Image: Stargate Origins (MGM)

[June 1, 2018] Please note: This article incorrectly states that Stargate Command All-Access is available worldwide. In fact, while the free portions of the Stargate Command site are available globally; The All-Access Pass is only available in six markets. You are advised to read our new, updated analysis instead.

The business case behind the Stargate Command platform

On 14th February 2018, the latest installment of the long-running Stargate sci-fi franchise was released. What makes this series particularly interesting is the distribution method employed by MGM: Instead of licensing the show to a traditional broadcast or cable network or even an established streaming platform, MGM opted to set up a franchise-specific platform called Stargate Command.

As the number of streaming services grows seemingly by the day, what made MGM think that they could stand out from the crowd of specialist services and attract a viable audience? The answer lies in the unusual set-up for subscribing to the platform. Membership to Stargate Command grants access to streaming for Origins, as well as all the previous series and films that make up the Stargate franchise catalog.

And unlike the established streaming business models, the subscription price is not set as a monthly fee. Rather, Stargate Command membership is a one-time US$20 charge to access all content; this one-time rate is applicable until May 15, 2018 at which point it may be revised.

This approach offers a clear advantage to a highly-focused, low-volume (of titles) platform compared to a monthly fee structure. For a start, with no pressure to reduce monthly churn MGM can concentrate on a small number of high quality releases rather than risking angering subscribers by overly stretching out release windows, or lowering the quality on their offerings. There is of course a chance that the once-only fee structure will be revised in the future.

Another obvious factor that would have affected MGM’s decision is the strength of the Stargate franchise. Since the release of the first film in 1994, passionate fans have shown over the years just how dedicated they are; the franchise has one of the largest fan wikia sites, ahead of many other sci-fi and fantasy franchises. Additionally, actors from the various Stargate series are a consistent draw at fan conventions worldwide. With a healthy franchise fanbase like this, there would be a significant proportion of hardcore fans who would regard US$20 as a small price to pay for new, official Stargate content.

However, as Star Trek: Discovery showed for CBS All Access, the overall success of a new platform is heavily dependent on the launch of its first major title. And in CBS’ case that has gone very well indeed .

How was the release of Stargate: Origins received?

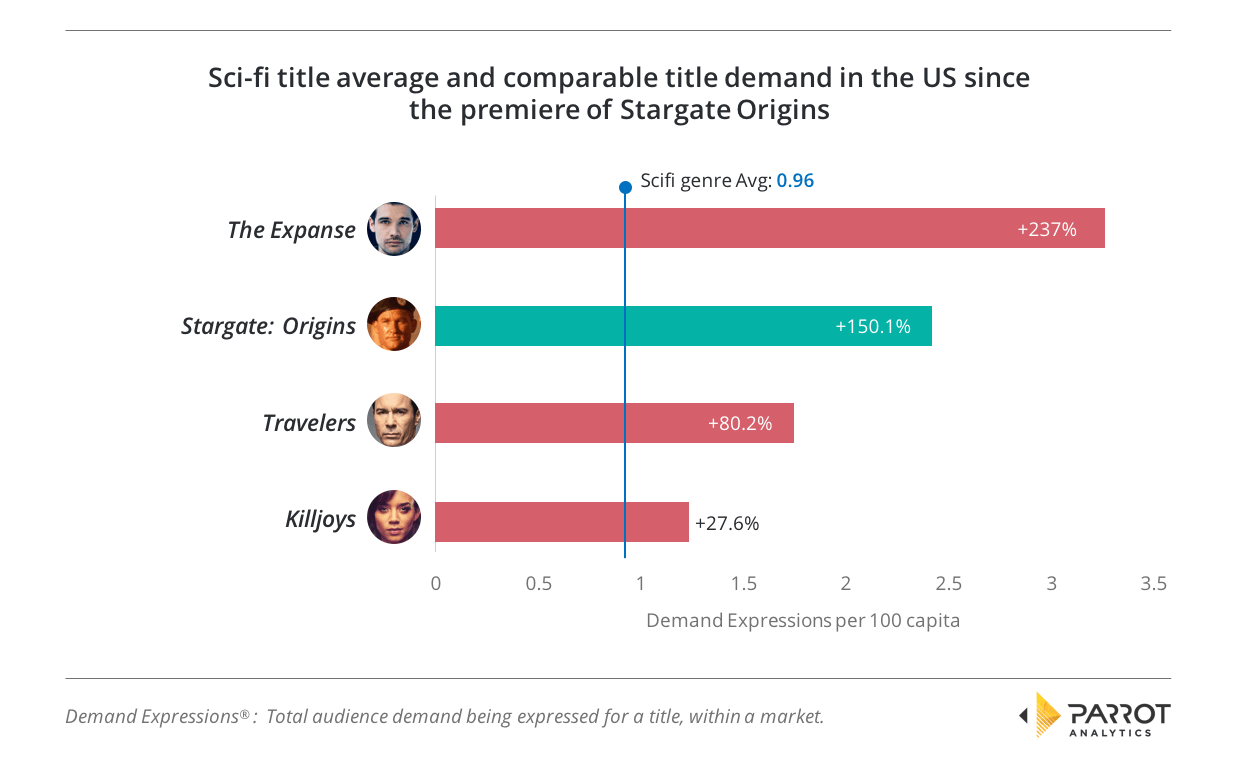

Luckily for MGM, Stargate: Origins has performed well in the USA. With around two and a half the average demand of a sci-fi title, Origins is a solid performer in the genre, with the title managing a performance similar to The Expanse, Travelers and Killjoys.

The ranking of Stargate: Origins in the US market since release is strong; the title is now the 12th most in-demand sci-fi title and the 238th most in-demand of all titles across all genres in the US. Few executives would be disappointed by these results for a cable sci-fi show, and considering the niche distribution method, this is a strong result.

Deployed on an unrestricted platform gives Stargate: Origins a real travelability advantage

What is interesting, however, is that the US numbers do not tell the full story of Origin’s success. One of the major advantages MGM is benefiting from is that the Stargate Command platform is not region restricted: Any interested fan anywhere in the world can pay the membership fee and then access the content.

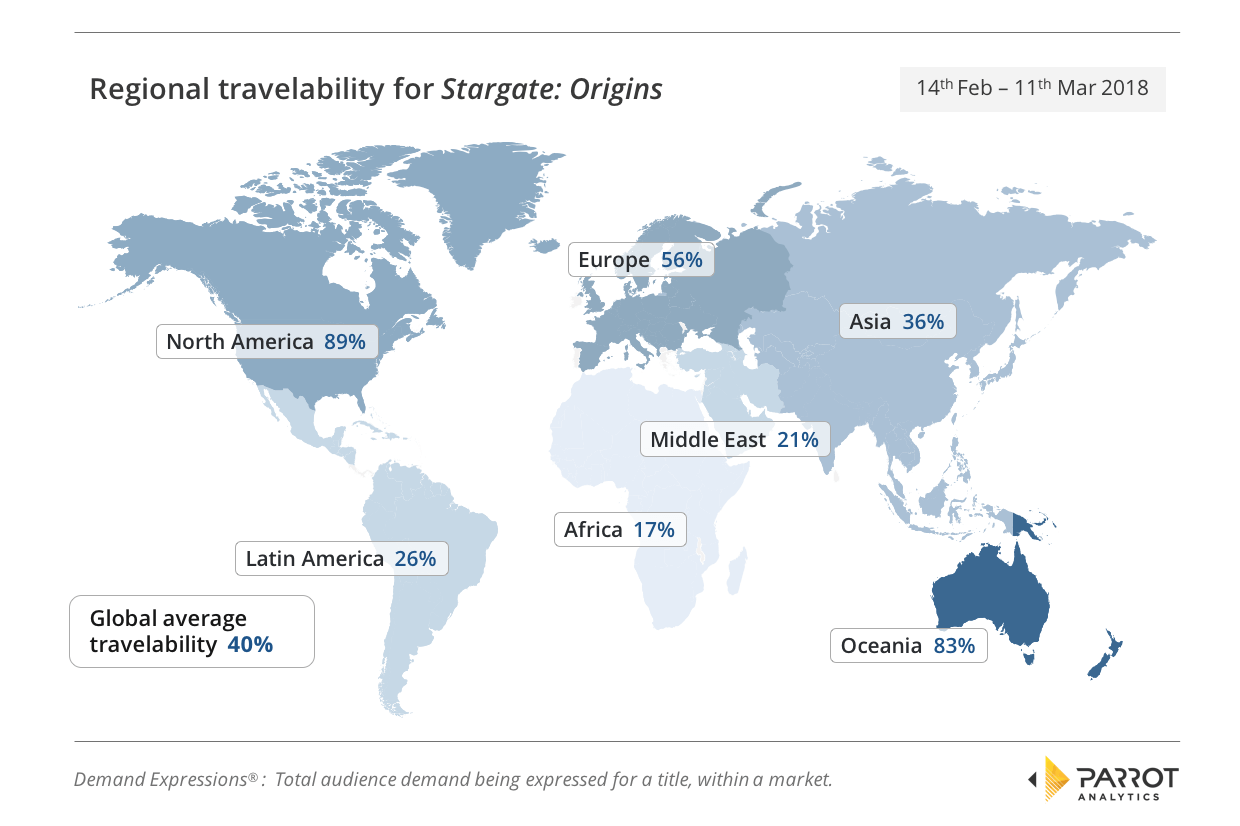

By looking at the Demand Expressions per capita for Stargate: Origins as a percentage of the show’s demand in its home market of the US, we can see exactly how well the title has performed in international markets.

Overall, Stargate: Origins is a strong performer with a global travelability score of 40%. As a comparison, although Hulu’s drama The Handmaid’s Tale achieved great success domestically and generated a lot of critical and social media buzz, the show was not available internationally in many markets for some months after the American premiere.

Consequently, for the four months after The Handmaid’s Tale was released in the US it had a travelability of 26% – Stargate: Origins travels around 1.5 times better. It must be noted that since its release, The Handmaid’s Tale’s travelability has improved, in line with further distribution rights being negotiated in international markets.

Regional highlights include North America, where Stargate: Origins has 89% travelability, followed by Oceania at 83% and Europe, which has 56% as much demand for the show as the US does. Looking at individual markets, Stargate: Origins is particularly popular in France (126%), Australia (92%) and the United Kingdom (89%). Note that France actually has higher demand per capita than the U.S. (!)

Of course, this content travelability phenomenon is not unique to Stargate Command as platforms such as Netflix and Amazon Video also benefit from a global viewer base.

Interest in Stargate: Origins is lifting demand for the rest of the franchise

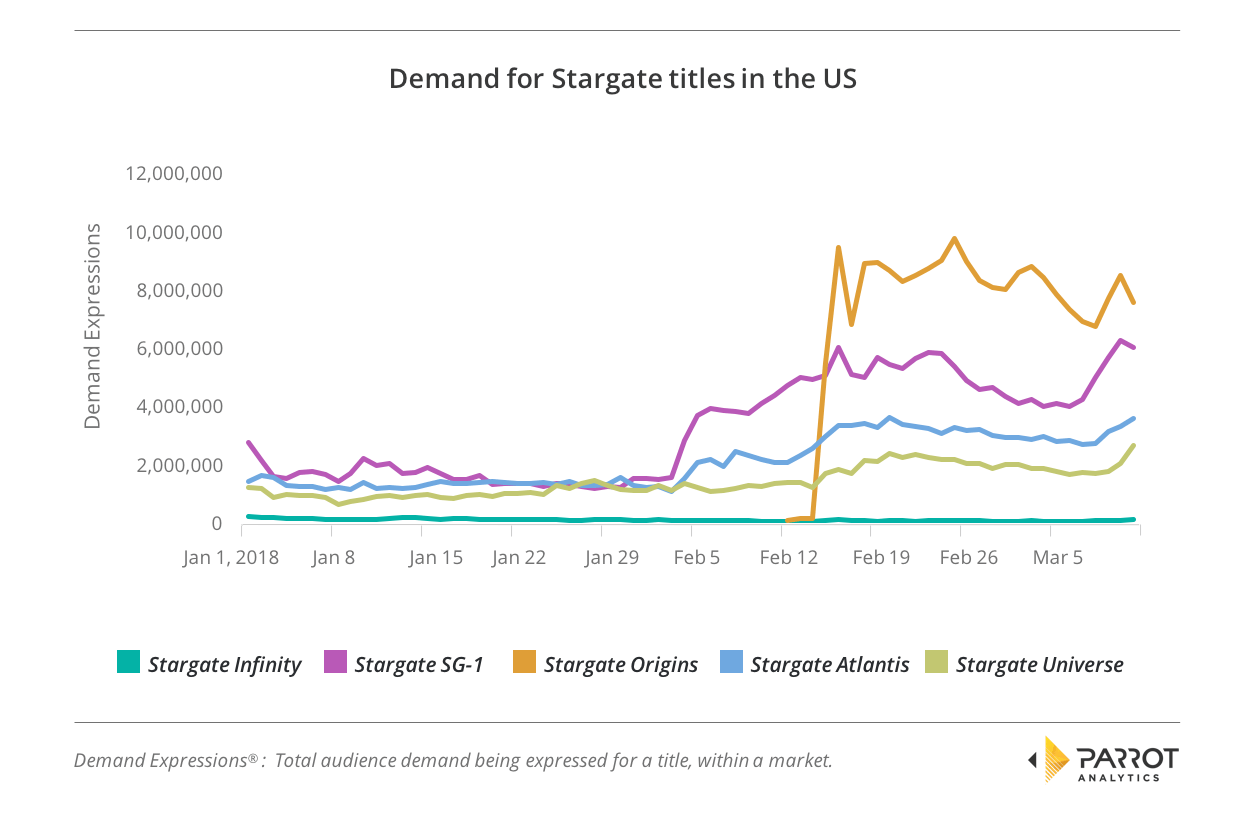

As the Stargate Command platform also offers streaming of the older titles in the Stargate franchise, it is unsurprising that the interest in Stargate: Origins is also boosting the demand for these other titles. This graph shows daily demand in the US for the individual Stargate titles:

Stargate: SG-1 and Stargate: Atlantis have noticeable increases in the weeks prior the premiere of Origins, likely due to franchise fans rewatching these older series to prepare for the new content. Between the 4th and the 14th of February, the average demand for SG-1 jumps by 160% compared to the baseline demand beforehand. After the premiere of Origins on the 14th the average increases again from this, rising another 20%. For Atlantis the increases are 68% pre-release and 41% post-release.

While Stargate: Universe doesn’t gain much demand before Origins premieres it does gain an increase after that event, with average demand almost doubling compared to before the premiere.

The animated series Stargate: Infinity was considerably less popular than the other series before the release of Origins. Infinity also experienced a lift in demand after the premiere of Origins, but as Infinity is not one of the shows available for streaming on the Stargate Command platform, making it comparatively much harder to view, this lift was minor.

In conclusion, the example of the Stargate Command platform and the launch of Stargate: Origins demonstrates that in the era of “Peak TV”, bold and perhaps unorthodox distribution approaches that leverage the strength of a new franchise title, even when deployed on a brand-new direct-to-consumer platform, can lead to the entire franchise’s popularity benefiting.