Image: Tali’s Wedding Diary, Showmax

South Africa is one of the most exciting emerging markets for OTT platforms. With ever-increasing high-speed internet penetration in the market, streaming is becoming a more and more attractive option to consumers that previously had no option but to use traditional broadcast options.

The first SVOD service to enter the South African market was South African-based Showmax, which launched in August 2015 and has since expanded to operate in over 70 countries. Showmax also produced the first South African digital original series, comedy Tali’s Wedding Diary, which was released on 14th December 2017.

Global player Netflix launched in South Africa in January 2016 but even with a USD 8 Billion+ content budget has not as yet announced any South African Netflix originals. Amazon Video followed their lead in December 2016.

Several other SVODs also offer alternative streaming options, including iFlix, iROKO and Trace Play, but they have not (as yet) produced any South African digital original series.

How do Digital Originals perform in South Africa?

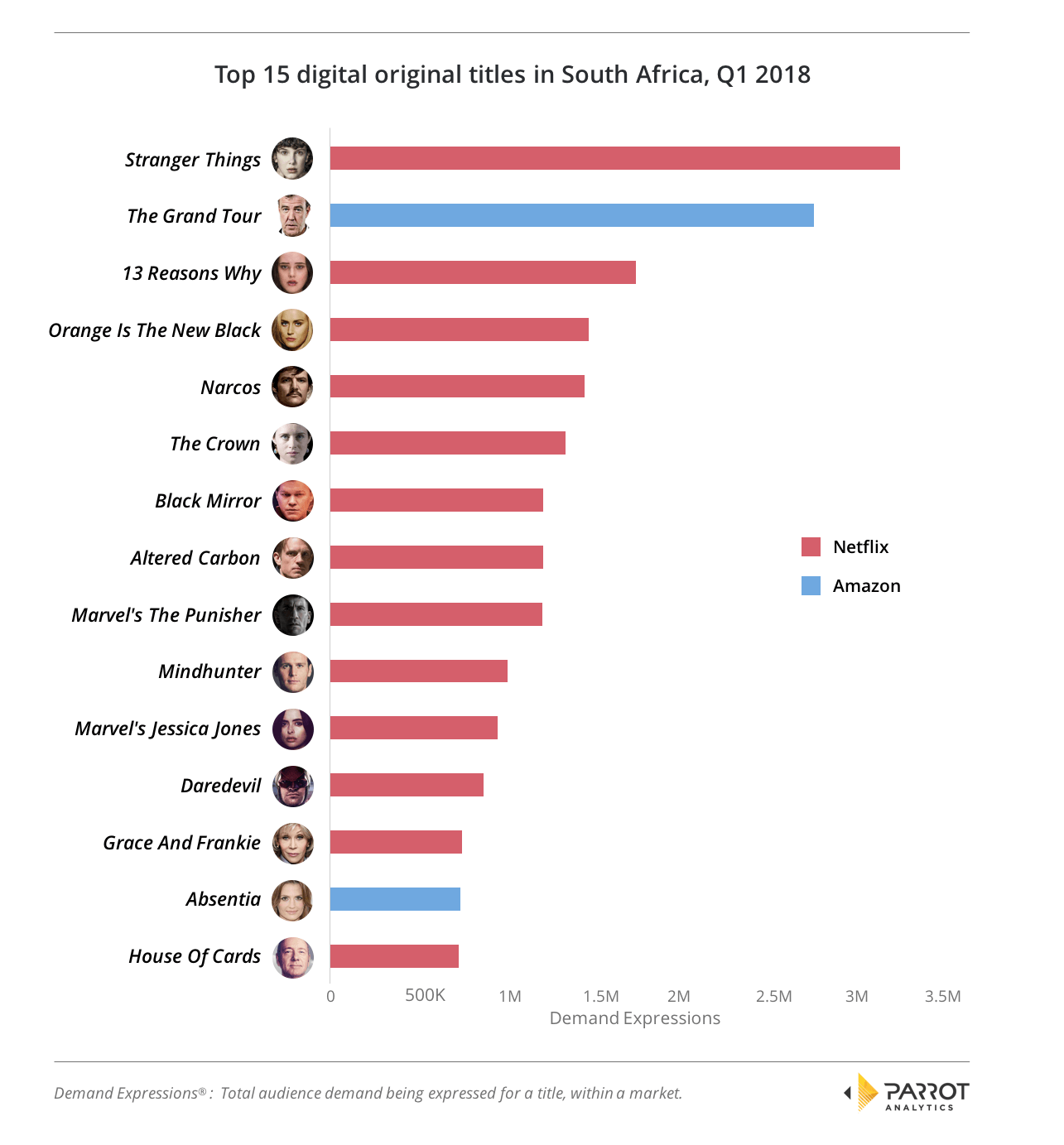

By ranking all Digital Original titles from platforms that operate in South Africa by their average demand in this market between January 1st and March 31st 2018, we can see which particular titles are capturing the attention of South African audiences.

We can see that in the top 15 titles in the market, most of the highest demand titles are from Netflix with Stranger Things being the top title. This is followed by The Grand Tour from Amazon Prime which is second in demand. The only other title from Amazon in the top 15 is their Bulgarian thriller Absentia which ranked 14th.

The remaining titles are all Netflix Originals. No titles from Showmax reached the top 15 in this quarter.

Which services’ Digital Originals are best regarded on average?

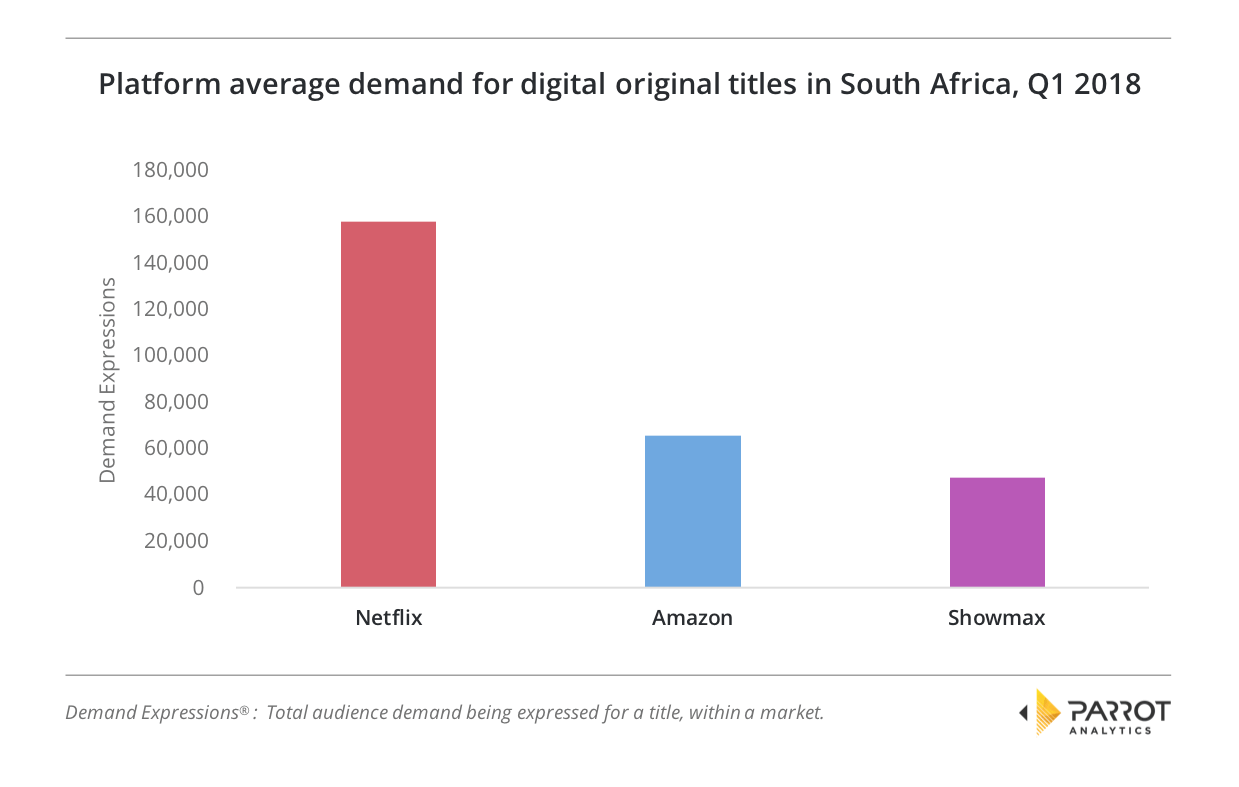

We can now examine the average demand in South Africa for a Digital Original title from Amazon, Netflix and Showmax.

Our platform level analysis reveals that over the quarter, the average Netflix Digital Original had approximately twice the demand of an Amazon Prime Original. Analyzing individual title demand reveals that a large proportion of Amazon’s demand here is from The Grand Tour, which has over five times the demand of the next-most popular Amazon Original.

In contrast, Netflix’s originals show a more consistent distribution of demand. Showmax Originals have the least average demand, however, the service has so far only released a handful of original titles.

The appeal of Digital Originals that are unique to a platform is certainly a powerful draw for subscribers, but Showmax’s offering overall is actually much more popular in the market than would be concluded from just this one chart.

Let us take a closer look.

Which service’s catalog is the most favored by South Africans?

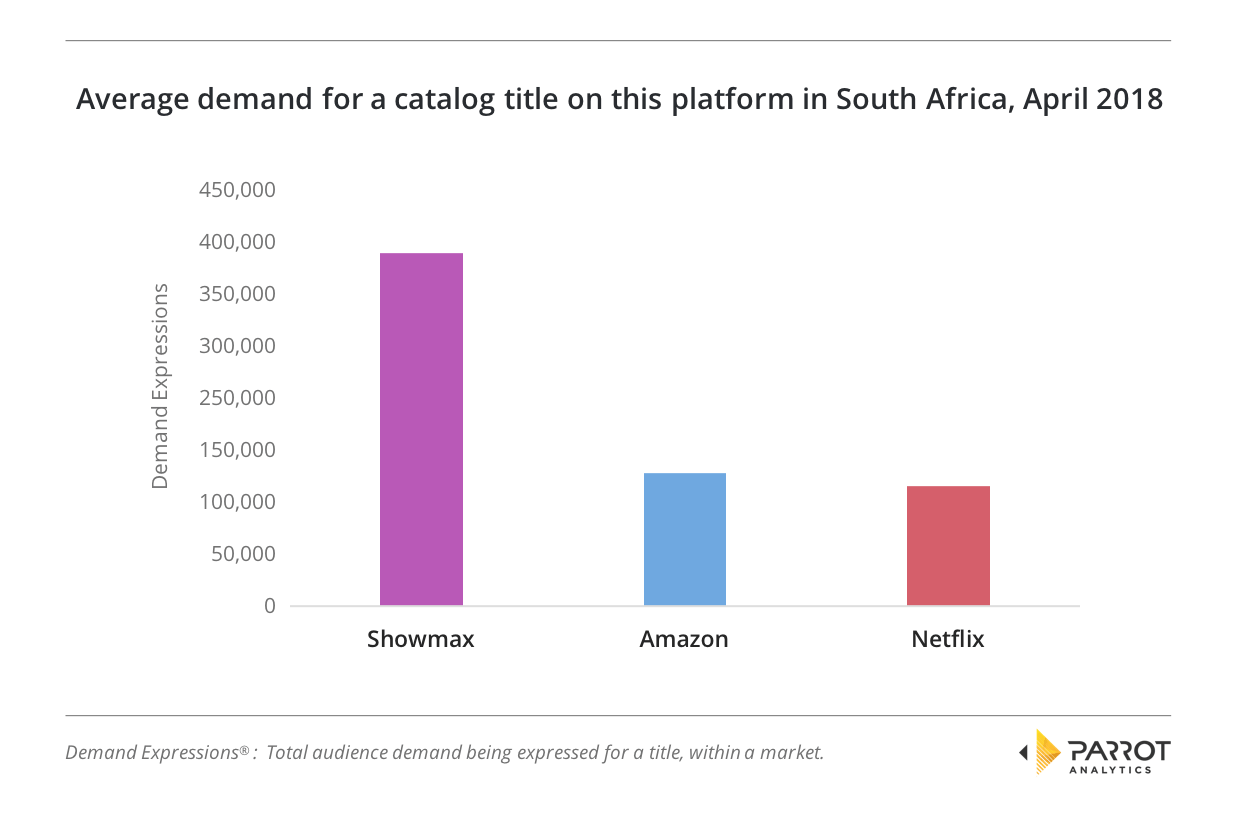

To fully assess the three SVOD’s appeal to South African audiences, we now analyze the appeal of each service’s catalog by averaging the demand of each catalog title over the 1st to the 24th of April 2018. This gives us the average demand per title for each of the services:

This result shows that Showmax is doing a far better job of targeting content to South African consumers than their US-based competitors. On average, each title in the Showmax catalog has around twice as much demand as the average Amazon and Netflix catalog title.

This demonstrates that local market knowledge can be a very strong factor in both content acquisition and marketing; effective application of local trends to both can result in increased content appeal for a platform, translating to subscription growth and churn reduction.