At Parrot Analytics, we quantify the attention economy to provide a 360 degree view into the elusive X-factor of making a hit series. In this piece, we illustrate (via Disney+) how cross-platform fans’ preferences can guide and support marketing decisions likely to boost subscriber growth.

3 Key Insights:

- Identify your platforms largest accessible fan base to target with your tentpole using brand affinity – a measure of shared brand preferences.

- Activate this large fan base before your tentpole’s debut by targeting its preferences identified via content affinity – a measure of shared content preferences.

- Leverage other channels and platforms with titles with high demand and high content affinity to your tentpole to increase fans’ awareness.

How Can All OTTs Identify their Next Tentpole?

The Mandalorian has become a world-wide success topping our global charts. Coupling its tentpole success with the promised and delivered nostalgic content, Disney+’s first launch markets certainly met expectations.

But, what’s next for Disney+’s marketing? And, what can OTTs do to identify the next tentpole’s audience?

In order to prioritize titles that will define the platform, we leverage brand affinity to quantify:

- the potential size of the fans that a title can attract and,

- the size of the overlap in audience demand for one entertainment brand with audience demand for the other entertainment brands.

When we evaluated the audiences of Disney+ one week before its launch, as an example, our insights indicated that the success of Marvel titles would be key for subscriber growth.

Chart 1 shows us the size and percentage of overlap in audience demand (i.e., fans) one week from fans of Disney+ and the various entertainment brands from in its library: Disney, Star Wars, Marvel, Pixar, National Geographic. The overlap of fans from Disney, Star Wars, and Marvel to the remaining entertainment brands are also represented.

The evidence (Chart 1):

-

Marvel’s fans (43%) are the second greatest portion of Disney+’s fans or potential subscribers.

- A great portion of Star Wars’ fans (73%) are also fans of Marvel. So Marvel content should retain these fans.

-

Yet, less than half of Marvel fans (41%) are Star Wars fans, which means they may not have converted quite yet.

-

The percentages of Marvel’s fans which double as fans of the other Disney+ entertainment brands represent a larger fan base for Disney+ to leverage for subscriptions, even if the percentages are smaller than Star Wars.

-

A greater portion of Disney’s fans are also fans of Marvel (56%) as opposed to Star Wars (34%). This is especially important because Disney fans account for the largest portion of Disney+ fans (48%), and Disney titles generate the majority of Disney+’s demand aside from The Mandalorian.

Our analyses of brand affinity confirms that producing a Marvel tentpole — a highly in-demand Marvel original — will likely increase Disney+’s subscription growth rate.

OTTs can support subscriber growth by identifying tentpoles that are likely to be highly in-demand and cater to their largest in-reach audience(s) (read here for a step-by-step example of this process).

How Can Marketing Activate Fans Before a Tentpole’s Release?

Marvel audiences are important for Disney+ to capture, but the next Marvel series to debut, The Falcon and The Winter Soldier and WandaVision will not be released until late 2020.

What could an OTT do in the meantime?

OTTs can nurture fans’ sense of community before a tentpole release (especially for IP-based titles) through related content including movies like Marvel’s The New Mutants and Black Widow, music or video games – take The Witcher as a recent example of the fan-based impact of content convergence.

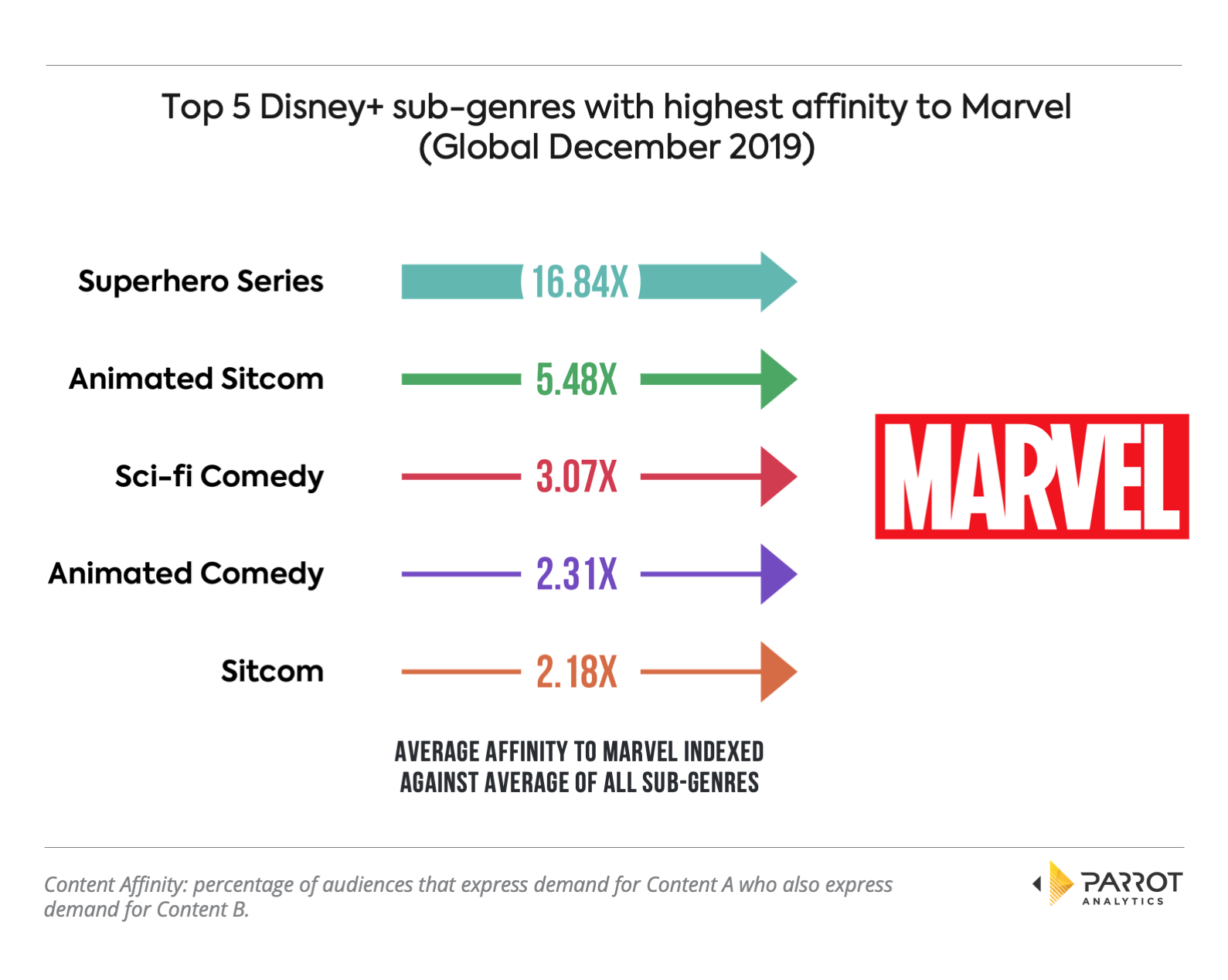

A less expensive option includes marketing library content from sub-genres with high content affinity to (i.e., lead to demand for) the tentpole. For instance our data illustrates Disney+ could market superhero, animated sitcom, science-fiction comedy, animated comedy and sitcom titles in its library to draw in audiences of the yet to come Marvel tentpoles.

Garnering attention for titles in high content affinity sub-genres can increase an OTT’s ability to convert the identified fan base.

Disney+’s chances of acquiring Marvel fans subscribers increase by growing their appetite for upcoming Marvel blockbusters (see Chart 2 below).

Chart 2 depicts the 5 sub-genres in Disney+’s library which had the highest affinity to Marvel titles; affinity was calculated using demand expressed for content across platforms and then indexed by the average across sub-genres.

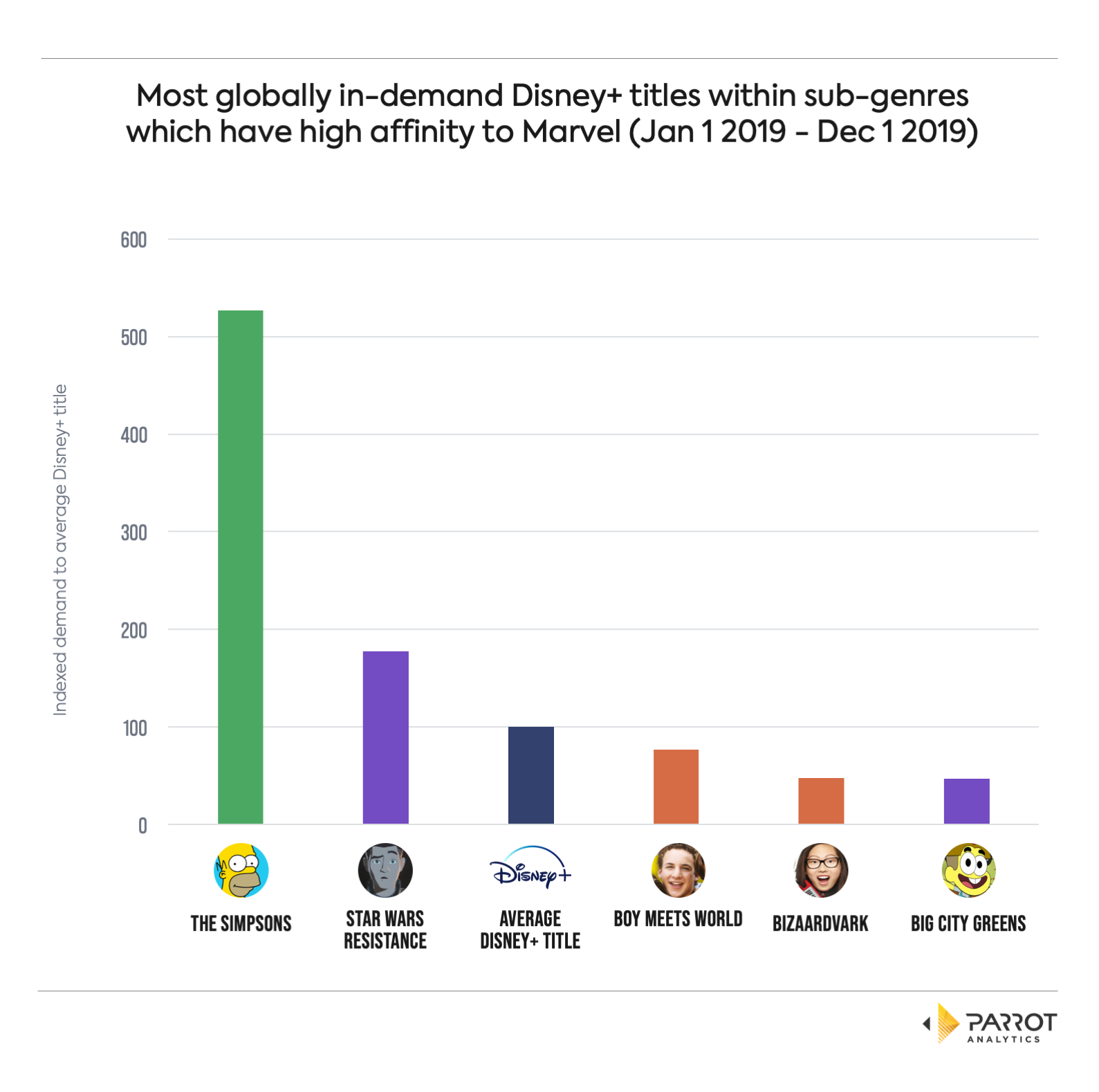

Disney+ has been successfully promoting at least one of these high affinity titles: The Simpsons (see Chart 3 below). However, its team could also aim to garner more attention for Star Wars Resistance or Boy Meets World and Bizaardvark, which have captured moderate attention compared to the average Disney+ title.

Chart 3 depicts the demand of the 5 most in-demand Disney+ titles within the 5 highest affinity to Marvel sub-genres. The demand each title has obtained is indexed and compared to the demand garnered by the average Disney+ title. These are the titles within the Disney+ library that are likely to lead to demand (i.e., attention) for the next Marvel title.

OTTs can place advertisement for a tentpole near shows on other platforms including linear or broadcast channels that garner a lot of attention.

Our metrics imply that placing advertising campaigns for upcoming Marvel hits near highly in-demand shows within high-affinity sub-genres on other Disney platforms would materially increase demand performance. This could include shows such as Marvel’s Guardian of the Galaxy, Kirby Buckets, as well as Walk the Prank.

The same strategy can be used to leverage shows on competitors’ channels that may have an even higher affinity to – or greater likelihood to lead to demand for – the upcoming tentpole.

Final Thoughts

The demand for all content can be monetized. Understanding audiences’ content associations, brand preferences and habits not only supports successful content strategies, but also marketing campaigns.

For more insights based on Disney+, see Part I on evaluating strengths and opportunities and Part II on content programming strategies.