Image: Black Mirror, Netflix

As we kick off 2018, SVOD demand is as high as it has ever been with plenty of new and returning Digital Originals on the cards for the year. Parrot Analytics’ global demand measurement system helps both linear and non-linear SVOD service providers excel: By providing real-time and globally standardized data, content can be monetized more effectively across all platforms and markets, irrespective of how this content is consumed by audiences.

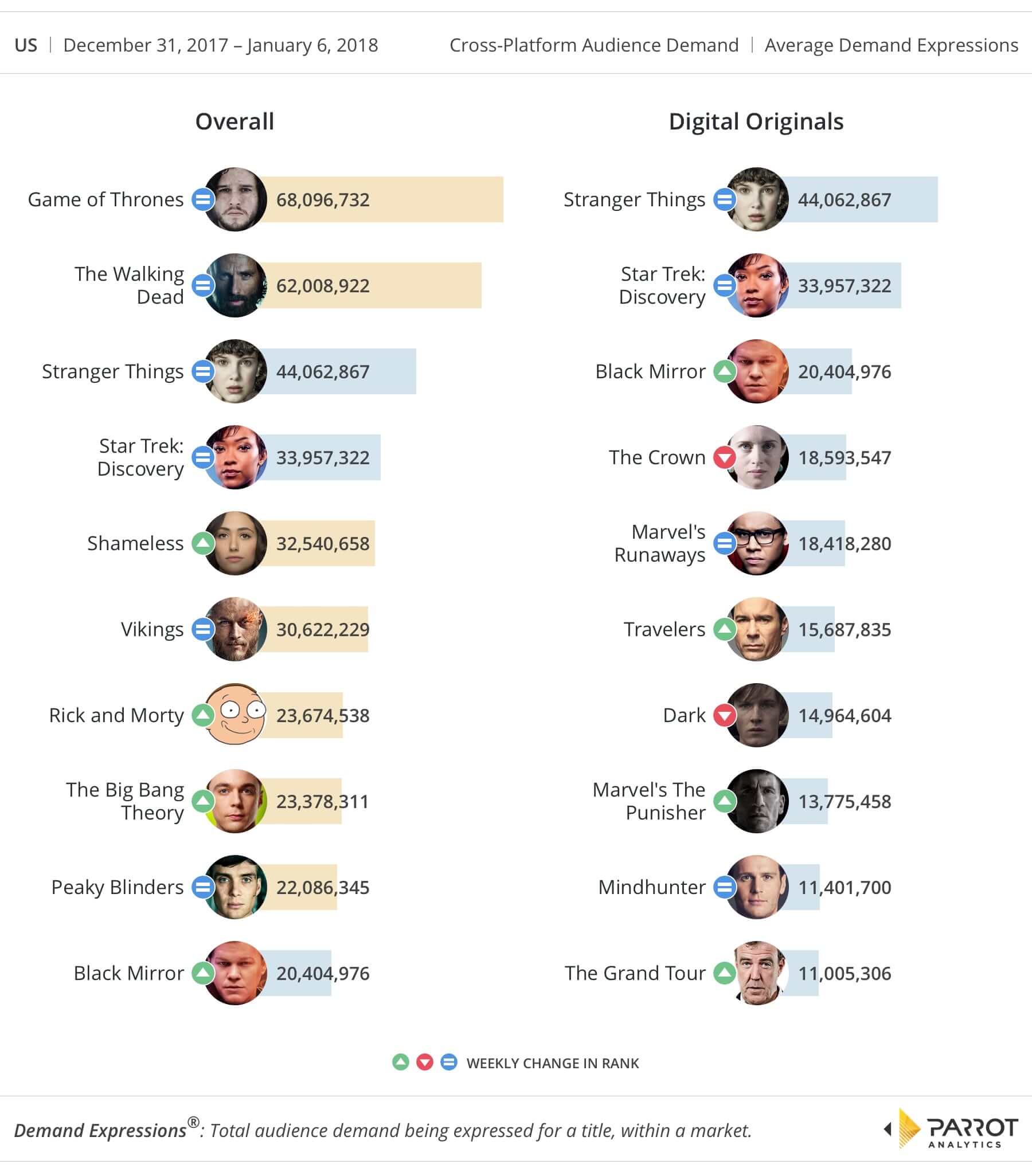

In early 2018 our SVOD demand chart is primarily dominated by Netflix titles, with the lone Star Trek: Discovery from CBS All Access ranked at #2 through most of its sophomore season. With new episodes returning on January 7, the science-fiction series had roughly 10% more demand compared to last week. Another series making the rankings this week that wasn’t there last week is Netflix’s Black Mirror. The fourth season was released two days before the end of the year on December 29 – it’s popularity has generated enough demand to drive it to #3. The Crown, which was released on December 8, had approximately 10% less demand than Black Mirror.

In the top ten chart this week, over half of the titles were dramas with a dark and moody tone – aligning with the end of the holidays when audiences are likely seeking thoughtful and engaging content. Rounding out the digital originals list at #10 was Amazon Video’s The Grand Tour, whose second season is currently airing weekly.

Period drama Peaky Blinders reappeared in the overall chart this week, due to the final episode of the fourth series airing, concluding with the dramatic return of Tom Hardy. Elsewhere, demand decreased somewhat for Game of Thrones and Rick and Morty with the news each series’ new season may not arrive until late 2019.