Image: Good Girls Revolt, Amazon

The cancellation of Good Girls Revolt by Amazon shocked many in the industry. The period drama attracted generally positive reviews after its release on October 28th and, according to data from its producer Sony Pictures Television, had twice as many viewers than Amazon’s most well-known show, Transparent. However, on December 2nd 2016 Amazon decided to cancel Good Girls Revolt with no stated reason, leaving Sony scrambling to sell the show to another network. Given the favourable reviews and reportedly high viewership, why did this show become only the second Amazon Studios title to be cancelled after a year? To get a fuller picture of Good Girls Revolt’s popularity, the demand for the show is compared against other Amazon titles to see if it truly deserved to be let go.

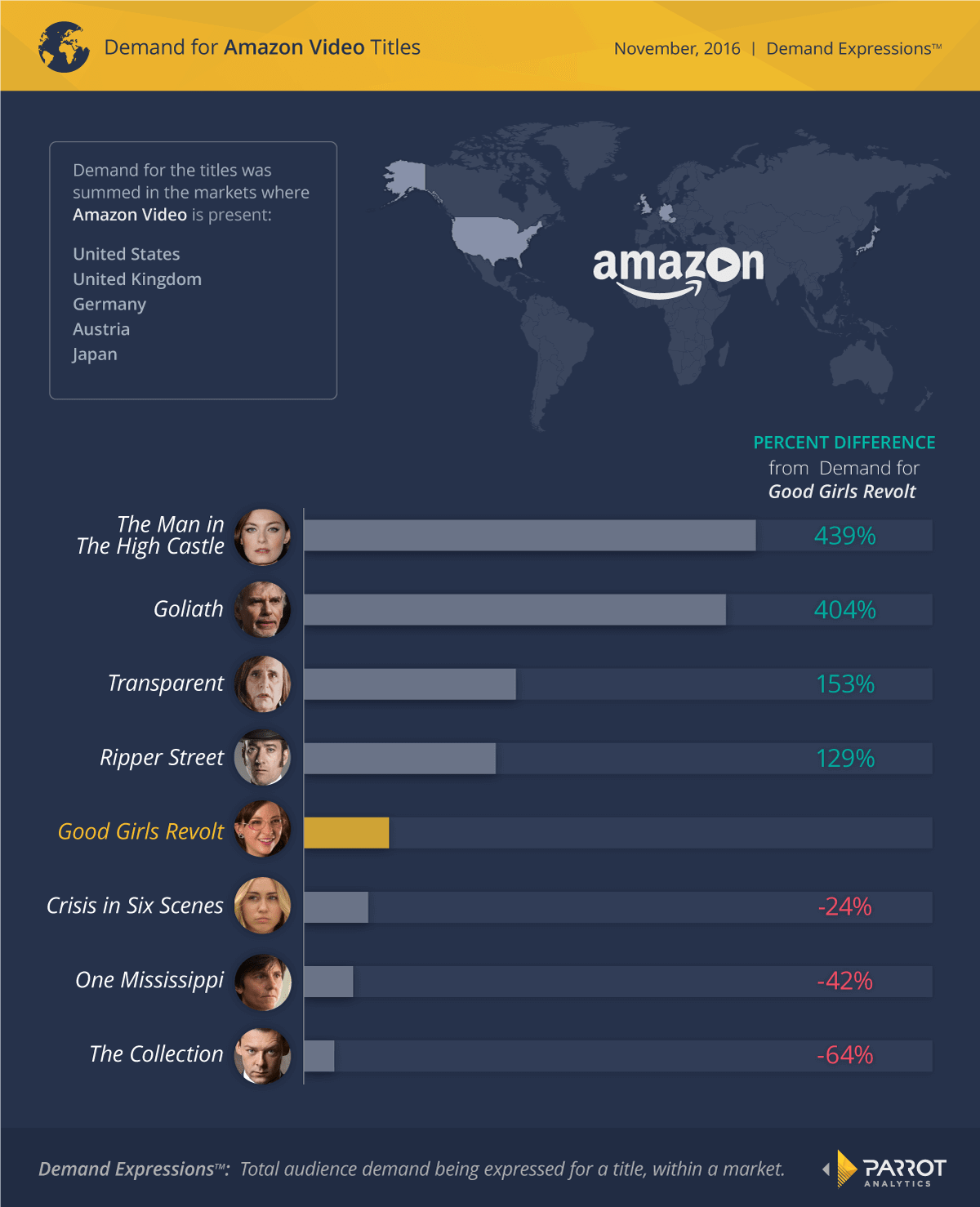

The demand for Amazon’s titles that aired in October and November was summed over November in the markets where Amazon Video is present: the United States, the United Kingdom, Germany, Austria, and Japan (this analysis was completed prior to Amazon’s global roll-out). Though The Man in the High Castle aired in 2015, it is included as a comparison and in fact has more demand than any other recently-airing series:

In addition to The Man in the High Castle, Good Girls Revolt had less demand than three other series. Fellow first season show, Goliath, had over 400% more demand, while Ripper Street (in its fifth season) had 129% more demand than Good Girls Revolt. In contrast to the data provided by Sony, Transparent has over 150% more demand in Amazon’s markets than the cancelled show.

Many reasons for this discrepancy exist: Parrot’s demand measurements capture not only consumption, but also other indicators of popularity from many data sources, such as social media and blogs, to arrive at a holistic, all-encompassing audience demand measurement. More people may or may not have watched Good Girls Revolt, but as measured by demand, it simply did not generate the same level of popular and critical attention as Transparent, which won two major Emmys in September. Amazon may value a less-watched but buzzier show over a low-key but solid performer if the buzzier show attracts more new subscribers to its platform.

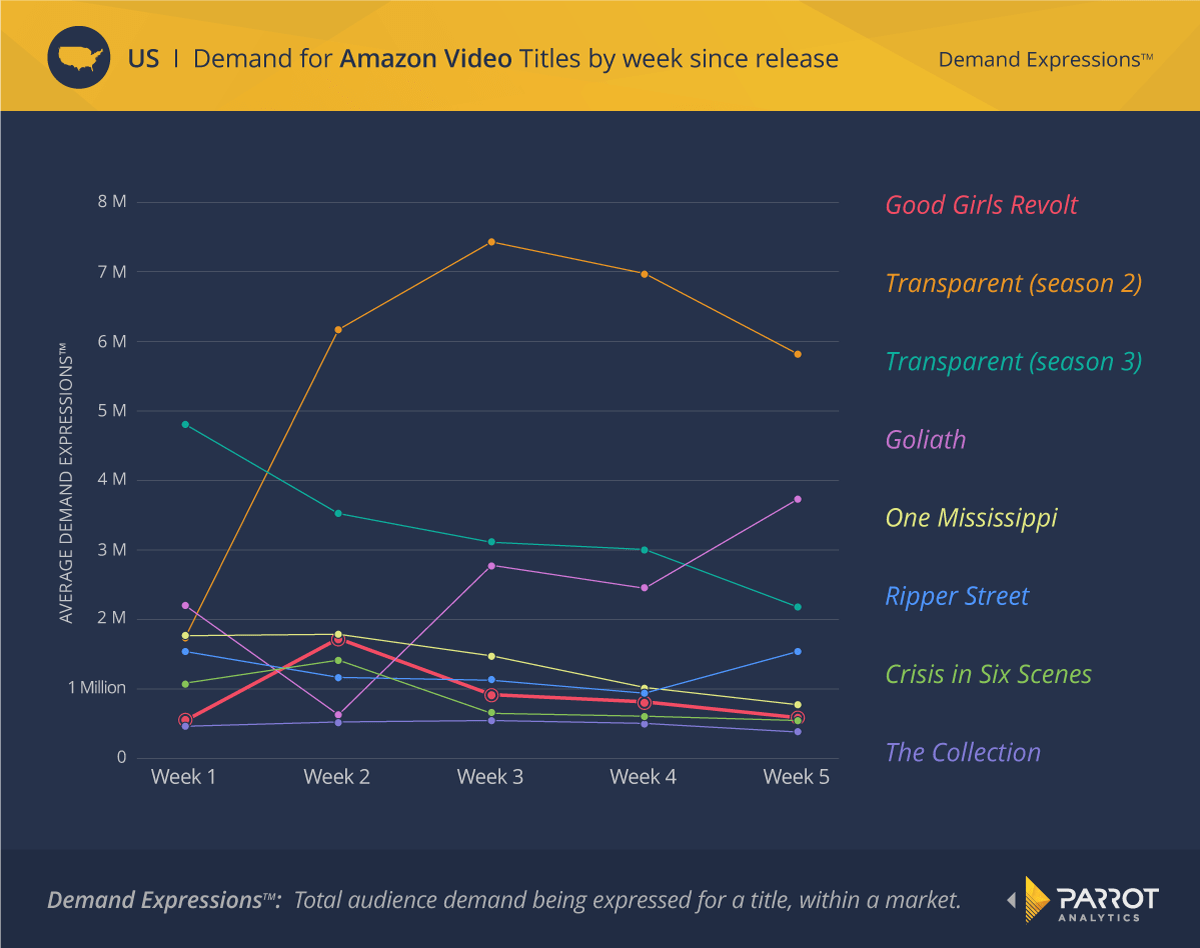

In addition, Transparent has over twice the popularity of Good Girls Revolt even into its third season. To see if Good Girls Revolt had the same potential to maintain its popularity from season to season, the patterns of demand for these Amazon shows are compared by week since their latest release.

While Good Girls Revolt grew in average demand during its second week, overall its demand declined after its release. Another new series for autumn 2016, One Mississippi, also declined over time but was renewed for a second season, likely because its demand was higher than Good Girls Revolt. However, two other freshman series which are yet to be renewed, The Collection and Crisis in Six Scenes, had lower demand than Good Girls Revolt; based on these results, their chances of reaching a second season do not seem high. In contrast, demand for Goliath grew by 70% from the first to fifth week after its release, making it the clear winner in this class of Amazon titles.

The demand after Transparent season two and season three is compared to these new shows. The second season climbed by over 200% in five weeks, making it a no-brainer for Amazon to renew. Therefore, even though Transparent’s third season declined in demand faster than Good Girls Revolt, its high baseline popularity means that it remained more in-demand than most of the first-season shows. Unlike Transparent season two, the pattern of demand for Good Girls Revolt shows no indication that the next season would be any more popular, contributing to its cancellation.

Amazon naturally based its decision to cancel Good Girls Revolt on data from the markets where it is present, but this covers only five countries; was it popular elsewhere in the world? Using demand data, the popularity of Good Girls Revolt after its release was found and ranked in over 100 countries. The United States only ranked 24th by demand for Good Girls Revolt, overtaken by markets such as South Korea, Denmark, Russia, and South Africa. The other four Amazon Video markets ranked even lower. Good Girls Revolt does have a strong audience in some countries, just not the ones where Amazon Video is present. On the bright side, this global appeal should help Sony Pictures Television find a favourable, new home for the series.

Amazon’s decision to cancel Good Girls Revolt becomes less mysterious after comparing demand for the show to that of its competitors. In markets with Amazon Video, Good Girls Revolt had less demand in November than several other titles, including fellow freshman series Goliath, Transparent, and The Man in the High Castle (which has not aired since 2015). After its release, demand for Good Girls Revolt generally declined in the United States, while demand for Goliath and Transparent’s previous season grew, making those two shows better candidates for renewal. While Good Girls Revolt did not do well in Amazon’s markets, it had more popularity in a variety of countries in Asia and Europe, indicating that it could still be a successful show in the right market. From Amazon’s point of view, though, its cancellation was almost inevitable.