Image: Club de Cuervos, Netflix

The number of digital originals has been increasing exponentially, elevating the importance of understanding the varying preferences from one market to another. Similar to the overall television landscape, depending on the country, SVOD audiences are partial to particular genres.

Audiences also expect local quality content to be included among their SVOD catalogs. The Latin American, and overall Spanish language market are clear examples of successful local digital originals with huge recent international hits including La Casa de Papel, and Club de Cuervos. Leveraging demand data and using Spain, Brazil and Mexico as examples, we uncover differences in demand for digital originals by market over the past year.

While there are similarities across these three countries, such as Stranger Things topping the rankings as the most popular digital original across the board, each market’s demand story is unique. One of the reasons is due to local content: Each of these markets had at least two local digital originals rank within the Top #10 in the past year.

For the period October 1, 2017 – September 30th 2018, we observe:

- Galinha Pintadinha and O Mecanismo rank third and eight in Brazil, respectively.

- In Spain, La Casa De Papel is ranked second, Las chicas del cable third and La Peste ninth.

- Club De Cuervos and Ingobernable are ranked second and ninth in Mexico, respectively.

Across the markets evaluated, Spain generated the overall highest average demand for digital originals in the past year, 48% higher than the European aggregate, as the chart below shows.

Demand for digital originals in Brazil was higher than the rest of South America. Audiences in this market also enjoy reality series on SVOD – generating the highest demand for the genre among markets evaluated (refer to next section). The top local digital original in Brazil over the past year was Galinha Pintadinha, the only children’s title to make the ranking across the Top 20 series for any of the markets.

As we explore the preferences of Mexican audiences in the SVOD digital originals space we observe that while the market’s demand for digital originals is lower than Spain or Brazil, it is still 22% higher than that of the aggregate of South American markets.

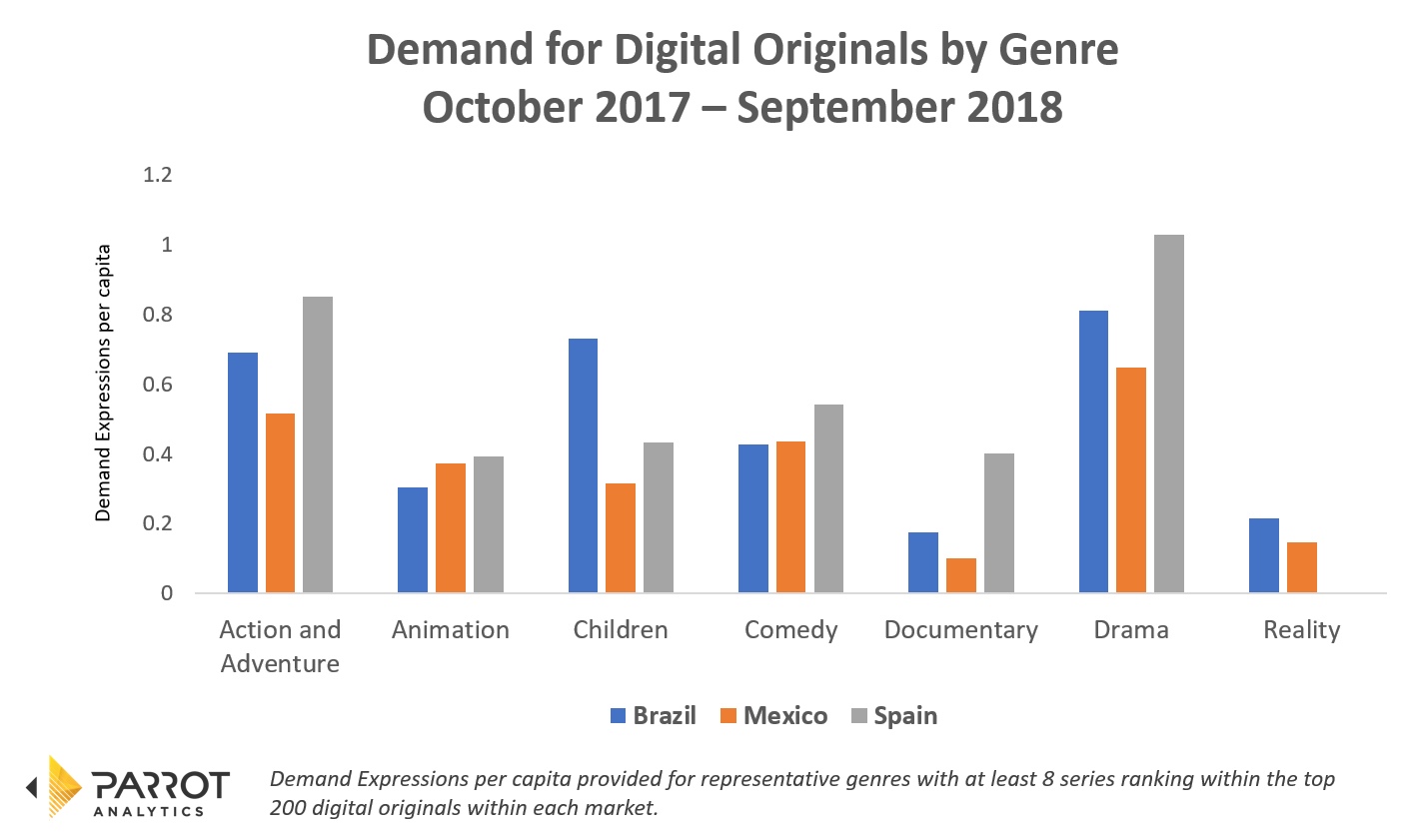

SVOD genre preferences in Spain, Brazil and Mexico

Similar to the two other markets evaluated, Mexico generated the highest demand amongst digital originals for the drama genre as the following chart shows.

Interestingly, there was a smaller gap between the top genre and those that immediately followed it: Action and adventure and comedy were very close, suggesting a more even spread of demand across content types.

In terms of Spain’s genre preferences, reality didn’t make the charts. There were fewer reality series in the top 200 than either of the other markets. In terms of local content, La Casa de Papel was the most in-demand local digital original in its home country of Spain.

As digital originals continue to proliferate, audience expectations of having access to the content they crave will continue to grow. Content producers and OTT platforms will need to do more than keep a pulse on the overall industry. A thorough understanding of the nuances of each market will help drive targeted content decisions that may well resonate with international audiences also.

For more information, check out the most up-to-date Mexico, Spain or Brazil television industry overview.