Image: Lucifer, Netflix

As the major English-language commercial broadcast networks in the United States consider new series for their fall slates, ahead of their upfront presentations to advertisers, they have also begun to consider which current shows to return for a new season and which to cancel after the 2018–19 season comes to an end.

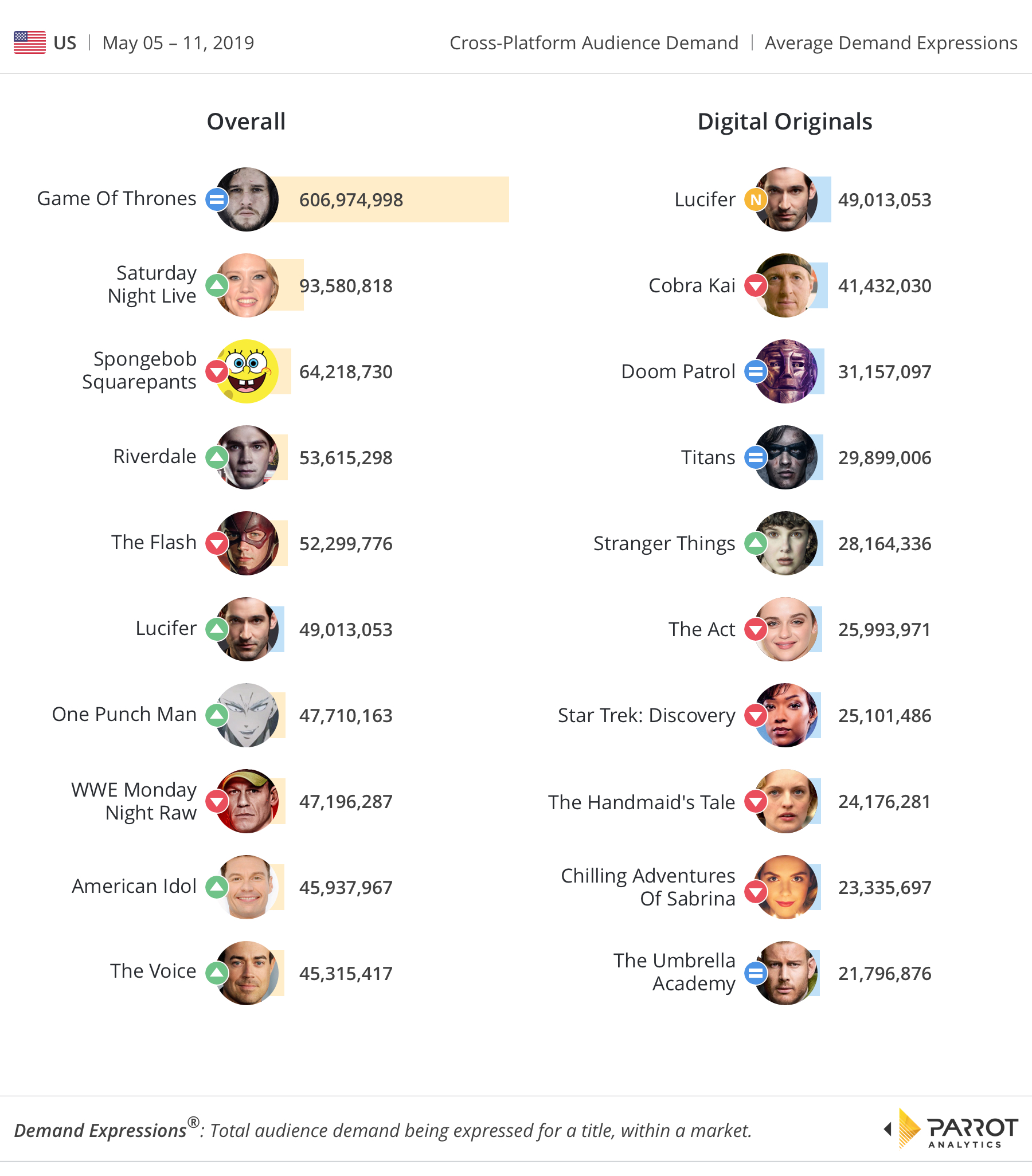

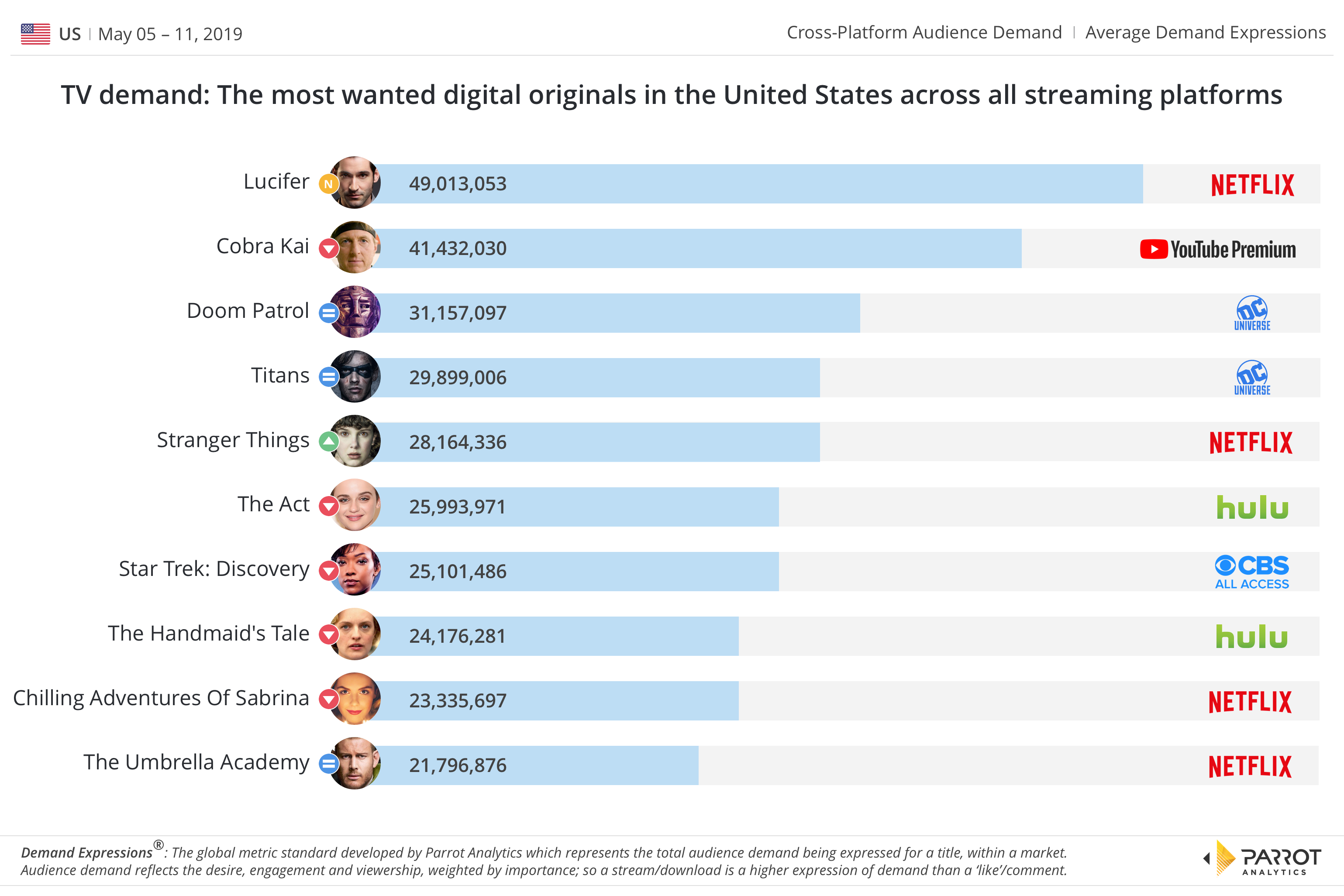

In today’s global marketplace of content, where streaming platforms play an ever-increasing role, Parrot Analytics empowers media companies, brands and agencies to better understand global audience demand for television content across all platforms, including SVOD TV demand. As always, let us now examine the most in-demand digital originals and overall TV shows in the United States.

Lucifer found salvation with Netflix last spring when the streaming service ordered a fourth season of the show in June, one month after it had been canceled by Fox network. It has now been nearly a year since the fantasy drama’s third season last aired and this week we are seeing high demand for Lucifer‘s 10-episode season 4 launch on May 8th; demand roughly doubled week-on-week. Note: The series is denoted “N” to highlight the fact that it was not part of last week’s digital originals chart; we define a digital original as a multi-episode series where the most recent season was produced or first made available on a streaming platform.

Lucifer is (loosely) based on the DC comic book series The Sandman, as originally written by Neil Gaiman. Other evergreen content based on comic book IP such as DC Universe’s Titans and Doom Patrol have also seen growing demand in the weeks since the DC Comics’ new direct-to-consumer digital service debuted last year.

Elsewhere in the chart, Stranger Things appears to be game sensation Fortnite‘s latest pop culture crossover and this week we have seen its demand growing slightly. We are now just a few months from the third season premiere and Netflix’s hit series shows no signs of slowing down.

Lastly, Netflix has signed a deal with Dark Horse Entertainment – the film and television production branch of publisher Dark Horse Comics. The two companies have previously collaborated on modern superhero series The Umbrella Academy, based on the Dark Horse published comic book of the same name by My Chemical Romance frontman Gerard Way.

The first season was a massive hit with American viewers and the series was recently ranked as the most in-demand superhero TV show – ahead of the likes of Doom Patrol and The Flash. The Umbrella Academy was also recently renewed for a second season, much to the delight of its growing fanbase.

The penultimate episode of Game of Thrones airs on Sunday, and we are expecting an epic showdown: Eight seasons, 72 episodes, and around 69 hours have led to the final confrontation between Daenerys, Cersei, Jon Snow, and Tyrion — and the characters that have survived this long, that is. We have observed demand surges throughout season 8 and the series’ daily demand is expected to go above the 800 million mark for the period of the remaining episodes. It is likely that demand for Game of Thrones will remain high, even after the last episode airs, for weeks if not months to come.

On the network scripted programming front, due to the upfronts – both Riverdale and The Flash has been renewed for the fourth and sixth season, respectively.

In unscripted news both American Idol and The Voice will be back for the 2019–20 United States network television schedule. ABC is preparing to unveil a third-season pickup for American Idol at its 2019-2020 season schedule presentation to advertisers on Tuesday, but the lineup behind the judges’ table is still a work in progress. The two series are ranked ninth and tenth, respectively.

Demand for Saturday Night Live jumped roughly 50% as this was Emma Thompson’s first Saturday Night Live hosting gig.