Parrot Analytics’ global TV demand data is generated in real-time by a new type of SVOD analytics measurement system, which helps the industry understand what audiences want across all platforms and devices.

With the fall television season underway, the top ten overall shows featured both summer title finales and fall title premieres.

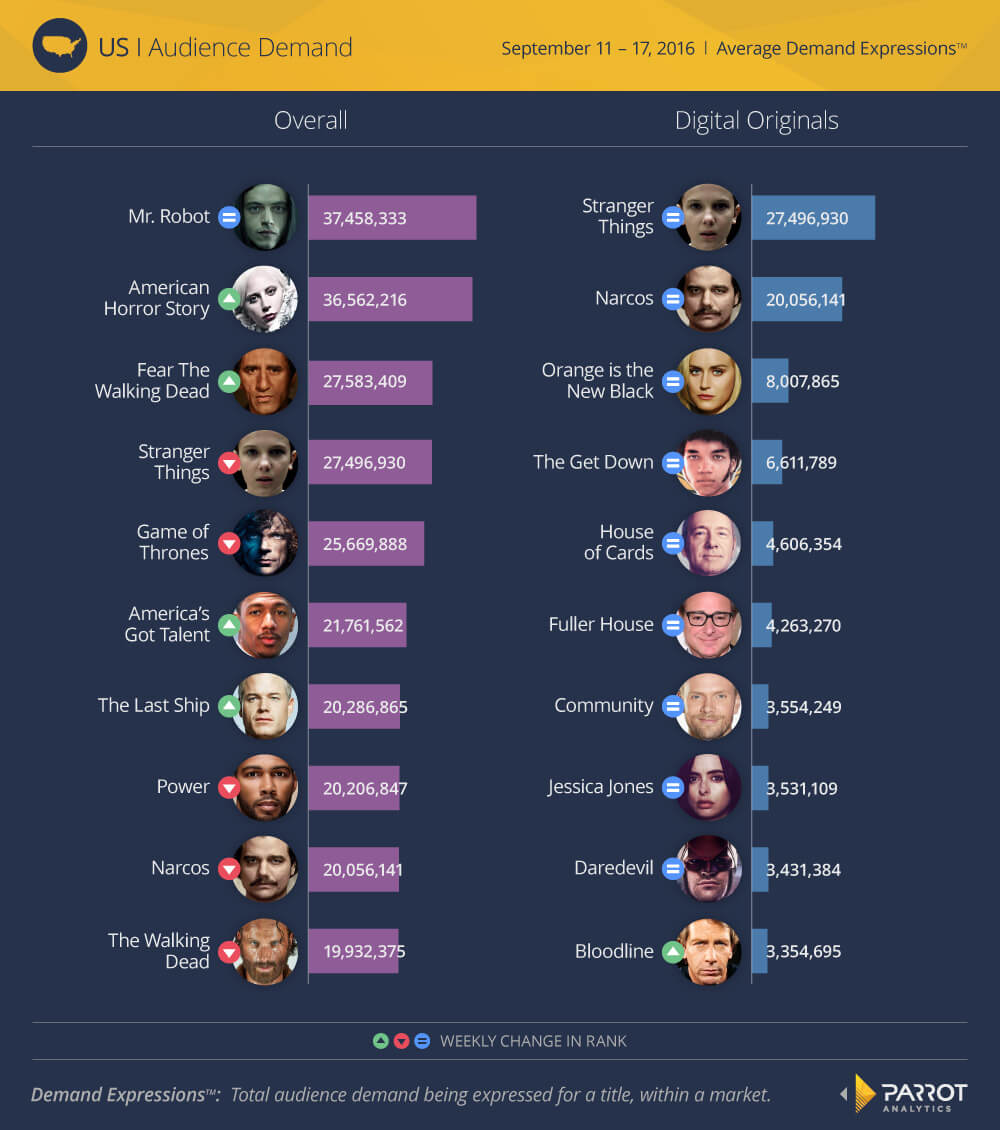

The penultimate episode of Mr. Robot’s second season kept it on top, but the second-most in-demand series went to the premiere of the secretive sixth season of American Horror Story.

Though it has not appeared in the top for many weeks, the finale of America’s Got Talent ranked sixth, while the finale of top ten regular The Last Ship only managed seventh place.

Demand for older hits continued to decrease this week, perhaps as audiences now have more new shows to watch in the fall. While Game of Thrones remained fairly steady with only a 1% decline in demand, The Walking Dead declined by nearly 6% and digital series Stranger Things and Narcos lost 25% and 35% of their demand, respectively. Despite these significant drop in demand, these two titles were still the most popular digital original series by a large margin.

In contrast to the shuffle in the top ten overall shows, the ranking of the digital originals was identical to last week except for Bloodline replacing The Man in the High Castle in tenth place. News of Bloodline’s cancellation likely caused its appearance in the top ten, but the fact that its demand was still lower than older shows such as Community and Jessica Jones indicates that it does not have a strong audience.

The rest of the digital originals only increased or decreased in demand by an average of 1%, which explains why none of them changed their ranking this week.