Parrot Analytics has recently taken an in-depth look at SVOD demand trends in the United Kingdom, including:

- The top 20 digital streaming shows in the United Kingdom across all SVOD platforms in the country.

- Which genres British audiences prefer and how these preferences have changed over a period of 12 months.

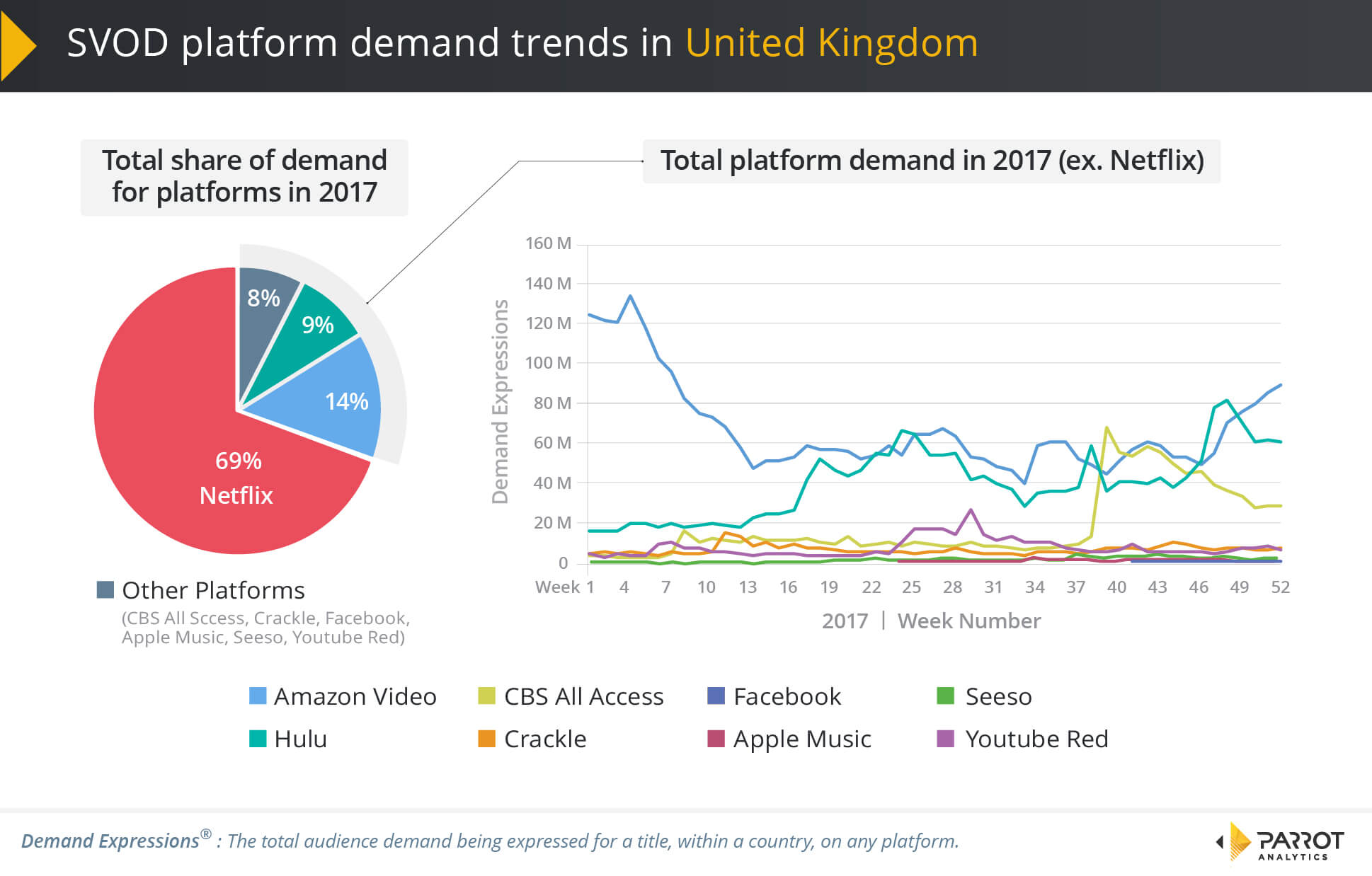

- The market share of the major OTT platforms Netflix, Amazon Video and Hulu in the United Kingdom.

- How the platform share of audience demand changes over time for Apple, CBS All Access, Crackle, Facebook, Seeso and YouTube Red.

We are pleased to reveal the following findings of our comprehensive study.

Top SVOD Platforms and Streaming Television Shows in the United Kingdom

Amazon Video, which besides Netflix is the only SVOD platform available in markets outside the US, had 14% of the total digital original series demand. While Hulu and other platforms had only about 8% of demand, these platforms increased their demand over the year to be on par with Amazon in the UK.

As in the United States, Stranger Things and 13 Reasons Why were the most popular digital original series in 2017 in the United Kingdom. The first non-Netflix title to rank was CBS All Access’ Star Trek: Discovery ranked eighth, followed by Amazon’s The Grand Tour at ninth.

CBS All Access’ Big Brother: Over the Top had more demand in the UK than Apple’s Carpool Karaoke.

Top TV Series Genres in the United Kingdom

Drama was the most popular genre in the UK and grew over the course of the year. The reality genre, led by The Grand Tour, was relatively high at the beginning of the year but declined, while the science fiction genre grew thanks to Stranger Things and Star Trek: Discovery.

For more information, check out the most up-to-date United Kingdom television industry overview.