Image: Star Trek: Discovery, CBS All Access

Exemplified by the most in-demand title in the world, Game of Thrones – as per Parrot Analytics data and certified by Guinness World Records, for some years now the fantasy subgenre has been one the industry has concentrated on.

Since Game of Thrones debuted in 2011, over 100 new fantasy series have premiered on our screens. And this pace is not likely going to slow down, as the end of the megahit next year is sure to bring with it a new slew of fantasy titles hoping to claim the fantasy drama crown.

However, in the past year it seems that sci-fi series are the ones grabbing our attention; comedies like The Orville and Rick and Morty, dramas like Westworld, Colony and The Expanse and of course, the 2017/18 revivals of beloved sci-fi franchises like Star Trek and Stargate.

Netflix in particular seems to have invested heavily in sci-fi for their original programming, examples include the psychological horror-tinged Black Mirror, the hard-hitting sci-fi Altered Carbon and a reboot of their own in the form of Lost In Space.

In the ongoing rivalry between the sci-fi and fantasy genres, have audiences switched their allegiance away from dragons and towards spaceships?

Does market data confirm that Sci-fi has overtaken Fantasy?

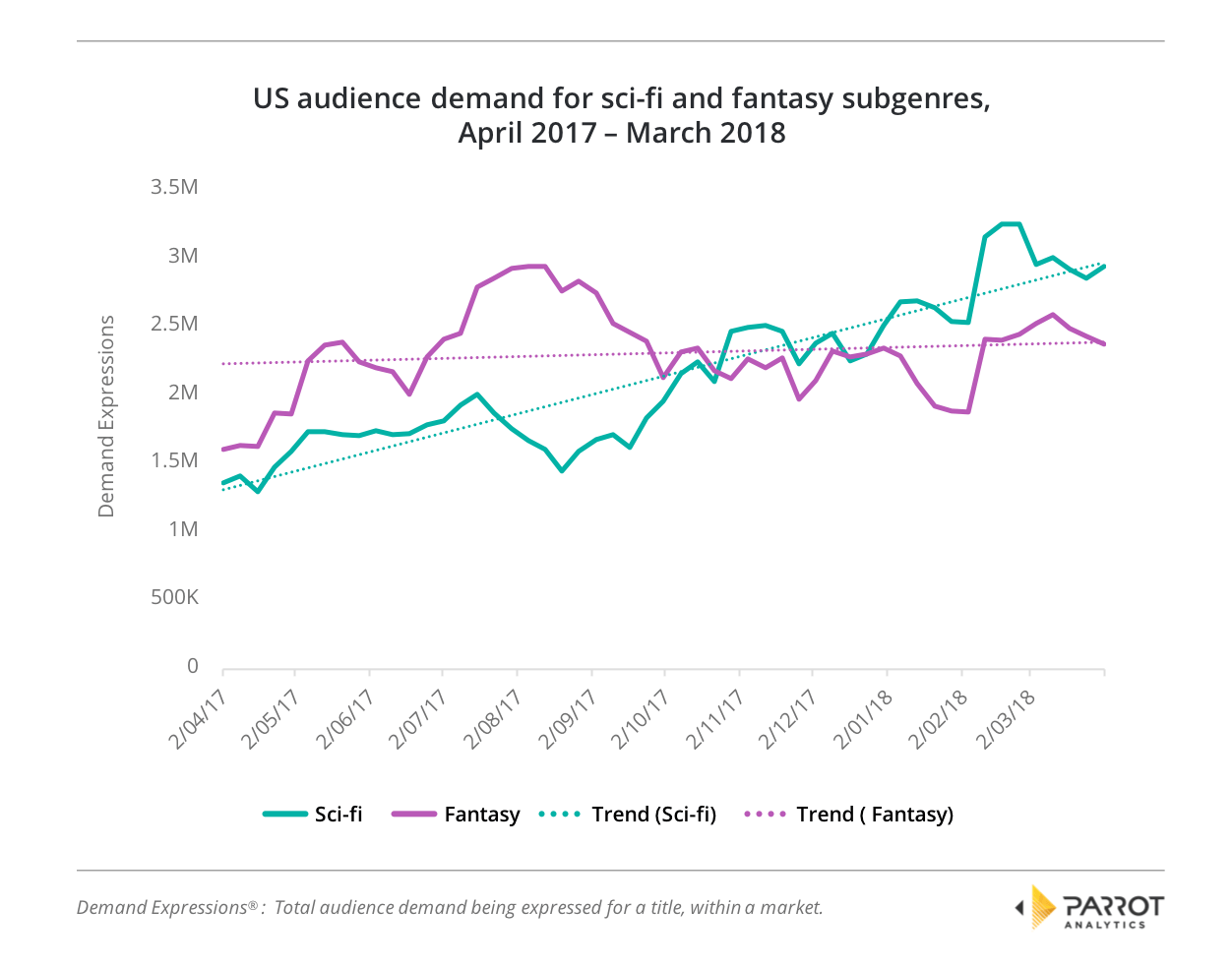

To assess if this is a genuine trend, Parrot Analytics studied the market demand data for the largest producer of both subgenres, the United States. It was found that over the past twelve months, a strong pattern has emerged:

While the popularity of fantasy titles does vary, particularly over the summer 2017 airing of Game Of Thrones’ season 7, overall the fantasy genre average is reasonably stable, as demonstrated by the trendline.

For sci-fi, it’s a different story: Since this time last year, the average demand for sci-fi titles has steadily risen and has exceeded the demand for fantasy consistently every single week since the start of 2018.

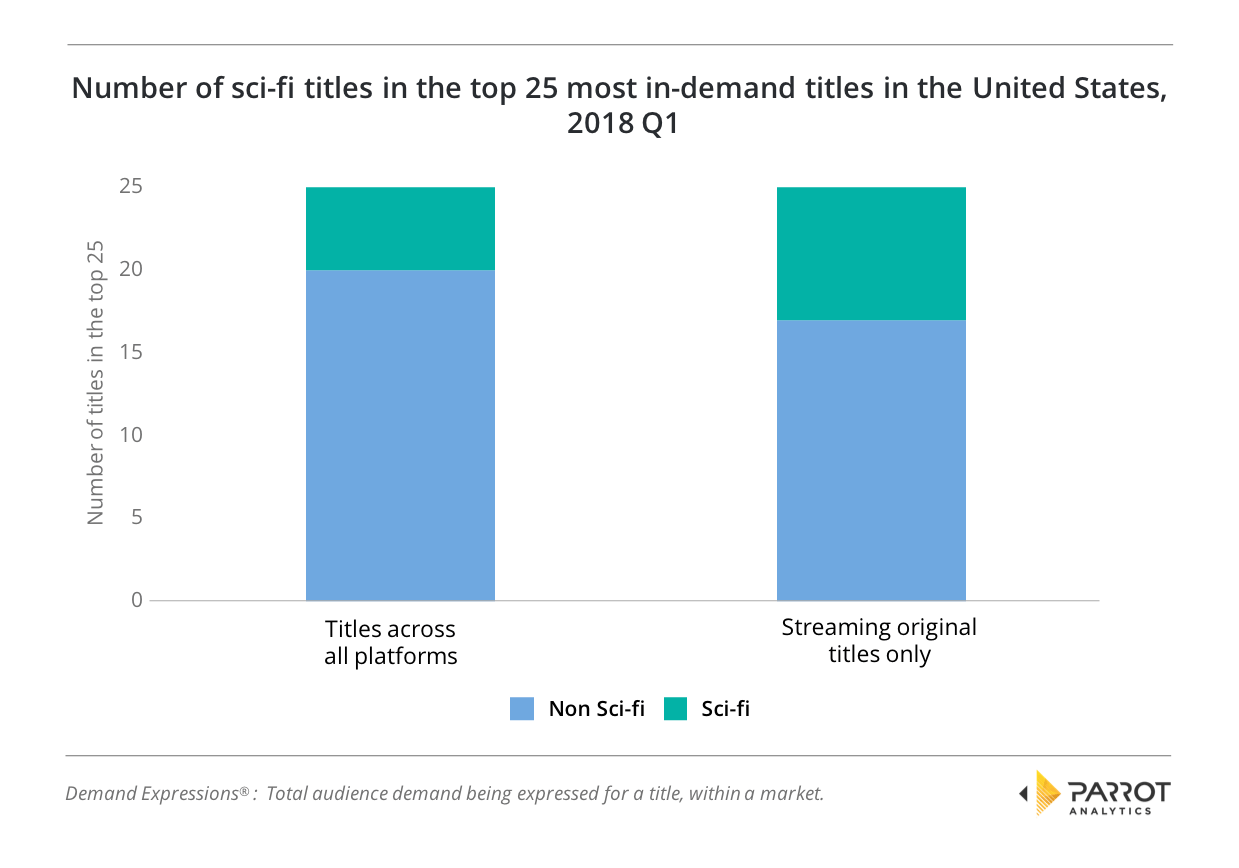

This result is reflected in the US most in-demand show data for the first quarter of 2018. Of the top 15 titles in America from all sources, no less than 3 are sci-f: Stranger Things, Star Trek: Discovery and Rick And Morty.

Interestingly, two of the three are digital original titles and not from broadcast or cable networks (the Star Trek: Discovery premiere did air on CBS before the show became solely available on CBS All Access).

If this is compared to the 25 most in-demand digital original titles in the US shows for 2018 Q1, we find that 8 of these are sci-fi titles. This demonstrates that there are a greater proportion of sci-fi themed digital original titles in the top 25.

Based on this, it seems that at least for the moment, the streaming platforms are responding quicker to American audiences’ shift towards sci-fi.

Is this trend global?

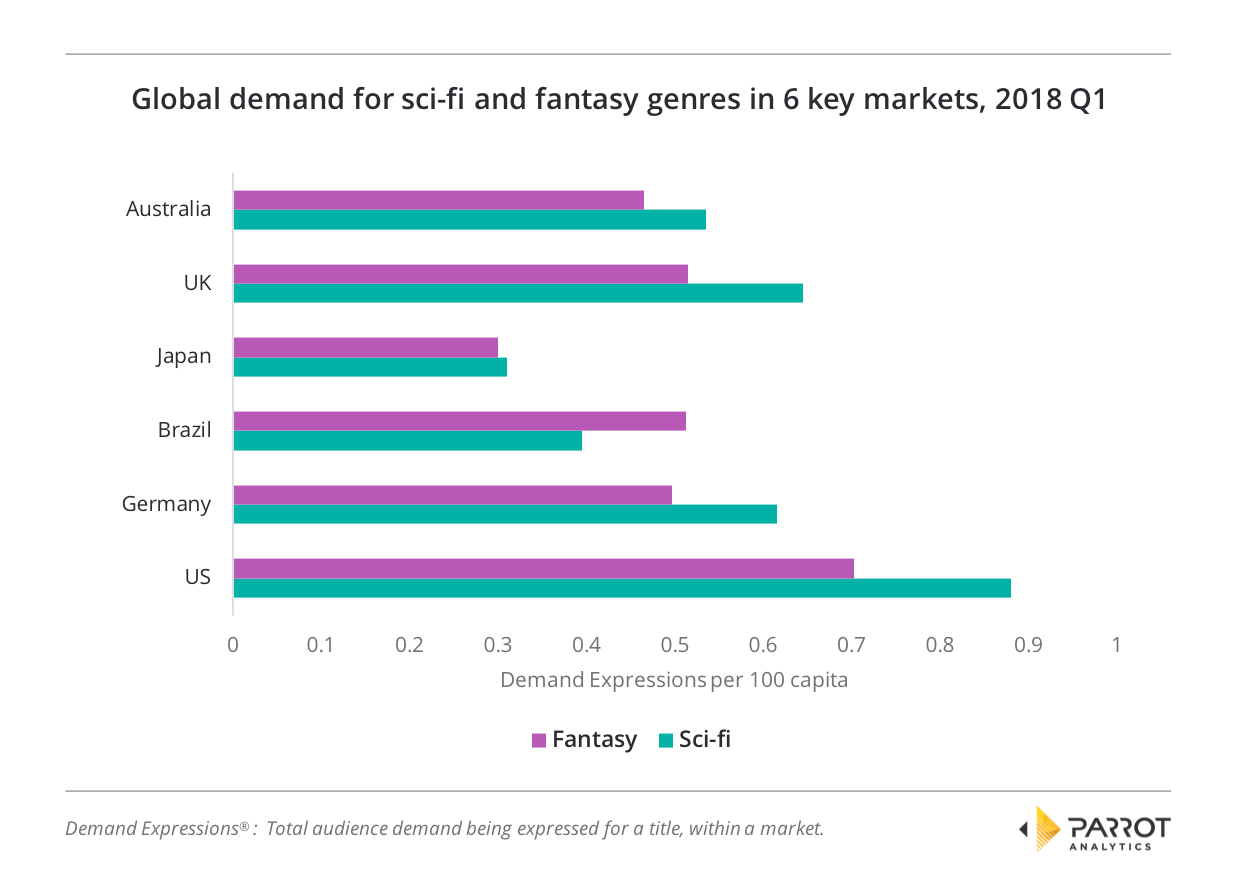

So far, we have only examined data from the USA. To see if the popularity of sci-fi is a global trend, we have averaged the demand for both genres for 5 other key global markets.

From this result, we can see that sci-fi does have higher average demand than fantasy in five of the six markets examined. Only in Brazil does the average fantasy title have higher demand than the average sci-fi title. Perhaps there is a link here, too, with Brazil’s abnormally high preference for superheros?

In conclusion, we therefore have a definitive answer to the question posed: For 2018 thus far, it does appear that sci-fi is indeed the new fantasy.