Image: The Marvelous Mrs. Maisel, Amazon Video

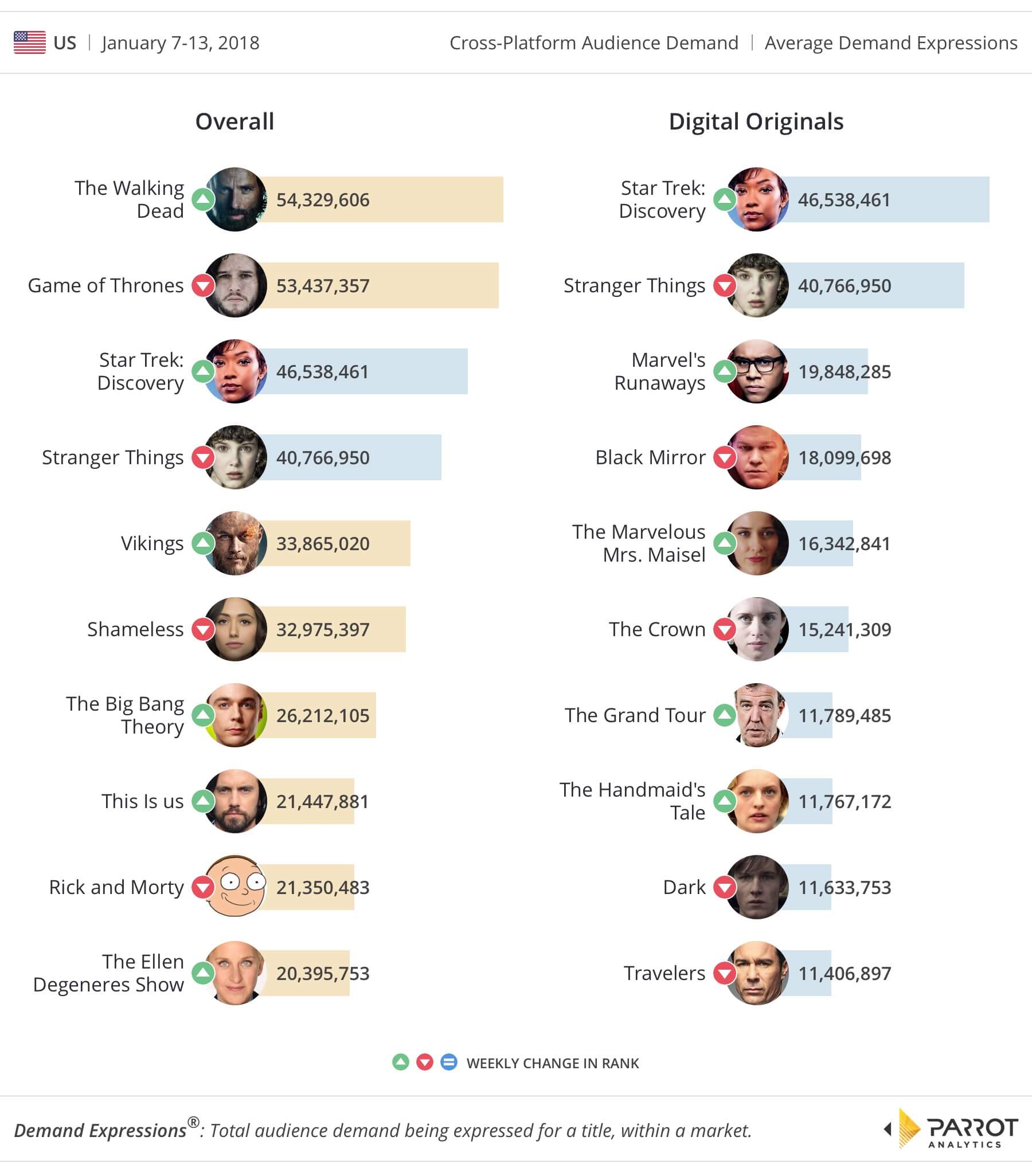

The overwhelming reason that new users sign up for an SVOD service is for its original content. Per the figures generated by Parrot Analytics’ global demand measurement system we have seen the importance of exclusivity-driven SVOD content consumption patterns growing, which mirrors SVODs like Netflix and Hulu’s increased investment in producing their own programming. This week, we have observed that Netflix-owned titles make up half of the top ten Digital Original titles, and include dramas like Stranger Things and The Crown, as well as German series such as Dark. Amazon Video and Hulu contributed the other half of the chart.

In this latest chart, returning Digital Original titles such as Star Trek: Discovery and linear series like The Big Bang Theory and This is Us returned from holiday hiatus – causing demand to increase roughly 40% week-to-week. Also experiencing a rise in demand are Hulu’s titles: Both Marvel’s Runaways (at #3) and The Handmaid’s Tale (at #8) featured strongly in the Digital Original Series chart this week. News from the Television Critics Association’s winter press tour regarding the new season of both titles gave Hulu a chance to dominate the streaming spotlight (since Netflix and Amazon are skipping the press tour).

Also making a return to the chart is Amazon’s The Marvelous Mrs. Maisel (at #5) after the comedy series won big at the Golden Globes last week. Finally, in the case of The Crown, demand decreased 18% compared to last week.

In the overall chart, The Walking Dead and Game of Thrones remained in the top five, but we expect demand to fade off slightly before returning next year. NBC’s This is Us returned on January 9, driving a 87% demand increase compared to last week.