As TV content is increasingly being watched on-demand over multiple screens, platforms and devices, linear ratings are falling exceedingly short in capturing the whole picture of content consumption. In parallel, consumers naturally interact with content brands through a wide array of online services that let them research, comment, like and even download or stream trailers, or entire episodes, of their favorite shows. Demand Expressions serves as the necessary standard to compare TV shows that people watch around the world, by accurately measuring activity from content consumers, on a global scale.

In addition, Demand Expressions also serves as a currency that values the interest that each genre generates by aggregating and consolidating demand from thousands of TV shows that belong to each genre. Since, every day, over a billion Demand Expressions are captured real-time and across all countries by Parrot Analytics, suddenly it is now possible to identify genres that are trending up or down in any geography of interest.

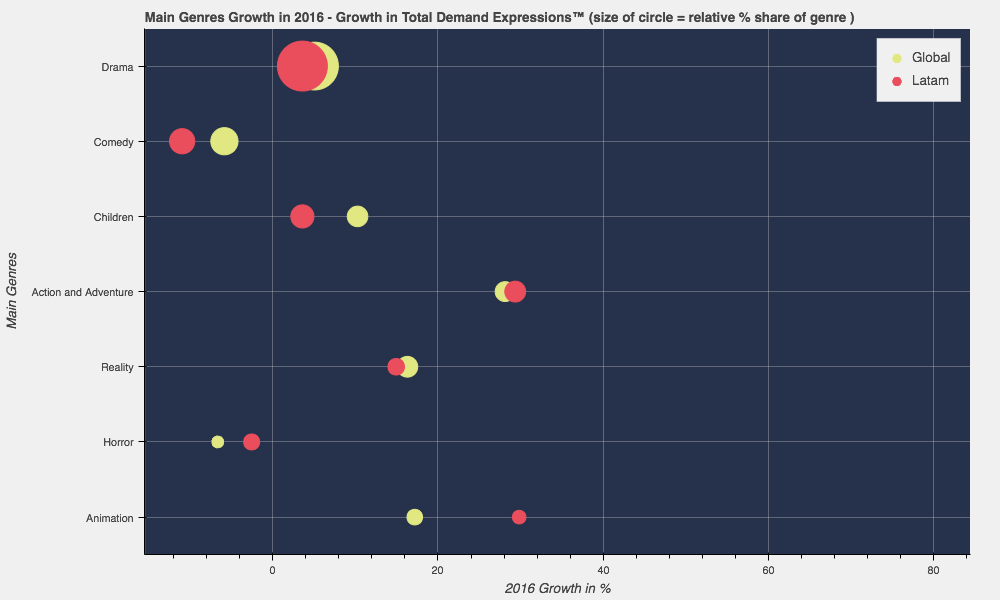

For instance, when comparing Latin America with all markets around the world, we found across the board similarities on the relative size and annual growth for most genres. Though comedy and horror are losing ground everywhere, Latin American demand for comedy is falling at a faster pace while demand for horror is dropping at a slower rate. Drama and content for children are barely growing while action, adventure and animation are accelerating rapidly. Identifying such pockets of growth can act as a valuable input for content decision making, for example, helping media networks and production companies look for fresh ideas to acquire and develop content within genres that are gaining traction.

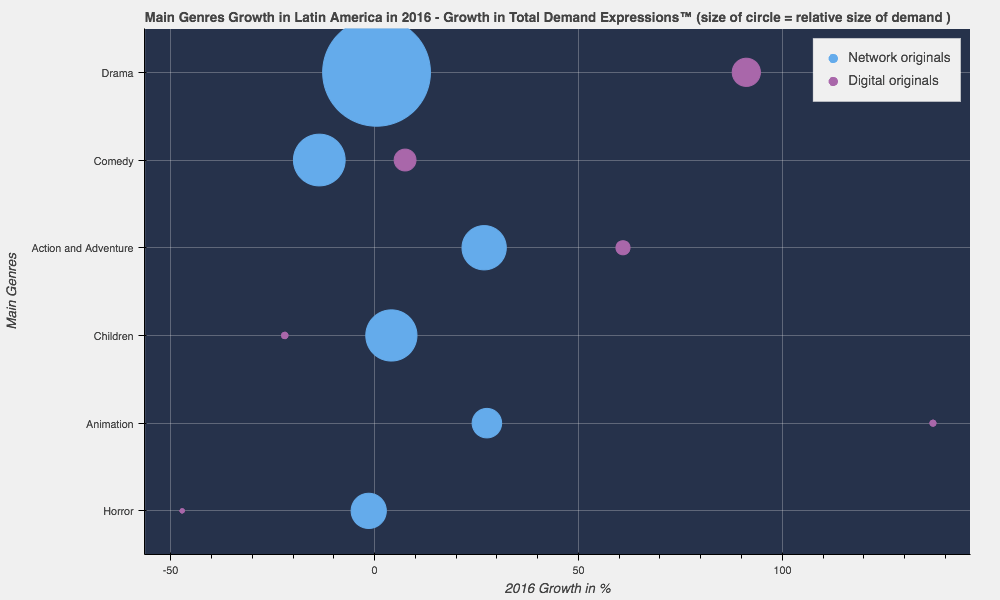

However, growth opportunities are not necessarily restricted to expanding genres. Deeper analysis has revealed that digital originals in Latin America are gaining ground on declining genres like comedy, and multiplying their demand in low-growth genres like drama. In high-growth genres like action and adventure and animation, digital originals are increasing their demand at a much faster rate than the rest.

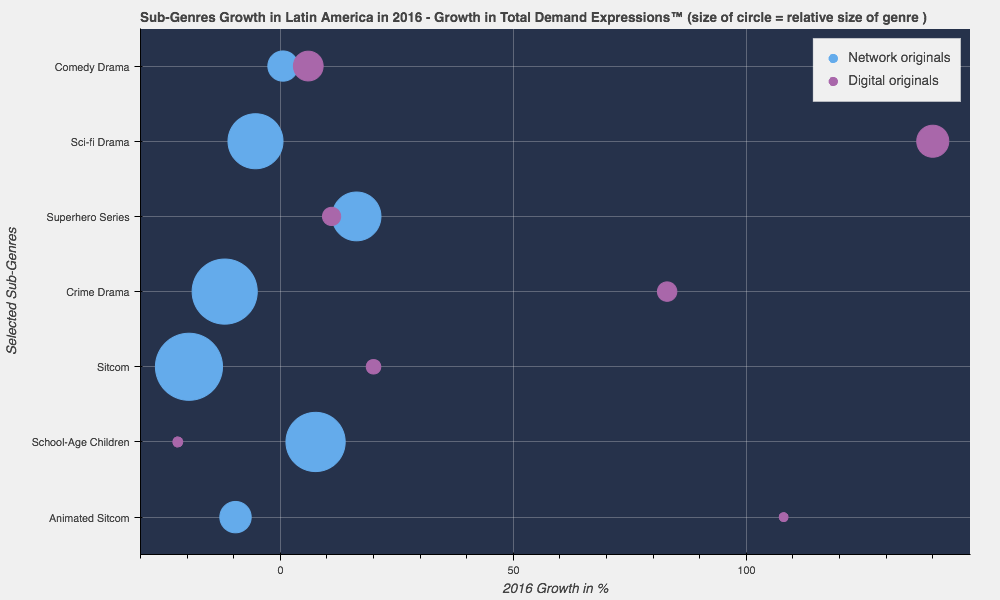

Digital originals are outgrowing their traditional network competitors in key genres in Latin America, in part, because they are starting from demand levels that are significantly smaller. Closer inspection reveals, however, that they are also doing a fantastic job at converting overlooked sleepy sub-genres like sci-fi drama into engines of growth, creating content such as “Stranger Things” and “Sense8”, and in doing so, widening the sub-genre’s appeal.

In other sub-genres, digital players are producing content embedded in the region’s local culture as a tactic to gain an edge over competition. “Narcos” and “Club de Cuervos” are banner examples of this strategy working in the crime drama and comedy drama sub-genres.

Overall, in Latin America, digital originals are enjoying spectacular growth in sci-fi drama and crime drama, sub-genres where traditional network originals are having difficulty holding on to their existing audiences.

Measuring and tracking demand within a genre and sub-genres, and across markets, uncovers hidden value to both traditional and new entrants. It helps them test hypothesis to identify engaging ingredients and more importantly, to generate actionable recommendations to grow their audiences.

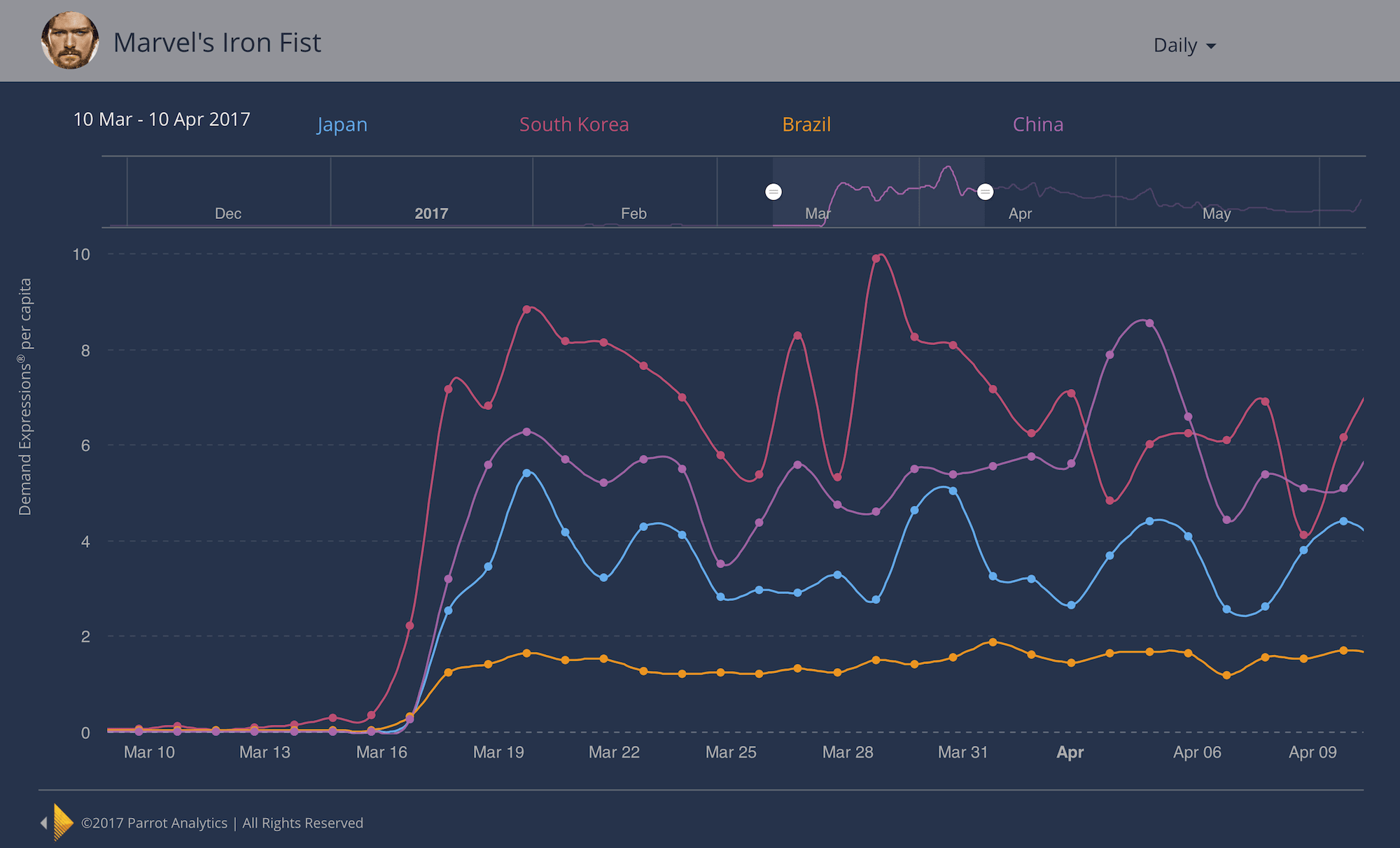

A recent finding regarding the demand for “Marvel’s Iron Fist” illustrates this point: Iron Fist was falling faster than comparable titles within the sub-genre of Superheroes in the US – but in Latin America, Brazil was bucking the trend. In this regard it is our hypothesis that the demand for this show is being sustained by a loyal set of fans with close ties to Brazilian martial arts like Capoeira and Jiu-Jitsu. Interesting enough, similar demand trends were found in markets where martial arts have strong followings like China with Kung-Fu, Japan with Karate and South Korea with Taekwondo.

Understanding genre trends is important but comparing demand across geography and genres and sub-genres is essential to dissect always-connected global audiences that engage daily with any TV show. Content creators and distributors that do not actively pursue this level of understanding may lag behind in the long run as they fail to foresee opportunities and threats in a rapidly evolving competitive landscape.

Alejandro J. Rojas

Parrot Analytics, Regional Director