Image: The Ranch, Netflix

There is an increasingly common trend towards disintermediation (e.g., Disney announcing the launch of its own VOD service planned for 2019); the industry is becoming more complex every day and consumer choices abound. Video-on-demand (VOD) television measurement, as well as SVOD, TVOD and AVOD TV series measurement, are all based on our Demand Expressions unit, a metric established by Parrot Analytics to capture demand for TV content across all platforms in 100+ markets. In this article, we investigate which streaming TV series, as well as pay TV, broadcast, and linear TV series, are currently the most in-demand in the U.S. domestic market. As each week, our charts are powered by Parrot Analytics global TV demand data.

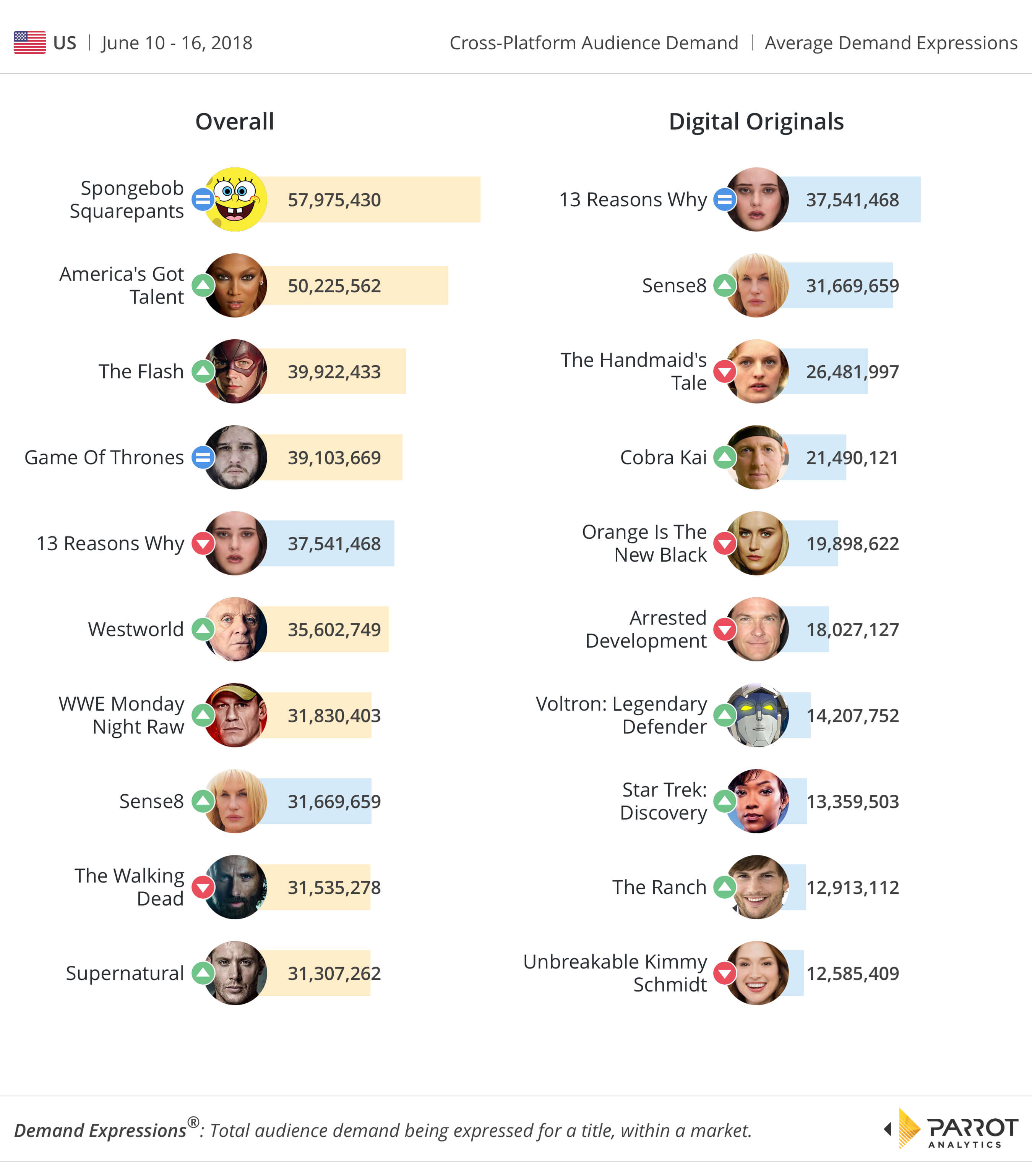

Season three of Netflix’s 13 Reasons Why was announced on June 6 – likely a contributing cause to helping the series to continue to be the most in-demand digital series, ranking #5 overall in the United States, with a 5.8 million Demand Expressions differences over the second ranking title, Sense8. It has been said that 13 Reasons Why is a show that lives in darkness; it has now held the #1 ranking for five consecutive weeks. Whilst Sense8 had a 40% increase in demand compared to last week (its ranking increased from #6 to #2), it was unable to overturn 13 Reasons Why at #1.

Elsewhere in our digital originals chart, returning Netflix titles are positioned in the bottom five: The new seasons of Voltron: Legendary Defender (previously ranked #16) and The Ranch (demand increased by 42% compared last week; previously ranked #20) caused these titles to reappeared in our chart this week.

Summer has officially begun and our overall series chart show the impact of linear titles with significant movement in demand week-on-week: After a successful season four, The CW’s The Flash is promoting multiple characters (and their actors) to series regulars, with demand swelling by 6% justified. Light-entertainment titles like America’s Got Talent (+7%), and WWE Monday Raw (previously ranked #14) occupy the rest of the chart.