Image: Orange is the New Black, Netflix

The proliferation of SVOD platforms and digital original content has continued unabated around the world. US-based platforms produce the majority of the original titles but these shows have found success in other markets as well, even when the platform is not available.

The demand for these digital original series is measured for the month of June in over 100 countries by Parrot Analytics’s Demand Expressions™ (for market-specific comparisons) and Demand Rating™ (for cross-market comparison). This data reveals the extent of both SVOD platform and content popularity internationally.

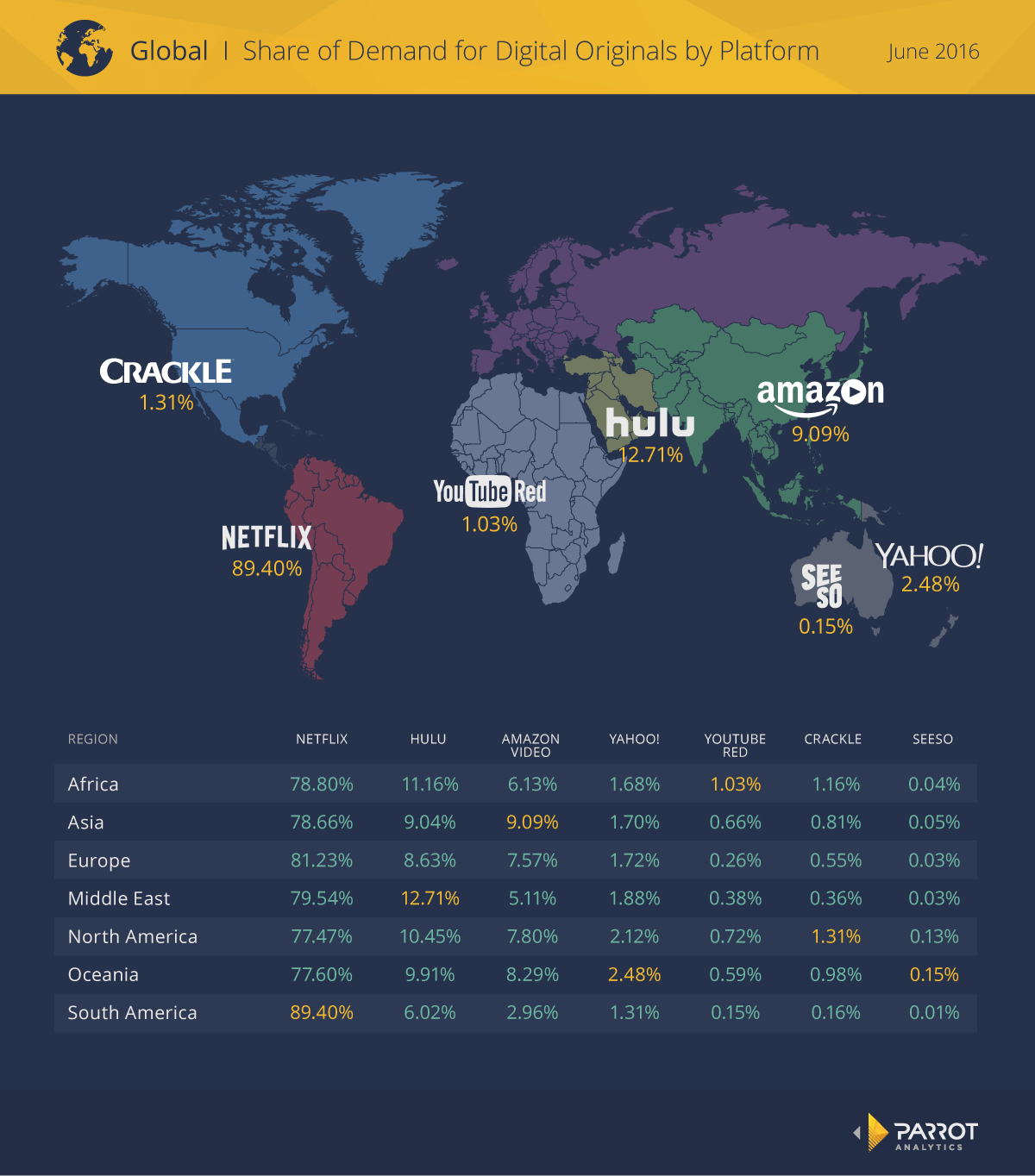

The demand for the digital original series is summed by platform in order to determine the market share of each platform in seven world regions:

Netflix, the most prolific producer of original content, dominates in all regions with over 75% of the total demand. Its hold is greatest in South America, where it has nearly 90% of demand, and weakest in North America, where it has 77.5% of demand. Though Netflix is still strong in North America, it is reasonable that the other US-based SVOD platforms cumulatively have a greater share of demand in this region.

However, each platform has its largest individual percentage in a variety of regions: YouTube Red’s largest demand share is in Africa, Amazon Video’s is in Asia, Hulu’s is the Middle East, Crackle’s is North America, and Seeso and Yahoo’s is Oceania. Hulu generally has the next-largest share (behind Netflix), with Amazon Video coming in third. As these platforms start producing more original content, their international market shares may grow.

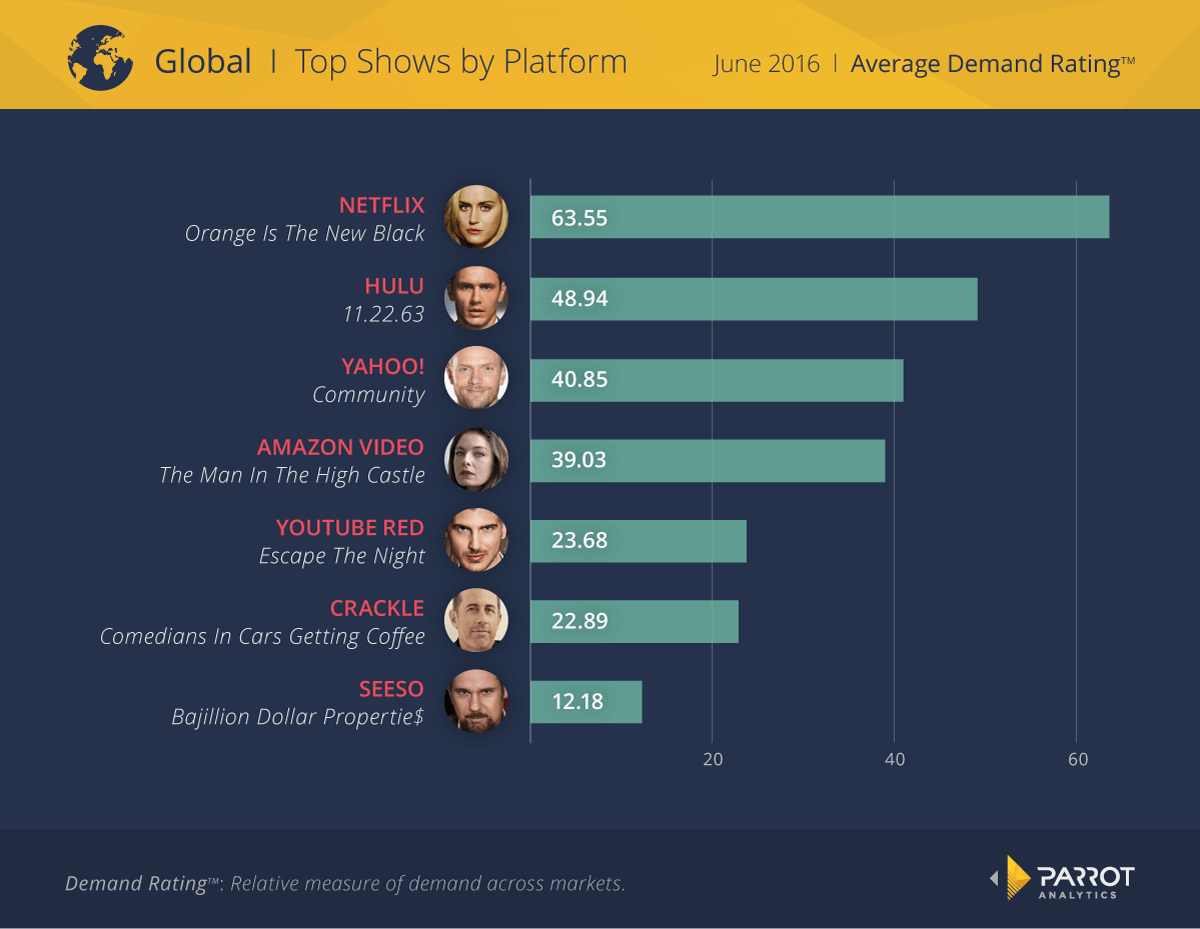

Another key to increasing demand market share is to release popular, in-demand content. By averaging their Demand Ratings™ from all markets, the most globally popular title on each platform in June is found and ranked:

Unsurprisingly, the recently-released Orange is the New Black is Netflix’s most in-demand title, with above-average demand around the world and significantly more demand than the other top platform shows. The last time we conducted this analysis, Hulu’s top original series had only 31.04 average Demand Rating™, but since then they have released a new, much more popular series: 11.22.63. Amazon and Yahoo’s top originals both last aired new episodes in 2015 yet they still have more average demand than the most popular originals on the smaller SVOD platforms. Similarly, YouTube Red’s Escape the Night and Crackle’s Comedians in Cars Getting Coffee have much higher demand than Seeso’s Bajillion Dollar Properties. This difference may be because both series aired new episodes in June while Bajillion Dollar Properties ended its first season in April. In addition, Seeso is the youngest of these seven SVOD platforms and therefore has not yet gained as many subscribers or fans, especially in non-US markets.

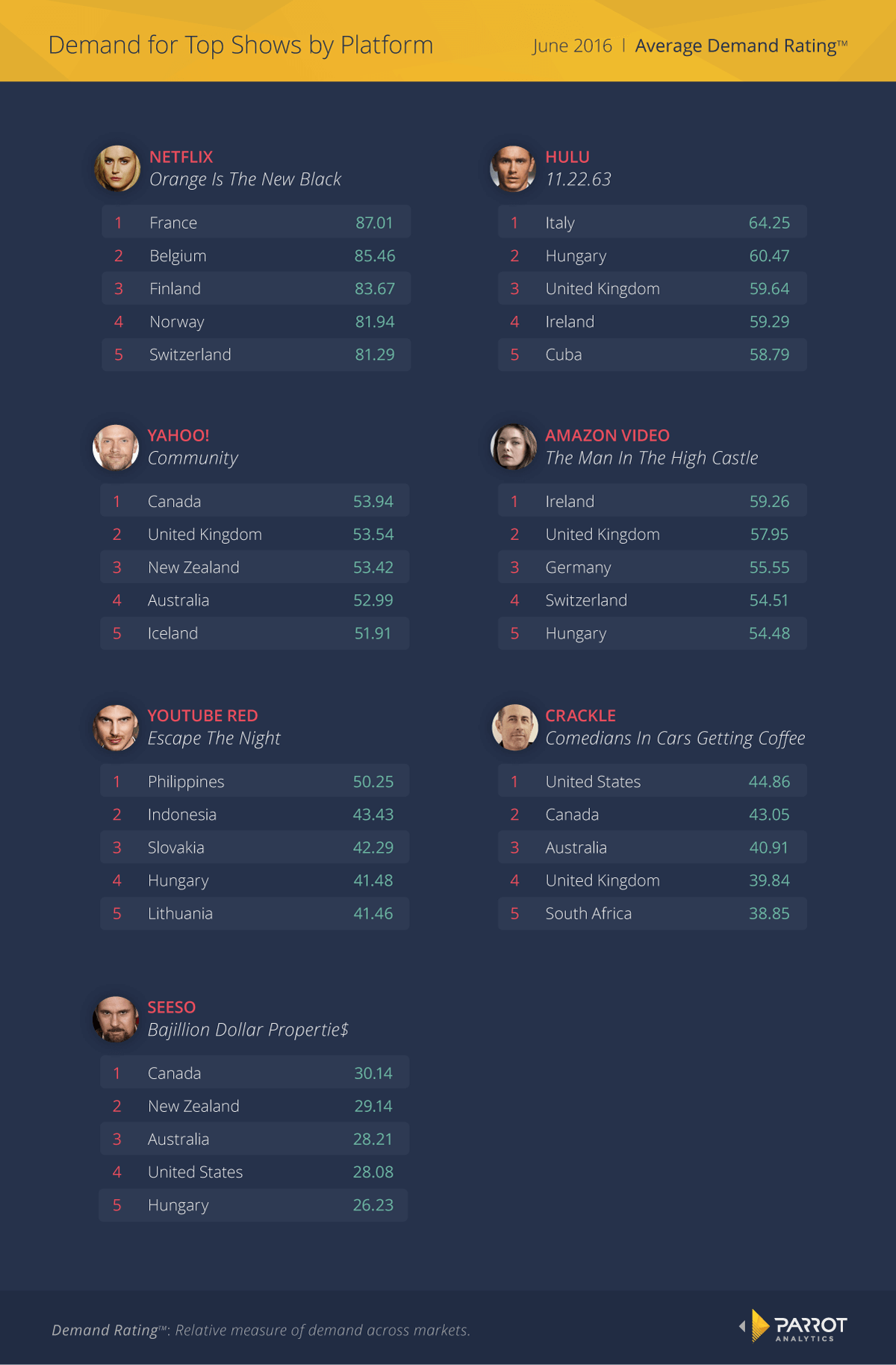

The top series on each platform naturally have more demand in some markets than in others; the top five major markets for each are ranked by average Demand Rating™ here:

Certain patterns emerge, revealing the types of markets where these titles are most popular. The top originals from the major SVOD platforms—Netflix, Hulu, and Amazon Video—all are most in-demand in European markets, even though Hulu and Amazon are not available in most of these countries. Community, Comedians in Cars, and Bajillion Dollar Properties are all most popular in English-speaking markets (though, in the case of Community, not the United States), likely because they and their platforms are less well-known globally.

In contrast to these clear trends, YouTube Red’s top show is in high demand in an eclectic mix of Southeast Asian and Eastern European markets. This variety may reflect YouTube’s global reach: the other platforms are only available in a few markets and Netflix only expanded to most countries in early 2016, but YouTube has been globally popular for over 10 years. Therefore, new originals on YouTube Red, starring existing YouTube personalities, also have a built-in international following.

Since most of these SVOD platforms are not available in all markets, measuring the demand for their original content indicates where the platforms may find success if they were to expand there in the future. Both the creation of new content and local popularity will increase the share of demand each platform has in a certain market, and both elements are necessary for an SVOD platform to grow internationally.