With May drawing to a close, another television season has come to an end. From September to May, over one hundred shows aired on the major broadcast networks and many hundreds more aired on cable channels and SVOD platforms.

For the broadcast networks, the decisions for the next season—which pilots to pick up, which shows to cancel, and the fall scheduling—have already been decided and the summer shows have begun to air, but we will revisit the 2015-2016 season in terms of demand. How did demand change for both new and long-running shows from their first episodes of the season to their conclusion?

To evaluate the changes in popularity of the network shows, the maximum Demand Expressions™ after each show’s first and last episode of the season are compared. We observe that this maximum in demand often occurs on the day after the episode has aired as people catch up on viewing and begin discussing the latest developments online. Much like linear ratings, demand for season premieres and finales can be higher than for the other episodes, but the difference between the two still gives an indication of the trend in demand over the course of the season.

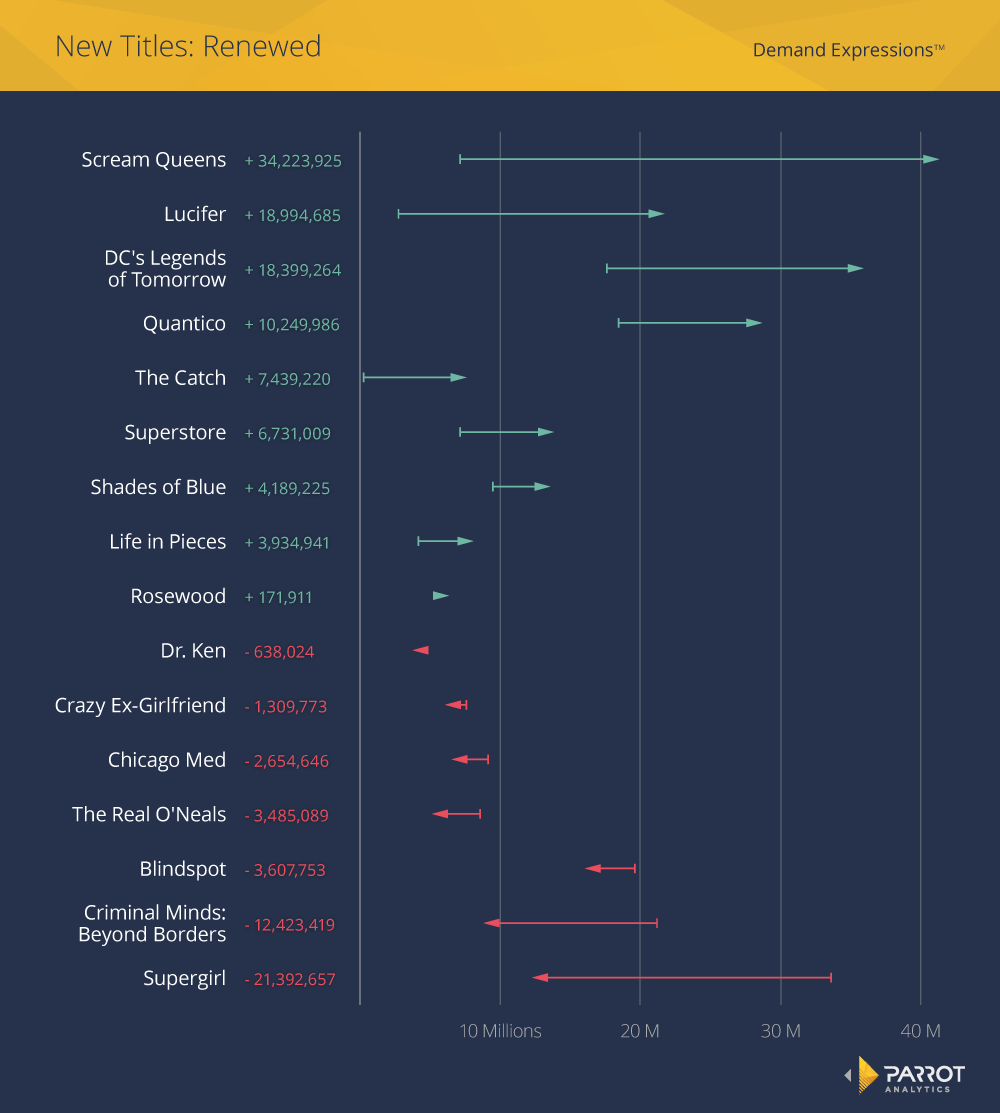

First, we will examine the demand for titles that were new during the 2015-2016 TV season and were renewed by their network.

Most of these titles increased in demand over the season, giving a good justification for their renewal. Though Scream Queens was not a hit by linear ratings standards, the demand surrounding the show increased by over 5 times to end as the most in-demand new title this season. The mid-season show Legends of Tomorrow also had a fairly large increase to end the season as the second-most in-demand new show. The steady Quantico and the fast-growing Lucifer (which ended with nearly 7 times more demand than its premiere) were the only other titles to end with more than 20 million Demand Expressions™.

On the other side, demand for Rosewood and Dr. Ken barely changed at all. The biggest decrease in demand was for Supergirl, which more than halved its demand from premiere to finale. Though it ended its season in the red in terms of demand, the fact that it is headed to the superhero-friendly CW may save it from being cancelled in the long run.

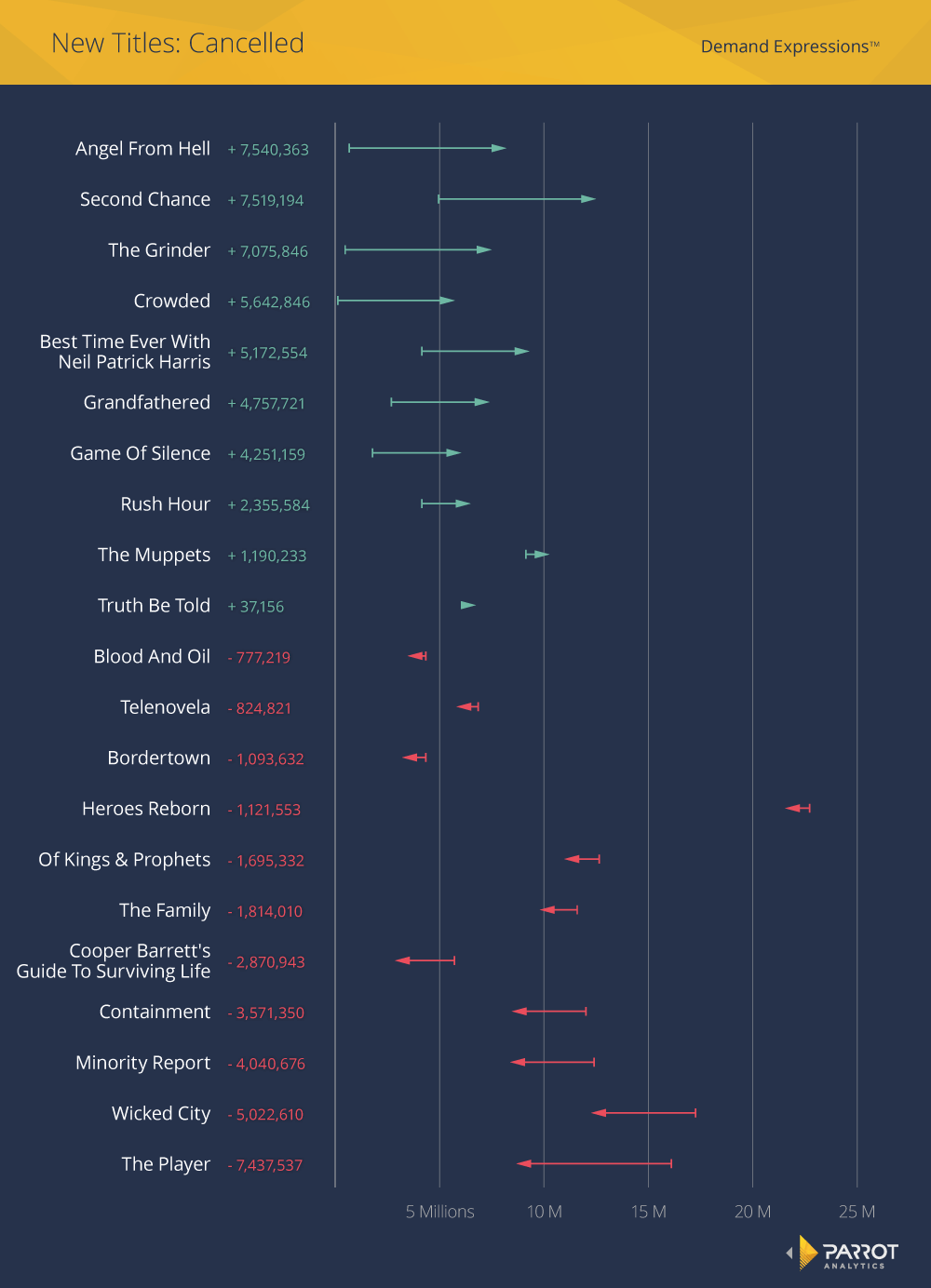

Out of the about 40 new titles released during this TV season, 21 of them were definitely cancelled (the fate of others, notably Limitless, are still unknown). Some, such as Wicked City, were axed after only a few underperforming episodes, while others, such as The Grinder, aired their entire season before facing judgement.

On average, demand for the new, renewed titles is 1.6 times higher than demand for the new, cancelled titles. Despite their lower popularity, about half of the cancelled shows managed to increase in demand from their first to last episode. Several such titles, like Crowded and The Grinder, started with very low demand and increased to be on par with other shows; this slow start probably doomed their chances at renewal. Other titles, such as The Player, started with decent demand but then decreased to be below average.

A third group, including Truth Be Told and Heroes Reborn, simply did not change appreciably in popularity. While the high-demand Heroes Reborn had the excuse of being a limited series, the other static shows did not start off strong enough or grow enough in popularity to earn a renewal.

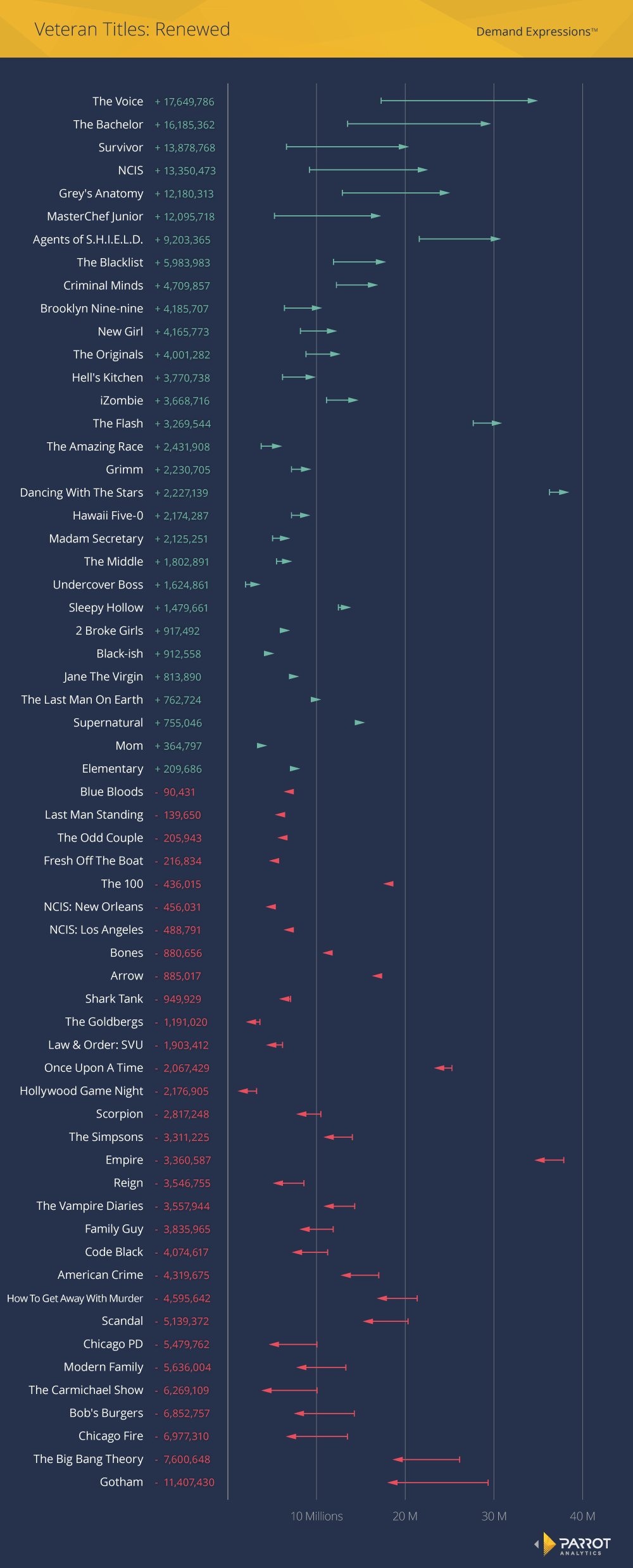

Of course, the majority of renewed titles were those that had already been running for a season or more. Over half of all the shows aired on broadcast channels fall into this category, indicating that networks like to stay with solid, proven content. However, demand for these incumbents can be just as volatile as for new shows:

Though many of these shows have been on the air for many seasons, they have nevertheless increased significantly in demand: both Survivor and MasterChef Junior saw their demand increase by over 3 times from premiere to finale. Along with The Bachelor and The Voice, whose demand increased by about 2 times, these competition reality shows naturally had higher demand for the last episode, when the winner is decided.

Fewer of these veteran shows decreased significantly in demand, and those that did, such as Gotham and The Big Bang Theory, still ended their seasons with above-average demand. While the top show, Dancing with the Stars, increased in demand like the other competition shows, the other most popular title, Empire, decreased slightly over the course of its season, but not enough to make them fall out of the top two titles by demand. Two superhero-themed shows, Agents of S.H.I.E.L.D. and The Flash, and The Voice increased in demand to join them in becoming the only four titles to end the TV season with over 30 million Demand Expressions™.

As it was neither the beginning or the end of the series for these shows, it makes sense that many veteran shows had about the same demand for their season premiere and finale. In addition, most of these static shows are fairly average by demand: they have a reliable audience but are unlikely to break records.

Lastly, the smallest group of titles in this analysis is the veteran shows that were cancelled this season:

Perhaps unexpectedly, all of these cancelled titles actually increased in demand with the exception of the quirky, mid-season show Galavant. For American Idol, hype surrounding the final season of this institution attracted a huge amount of demand. This excitement peaked for the finale, which was one of the highest points of demand for any show this TV season. Likewise, the final season of The Good Wife was announced in advance, drawing back in viewers who wanted to see how the story ended. In contrast, shows like Castle and The Mysteries of Laura were cancelled right before or after their season had already ended, preventing as much series finale demand from building.

Overall, this television season has seen both exciting increases and disappointing decreases in demand for the broadcast shows. We eagerly await to see how the recently-announced new shows for next season change the demand landscape again.

by Kayla Hegedus, Data Scientist