Image: Yellowjackets, Showtime

On Thursday, Paramount Global reported its first earnings since announcing the Skydance Media sale. The company’s future leader, David Ellison, will be taking over a high value library, as well as Paramount+’s 70M+ subscribers. He will need to weigh fundamental questions such as what his streaming and licensing strategy will be, how to best leverage sports rights — especially the NFL on CBS — and even whether he wants to keep the company public or not. A look at which Paramount brands are over performing with Paramount+ audiences should help the new ownership with priorities.

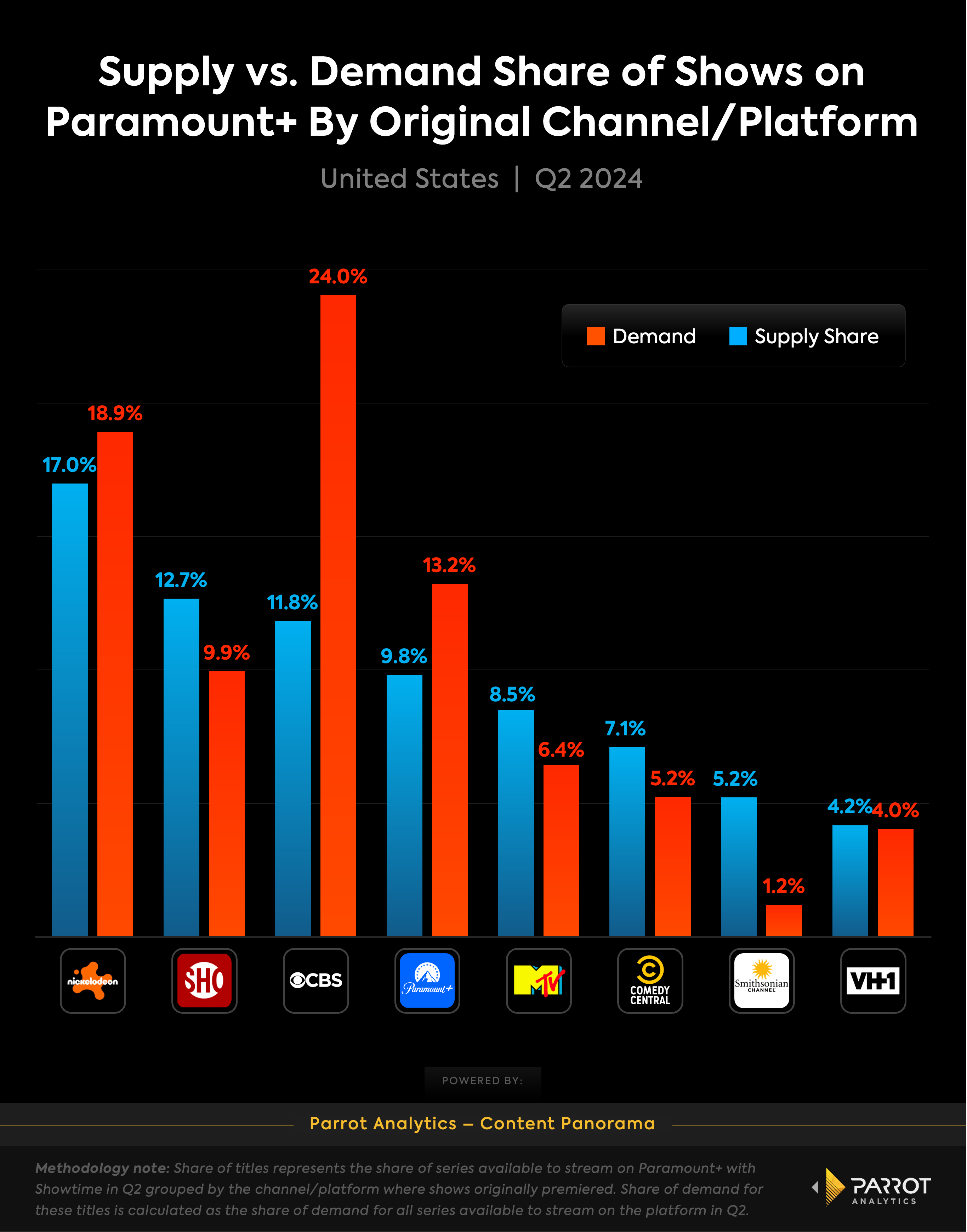

CBS shows are a delivering big time not only for Paramount+ but also other streamers where the channel’s industry-leading sitcoms and procedurals are some of the most in-demand titles available (eg. “The Big Bang Theory” on Max or “NCIS” on Netflix). On Paramount+ CBS shows account for 11.8% of titles on platform but drive 24% of demand for shows on Paramount+.

Nickelodeon makes up a large share of titles available on Paramount+ and also punches above its weight in terms of demand for this content. Kids’ content is an important part of the mix on any streaming platform hoping to appeal to families. Nickelodeon content not only overperforms on-platform but accounts for more demand across all kids’ content than other youth programming heavyweights, Cartoon Network and Disney.

It is interesting to note how Paramount+ original series are overperforming on the platform. This highlights how Paramount is allocating some of its most popular titles and franchises (like Star Trek) to be streaming originals on its platform. Contrast this with Max for example, a platform whose streaming originals underperform on its platform, which is compounded by the fact that Warner Bros. Discovery is rebranding some of the most anticipated franchise series to be HBO (rather than Max) originals.

Shows from the Smithsonian Channel seriously underperform their share of catalog. Not only do these shows have low demand relative to their share of catalog, when we look at the viewing path these audiences are taking, they are less likely to watch other titles on Paramount+ than viewers who watch shows from these other major brands. CBS also leads in this measure - the people who watch CBS content on Paramount+ are the most likely to watch another title on the platform. This cross-platform measure of audience behavior is a helpful gauge for how good of a fit content is with a platform, particularly when it comes to keeping subscribers engaged and retained. The weak performance of The Smithsonian Channel’s content on these measures could indicate an opportunity to find a better home for these titles.

Showtime is the second largest channel in terms of the number of shows on Paramount+ with Showtime, accounting for 12.7% of titles on the platform. The demand for these shows underperforms their catalog share (9.9%). This is even more striking when looking at a platform like Max where content from its premium prestige cable channel, HBO, strongly overperforms. Showtime always struggled to match the success of HBO but the fact that its original shows are not even pulling their own weight on the company’s streaming platform is a warning sign.

One positive signal for the profitability prospects of Paramount+ is the price increases announced Thursday. By the end of August, Paramount+ with Showtime will cost $1 more and the price of Paramount+ Essential will rise by $2. Our Pricing Framework already showed that Paramount+ had room to increase prices and remain a good value for subscribers. With recent price increases from Peacock and upcoming price increases across Disney platforms, Paramount+ looks set to remain an attractive value proposition for consumers.