Image: Narcos (Netflix)

“Peak TV” is a global trend, and nowhere is this more apparent than the ever-increasing amount of content arriving for US Hispanic audiences. The United States has several platforms that cater specifically to the Hispanic population inside the US; these networks distribute Spanish-language shows and commission original content for the US Hispanic market. The two largest are Univision and Telemundo.

Meanwhile, the Latin American TV industry has never been more productive and is putting out increasingly more shows of ever-increasing quality aimed at audiences in Brazil, Argentina, Colombia, Mexico and the rest of the continent and the world.

As well as these sources, also of interest to audiences in both the US Hispanic and Latin American markets is content that crosses the Atlantic from TV producers in Spain and Portugal. Naturally, streaming services are also starting to court the Spanish and Portuguese speaking markets as well; global platform Netflix is leading the way in this so far with a number of Mexican and Spanish original series released already.

With Latin America no longer as reliant on US content imports, are significant differences starting to appear between US and Latin American preferences in Spanish and Portuguese language content?

Parrot Analytics has relied on its global TV demand data to investigate this question further.

Which titles were the favorites in each region?

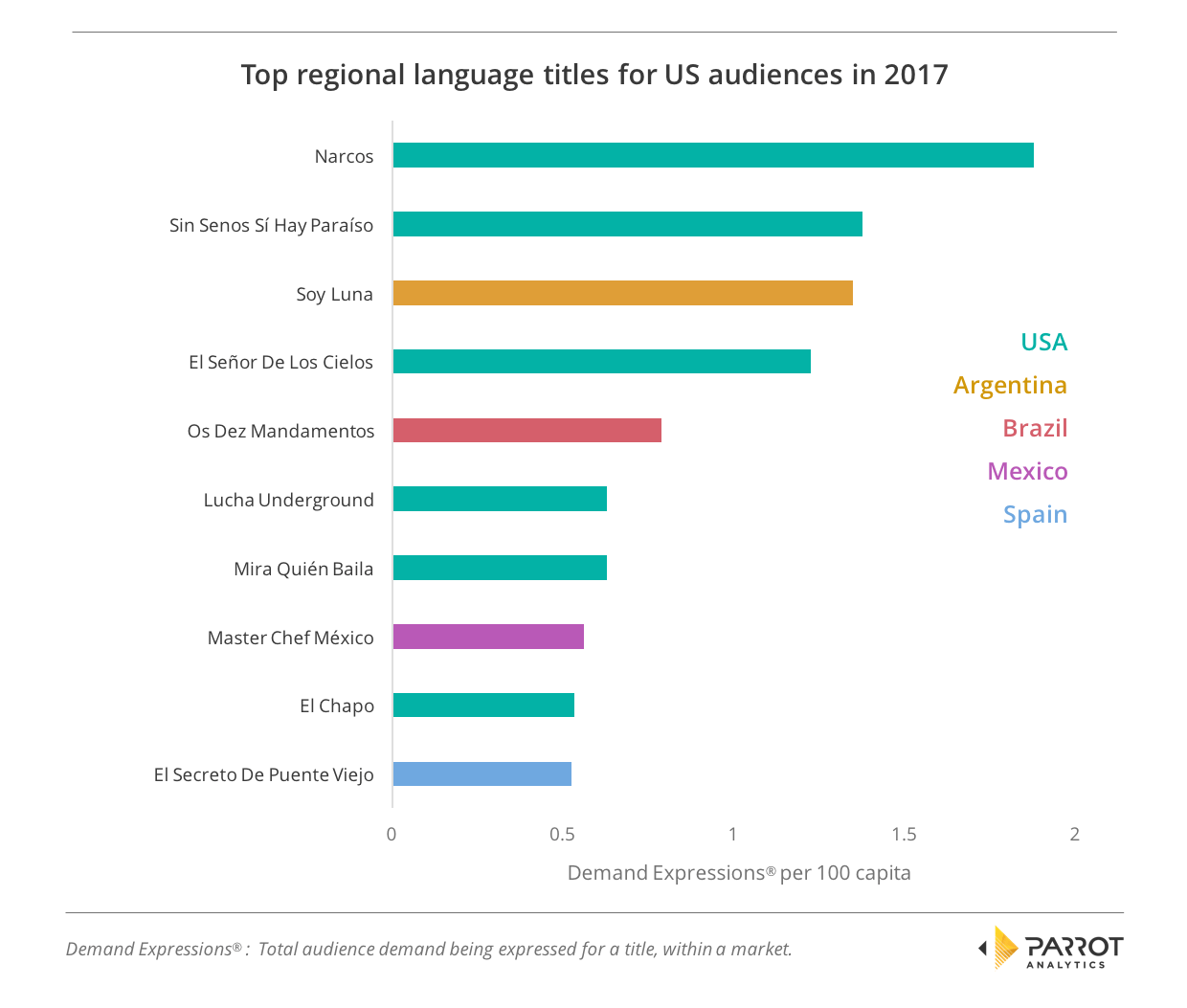

The average demand for every Spanish and Portuguese language title was calculated both for the United States and for Latin America over 2017. This allowed us to discover which titles had the highest average demand within the Latino population in the US and outside of it.

In the US, the top show was Netflix’s crime drama Narcos. Set in Colombia, the show’s dual English-Spanish nature helped it appeal beyond the strictly Spanish-speaking audience to the mainstream US.

The most in-demand “purely Spanish” show was Telemundo’s telenovela Sin Senos Sí Hay Paraíso. Brazilian biblical telenovela Os Dez Mandamentos also performed well amongst US Hispanics, as did the Mexican version of the Masterchef franchise.

Unsurprisingly, US titles dominate Hispanic content in the country: Six of the top ten were commissioned in the US, while the remaining four are from Argentina, Brazil, Mexico and Spain.

US titles are also the most common country of origin across Latin America over 2017, but not to the same extent. Four of the top ten are from the US, while two are from Colombia and two are from Mexico. Argentina and Brazil complete the list with one title each.

Telemundo’s crime drama El Señor De Los Cielos was Latin America’s most in-demand show of 2017; it was fourth in the US over the same period. Sin Senos Sí Hay Paraíso and Soy Luna stay unchanged from the US, remaining in second and third place respectively. In the case of Soy Luna it is interesting to note that the lead character is a Mexican national who as part of the plot moves to Argentina. This explains its wide ability to gain traction across the LATAM region and US Hispanic.

Similarly, Sin Senos No Hay Paraíso leverages the fact that it was co-produced by Colombian and US networks. Colombian shows were popular across the rest of Latin America, Caracol Televisión’s competition show Desafío had fifth highest demand while their crime drama Sobreviviendo A Escobar Alias JJ is sixth.

This list demonstrates the strength of Netflix in the region as three shows of the most in-demand shows are originals from that platform: Club De Cuervos, Narcos and Ingobernable.

Are there significant differences in subgenre popularity between the US and LATAM?

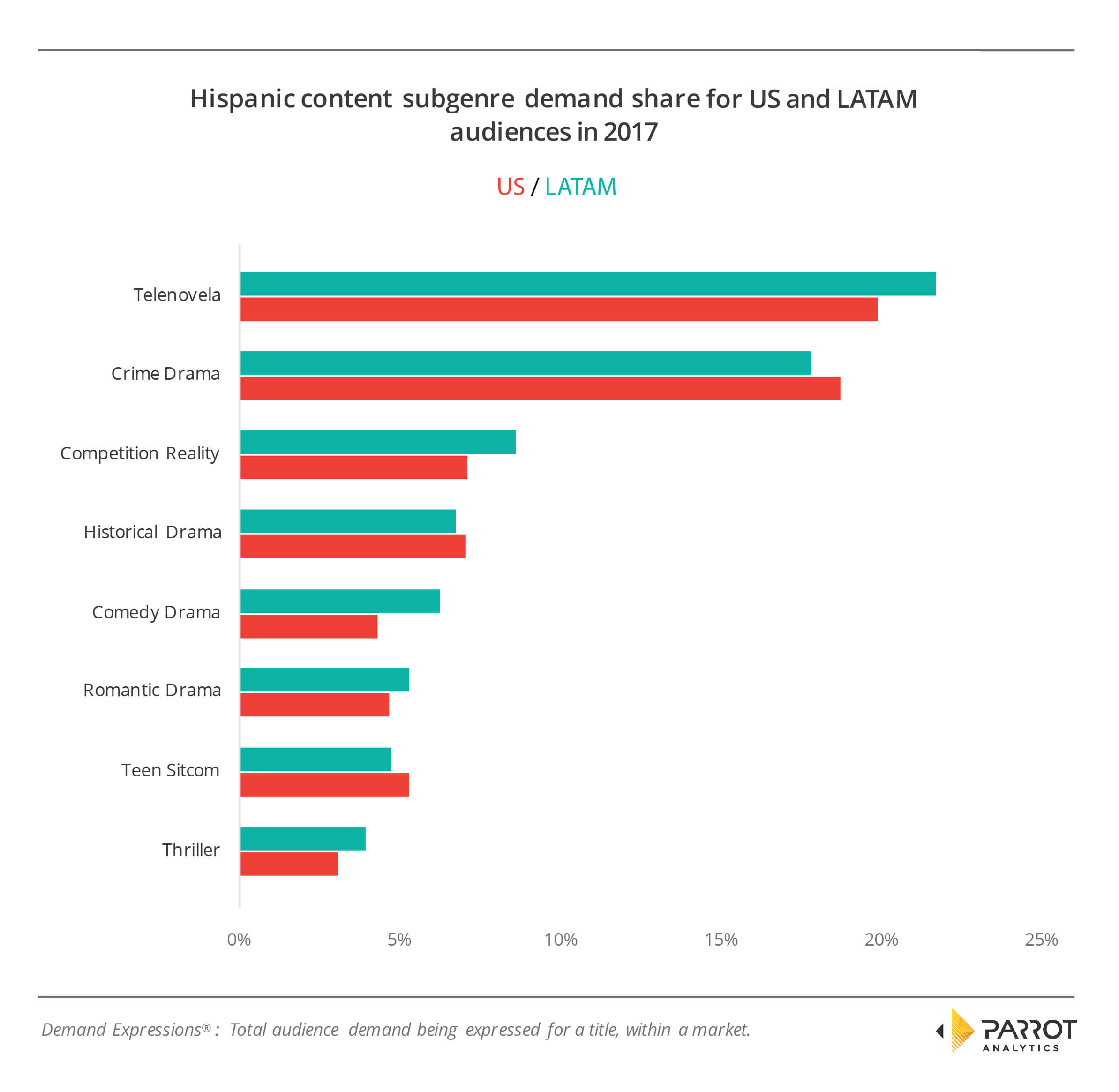

We now take every Spanish and Portuguese speaking title and aggregate their demand by subgenre in both the US and Latin America. This yields the following result:

This graph shows there is not a great deal of difference between the overall content of shows consumed by US Hispanics and Latin Americans in 2017. The top four subgenres are the same, with virtually identical shares of overall demand.

The most popular subgenre is telenovelas which has 22% of the demand share in both regions. Crime dramas are the second most popular subgenre with 20% demand share in the US and 18% in Latin America, unsurprising given the number of titles focused on drug cartels that appeared in each region’s top ten titles! Competition reality and historical dramas are the next most popular subgenres after those.

The first difference comes in at the fifth most in-demand subgenre, where US audiences prefer teen sitcoms while LATAM audiences go for comedy-dramas; the reverse is true in seventh.

The final difference in the highest demand subgenre in each region is that the US prefers action dramas and period dramas, while Latin Americans prefer mystery dramas and sitcoms (not shown on graph above).

This article was first published by ttvnews.