In this post we will discuss the science behind successful content decisions. But first, let us briefly recap a few of the central concepts that our analysis will be based on.

The premise: Audience demand is finite

We live in an attention economy, a hyper-competitive landscape of content, access to which is the same for every consumer. Every person has the same number of hours in a day.

Multi-screening is a fact, however, we suggest that every consumer can only ever truly pay attention to a single source of entertainment.

This means when a consumer spends a minute listening to a podcast or watching a show, they now have one less minute available to spend consuming any other content. Thus, the central premise for all direct-to-consumer (D2C) initiatives is that they are competing with one another – demand is finite. Today competition exists not only in the form of other TV platforms, but also in the form of entire universes of entertainment, such as Fortnite.

Before we can quantify and optimize audience monetization, we need to first understand how to quantify audience attention, and we need to be able to do this on a global scale. So, how does one measure audience attention across platforms worldwide?

Parrot Analytics has built the world’s only global demand measurement system that is able to quantify the attention economy. We capture billions of audience demand expressions each day in 200+ markets around the world, to reveal the content consumers engage with and watch the most across platforms. As a trusted partner to some of the biggest media companies and content creators in the world, we are focused on helping to optimize content workflows.

Let us now examine how this kind of “demand thinking” can be employed to create a commercial advantage in the context of a content licensing workflow.

Getting ahead of the curve with demand thinking

Parrot Analytics optimizes decision-making by quantifying attention for content across platforms, around the world, in over 100 languages. We capture indicators of attention such as whether consumers “like” the content, blog about it, research it, or download or stream it on peer-to-peer networks to create the best metric of weighted audience demand: For instance, streaming three episodes back-to-back is a stronger and clearer expression of demand than simply liking a show on Facebook.

Demand is a holistic measure of attention that drives smart decision-making by providing and tracking insights into the global content ecosystem. Using demand, you can analyze a title:

- On a country-by-country basis.

- Relative to its title peers – even before titles are officially released.

- Compared to competitors on different platforms (audience demand is platform agnostic).

As the leader in global cross-platform TV demand measurement, we help our partners apply demand thinking across all aspects of their business models: From finance and strategy, greenlighting and productions, acquisitions and sales, content marketing and advertising, questions relevant to talent agencies as well as TV research content product decisions. Global TV demand data provides value for all TV content stakeholders.

Let us now take a specific case of using global TV demand data to maximize the success of a subscription-video-on-demand platform.

The four essential ways to leverage demand to maximize SVOD platform success

Let’s say, hypothetically, that we are in charge of running a SVOD platform called “Streaming+”, which specializes in legal and procedural dramas. In this hypothetical case, our platform only has a few titles, but we have decided that want to acquire more content. For the purpose of this scenario, let us assume we want to license four titles that have not been released yet. So, what content should we license?

Luckily, this is where we can apply demand thinking to optimize our most challenging content licensing decisions.

We need to apply a data-driven decision model to understand which of the four titles to put on our platform. But what are the criteria for making that decision?

Before getting into the decision-making process, and the underlying data this is based on, let us first apply some simple guiding principles: The first principle is to define what a “successful” acquisition is. Typically, there are two primary outcomes of a beneficial acquisition:

- An increase in new subscribers.

- An increase in the retention of existing subscribers.

The second principle is to optimize towards these objectives given our resources such as available budget, time, market access, etc.

To do this, in the following section we present the four essential questions about each title that should be answered before making a decision on what to license.

Question 1: How will you establish which titles truly matter? (Hint: Use latent demand)

Although it is a common occurrence that most of the high demand content will likely already be licensed, using the Parrot Analytics Content Genome, we can extrapolate the latent demand for pre-release titles.

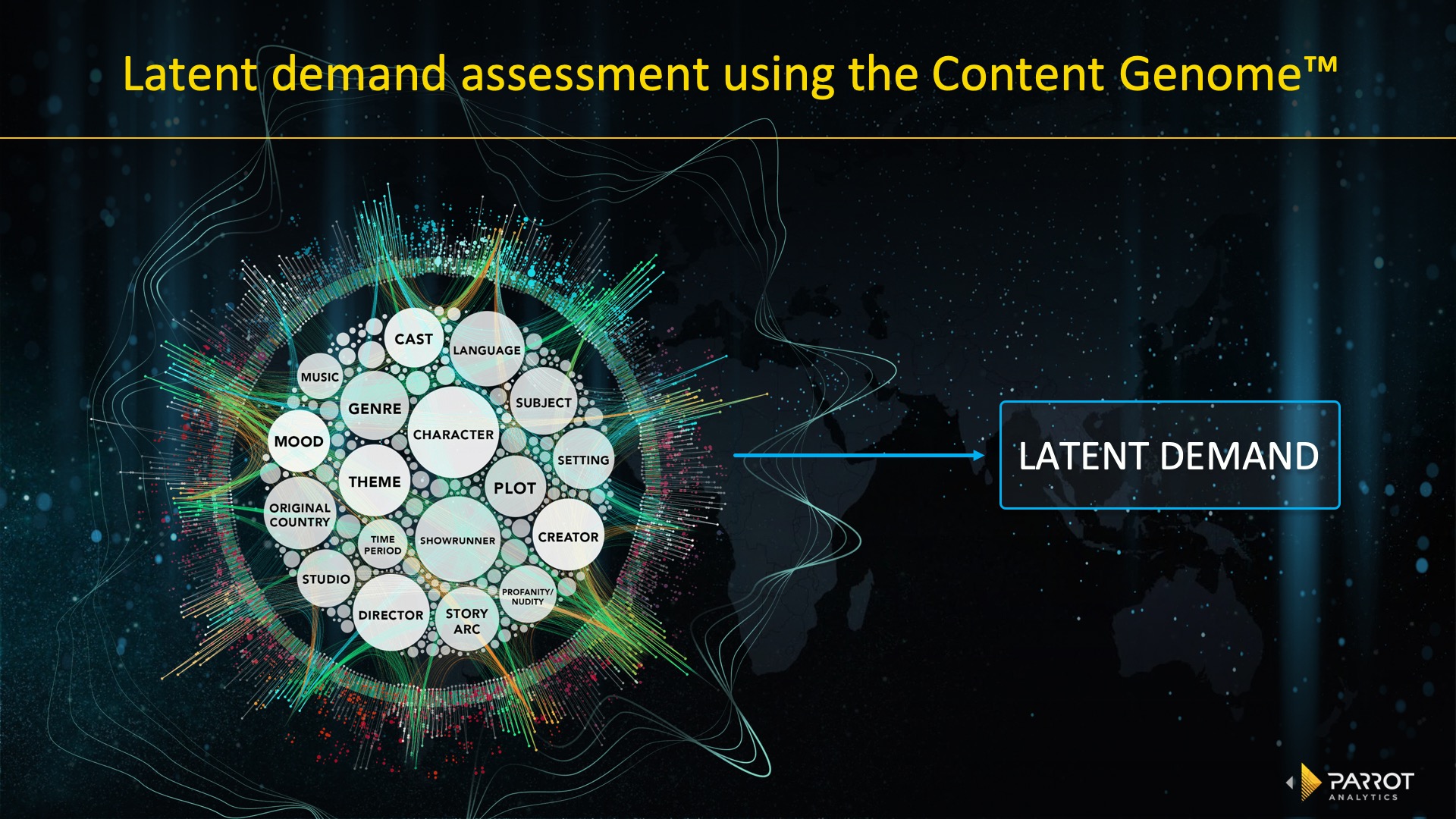

The Content Genome includes all of the creative parameters of a title: Its actors, genre, setting, producers, music, mood and many more. When we analyze the genome of a potential piece of content (i.e. prior to its release), we can predict how much demand to expect based on these comparable success factors. We call this latent demand.

The following image provides a visual illustration of the Content Genome, the underlying driver of a latent demand assessment.

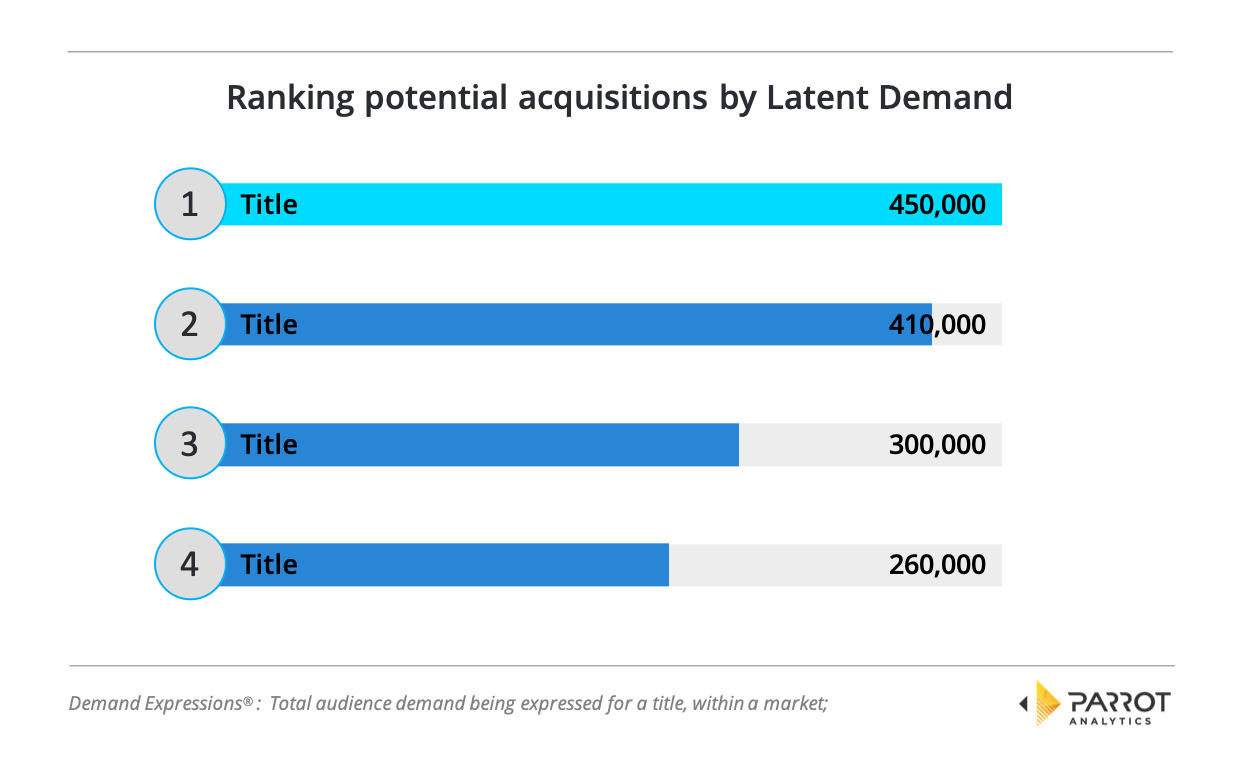

Applying the Content Genome to our potential acquisition titles, we can now rank these by their latent demand in the markets our SVOD, “Streaming+”, operates in: The latent demand results reveal which of the four titles audiences are most looking forward to watching. In our case, we now know (see figure below) that out of the four pre-releases, Title 1 has the highest latent demand. This is the title that audiences are looking forward to the most.

Would adding this title simply satisfy our existing audience? Or, would it add incremental demand on top of the demand already expressed by existing subscribers, to reach a critical mass leading to more people to subscribe to our platform?

We need to understand the content consumption behaviors of our “Streaming+” SVOD audience in order to gain clarity about each title’s value contribution to our existing library (and thus our existing subscribers).

Question 2: How will you gain clarity about each title’s value contribution to your existing subscribers? (Hint: Use content affinity analysis)

Each title’s value contribution can be established by assessing the content affinity between our existing library and the pre-release titles we are looking to purchase. What is content affinity? Simply put, a shared liking. If two titles have a high degree of affinity, a person that watches the first title will likely watch the second title. In other words, there is a correlation between title A and B: People who finish watching title A tend to go on to watch title B next.

In this second step, we therefore calculate the affinity for each of the pre-release titles against that of every one of our titles in our existing “Streaming+” SVOD library. In doing so, we assess whether our existing library is already satisfying the latent demand the new titles will be capturing.

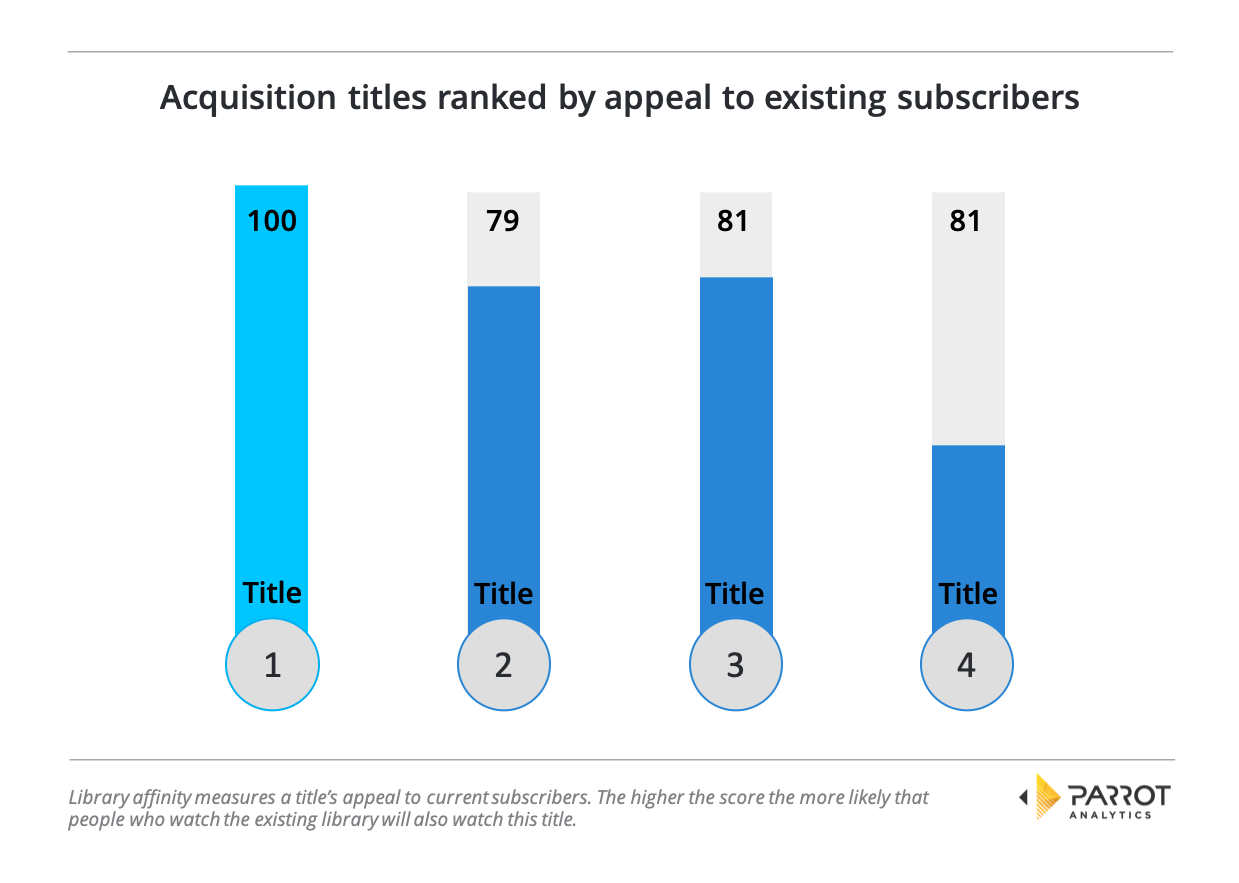

The chart below reveals how the titles we are considering for purchase are ranked by their affinity score: The higher the score, the higher their appeal to existing subscribers. These are the titles that will have the greatest appeal to our current subscriber base.

In our case, Title 1 has the highest affinity with our existing library. This means that Title 1 holds the highest subscriber retention value for us. To make our data easier to interpret, we have indexed the other three pre-release titles to our top pre-release title, Title 1. (This is the reason why Title 1 comes in at 100% – relative to the other 3 titles, it achieves the highest retention score relative to the catalog).

Ultimately, however, we want understand to what extent the new titles we are looking to purchase not only help us achieve our retention objectives but also our subscriber acquisition objectives, and by how much.

So, do our findings reveal that licensing Title 1 will result in a “successful” acquisition? In terms of its subscriber retention potency, yes we can. Title 1 is good at that. (Potentially we could be over-saturating our library because our subscribers are already satisfied with this type of content. But that’s perhaps the topic for another post).

But can we say anything at all about each title’s success in driving new subscribers? – No, we cannot. To answer that specific question, let’s add another layer to our thought process: How to maximize our acquisitions in the context of our upcoming original content pipeline.

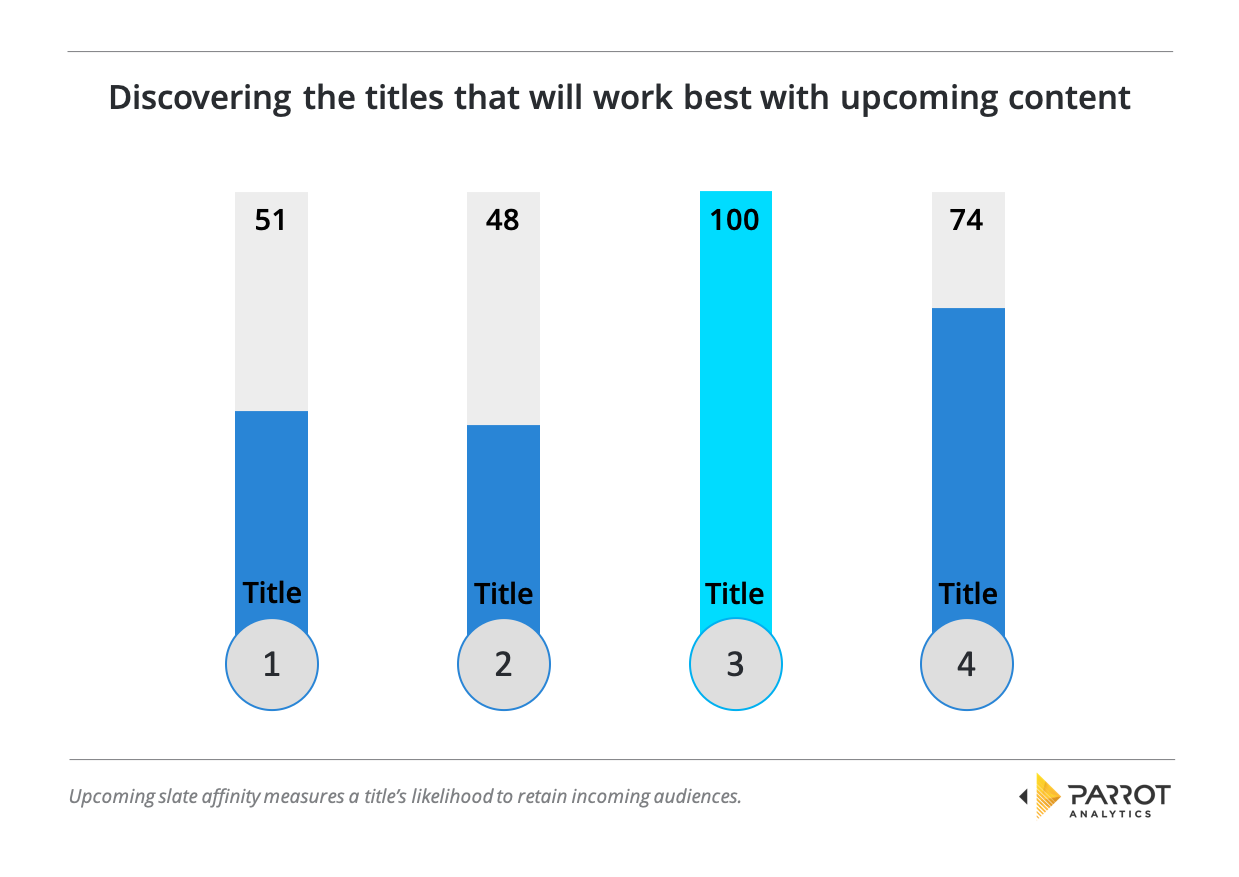

In this second, follow-on affinity analysis, we want to know the affinity between the four pre-release titles and our upcoming slate, which is what the following chart reveals.

In this case, we find out that pre-release Title 3 has the highest pre-release affinity compared to our upcoming slate. But how do we now choose between Title 1 and Title 3?

To make an effective decision, we need to translate these affinity-derived insights into metrics that capture the true value of what we are actually after: Subscriber growth and retention.

Question 3: How will you work out to what extent each title impacts on subscriber acquisition and retention?

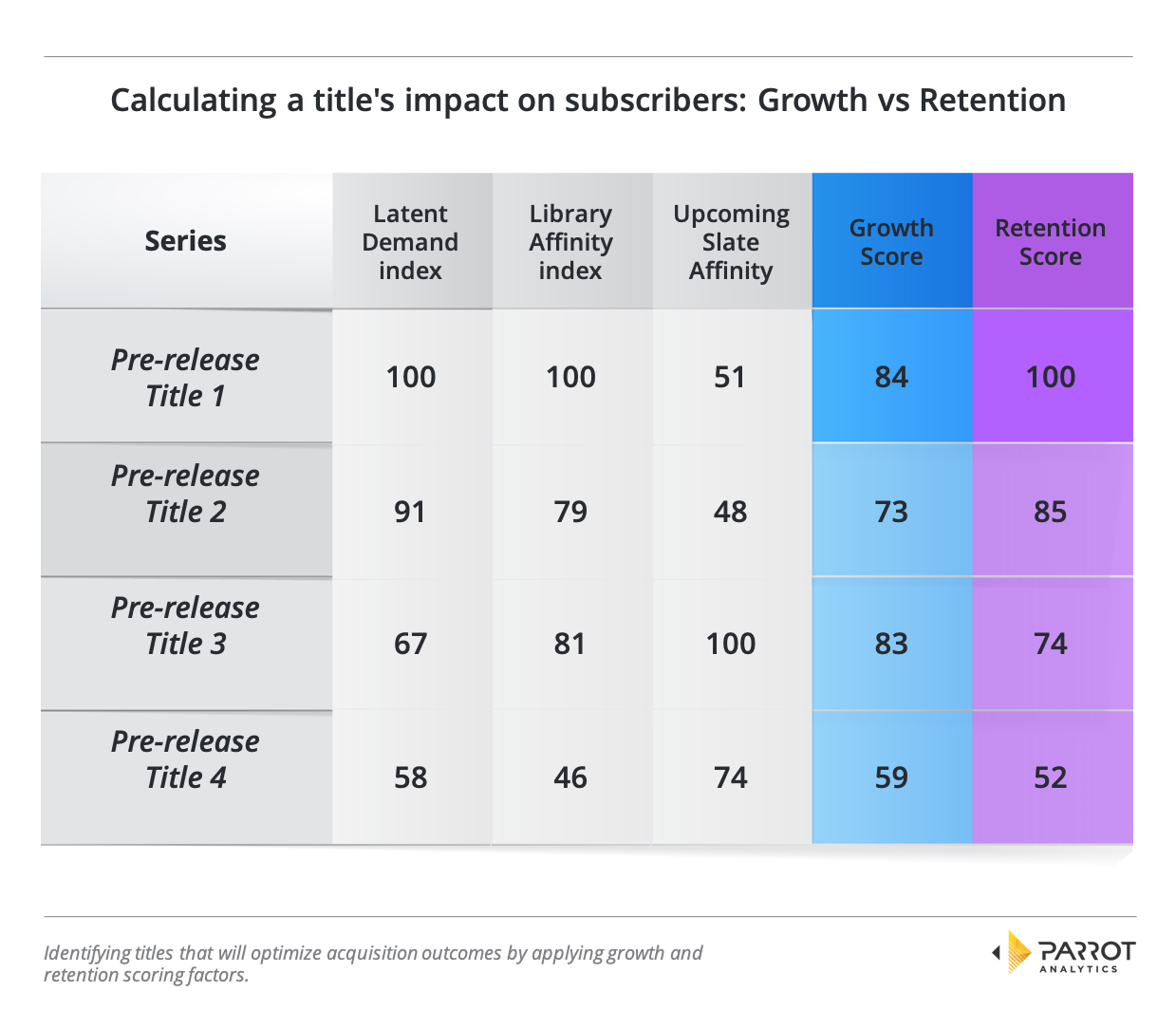

In this step we want to assign growth and retention scores for every pre-release title that we are considering. In doing so, we convert our latent demand index (refer to Question 1 above) and affinity indices (Question 2) into the type of SVOD platform success metrics that the CFO will appreciate:

In effect we are asking: “How much growth and retention are each of these pre-release titles going to drive?”

In this third step, we discover that our growth and retention scores are maximised for pre-release Title 1. What does that mean? All things equal, Title 1 is the pre-release title we should license as it offers us the highest utility across both our growth and retention key results areas.

However, there is one very important factor that has yet to impact on our analysis: The actual cost of acquiring each of these titles, which will impact our decision model across all 4 of these pre-release titles slightly differently.

Let us recap:

Finally, in this last step we will be including each title’s dollar acquisition cost to introduce a cost layer into our model. In doing so, we can prioritize on a demand per dollar basis.

Question 4: How will you rank your acquisition titles on the basis of return on investment? (Hint: Use value prioritization)

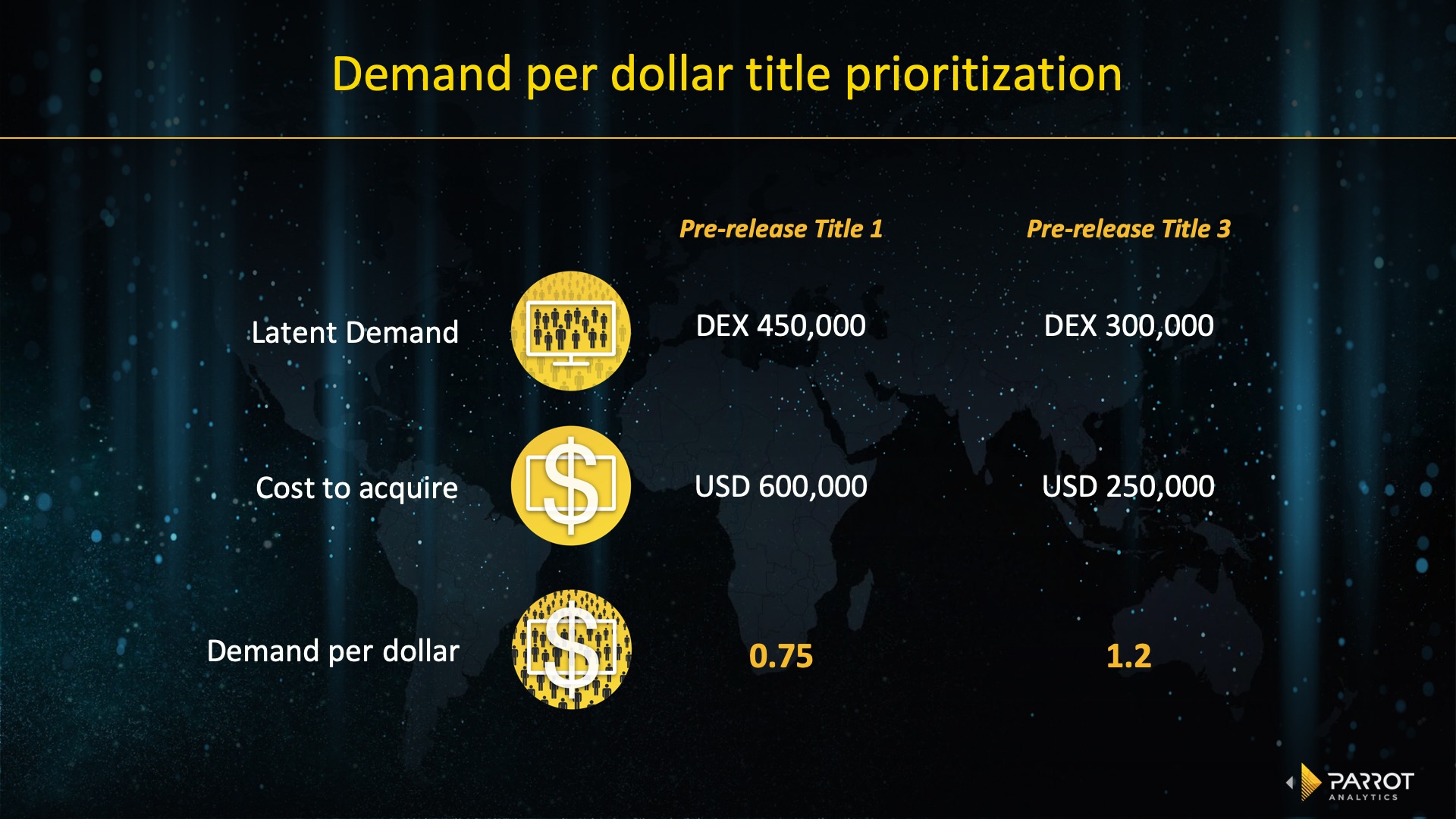

In this last step we are reducing our analysis down to a single ranking factor that we can use to prioritize our decision making: Demand per dollar.

But what does “demand per dollar” really mean? Simply put, we are answering the following question:

“For every $1 dollar that we invest in one of these four pre-release titles, how much audience attention are we going to capture? And is this attention coming from existing subscribers, or is it coming from new subscribers that we have yet to add to our platform?”

The following image makes our suggested approach clear (“DEX” stands for Demand Expressions):

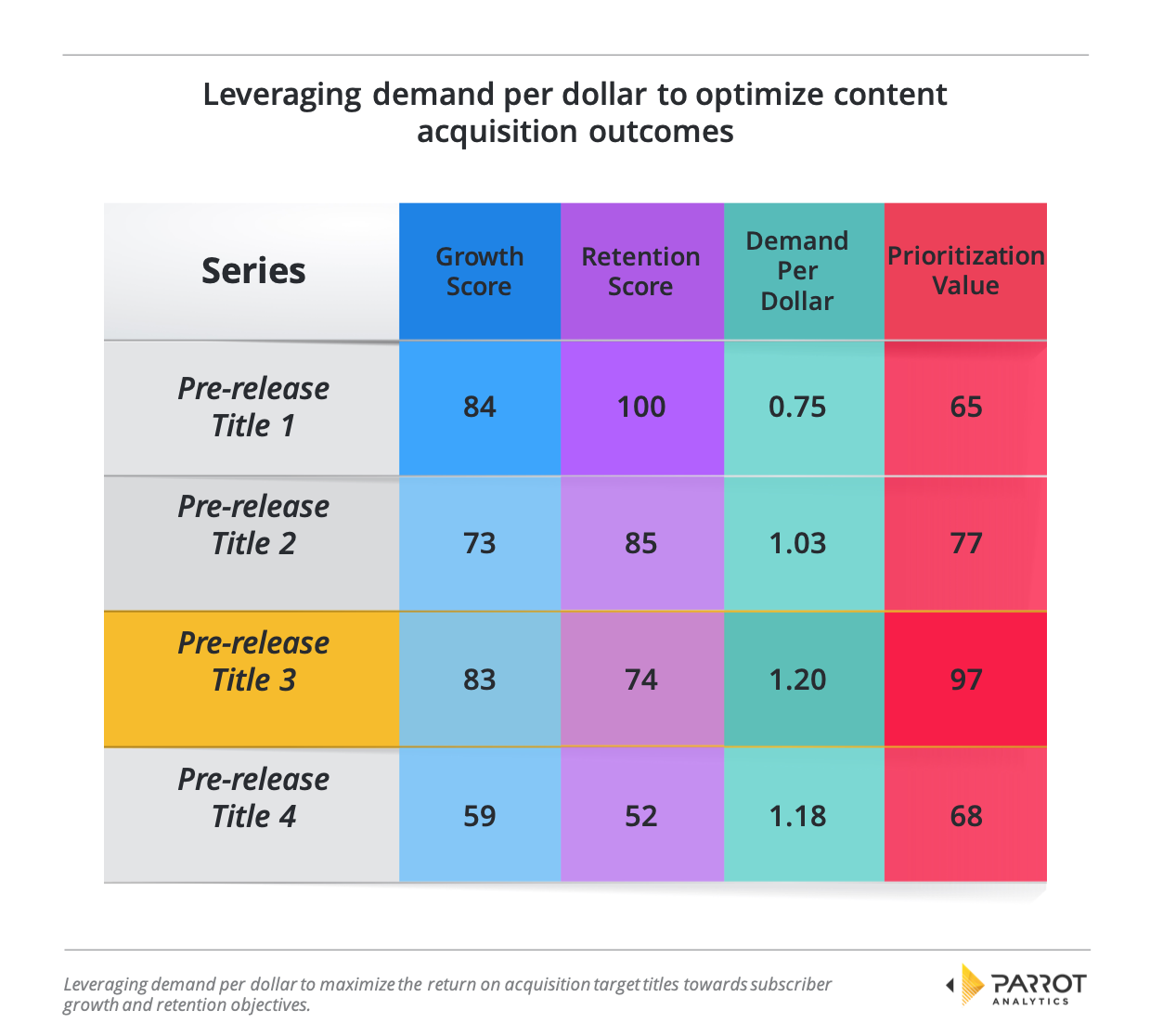

Demand per dollar gives us the ability to prioritize our title acquisition: So, based on the chart below, which title represents the most effective use of our funds?

As can be seen, there is a bit of a “plot twist” here: When costs are factored in, Title 1 is actually no longer the most desirable acquisition target.

Using demand per dollar as the final arbitrator (via the derived “prioritization value”, column 4 in the chart above) it turns out that Title 3 actually represents the greatest ROI.

As the above chart shows, Title 3 clearly pulls ahead of all the other titles, including Title 1. This is because Title 3 is the most valuable as far as driving both retention and growth is concerned, with its acquisition cost factored in. In other words, this title not only offers us the greatest utility in terms growth and retention – this utility is also the most most economical overall compared to the other 3 titles. Title 3 offers us the most “bang for our buck” when it comes to growth and retention.

Congratulations! We have now officially optimized our decision-making process by leveraging a Parrot Analytics industry workflow analysis, for a hypothetical SVOD example.

In the next section we offer a word of caution when relying solely on on-platform audience data to make content acquisition decisions.

Avoid the on-platform data bias

Here is one last plot twist: Whilst this example uses hypothetical data, the process we have described in this post has actually been deployed in multiple real-world SVOD content acquisition scenarios.

By examining internal platform-only data, some SVOD’s are inherently working with a biased sample, because they are only considering their existing audience, their platform subscriber base. By using a platform-only dataset exclusively to make decisions for acquisitions, they are likely going to be licensing shows that are “more of the same” – the kind of titles that are appreciated more or less by their existing subscriber base only.

But how can these SVOD services ever achieve their growth targets with this kind of restricted thinking?

Let us be clear: If your goal is to grow, then by definition, you must appeal to new audiences. You must expand your content offering such that it appeals to as-yet untapped audiences in your markets of interest, new subscribers that you have yet to reach.

To do this, market demand data is required to help guide the decision-making process: By combining your internal datasets (e.g. on-platform subscriber activity data) with the market all-inclusive datasets offered by Parrot Analytics, you will be able to prioritize key acquisition titles on the basis of return on investment and optimize for both retention and acquisition.

This is one example of many that demonstrates just how valuable global TV demand data is. Whilst the above content licensing example was geared toward SVODs, Parrot Analytics workflows powered by demand thinking, can be applied to all TV platforms. We work with our client partners on a daily basis to assist with a plethora of content decision-making scenarios, right across the entire entertainment content supply chain.

In this last section we will briefly examine some of the questions that can be answered with global TV demand data.

Using global TV demand data to capture more value

We help our partners around the world capture more value by applying audience demand thinking to core entertainment industry workflows. By leveraging global TV demand data, the following questions can be answered (not an exhaustive list):

Accelerated sales and distribution:

- In which markets is my content most in-demand?

- How do I prevent under-selling my content in international markets?

- How can I make my content appealing around the globe?

- How can I show my content’s value in the absence of viewership data?

- How do I show demand for my series is growing?

Better acquisitions:

- Which titles maximize the return on my content acquisition budget?

- Which titles drive the most consumer retention for my platform?

- What genres resonate beyond just one country?

- How popular is this title I’m interested in acquiring, in my market?

Smarter programming:

- Which titles should I acquire to appeal to multiple markets?

- How do I reach my ideal audience given the proliferation of content platforms?

Cost-effective, high-impact marketing:

- How can I get an early read on the effectiveness of the different marketing campaign elements before the season premiere?

- How can I better understand my competitor’s marketing strategy?

- How can I best promote my newly acquired title?

De-risking of productions:

- How can I estimate the revenue for a production?

- Is the premium price for this actor worth it?

- What aspects of my show do fans like most?

Better content strategy and recommendations:

- How can I make data-informed partnership decisions?

- How do I gauge a show’s potential prior to release?

- How can an SVOD platform promote the right shows to the right people?

Better merchandising deals:

- How can I compare shows from one country to another when ratings data isn’t always available?

- How do I show the popularity of my title or brand in the absence of ratings data? (Pre/post season)

Global TV demand data helps entertainment content stakeholders stay ahead of the curve. We work with change agents and innovators all across the globe – and all of these thought leaders are interested in future-proofing their decision making, which is one of the reasons they have chosen to partner with Parrot Analytics.

Future-proofing decisions with demand thinking

Parrot Analytics measures consumers’ attention for content. Our global TV measurement capabilities are empirical; we quantify the global audience demand for content across all entertainment platforms.

In today’s highly competitive landscape, “future proofing decisions” means truly pushing the envelope to grow a platform, to gain a greater share of the finite attention economy, in all markets around the world. It also means looking past the hype, and the uncertainty, and instead bringing our opportunities into actionable focus by applying empirical, market-driven audience demand data.

Ultimately it comes down to this: What decision are you trying to make, and how do you make this decision in a more effective manner by incorporating empirical evidence into your existing TV workflows?

For those who want to join us as innovators in the rapidly changing TV business ecosystem, to be a contributing thought leader to today’s current TV revolution – and perhaps even to disrupt the disruptors – we invite you to get in contact. Reach out now and start the process of optimizing your decision-making workflows by leveraging audience demand thinking.

Keen to just watch the video of this blog post? Here it is: Watch our CEO Wared Seger’s keynote at NATPE Streaming+2019. Follow along with the practical steps to maximise the return on content acquisitions for a subscription-video-on-demand (SVOD) platform, download the slide deck.