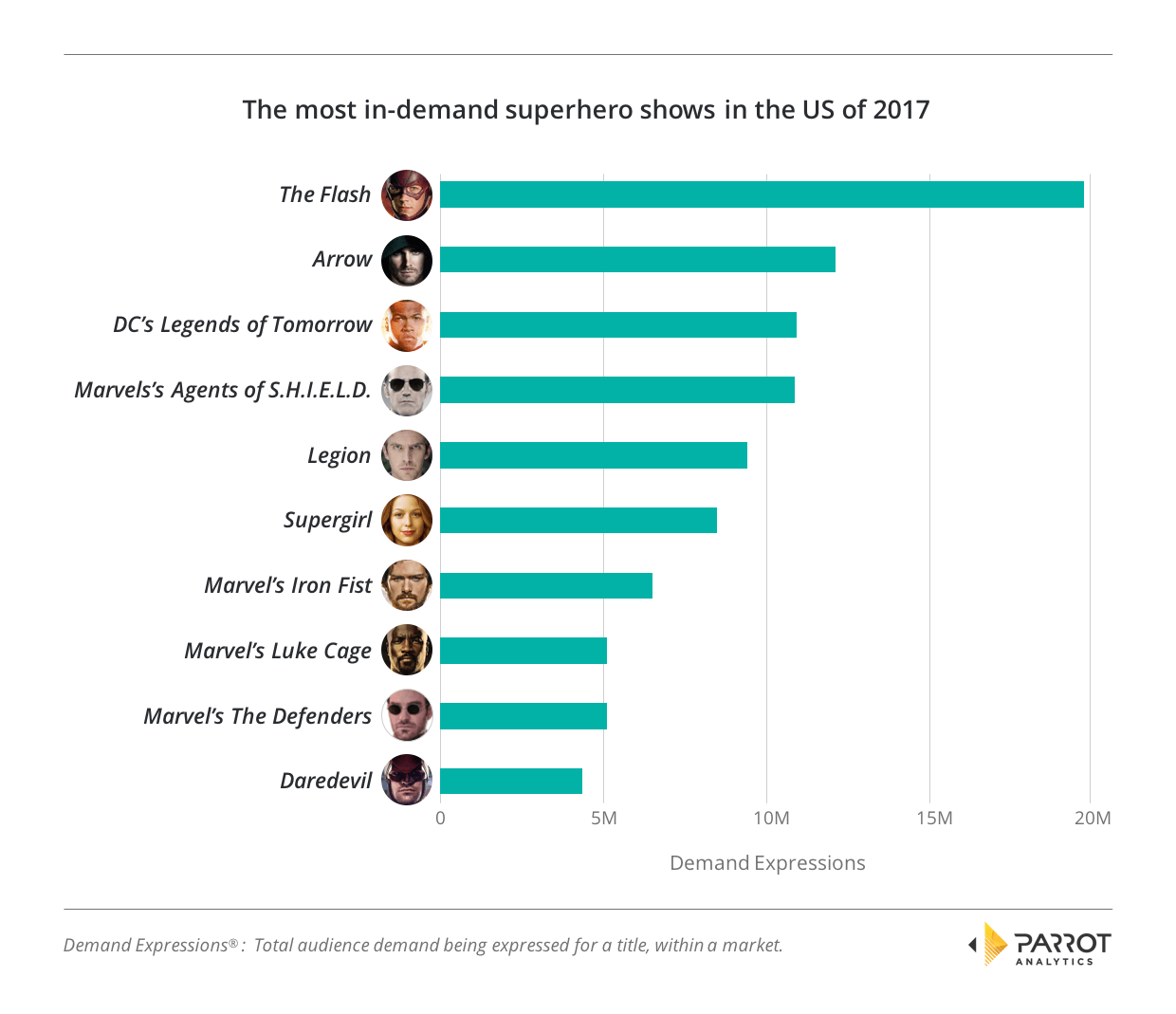

The Top US Superhero Shows of 2017

The United States is by far the world’s largest producer of superhero shows. This chart lists the top ten by average demand in the US over 2017. These ten shows are the most successful with audiences and aspects from each of these will most likely be incorporated in future shows in this genre.

The top show, The CW’s excellent The Flash, has enough demand to make it the 4th most in-demand show in the US out of all genres, and indeed the 7th most popular show in the world in 2017. Unusually for any genre, the top ten shows are comprised of only 3 franchises: Four of the top ten are part of DC’s Arrowverse, which is going from strength to strength, five are part of the Marvel Cinematic Universe, and the remaining show is part of the X-Men franchise.

Therefore, to see if demand for the superhero genre is changing we take a look at how the aggregate demand for the US’s two biggest superhero franchises has evolved over the last 6 months.

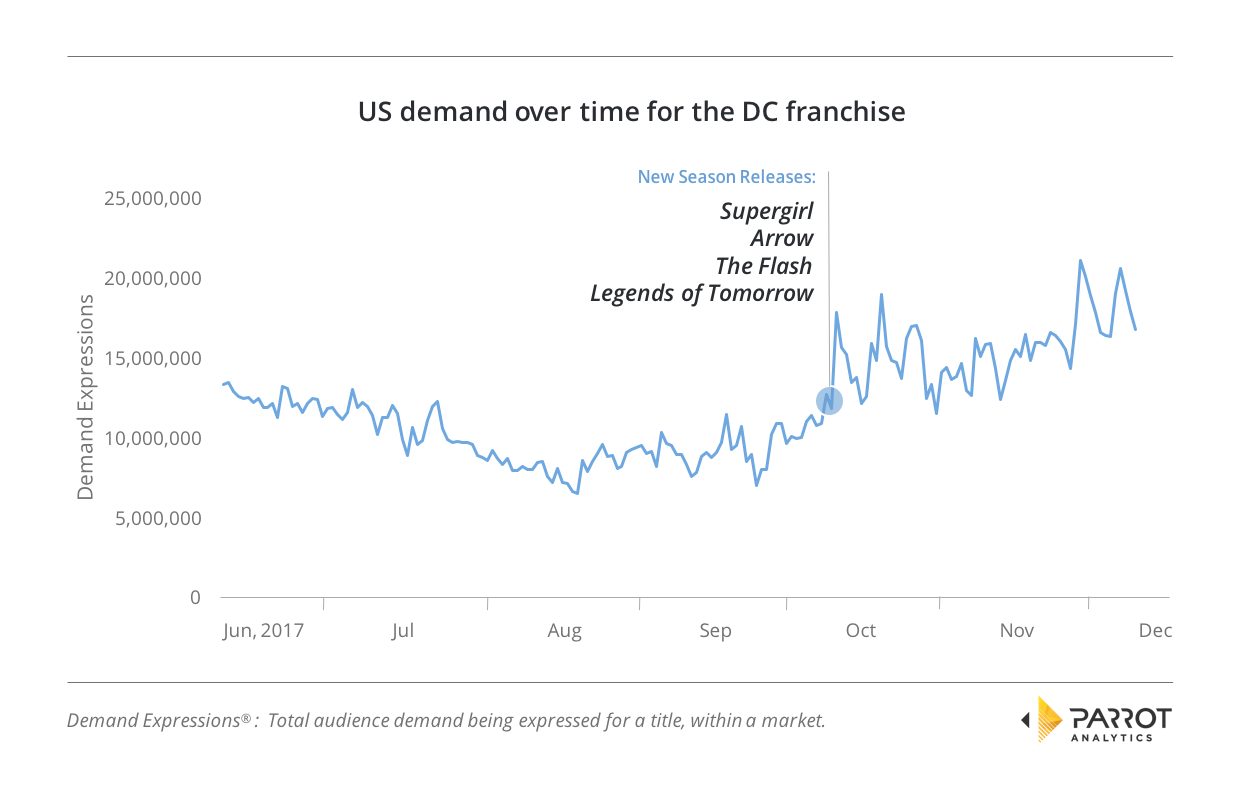

The Strength of the DC Franchise

While both DC and Marvel have interconnected film and TV universes, each of these huge franchises has taken a different approach to how they distribute their TV shows. DC prefers the traditional method of weekly broadcasts on the networks, anchored by the interconnected Arrowverse on The CW, which consists of shows such as The Flash and Supergirl.

The DC shows share similar releases: Supergirl, Arrow, The Flash and Legends Of Tomorrow all premiered new seasons between the 9th and 12th of October. Similarly, they all concluded their previous seasons around April to May, so demand at the beginning of the above graph is still high from those finales. With little activity over the summer, demand dips except for occasional spikes as information about the new seasons is released, but the baseline demand for the franchise stays high throughout.

With the seasons for these existing shows still ongoing and with the promising new show Black Lightning arriving in January 2018, demand for DC content is likely to stay high.

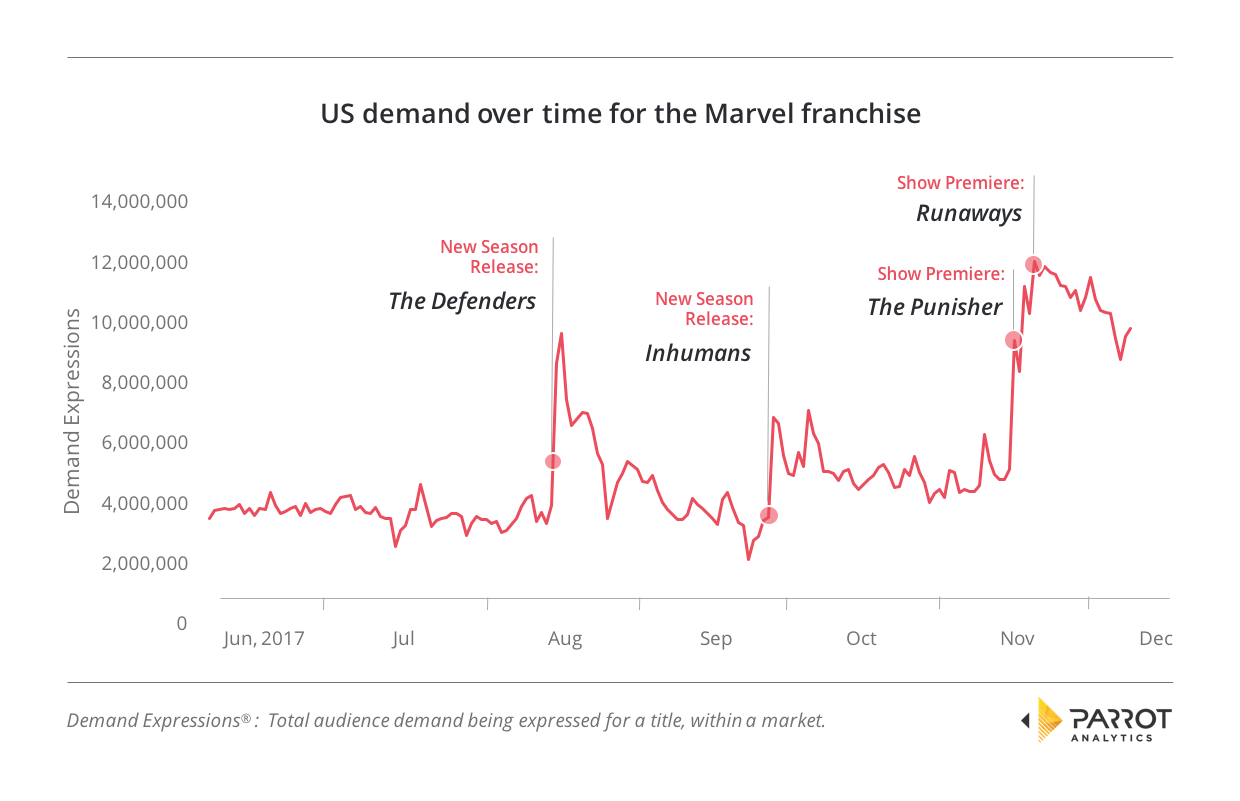

US Demand for the Marvel Franchise

In contrast, Marvel leans stronger into binge-friendly all-at-once SVOD distribution. While there are some Marvel Cinematic Universe TV shows on broadcast networks, like Agents of S.H.I.E.L.D. on ABC, the bulk of the franchise’s shows are produced in partnership with Netflix.

The daily time-series graph clearly shows the impact of new Netflix releases on demand for the Marvel franchise; most prominently with the release of The Defenders in the month of August. All the episodes of this show were released at the same time and although the peak demands are high, the return to baseline is also quick (as seen with most other all-at-once releases).

Released 6 weeks after The Defenders is Marvel’s Inhumans, which aired weekly on ABC between September 29th and November 10th. During that time, average demand for the franchise increased by around 25% compared to the pre-The Defenders numbers, with peaks for both the premiere and finale.

The biggest feature of this graph is the almost simultaneous release of the full season of The Punisher on Netflix and the start of weekly episodes of Marvel’s Runaways on Hulu. In this case, the high peak of a simultaneous release has been sustained by the continued interest of a weekly release and so demand for the franchise has stayed high for the end of 2017.

Recently, the industry learned the partnership between Marvel and Netflix is ending in 2019. While there are no details yet as to how exactly that will affect future Marvel TV titles, it is going to be interesting to see if Disney stays with the current Netflix release strategy, or if they believe bigger audiences can be gained with another approach.

Conclusion

With audience demand making shows in the superhero genre some of the most popular in America, and with the two biggest franchises in the genre both showing no signs of demand declines, it seems that the golden age of superhero TV is not over yet!