Parrot Analytics has recently taken an in-depth look at the market share of SVOD platforms in Mexico based on the Mexican audience demand of each platform’s digital original productions. The SVOD market share report leverages Mexico demand data for streaming originals from Netflix, Amazon Prime Video, Hulu, CBS All Access, as well as local SVOD platforms.

Please download the full 68 page report here, which also includes data and analysis for 9 other countries: Mexico SVOD Market Demand Report.

SVOD market share in Mexico

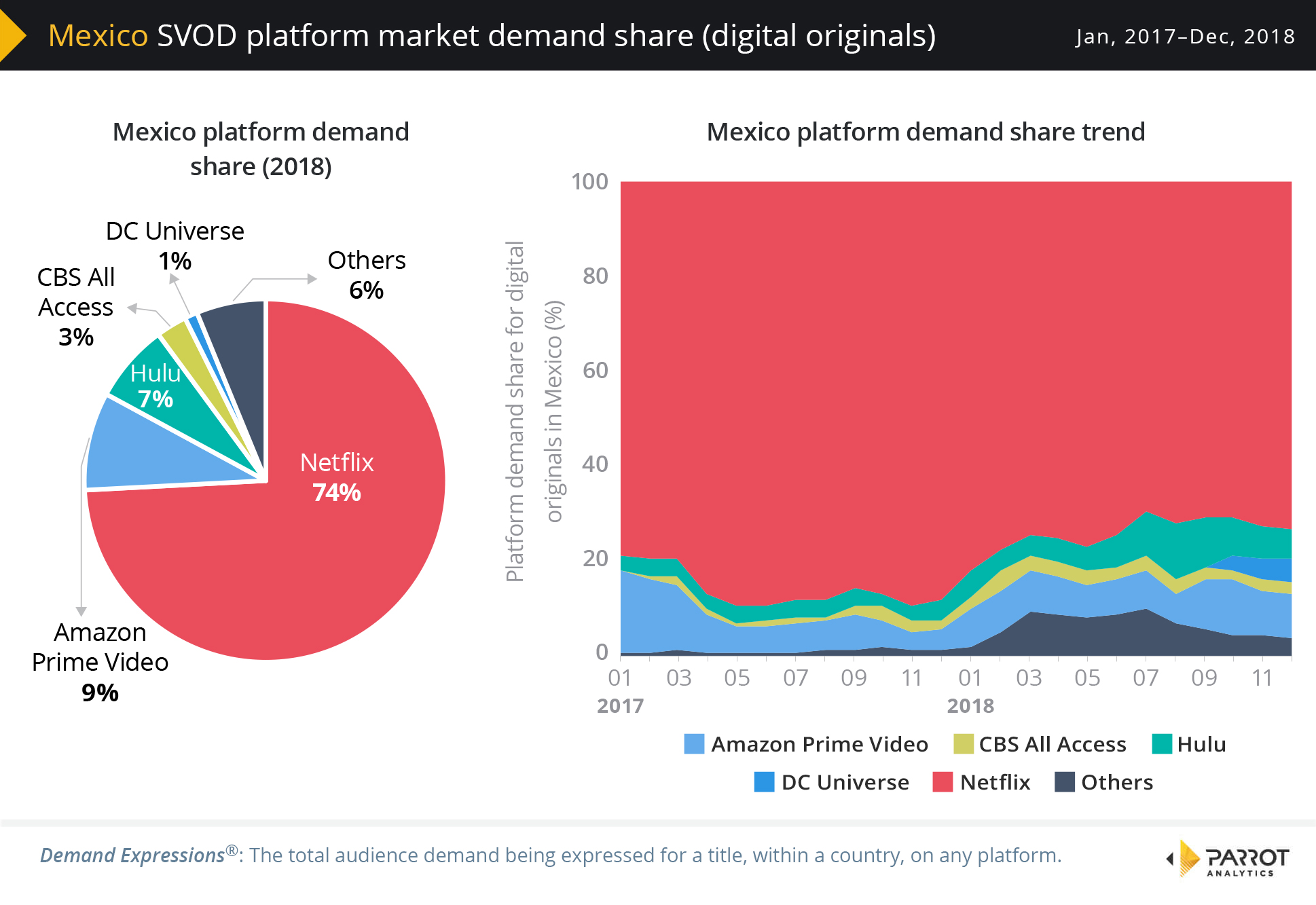

We define “SVOD market share” as the share of demand for each platform’s digital originals. Based on this measure, we are able to make the following observations:

- Mexico is one of the strongest markets for Netflix in this report: 74% of all demand expressed for digital originals is for a Netflix title in 2018. In fact, the 24 month platform demand share trend sees the company moderately strengthen its position in the second half of 2018.

- The second highest demand share in 2018 is for Prime Originals (9%), followed by Hulu Originals (7%).

- The impact in Mexico of highly in-demand DC Universe content can be clearly seen towards the end of 2018.

SVOD drama market share in Mexico

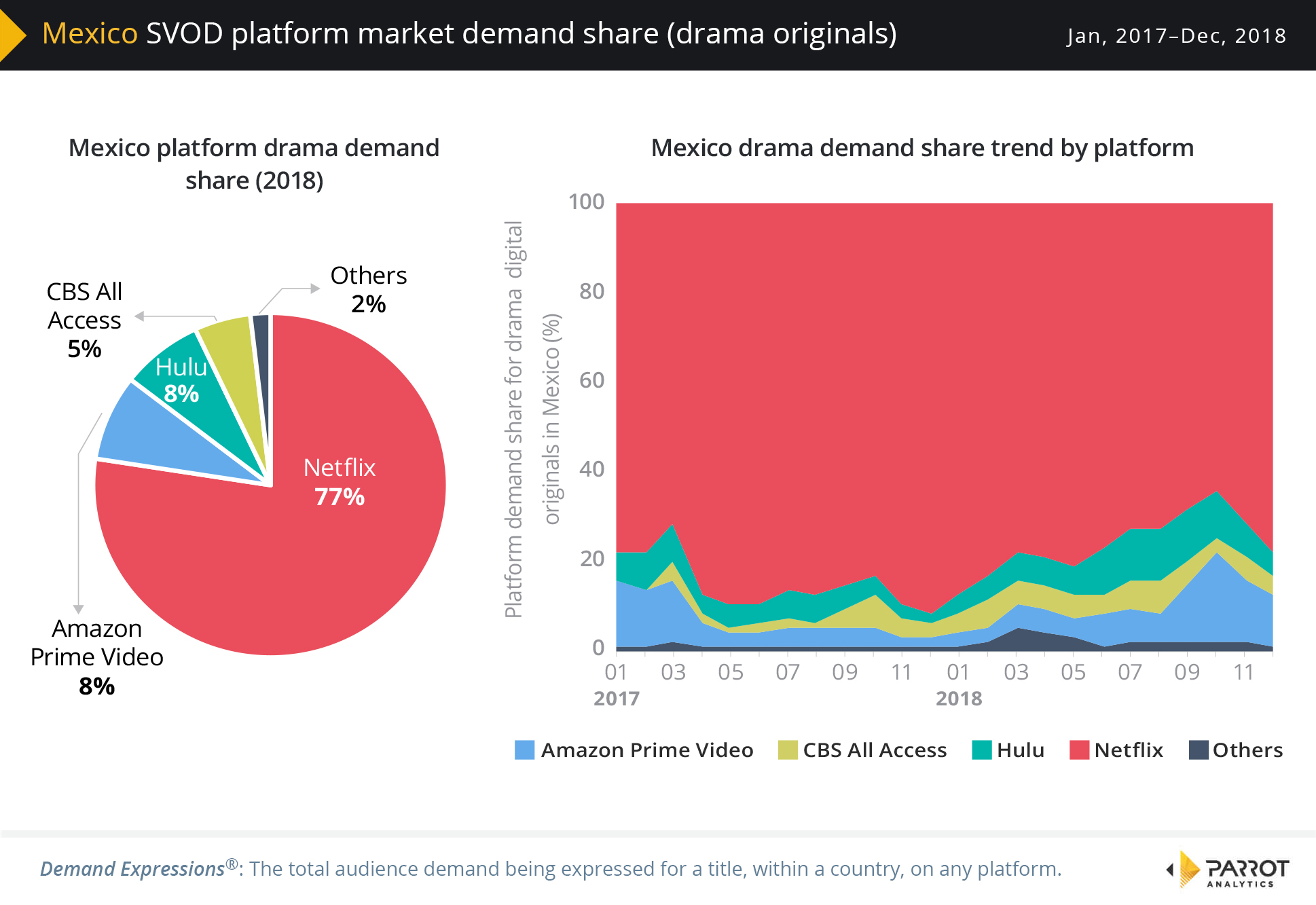

Here we define “market share” as the share of demand for each platform’s drama digital originals in Mexico. Based on this measure, we are able to make the following observations:

- Netflix has a stronger presence in the drama SVOD space in Mexico than in the other nine markets in this report.

- 77% of all demand for digital original drama titles in Mexico is expressed for a Netflix title, followed by Prime Originals (8%) and Hulu (8%).

- Our 24 month series chart reveals that Netflix has re-captured lost platform demand share in the last two months of 2018.

SVOD action/adventure market share in Mexico

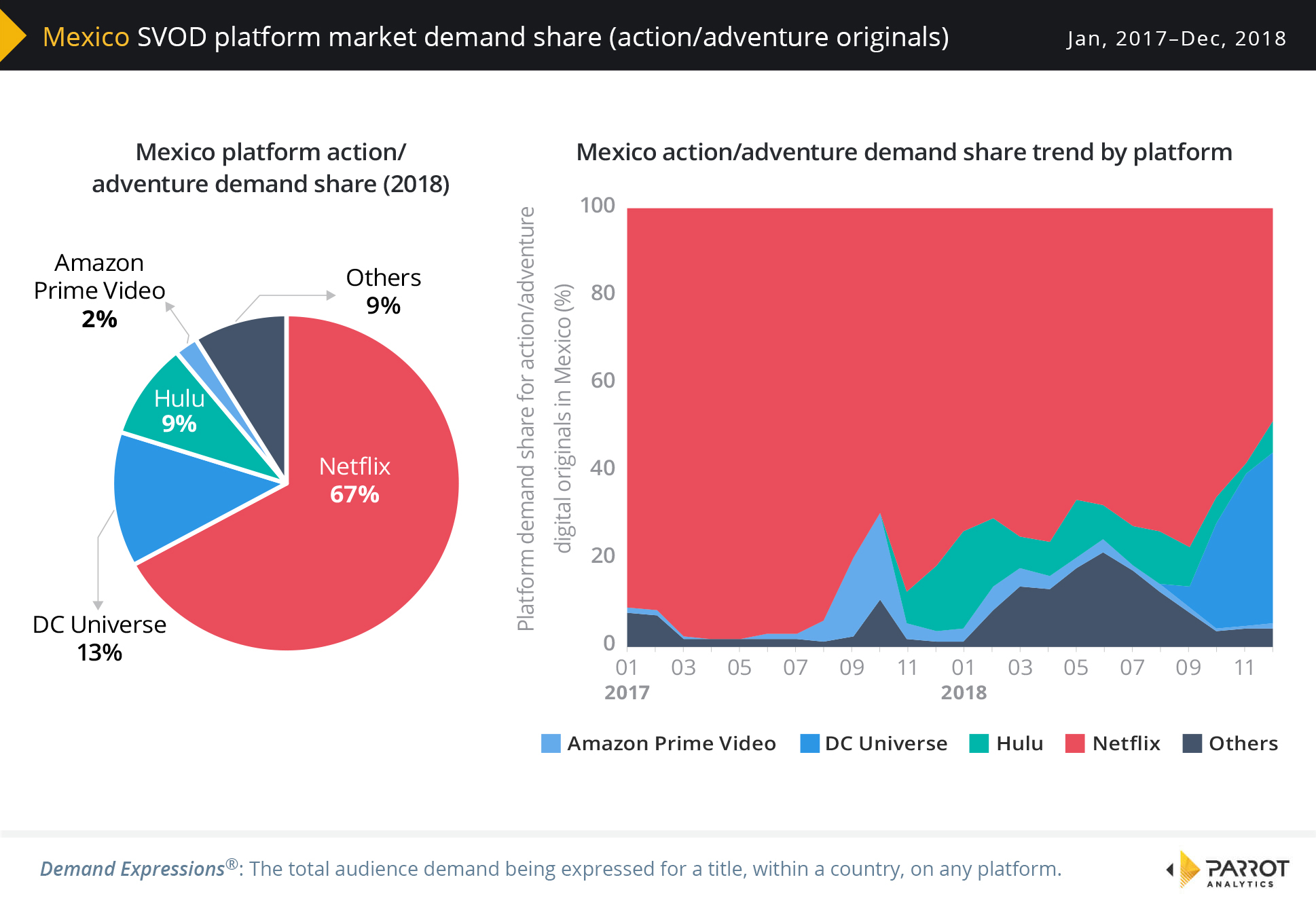

Here we define “market share” as the share of demand for each platform’s action/adventure digital originals in Mexico. Based on this measure, we are able to make the following observations:

- Netflix has 67% of the demand share for digital originals in the action/adventure genre in Mexico.

- DC Universe titles perform best in Mexico out of all territories in this report with 13% of platform demand expressed for titles in this genre. The platform’s rapid rise is clearly evident in the 24 month timeseries chart.

- Hulu titles account for 9% of action/adventure digital originals in Mexico.

Download the free SVOD market share report for Mexico

Download this report now and discover the latest SVOD market demand trends for Mexico. Our comprehensive global TV demand report includes the following insights:

Mexico Domestic TV Insights:

- We reveal the 2018 Mexico SVOD market share of the major platforms including Netflix, Amazon Prime Video, Hulu and CBS All Access based on audience demand for each platform’s digital originals.

- Discover how SVOD market share trends in Mexico have changed over the last 24 months, including the contribution made by DC Universe.

- Find out what percentage of the market for drama and action/adventure digital originals each SVOD platform has managed to capture over the last 24 months.

- Learn where in the world content produced in Mexico is the most wanted relative to the Mexican home market; we refer to this as content travelability.

- Discover which sub genres resonate the most with Mexican compared to the global average.

- Find out what the demand distribution of a selection of digital originals in Mexico looks like.

- Discover the top 20 digital streaming shows in Mexico, as well as 5 additional titles of interest to audiences in Mexico.

Global Television Insights:

- Find out the 2018 global SVOD market share of the major platforms including Netflix, Amazon Prime Video, Hulu and CBS All Access across 100+ markets.

- Discover the worldwide platform demand share of drama digital originals as well as the worldwide platform demand share of action/adventure digital originals.

- The increase in the global investment made by SVOD platforms over the last 5 years.

- The global growth of SVOD subscribers over the last 5 years.

- The increase in digital original titles worldwide over the last 7 years.

- A TV industry update for 2018 detailing important market events concerning SVOD services.

- We have also included a mini analysis of the global demand for critically acclaimed digital original comedies.

For more information, check out the most up-to-date Mexico television industry overview.