Image: Running Man (런닝맨), Seoul Broadcasting System

Parrot Analytics’ revolutionary approach to capturing and measuring audience demand for TV content across all platforms in 100+ countries, through the application of our industry standard demand metric, is now offering unprecedented insights into exactly how much demand there is for a specific title within a specified market – in this case, China.

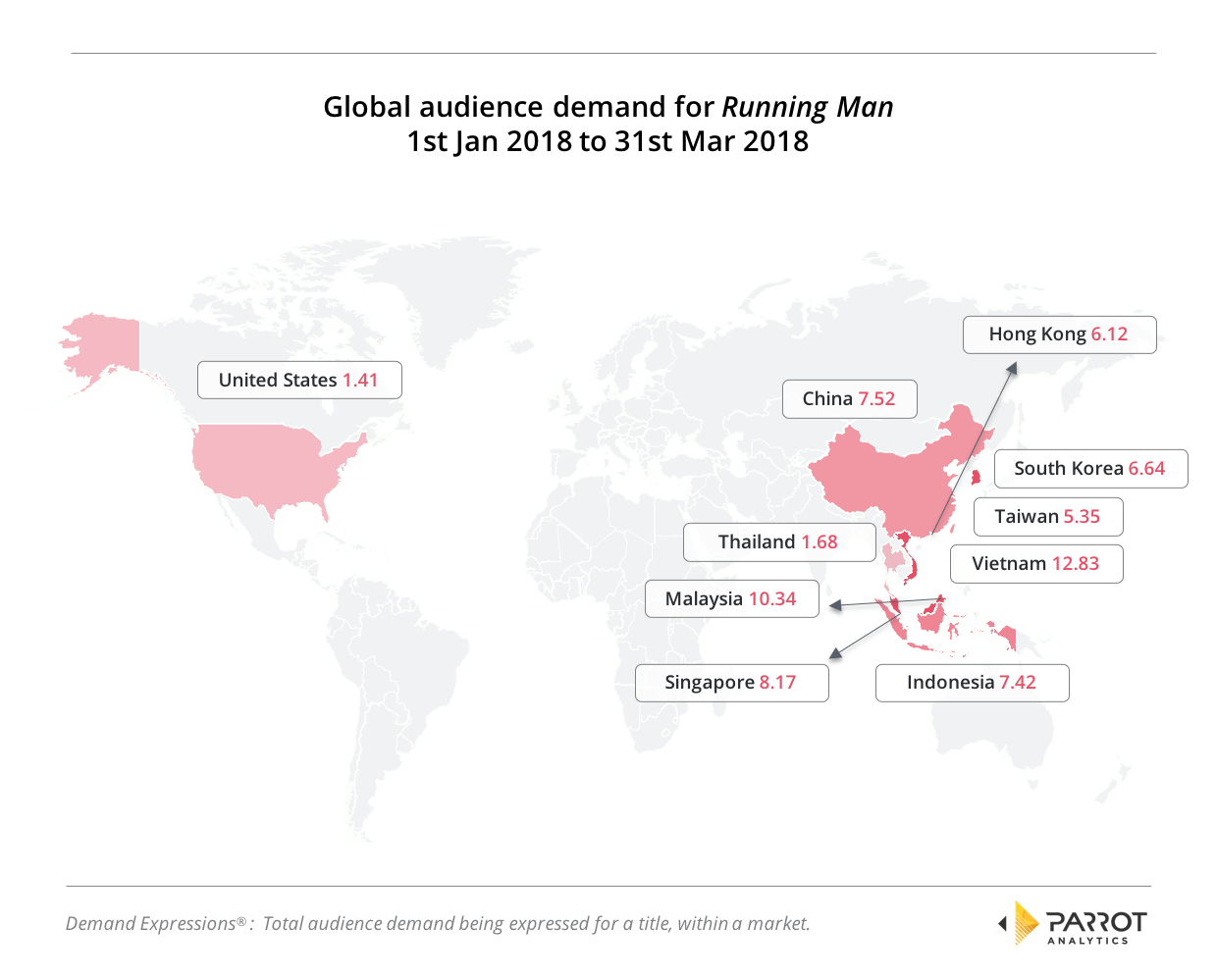

Audience demand in China for foreign TV content has remained high over the

first quarter of 2018 with South Korean variety superhit

Running Man dominating screens across the country. In this

analysis, we take a look at which TV content was the most sought after in

China for the first quarter of 2018:

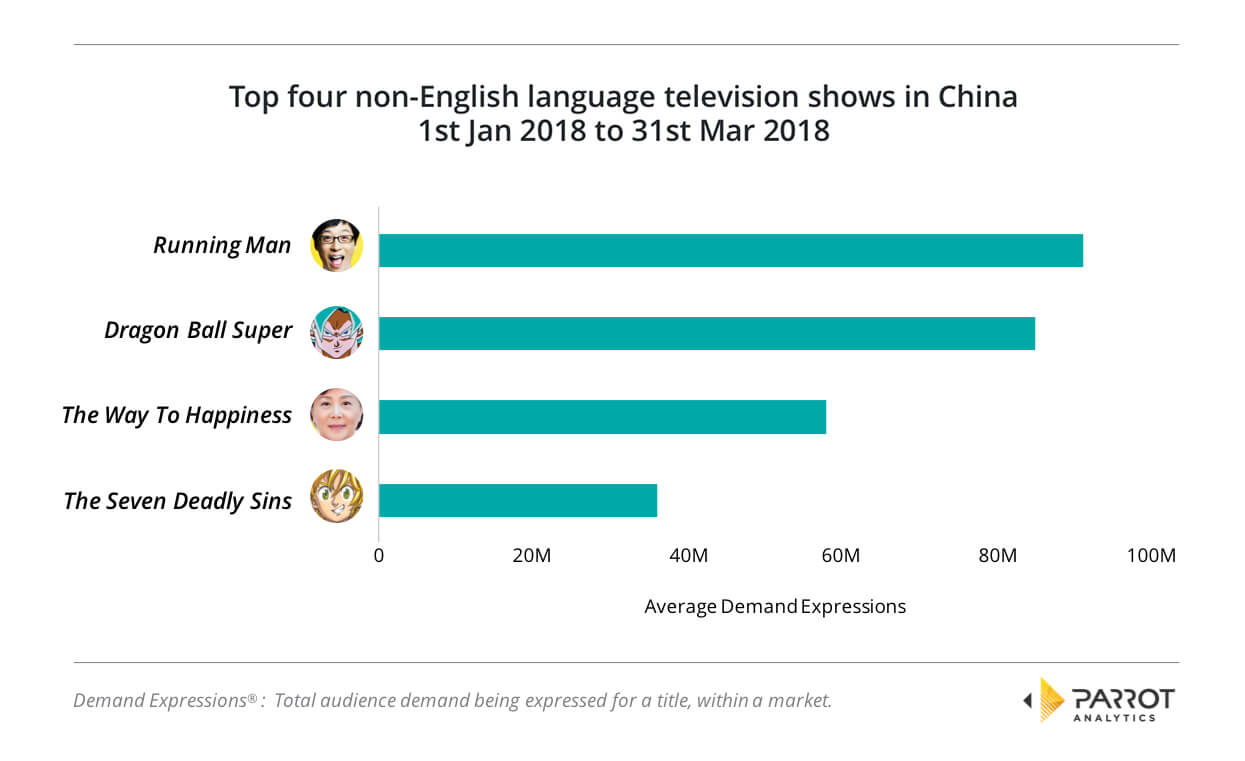

Running Man tops the list of the most in-demand overall TV show of non-English origin

With 91.7 million average daily Demand Expressions (DEX), this South Korean SBS production which pits 7 celebrities against each other in a medley of games and races throughout various locations in Korea, ran away with the most in demand non-English original, edging out regional titans like Dragon Ball Super and The Way to Happiness.

Broadening our focus to how well Running Man is doing

elsewhere internationally, it becomes apparent that whilst the show is 5

times as popular in China as in the US, Vietnamese demand for this

particular title is actually on average 1.5 times higher than Chinese

demand – and almost double that of demand in South Korea..

Dragon Ball Super and The Seven Deadly Sins resonate with Chinese TV content consumers

Japanese Animation mega-hit Dragon Ball Super is clearly a fan-favorite amongst Chinese viewers. The show enjoys a long-entrenched fan base that has welcomed the arrival of this next chapter in the Dragon Ball franchise from creator Akira Tokiyama. The series – which finished airing in March 2018 – has already cemented its place as a success among Chinese content consumers by generating 85.4 million average daily Demand Expressions during the first three months of 2018.

Close on its heels is the highly popular adaptation from the hit Manga animation series, written and illustrated by Nakaba Suzuki, The Seven Deadly Sins. With 36.2 million average daily Demand Expressions The Seven Deadly Sins is the second Japanese Anime import to land in the top 5 non English titles amongst Chinese audiences.

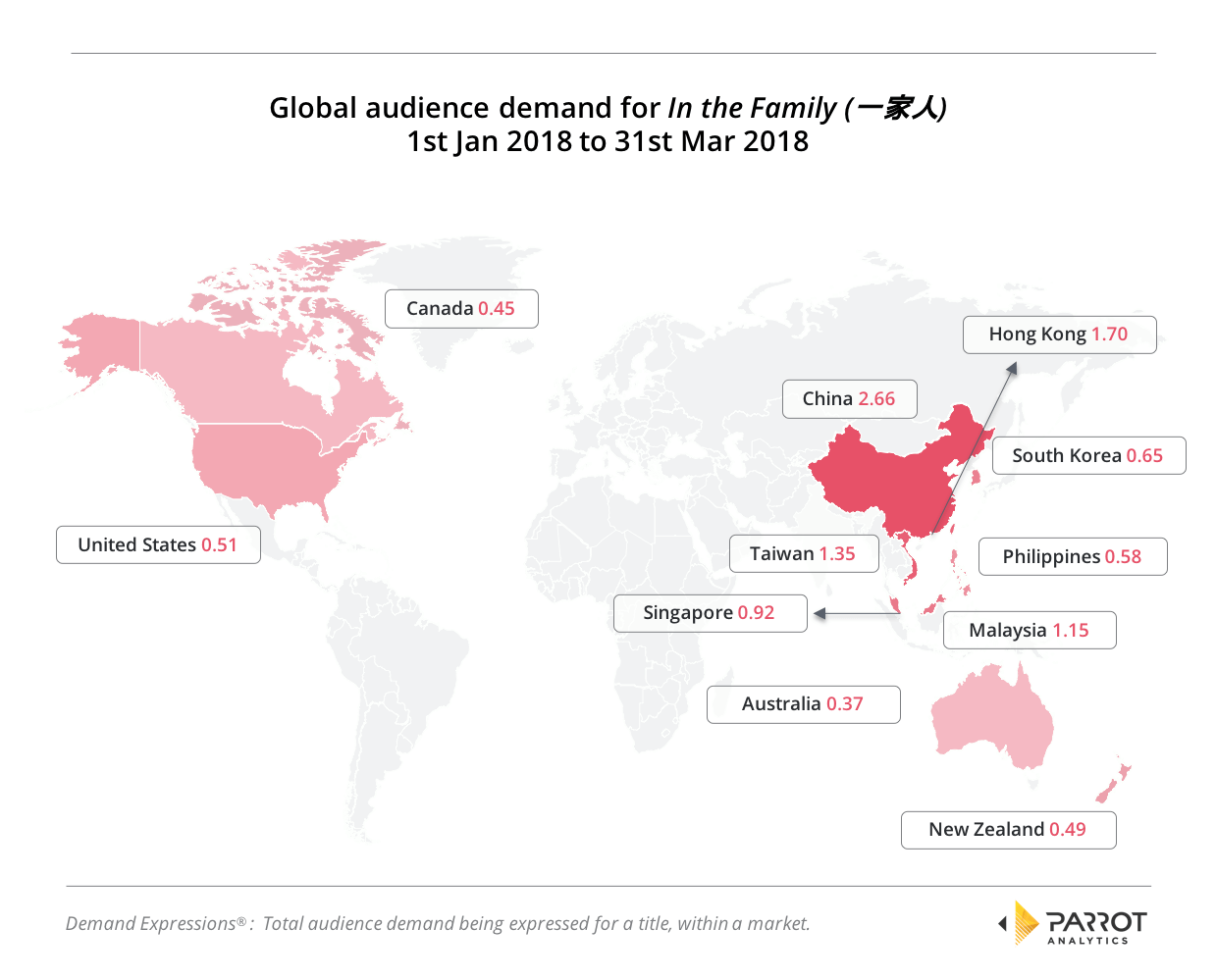

Taiwanese night-time soap In the Family (一家人) enjoys double the demand in China than Taiwan

In the Family (一家人) is somewhat of a sleeper success in that it is widely regarded, perhaps unfairly, as having a heavily rote plot propelled by ham-fisted acting and a poor production value. Despite this, the show’s traditional ratings show that it captured significant viewership in Taiwan, and per our Demand Expressions metric, a notable share of demand in both China and Hong Kong.

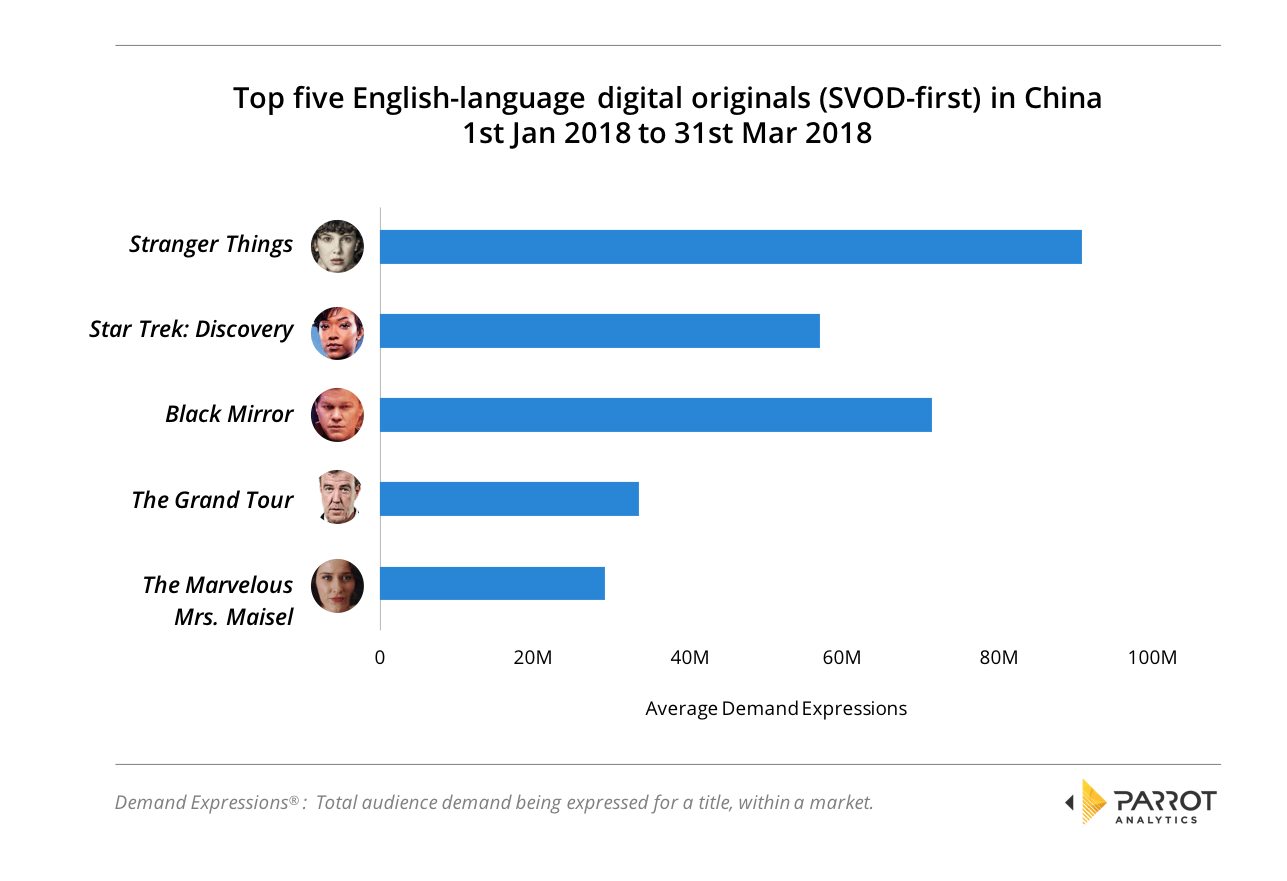

Stranger Things tops demand for English language digital originals

When it comes to which English language digital originals titles

(SVOD-first) were most sought after by Chinese TV audiences, there is one

show in particular that stands head and shoulders above the remaining four

titles in the category: Stranger Things beat out second

placed Black Mirror by close to 20 million average daily

Demand Expressions in the first quarter of 2018.

The show’s appeal has resonated with almost every television market we have analyzed, and China has proven to be no exception. Star Trek Discovery has also enjoyed success in China over the first quarter with just over 50 million average daily Demand Expressions.

Amazon’s hugely successful motoring show The Grand Tour also placed highly in our popularity rankings in China, with 33.5 million Demand Expressions, followed in fifth position by American period comedy drama The Marvelous Mrs. Maisel with just under 30 million Demand Expressions to its name.

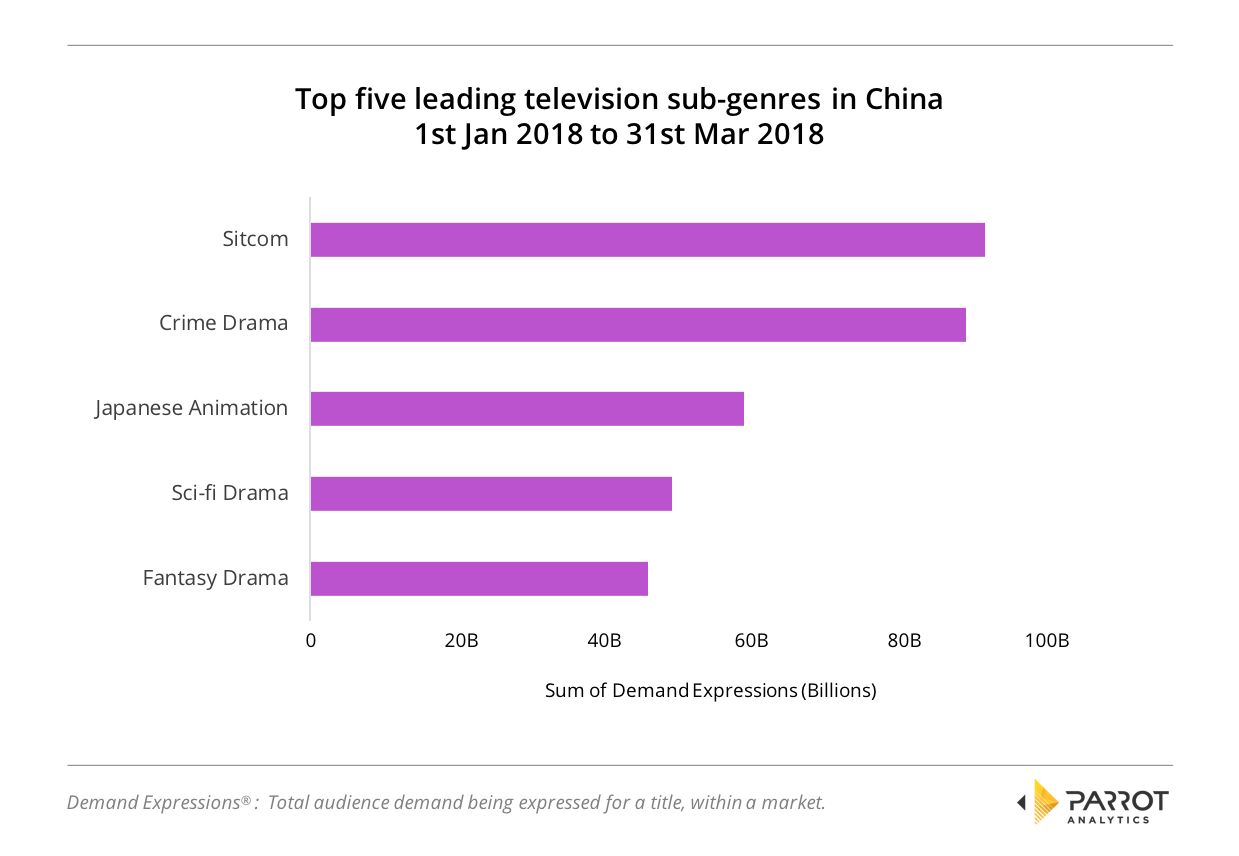

Sitcoms enjoy pole position in demand rankings in China as the most popular sub-genre

Sitcoms stand out as the most in-demand sub-genre among Chinese TV

consumers across all TV series, as the following chart reveals:

Both local productions and foreign productions are driving this; one example is the Korean import The Sound of Your Heart.

In the first quarter of 2018 alone, this highly anticipated sitcom series, based off the Webtoon of the same name, has enjoyed massive success in South Korea where it became the most watched web sitcom of all time after being broadcast on internet giant Naver’s TV Cast.

The show has now caught fire in China too – this despite the current ban in China on Korean entertainment.

Crime Drama second in-demand in China

As just one example in this genre, it is very unusual for a Japanese drama series to enjoy more than one season on night time television in China, but Galileo has proven to be the exception. Chinese audiences have clearly demonstrated their enjoyment of this highly entertaining series which sees a respected and revered genius physicist nicknamed “Galileo” team up with Kaoru Utsumi (a female rookie cop) in order to solve one mysterious crime after another.

Japanese Animation rates as third most popular sub-genre in China

When it comes to Anime, Japanese productions remain a powerhouse in China. The buzz over the first quarter has been all about the highly anticipated newly released series in the hugely popular Dragon Ball franchise – Dragon Ball Super.

This title has generated over 70 million average daily Demand Expressions over the first three months of 2018. Although the show finished airing in Japan on Fuji TV in March of 2018, it has already established a very strong foothold among Chinese audiences.

Sci-Fi drama fourth in demand rankings buoyed up by shows like I’m not a Robot.

Sci Fi drama remains a top 5 sub-genre in China. One of the standout shows is the South Korean Sci-Fi romanticized drama “I am not a Robot”. The show blends a suspension of reality with an endearing love story about a man who lives in isolation due to a severe allergy to other people, but who falls in love with a woman who pretends to be a robot.

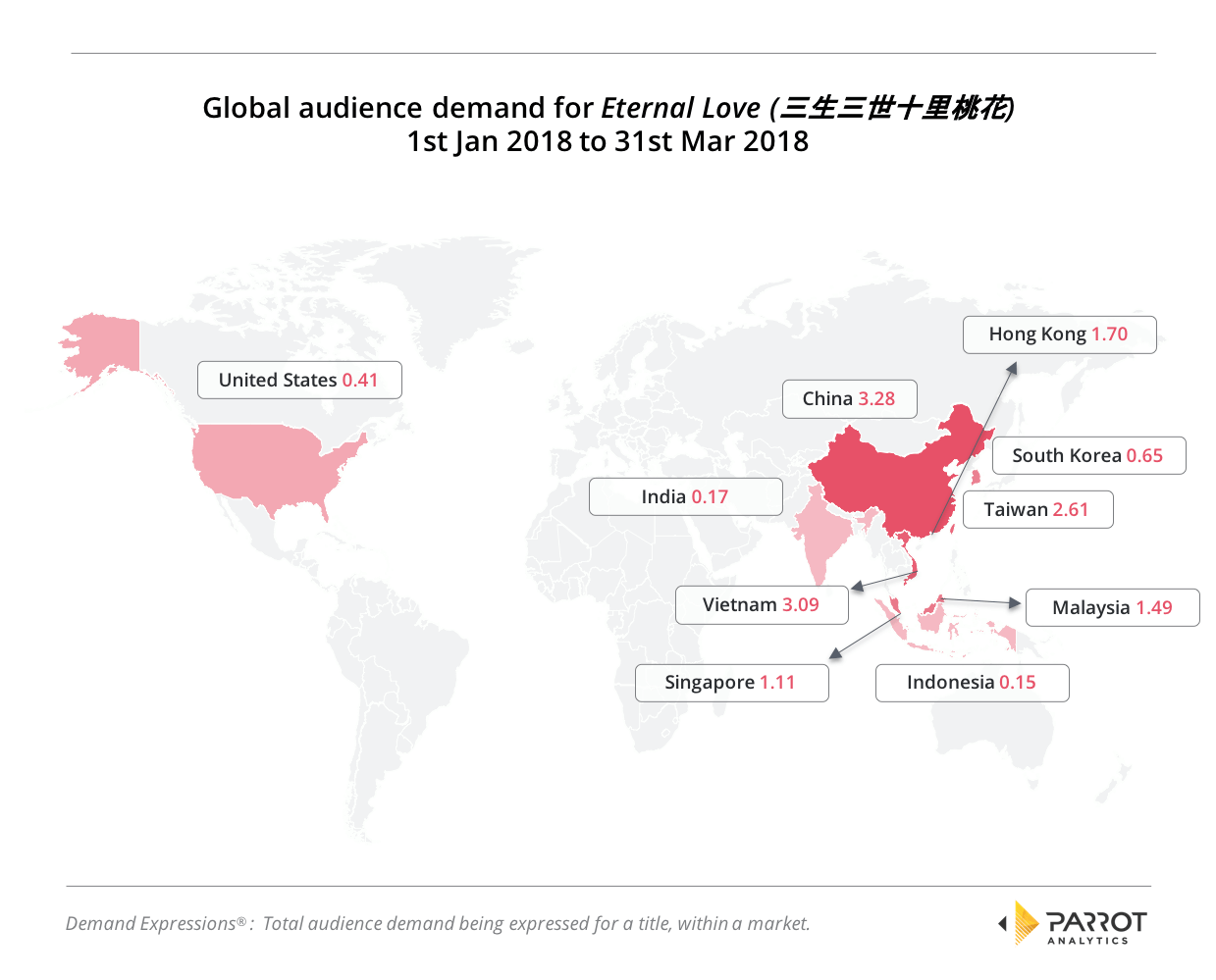

Eternal Love (三生三世十里桃花) massively popular in 5thplaced sub-genre Fantasy Drama

Chinese language Fantasy Drama Eternal Love has proven to be hugely popular among Chinese audiences. The show, which is generating a lot of rave reviews thanks to its fresh take on traditional drama storytelling, remains true to the “soul switching” theme, but in a dynamic and invigorating way. What’s more, there is promise of widening its global audience to include English speakers as YouTube and Viki have undertaken offering English subtitles for the show.

There is a lot of buzz surrounding this show, particularly regarding its eschewing of the traditionally slower paced Chinese Dramas by wrapping up production in just 24 episodes. A cast of fresh faces and an engaging storyline that progresses quickly, coupled with stunning visuals, is proving to be a winning formula both within China and beyond.

The show’s global appeal is strongest in Vietnam, Taiwan and Hong Kong, with Vietnam in particular expressing strong demand. Penetration into the US market is notably less, however, garnering 5 times less demand in the US as in China.

From China to the world

Looking ahead to the rest of the year it remains to be seen how well Chinese language shows will do in overseas markets, but the trend looks positive as content providers and online communities continue to increase accessibility to non-English productions through subtitles.

With television content now a truly global cross-platform phenomenon, Parrot Analytics will continue to ensure that TV content is understood like never before in all markets, including China, and 100+ others around worldwide.