In this post we analyze the top digital content in LatAm right now.

With the Rio de Janeiro Olympics underway, the world’s focus is on South America. While the region’s overall economy is not strong, this fact does not seem to have affected SVOD providers: the number and subscriber base of OTT platforms continues to grow, especially in Brazil and Mexico. Along with Argentina, Colombia, and Chile, these markets account for over 90% of the total OTT subscriptions in Latin America , often at the expense of more traditional paid TV subscriptions. Netflix, with its lineup of original content, is popular in the region but is joined by local platforms as well. This report will reveal which digital original series people in Latin America prefer, the differences between Latin America and other regions, and how these tastes have changed over time.

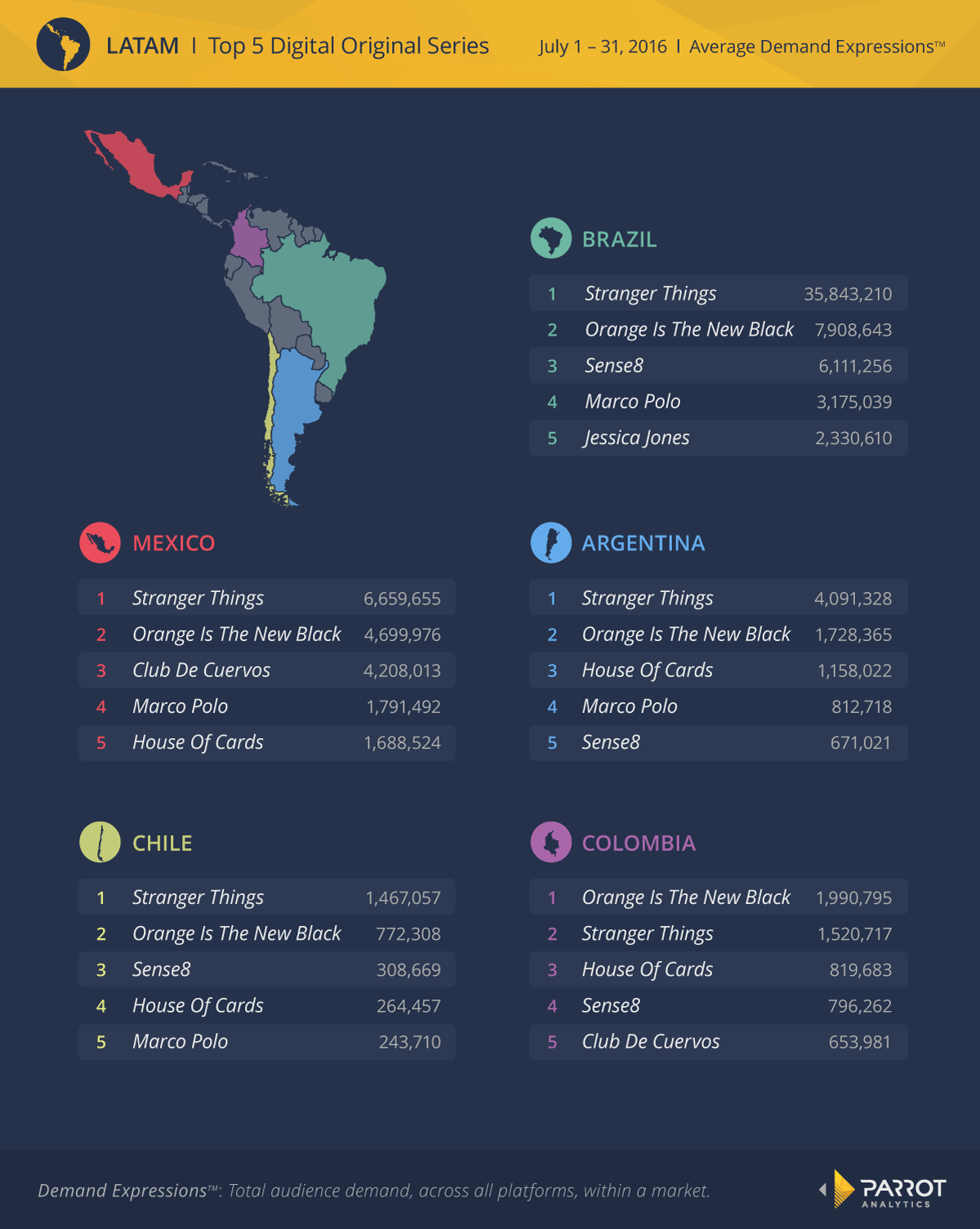

The top 5 digital original series in July for the five major Latin American markets—Brazil, Mexico, Argentina, Chile, and Colombia—are ranked by average Demand Expressions™.

Stranger Things, which was released in July, has the most demand in four out of the five markets, while Orange is the New Black, released in June, has the most demand in Colombia and came in second in the other markets. Similar titles also appeared in the rest of the top five: House of Cards, Sense8, and Marco Polo all rank in four out of the five markets. All the top shows are from Netflix, the only major OTT producer of original content as Amazon and Hulu are not present in the region.

Despite the strong similarities between the Latin American markets’ top shows, several interesting differences do appear. The Spanish-language Club de Cuervos is popular in Mexico and Colombia (but not Argentina or Chile), while Brazil uniquely prefers Marvel’s Jessica Jones. Since Brazil speaks Portuguese instead of Spanish, Club de Cuervos is not as accessible, and its current political crisis may make fictional governmental intrigue (a la House of Cards) less palatable. However, overall the similarities between the top digital original series in Latin America are more significant than the differences.

The top five series in these markets may be similar, but how does the overall preferences for digital titles compare across the region?

To determine the level of similarity between 14 Latin American markets, over 100 digital original series were ranked in each market and the correlation between these rankings calculated. On average, Latin American countries had 87% correlation between their rankings, indicating a high level of similarity between these countries. In comparison, the ranking between Latin American markets and others—such as the United States, Japan, and Italy—are less correlated, with 84%, 81%, and 83% respectively. Countries in Latin America have more similar tastes than they do to other regions, suggesting that content strategies for LatAm must be different than for other global regions.

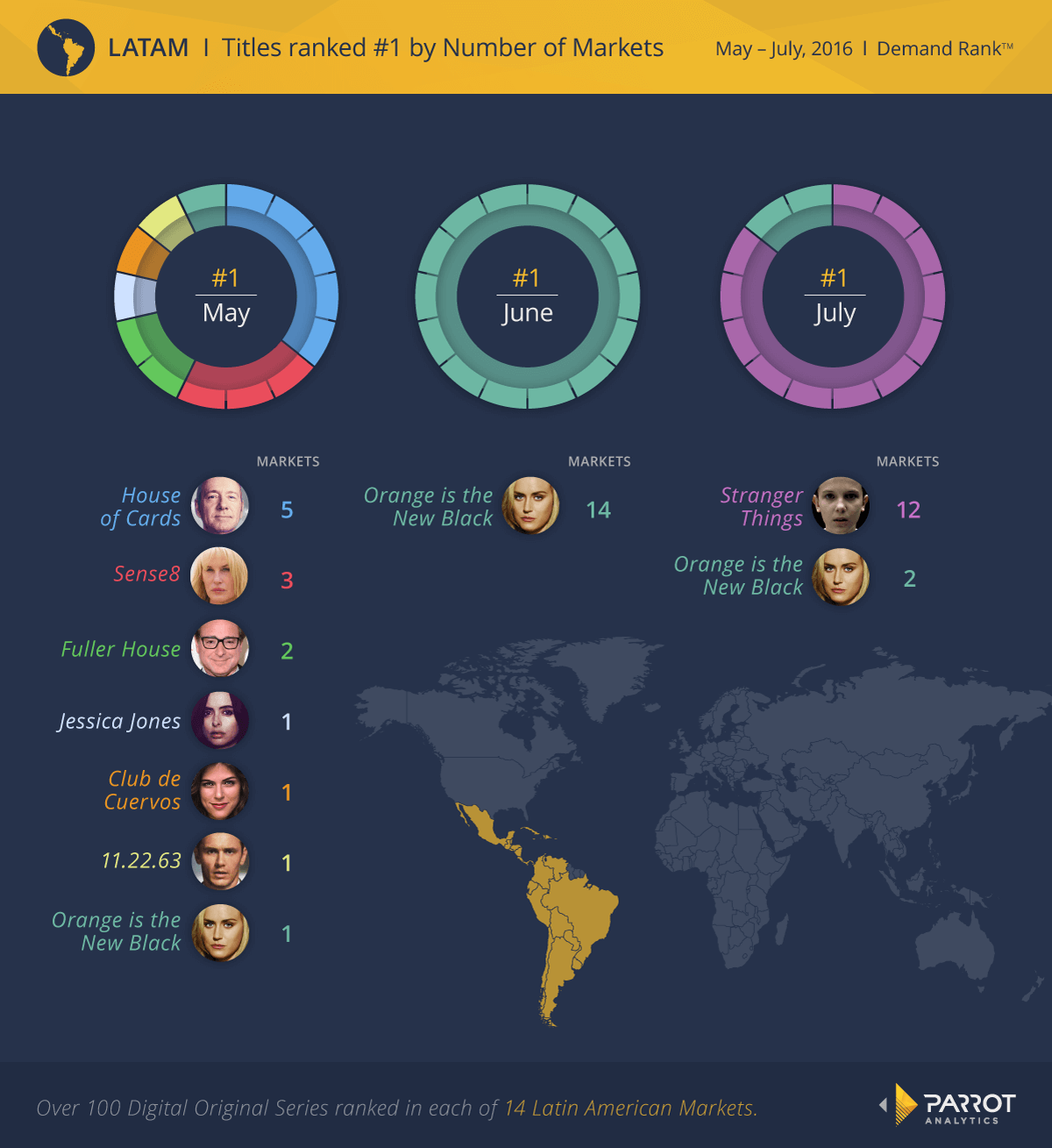

While Stranger Things was the most popular title in July in Latin America (and many other markets around the world), the tastes of this region changed over time. The most in-demand titles for the last three months are tracked by number of markets where they are rank #1 out of 14 Latin American countries.

Working backwards in time, Orange is the New Black managed to have more demand than Stranger Things in only two markets (Colombia and Cuba) in July. However, a month earlier it topped the list of digital original series in all Latin American markets, propelled by the release of its fourth season on June 17th. Both June and July were dominated by titles that aired new episodes that month, but May reveals a more varied picture of Latin American interests. Orange is the New Black was only the top show in Cuba; only Fuller House and House of Cards were the most popular series in more than one market. More of the differences between Latin American markets can be seen when a single show does not top the list in every country, which may reveal interesting trends and opportunities for content providers.

Latin America appears to be a fairly unified region when it comes to digital original titles: the top shows are similar between markets and the overall ranking of titles is more similar between LatAm countries than they are to countries in other regions. However, OTT platforms in this growing region should be cautious in treating all Latin American markets the same, as differences in preferred titles, especially in the absence of a single dominant title such as Orange is the New Black, indicates that specific content strategies tailored to each market would be most effective. As the popularity of SVOD content increases in Latin America, it will be interesting to see if each market’s preferences become more similar or more different over time.