Content players in Asia are marking their spots in a radically changing universe. This year’s ContentAsia Summit was all about the humongous, super-charged effort going into creating whole new stories and building a production ecosystem to support them.

Parrot Analytics CEO Wared Seger presenting a keynote on data and analytics for the streaming wars.

In this post, we’ll share the top ten takeaways from the presentation that you need to know if you’re a part of the global entertainment industry.

#1: Attention is finite.

First thing’s first – we live in an attention economy, a hyper-competitive landscape of content in which consumers can access virtually whatever they want whenever they want it. Each person is given 24 hours in a day, which means when demand increases in one area, it decreases in another. Multi-screening is a fact, however, we suggest that every consumer can only truly pay attention to a single source of entertainment.

[Read more about the attention economy and the science behind success content decisions.]

Let’s take a look at the specific content that is making an impact in Asia.

#2: Superhero series are in high demand with South East Asian audiences

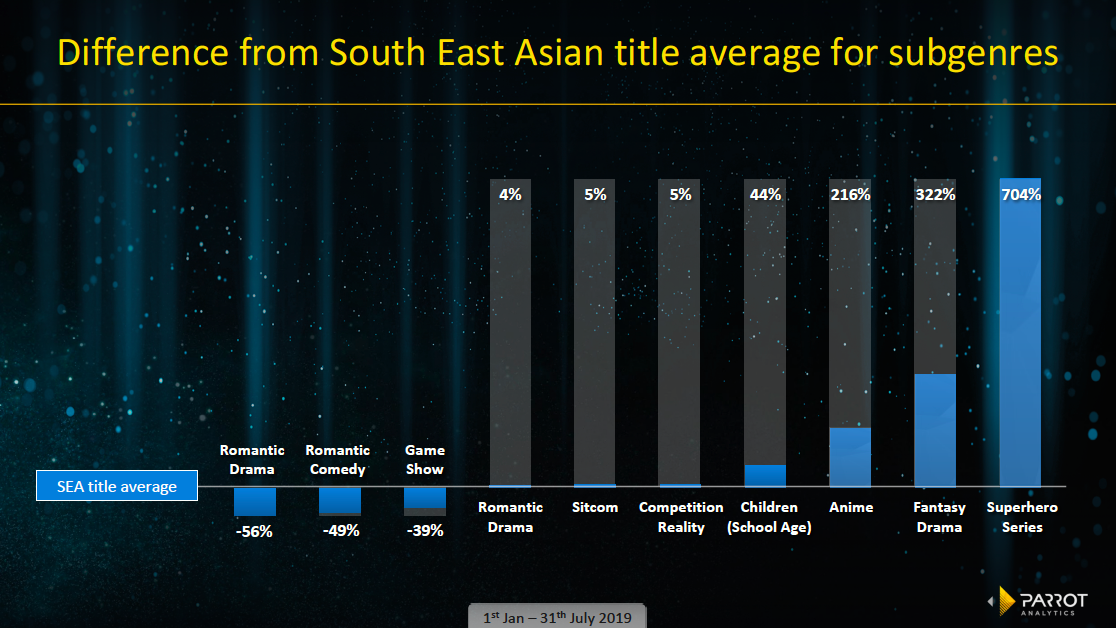

This shows how the average demand for a title in ten evolving subgenres (with a high level of year-on-year change in total demand) in South East Asia compares to the average demand for a title in the region.

For example, an average romantic drama in this region has 56% less demand than the average title. At the other end of the spectrum, the average superhero series has 704% more demand than average!

Producers of new TV shows in the romantic comedy subgenre are starting at a disadvantage against the average title, so execution will be all the more important to make up the difference.

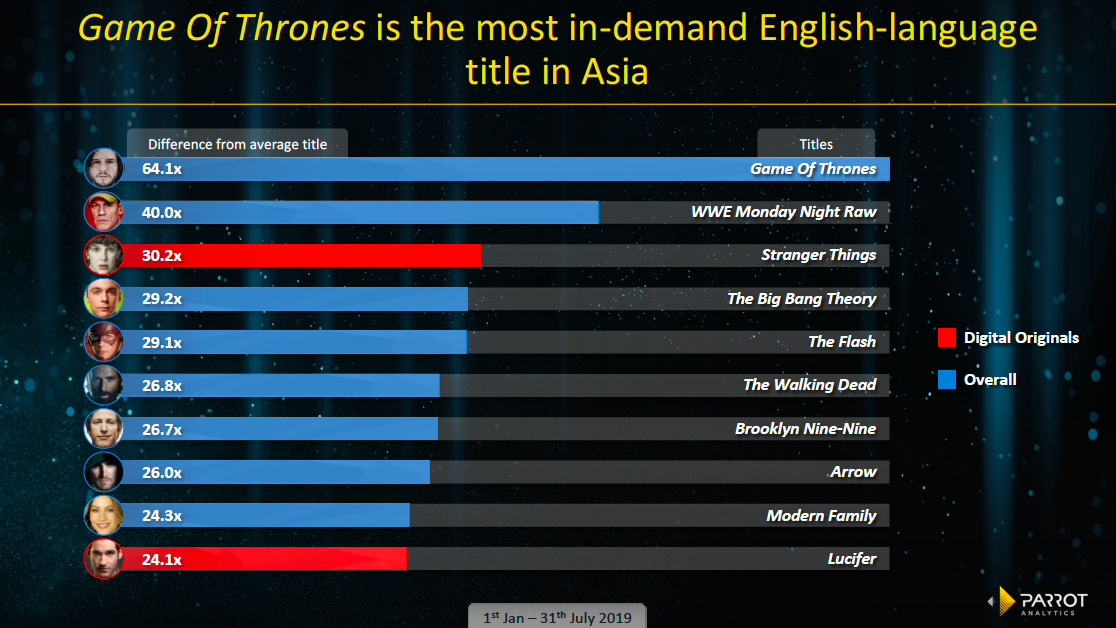

#3: Game of Thrones is the most in-demand English-language title in Asia, and you might be surprised at what’s number two.

Parrot Analytics demand data allows you to have an apples-to-apples comparison between linear and OTT television shows for the first time. This means you can now compare a linear TV show like Game of Thrones with a digital original such as Stranger Things.

[Click here for the definition of a digital original]

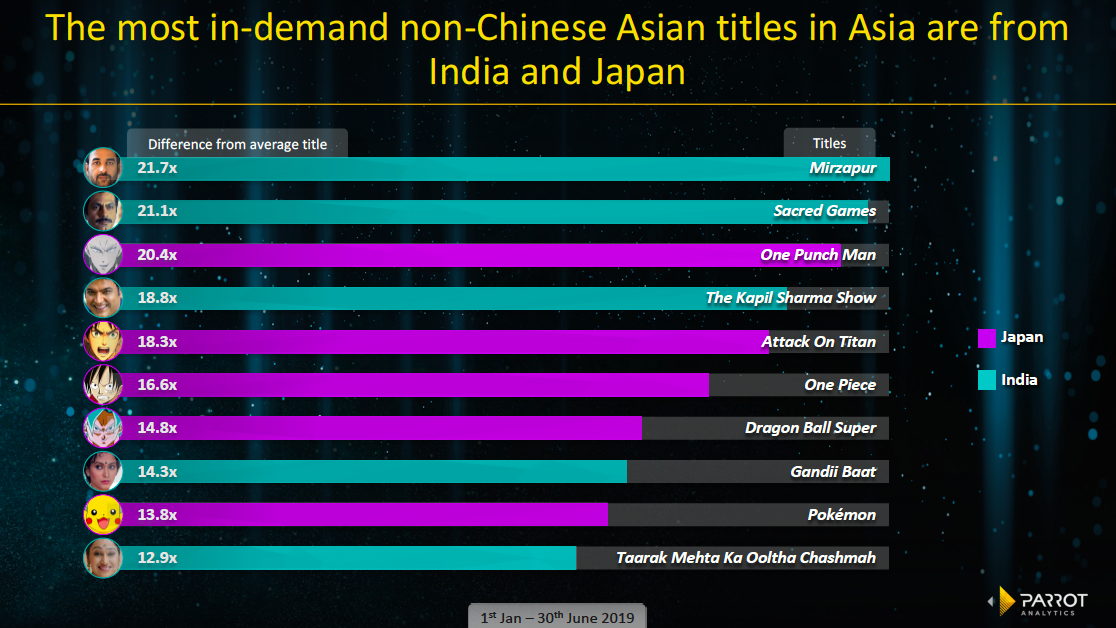

#4: Indian and Japanese titles are the most in-demand non-Chinese Asian titles in Asia

Now let’s look at the most in-demand titles in Asia that are from Asia (excluding China). We can see that Indian content has the highest average demand across the region. Half of the top ten are from India, including the top two shows.

The fact that Mirzapur and Sacred Games are widely available in Asian markets (with the notable exception of China) through Amazon Prime Video and Netflix is likely an important factor in this result.

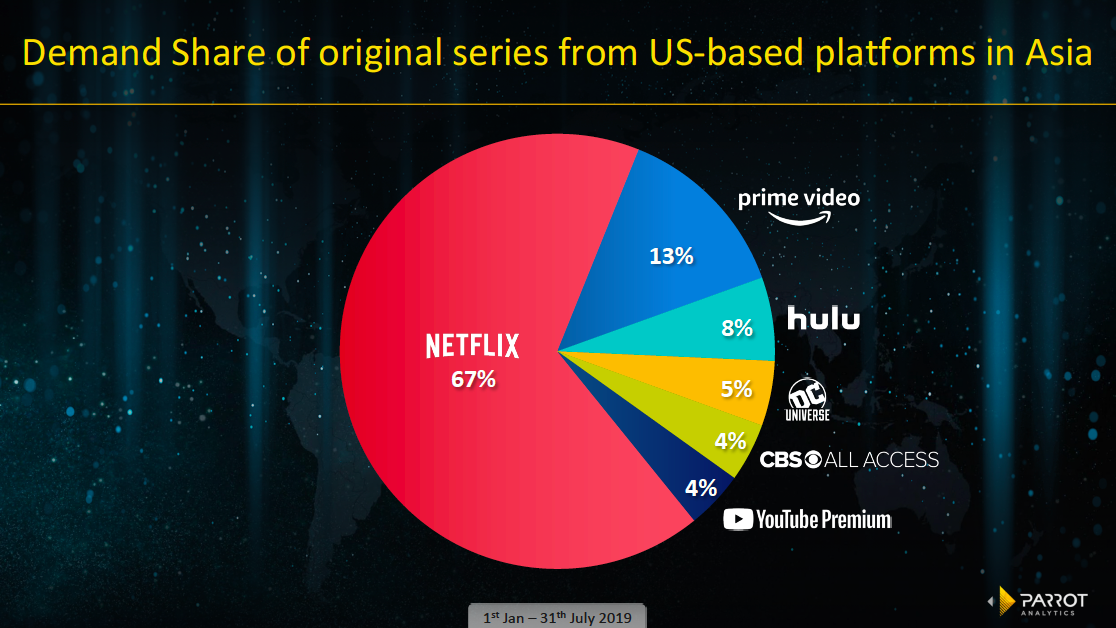

#5: Netflix dominates when it comes to which US-based platform holds the highest share of demand for digital originals

Now that we know how many of the most in-demand new series are digital originals, let’s see which US platforms generate the most demand for their digital originals in Asia. Put another way, this chart shows the total Asian demand for original series from Netflix against the total demand for original series from Amazon and so on.

Netflix originals have a strong majority – 67% of digital original demand is for a Netflix series. Not too surprising a result given the volume of originals Netflix produces.

#6: A drama set in Europe is the most in-demand English-language premiere in Asia for 2019

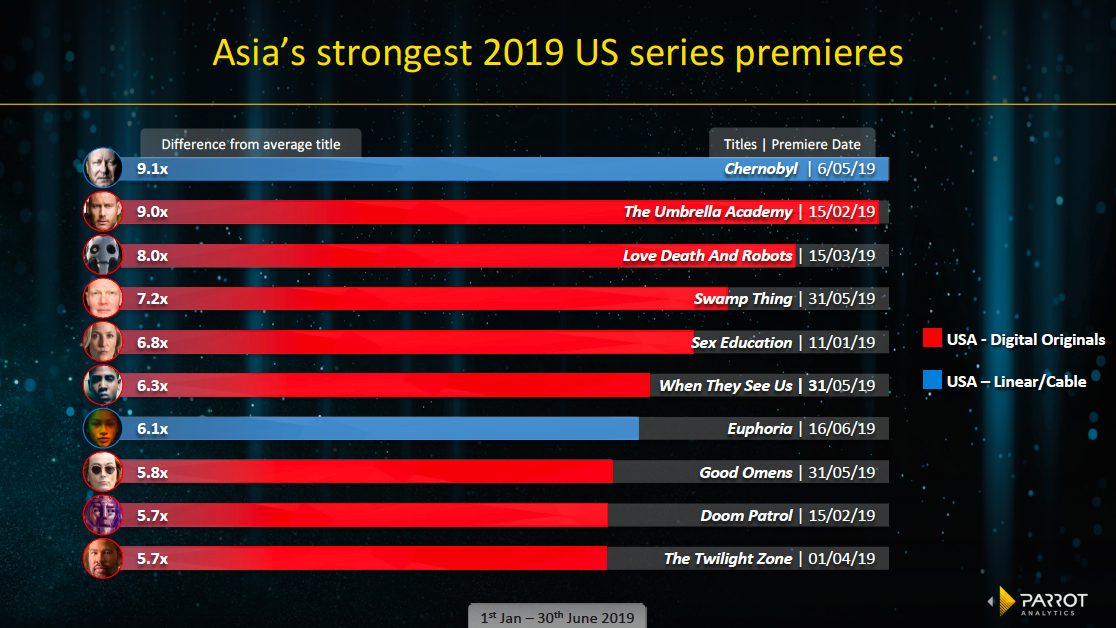

This chart shows the top new US titles in 2019 by average demand across Asia. For a fair comparison, it’s the average demand of the 30 days from the premiere date of each show.

HBO’s Chernobyl has the best demand for its premiere month, but it’s one of only two titles from linear networks. The other eight are all digital original series from platforms like Netflix and Amazon Prime Video, led in Asia by Netflix’s Umbrella Academy.

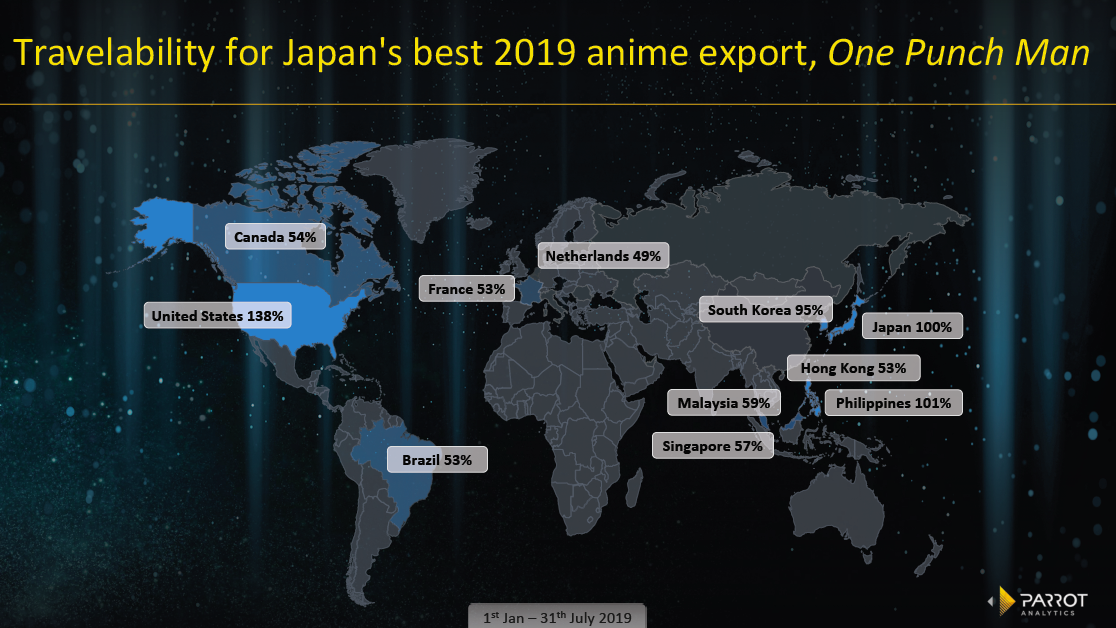

#7: Japan’s best export is an anime title that travels well to the US, Canada, Brazil and the Netherlands.

Japan’s most successful anime export- the anime title with the highest demand outside of Japan in 2019 to date – is TV Tokyo’s One Punch Man. This travelability map shows which countries’ audiences are generating the most demand for the title.

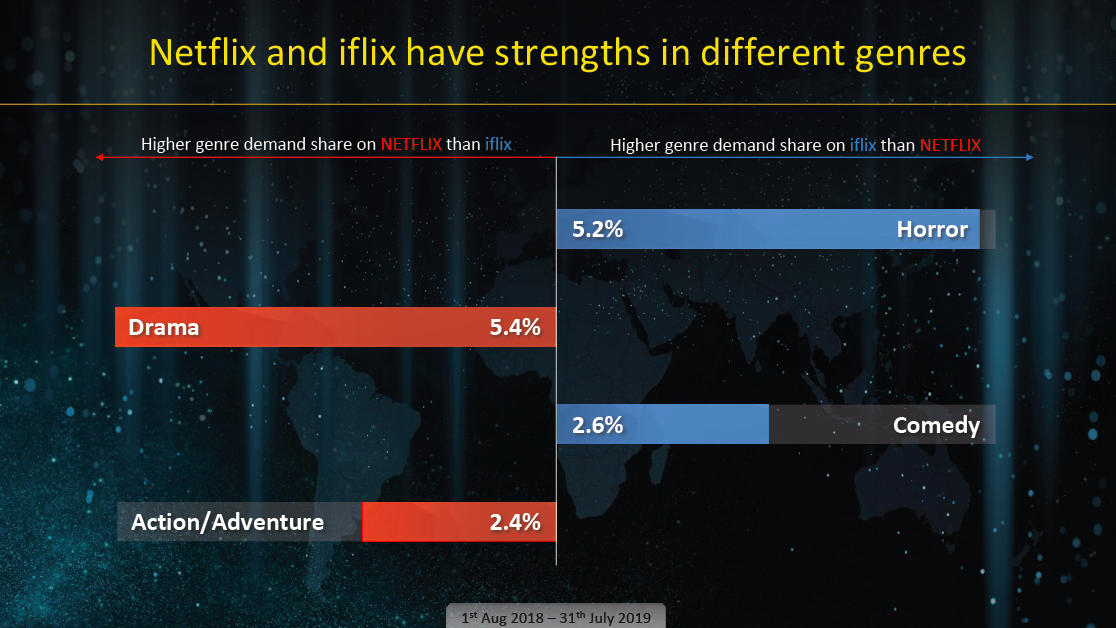

#8: Netflix and iflix are both strong platforms in Asia, but they have wildly different strengths

Looking at the demand shares by genre of scripted content (both original and licensed) within iflix and Netflix, there are some distinguishing factors between the two platforms in Indonesia. Netflix has a larger demand share for its drama and action and adventure titles, while for iflix, comedies and horror have a larger demand share within the SVOD.

These differences may point to the platforms’ strength of appeal to different audience clusters: for example, Indonesian horror fans may find iflix’s catalog more attractive than Netflix’s.

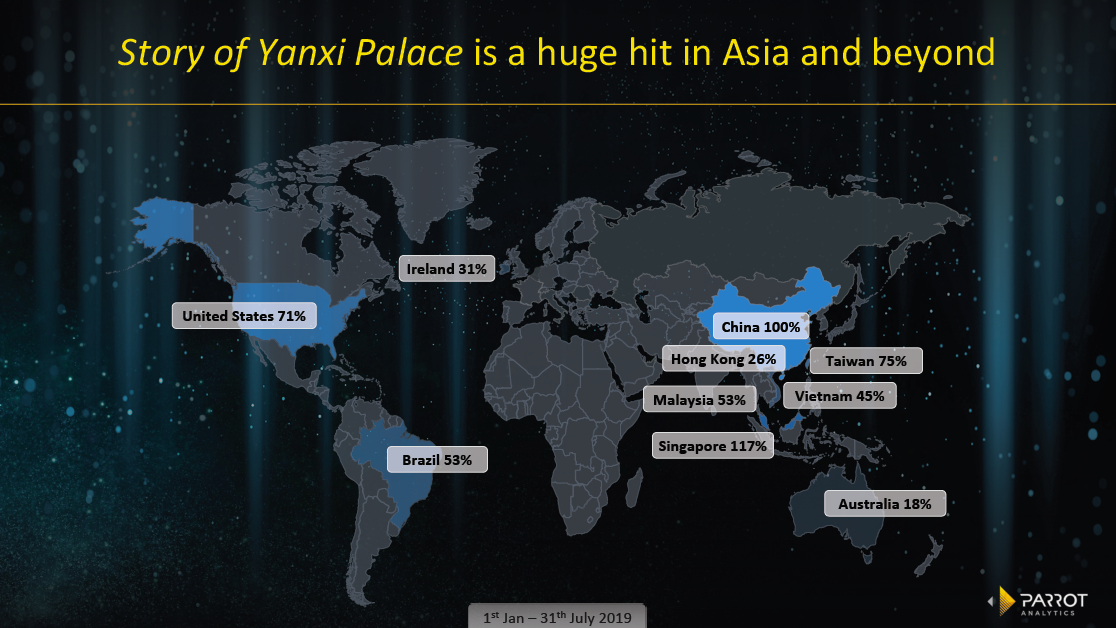

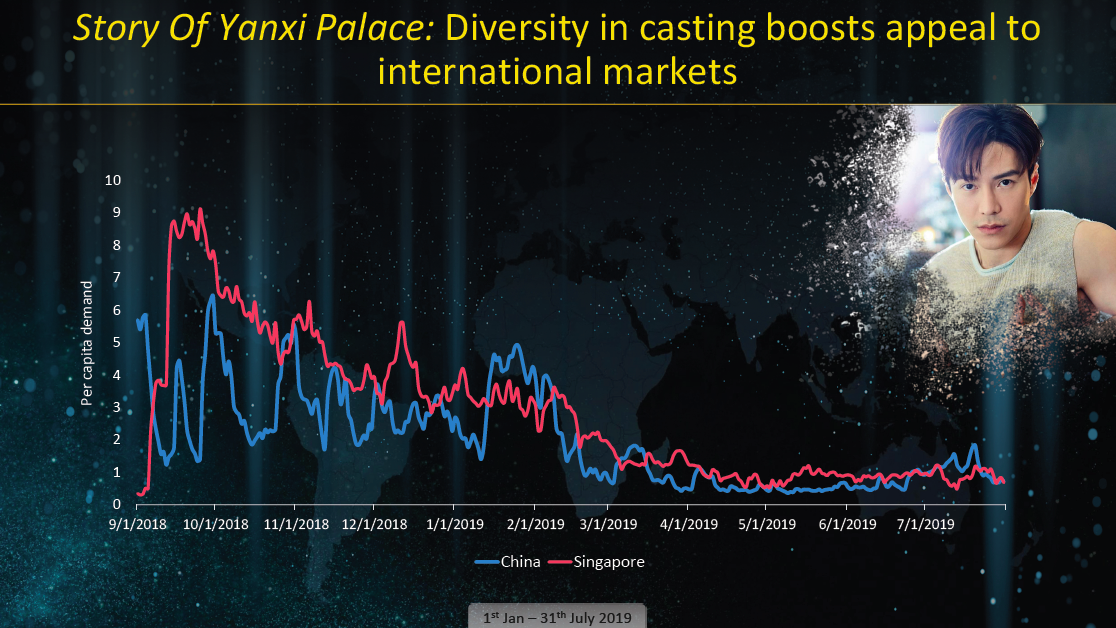

#9: The world’s most-Googled show of 2018 is a Chinese period drama that made a huge impact outside of China.

Story of Yanxi Palace is a huge hit in Asia and beyond. In fact, it was the world’s most Googled show in 2018. On top of attracting high demand in typical markets for Chinese content like Taiwan and Vietnam, the series attracted significant interest from audiences in non-Asian markets like the USA, Ireland and Australia.

#10: Diverse casting can make a major impact on the success of a show

The Story of Yanxi Palace was the most in-demand in Singapore, which is likely due to the breakout performance of Singaporean actor Lawrence Wong. Lawrence became a superstar in Singapore because of his performance in Yanxi Palace.

This provides an easy-to-action takeaway for producers – as long as they fit the part, casting actors from diverse backgrounds can significantly boost a show’s international performance.

To get our full take on content trends from Asia, download the free presentation here and get access to even more insights.