Image: Cobra Kai, YouTube Red

Parrot Analytics provides a broadcast TV measurement system, also able to measure SVOD/OTT audience demand. Our system uses a wealth of global data source inputs every day, resulting in the industry-leading cross-platform global TV demand measurement rating that we refer to as “Demand Expressions”.

We believe that the data we are currently collecting will soon not only be used to measure streaming television (all premium content across all platforms) – but to predict the success of future TV shows, writes our CEO Wared Seger: “We can now look at the popularity of certain genres, sub-genres, themes, cast members, show-runners and even more accurately predict what kinds of content will resonate with viewers in certain territories around the world.” – With this exciting future in mind, let us now take a look at the US domestic numbers.

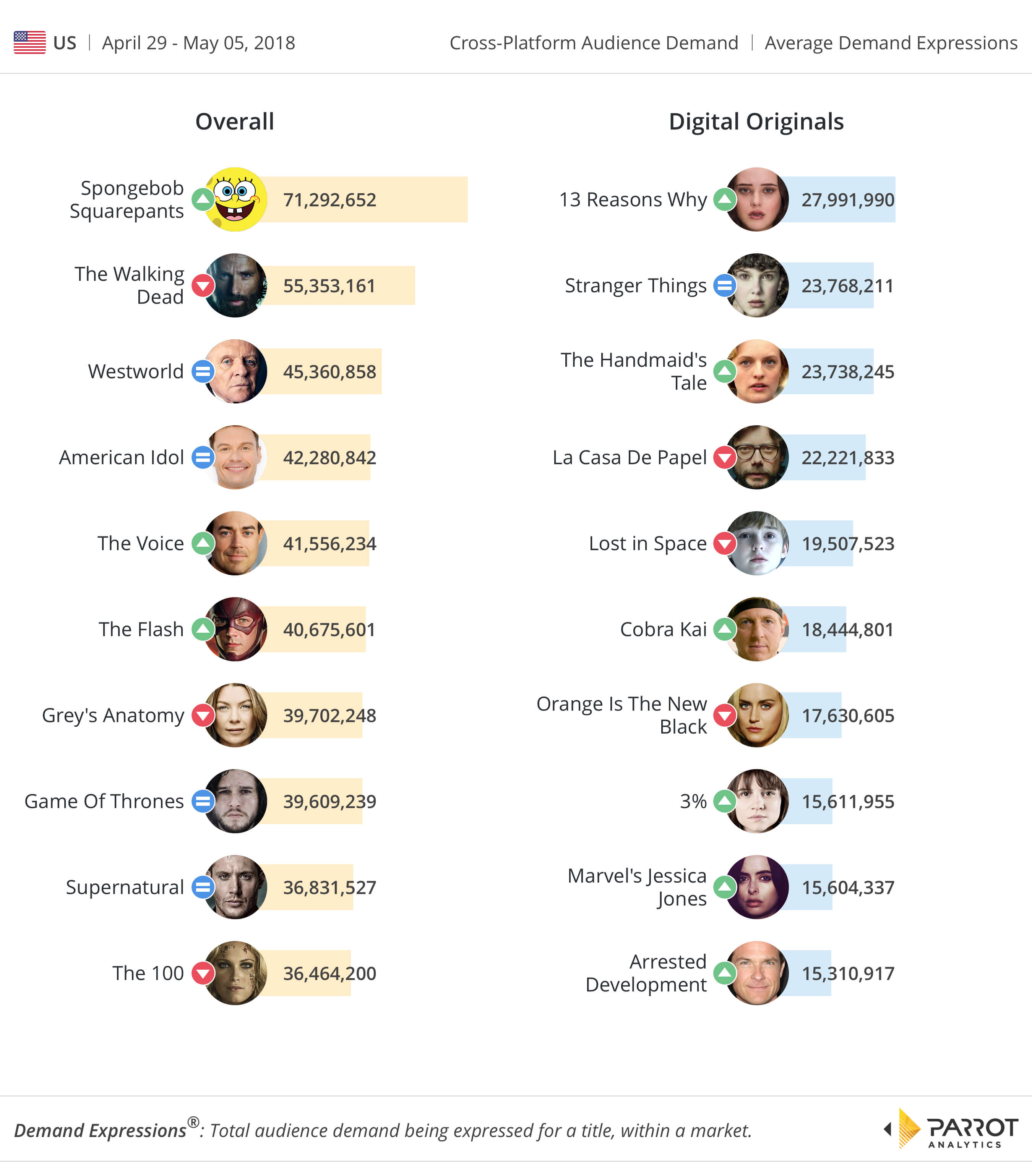

This week there is a bit of “upheaval” in our latest chart as more established Netflix titles are being displaced by newer series from YouTube Red. Despite this, 13 Reasons Why is at #1, demand has increased 134% compared to last week after the release of a teaser trailer on April 30. Netflix has announced the launch date for the teen drama series’ second season; the show is set to return to the streaming giant on May 18.

Cobra Kai premiered on May 2, a sequel series to The Karate Kid; the comedy-drama series on YouTube Red was produced by Jon Hurwitz and Hayden Schlossberg – the duo best known for the Harold & Kumar films. In the week ending May 5, Cobra Kai had 18.4 million Demand Expressions making it the 6th most popular digital original in the US; in the previous week during the lead up to the release, the reboot series was only ranked #26.

Over three decades have passed since its inspiration became a cultural phenomenon, and despite several sequels, a reboot and a remake, that is quite a lot of time for something like a new television series on a digital platform to contend with to attract new audiences. Nevertheless, YouTube Red has done well with this show: Cobra Kai‘s peak demand thus far is more than twice as high as any other series the platform has previously released to paid subscribers; Bad Internet held the highest peak demand record prior to Cobra Kai.

Also, two weeks after launch, The Handmaid’s Tale had slightly more demand compared to Money Heist (La Casa De Papel). And further towards the bottom of the chart, we have two returning series that we haven’t seen in a while: 3%, a Portuguese-language Netflix original series that is set in a world sharply divided between progress and devastation. The thriller series, its second season premiered on April 27, moved 24 places to be the 8th ranking series. Also returning is Arrested Development, which had the highest increase in demand for titles on the digital originals chart compared to the prior week (a 182% demand bump), on the back of its 5th season renewal announcement.

Overall audience demand for network broadcast series waned off; it appears audiences chose to spend their time elsewhere – in general, we have observed little change in demand this week compared to last week. Notably, however, HBO’s Westworld which this week holds the same ranking as the week prior, decreased slightly in demand after a pivotal episode (warning, spoiler alert) dramatically shifted the location to a different theme park. Elsewhere, ABC’s American Idol decreased slightly in demand also compared to last week, having now aired half of the current 16th season. On May 4, it was announced that ABC would renew the revival series for another season.